What is GSTR 2x: TDS & TCS Claim—Complete Guide

- 16 Sep 25

- 7 mins

What is GSTR 2x: TDS & TCS Claim—Complete Guide

Key Takeaways

- GSTR-2X is a special return form for claiming TDS and TCS credits deducted by government entities or e-commerce platforms.

- The form is auto-populated with details from GSTR-7 (TDS) and GSTR-8 (TCS) filed by deductors and collectors.

- Taxpayers can either “Accept” or “Reject” the entries; once filed, actions cannot be reversed.

- There is no fixed due date or late fee, but GSTR-2X should be filed before filing GSTR-3B or CMP-08.

- Accepted TDS/TCS credits are added to the Cash Ledger, which can be used to pay tax liabilities.

GSTR-2X is a special return filing form that authority designed for taxpayers to claim TDS and TCS credits under the GST filing framework. It especially applies to registered individuals or businesses dealing with e-commerce platforms or government contracts.

In this blog, we will explain what GSTR-2X is, how TDS/TCS claims work and the due date for filing this return. Scroll down!

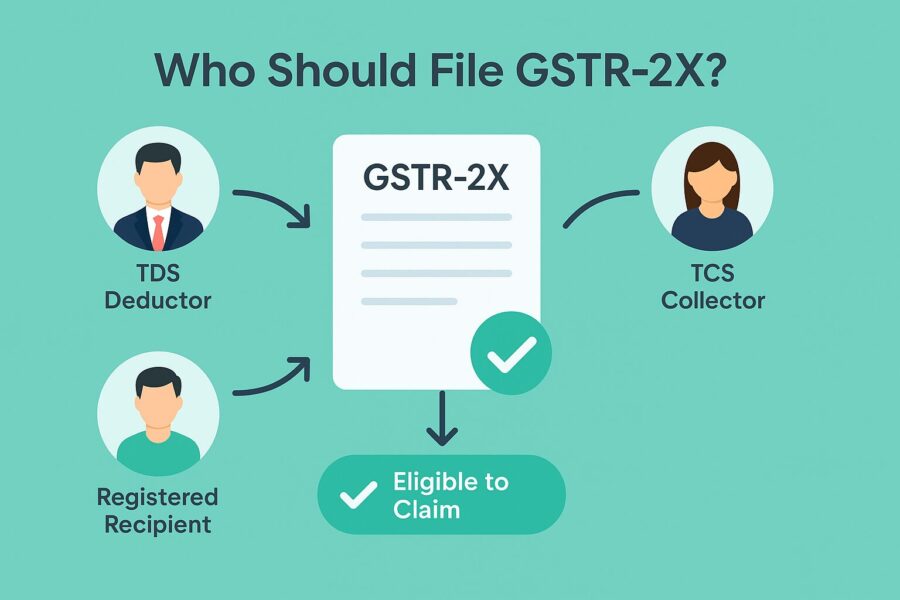

What is GSTR-2X & Who Should File It?

The Form GSTR-2X is a return that needs to be filed by registered taxpayers who want to claim TDS (Tax Deducted at Source) or TCS (Tax Collected at Source) credits. This tax return process is specifically for those who have tax deducted or collected by other parties, such as government departments or e-commerce platforms.

The data in GSTR-2X is auto-filled based on details submitted by the deductors and collectors. For instance, TDS details in Form GSTR-7, filed by the deductor (like a government entity) and TCS details in Form GSTR-8, filed by an e-commerce operator.

If you are selling products through an e-commerce portal, the platform collects TCS and files it in GSTR-8. These collected amounts will automatically appear in your GSTR-2X. You only need to review and either accept or reject the entries.

Once you accept the TDS/TCS credit, it appears in your Cash Ledger and you can use it to pay any remaining tax after adjusting the Input Tax Credit (ITC).

What is the Due Date for GSTR-2X Return?

The government has not implemented any due date or late filing fee for GSTR 2X. However, this form for taxpayers should be filed before the deadline of tax payment. Taxpayers either choose the 20th day of the following month prior to filing Form GSTR-3B or the 18th day of the month following every quarter (it is for those who need to file CMP-08).

Registered businesses or individuals can file it only once a month using the online portal. However, the notable fact is you can file Form GSTR 2X prior to filing Form GSTR-1/GSTR-3B.

What Can You Do Under GSTR-2X?

Users can avail two actions under GSTR 2X. The first option displayed on the portal is “Accept” followed by the second option, which is “Reject".

The deductee needs to cross-check these data with the previously mentioned records produced and then take action accordingly, which is to accept/reject the record. Once you file Form GSTR 2X, you cannot accept the record to reject or reject to accept.

Moreover, if you think of taking no action on all the system-generated records in every table, you cannot file Form GSTR2X for your needs.

What Will Be the Effect of Taking Action?

Here is a glimpse of the effect of actions in table format:

| “Accept” Action | “Reject” Action |

| After you accept the data, the TDS/TCS amount will be added to your cash ledger. You can then use this credit to pay off your tax dues. | After you reject the data, you can view this on the counterparty in their upcoming month Form GSTR-7/GSTR-8 form under the section of amendments. |

Procedure to Verify & File Form GSTR-2X

Here is a step-by-step guide to verify & file your GSTR-2X Form:

● First, you need to navigate to the GSTR-2X section, where you can see detailed records and their corresponding values in each category. Go to GST Returns, then select " Regular Returns" among other options. Then opt for "Return Filling" and lastly GSTR-2X.

● Now, choose Year, Month, and Location using the filter option and enter the OTP if the website does not activate the session.

● The Form GSTR-2X is an auto-populated statement. So, the system fills this form with the data uploaded. Now, you can verify if the "System" and "GST" values match with each other.

● If you find an exact match, submit the return by choosing the "Submit" button and file the return using the "File" option.

● To download the details, click on the Actions > Download PDF/ Excel.

Follow this process and file Form GSTR-2X swiftly and precisely.

Conclusion

Understanding what is GSTR-2X helps taxpayers seamlessly claim TDS and TCS credits collected by others, like e-commerce portals or government departments that are in charge of deducting taxes.

It is a premium GST compliance solution that ensures accurate payment of tax and easier GST compliance if you file on time.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By