A Simple Guide on How to File GSTR 2A on GST Portal

- 16 Sep 25

- 8 mins

A Simple Guide on How to File GSTR 2A on GST Portal

Key Takeaways

- GSTR-2A is an auto-generated, read-only statement showing purchase details based on sellers’ returns.

- It helps taxpayers verify Input Tax Credit (ITC) by cross-checking supplier invoices.

- Businesses cannot file or edit GSTR-2A; they can only review, reconcile, and download it.

- Reconciliation between GSTR-2A/2B and GSTR-3B is crucial to avoid ITC mismatches, reversals, and penalties.

- Regular use of GSTR-2A ensures accurate GST compliance, timely ITC claims, and smooth GSTR-9 filing.

The government introduced the Goods and Services Tax (GST) in 2017 to simplify indirect taxation. Still, many businesses in India are learning how to use it. A key part of GST involves handling different forms, and GSTR-2A is one of them.

The system automatically generates GSTR-2A to show all your monthly purchase details. It pulls data from the forms your sellers file, such as GSTR-1, GSTR-5, GSTR-6, GSTR-7, and GSTR-8.

You do not need to file GSTR-2A yourself. You can use it to track your purchases and verify your input tax credit (ITC).

Hence, let us help you understand GSTR-2A and show you how to view it easily on the GST portal.

What is GSTR-2A?

GSTR-2A is a read-only document that shows what a business bought in a specific month. The GST portal creates it automatically using details from sellers and others who file forms like GSTR-1, GSTR-5, GSTR-6, GSTR-7, and GSTR-8.

This form shows invoice details that sellers submit and helps buyers check their purchases and claim input tax credit (ITC).

If a seller delays filing their return, the buyer may have to enter the missing details manually. Since August 2020, taxpayers have used GSTR-2B, a fixed version of GSTR-2A, to file GSTR-3B.

Comparison between GSTR-2A and GSTR-3B

As previously stated, GSTR-2A is an automatically generated report that displays the specifics of your purchase based on the information your seller files in GSTR-1. It facilitates the process of verifying and comparing your purchases.

In contrast, companies are required to file GSTR-3B, a monthly summary return, by the 20th of the following month. It includes Input Tax Credit (ITC) details in Table 4, such as eligible tax credit on ITC, reversed ITC, and net ITC.

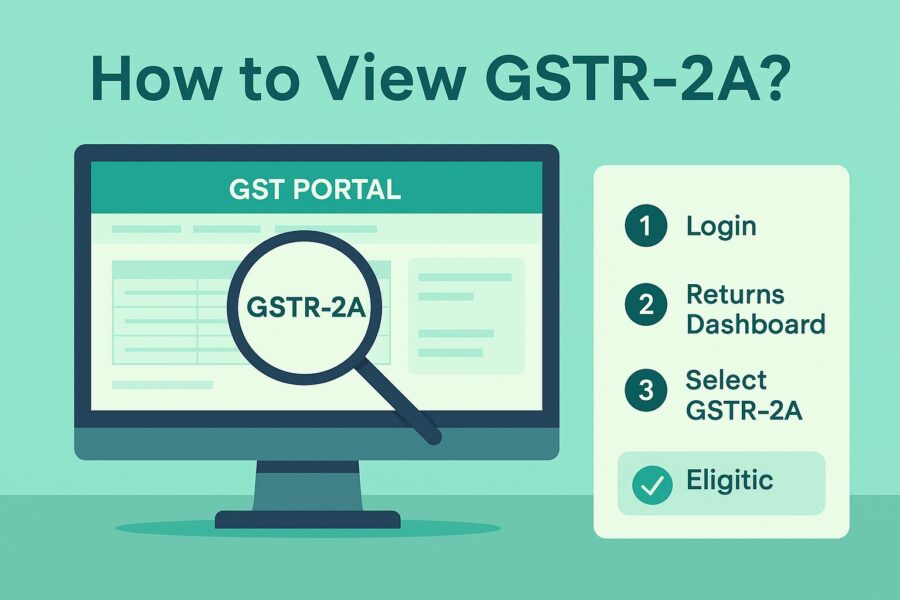

How to View GSTR-2A?

Follow these steps to view Form GSTR-2A,

- Go to the official GST portal.

- Log in using your compulsory credentials.

- Select “Services” on the dashboard.

- Choose “Returns” and then click on “Returns Dashboard”.

- On the File Returns page, select the Financial Year and Return Filing Period and select “Search”.

- Click on the “View” option under GSTR-2A.

- The GSTR-2A – Auto-drafted Details page will open.

You can now check the details shared by your suppliers. To see specific information, click on the relevant sections.

If you want to keep a copy, you can also download the form by selecting the download option in Step 6.

GSTR-2A Format

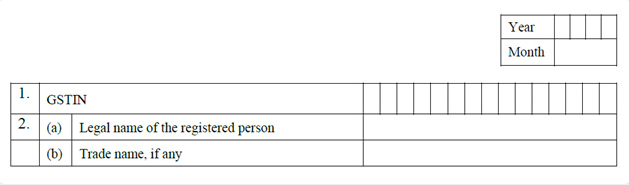

The format of Form GSTR-2A is quite simple. It has separate sections that show the following details:

- GSTIN: The 15-digit GST Identification Number of the business.

- Name of the Taxpayer: The registered person’s legal name and trade name (if available).

Part A

- Invoice details: Shows inward supplies received from registered suppliers, except those under reverse charge.

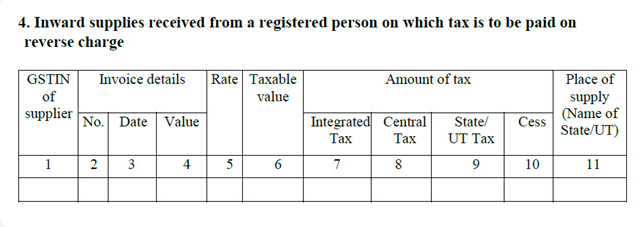

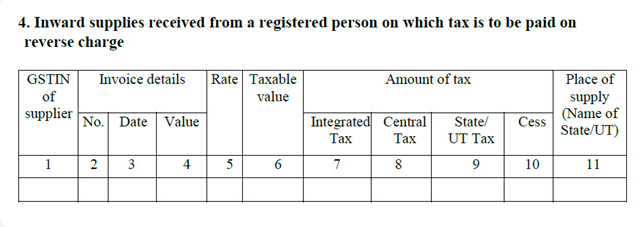

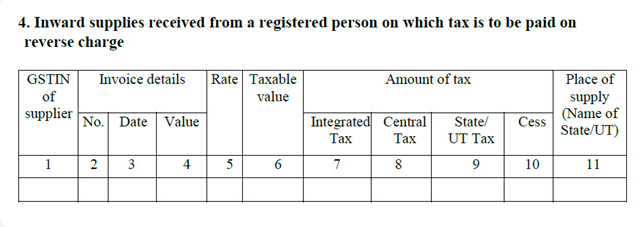

- Reverse Charge Supplies: Lists inward supplies where tax is paid under the reverse charge mechanism.

- Debit/Credit Notes: Shows all debit and credit notes received, along with any changes made during the current period.

Part B

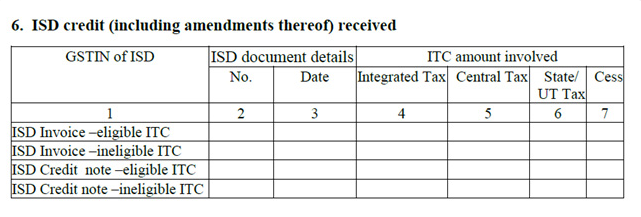

● ISD Credit Received: Shows credit received from an Input Service Distributor (ISD), including any amendments.

Part C

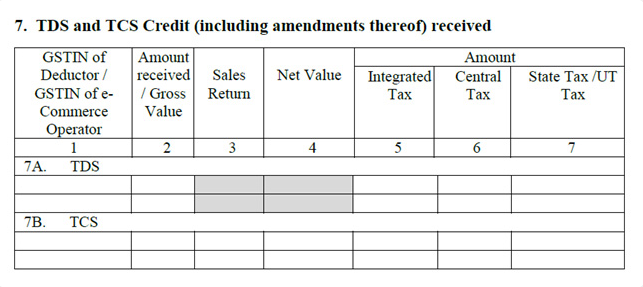

● TDS and TCS Credit Received: Shows Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) credits, including any updates. This applies to businesses that deal in TDS or sell through e-commerce operator platforms.

What are GSTR-2A E-Filing Steps?

This auto-generated, read-only form cannot be edited or filed. It simply pulls in invoice details from your sellers’ GSTR-1 filings each month. While you cannot edit or submit this form, it is important to check it carefully.

If there are any mismatches, you may need to follow up with your seller or adjust your return manually. These changes must be made in GSTR-2, not GSTR-2A.

GSTR-2 is usually updated between the 11th and 15th of the month following the return period. There is no cut-off date for GSTR-2A itself.

So, if you are wondering how to file GSTR-2A on the GST portal, the simple answer is that you do not file it, but you must review and verify it before filing other returns.

How to Download the Form?

You can easily view GSTR-2A online on the GST portal. However, if your invoice count is over 500, it is better to download it. To do this, you will need the GST Returns Offline Tool installed on your computer.

Here is how you can download Form GSTR-2A:

- Log in to the GST portal and go to the GSTR-2A section.

- Click on the ‘Download’ option in the GSTR-2A block.

- Then, click on ‘Generate JSON file to download’. This will prepare your data in JSON or Excel format.

- Once the file is ready, a link saying “Click here to download JSON file” will appear.

- Click the link to download the file, and then open it using the Returns Offline Tool available on the GST portal.

This process helps large taxpayers access and review their invoices more efficiently.

What are the Reasons for Non-Reconciliation?

GSTR-2A or GSTR-2B may not match with GSTR-3B for several technical reasons. These include claiming Input Tax Credit (ITC) on IGST paid for import of goods or services, or GST paid under the Reverse Charge Mechanism (RCM).

It can also happen due to transitional credit claimed through TRAN-I or TRAN-II. Another common cause is when goods or services are received in one financial year (e.g., FY 2023–24), but the ITC is available in the next (e.g., FY 2024–25).

In such cases, no matching entry appears in GSTR-2A/2B as the supplier has not filed a corresponding GSTR-1.

● Discrepancies and Reconciliation Requirement

If discrepancies between GSTR-1 and GSTR-3B result in excess ITC being claimed, the taxpayer must reverse the ineligible credit and pay the difference with interest. Regular reconciliation is essential to ensure accurate and legitimate ITC claims.

● Annual Return Reconciliation

During GSTR-9 filing, ITC must be reconciled using Table 6 (ITC availed) and Table 8 (ITC as per GSTR-2A). This confirms the consistency between GSTR-3B and GSTR-2A.

Why is GSTR-2A Reconciliation Important?

It is important to match the ITC in GSTR-3B with GSTR-2A regularly. This helps avoid errors, fake invoice claims, and missing or duplicate invoices. If any mismatch is found, the business may need to pay the difference with interest and respond to GST notices like ASMT-10. Reconciliation is also needed while filing the annual return in GSTR-9.

Conclusion

While GSTR-2A is not a form you file, it ensures your GST compliance stays accurate and hassle-free. If you are wondering how to file GSTR 2A on the GST portal, it is important to understand that this form is auto-generated and read-only. You do not need to file it, but you must review it regularly.

By regularly reviewing GSTR-2A, businesses can catch mismatches early, avoid penalties, and claim the right input tax credit. It acts as a helpful tool to cross-check supplier data and maintain clean records.

In the long run, consistent reconciliation with GSTR-2A supports better financial planning and builds credibility with tax authorities.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By