How to File GSTR 5A on GST Portal?

- 4 Aug 25

- 10 mins

How to File GSTR 5A on GST Portal?

Key Takeaways

- GSTR-5A is a mandatory monthly return for non-resident OIDAR service providers supplying to unregistered persons in India.

- The form must be filed even during months with no transactions, and failure to do so may attract penalties.

- GSTR-5A includes detailed sections for outward supplies, amendments, interest, and other tax liabilities.

- Filing can only be completed after full payment of taxes and liabilities through a challan if necessary.

- Accurate, timely GSTR-5A filing ensures smooth GST compliance and avoids legal or reputational complications for OIDAR businesses.

For Online Information and Database Access or Retrieval (OIDAR) service providers, outside India who supply services to unregistered persons in India, the GSTR-5A form is crucial. This is required to report tax liabilities and direct tax compliance with Indian GST laws. GSTR-5A must be filed monthly, even for periods with no transactions.

Filing GSTR-5A is straightforward and is done online using the GST portal. Inaccurate filing will expose you to penalties and clutter your business record. Following is a basic guide on how to file GSTR-5A on the GST portal accurately.

What Is GSTR-5A Form Under GST?

GSTR-5A is a return form that non-resident taxpayers providing OIDAR services in India are required to file. OIDAR services include services delivered on the Internet, such as the supply of digital content through online mode, access to databases electronically, hosting of websites and more.

Who Should File for GSTR-5A?

Non-resident providers of OIDAR services are obligated to supply services to unregistered government bodies, local authorities and individual consumers. When such services are rendered to GST-registered entities, the responsibility to pay GST falls on the recipient under the reverse charge mechanism.

However, in cases where the services are delivered to unregistered individuals or entities for non-commercial use, the non-resident OIDAR provider must discharge the GST liability themselves. To comply, they are required to file GSTR-5A.

What are the Various Sections and Subsections of Form GSTR-5A?

GSTR-5A can be well understood through the presentation of sections and sub-sections of 7 tables and one sub-table:

- Table 1: This comprises the GSTIN of a supplier.

- Table 2: This consists of an authorised name of the registered taxpayer and its trading name (if any).

- Table 3: This table presents the details of the authorised representative responsible for filing the return. If the service provider has designated an agent in India, their details should be provided in this section.

- Table 4: This denotes whether the relevant period is a month or year while filing a return

- Table 5: This table showcases every taxable outward supply prevalent for each registered user in India. It entails detailed information on tax rates, taxable value, places of supply and integrated taxes.

- Table 5A - Amendments: All amendments that are subjected to modification of taxable outward supplies to non-taxable persons in the country.

- Table 6: It comprises a thorough evaluation of penalty, interest and other due amounts.

- Table 7: This table displays detailed information about late fees, tax interest and other payable amounts or amounts already paid.

Steps to File GSTR-5A on the Official GST Portal

Here are the detailed steps to follow for filing GSTR-5A on the official GST portal:

1. Navigate to the official GST portal following the path- Services>Returns>Returns Dashboard.

2. Visit the 'File Returns' page and then choose the financial year and year for which you wish to file your returns. Then, click on ‘Search’.

3. Go to the GSTR-5A tile and then click on the option of ‘Prepare Online’.

4. Enter all relevant information across various tiles.

While following these essential steps, if you need help, click on the ‘Help’ option and avail necessary help to proceed further.

5. Proceed to click on the 'Taxable Outward Supplies Made to Consumers in India' tile. Once done, you can continue to add further details relating to supplies made to consumers residing in India.

6. While you are on the same page, click on 'Add Details'. By doing this, you can add more information relating to the new POS.

7. A drop-down list appears. From the list, choose the 'Place of Supply'. Further, in the field provided, enter the taxable value. Enter Cess in the field and then select rate and further click on the ‘Add’ option.

8. After adding all necessary details, click on the ‘Save’ button.

Most importantly, you can continue to edit and delete the details by choosing the respective button. You can also choose to ‘Add details’ using the button. Once you receive the confirmation message with details being saved, you can proceed to click on the ‘Back’ button and visit the 'Dashboard'.

Go again to the GSTR-5A dashboard with the tile mentioned on the screen as '5-Taxable Outward Supplies Made to Consumers in India'. Following this same method, you can continue adding information on POS-wise supply.

9. Click on the '5A - Amendments to taxable outward supplies to non-taxable persons in India' tile.

This table can be divided into two major classes:

To Add Details

Follow the below-given steps if you want to add details:

- Choose a financial year, month and place of supply.

- Click on the ‘Search’ button.

- Enter the taxable value, cess and rate in the required fields and click on the 'Add' button.

- Click on the ‘Save’ button.

To Amend Details

Here are the below-given steps to follow if you want to amend details:

- Choose the financial year and place of supply.

- Click on the ‘Edit’ option and then continue to ‘Save’. After this, you will receive a success message.

- Once you complete adding all detailed information, click on the ‘Back’ button to get back again to the GSTR-5A dashboard.

10. For further adding interest with other prescribed details, click on the 'Interest or Any Other Amount' tile. Further, follow the steps below:

11. Enter relevant details that include the place of supply, cess, integrated tax and other details (if any) and click on the 'Save' button. Click on the confirmation message you receive.

12. Following the same manner, click on the 'Others' option to add information. Further, click on the 'Back' option in order to return to the dashboard.

13. Once you visit the dashboard, the '6- Interest or any other amount tile in GSTR-5A' tile shall describe the total interest and cess amount.

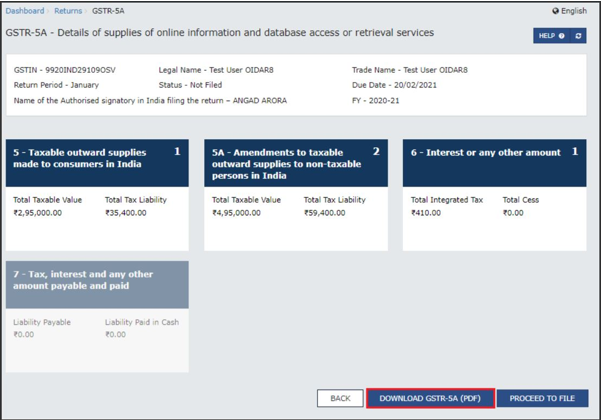

Preview Draft for GSTR-5A

Here is a preview of the draft showcasing GSTR-5A:

14. After this, click on the 'DOWNLOAD GSTR-5A (PDF)' to view the file.

Initiate Filing for GSTR-5A

Here are the steps to follow to initiate filing for GSTR-5A:

15. Click on the ‘Proceed to File’ button to begin proceeding with filing

16. Once you click on the button, you shall enable the '7 - Tax, interest and any other amount payable and paid' tile. Click on it

17. Hit the ‘Download GSTR-5A (PDF)’ button to receive the file in PDF format

Note: Filing returns for GSTR-5A will fail to complete until you file for full payment of taxes with other liabilities for the previous tax period. In this case, you need to create a challan.

Follow the below steps to create a challan:

18. Go to Services>Payments>Create Challan and you will receive the PDF format.

17. On the declaration checkbox, navigate to the 'Authorized Signatory' tab and then click on ‘File GSTR-5A’.

3. Once you receive the warning message, click on ‘Yes’.

4. Select the 'File with DSC' or 'File with EVC' button to start filing GSTR-5A.

Once you receive a confirmation message, hit the 'Download GSTR-5A' button to receive the form in PDF format.

What are the Rules and Guidelines for Filing GSTR-5A?

Here is a detailed overview of rules and guidelines mandatory for each taxpayer to follow while filing GSTR-5A:

- Every non-resident OIDAR service provider should file a GSTR-5A return.

- Every taxpayer should file this form by the 20th of next month after completing payment of taxes due or other amounts.

- Filing a GSTR-5A form is mandatory for every taxpayer irrespective of the transactions made under the tax period. If you miss, the monthly return will be a NIL return.

- Input Tax Credit is not mandatory while filing a GSTR-5A return, for which the Electronic Cash Ledger is not under maintenance.

- Filing of GSTR-5A is only possible if taxpayers pay taxes along with other liabilities for any particular current period.

The Government has purchased the business of Online Information and Database Access or Retrieval (OIDAR) for GST so that they can obtain equal chances among other businesses. However, important dimensions of a GSTR-5A filing will need to be understood in addition to how to file for every registered entity under GST (Goods and Service Tax).

Conclusion

Filing GSTR-5A is a crucial part of GST compliance for the OIDAR service providers. By following the necessary steps on the GST portal, businesses can ensure maintaining tax responsibilities within the due time.

Make sure to file GST returns each month even if there are no transactions to prevent penalties. Besides, maintain a transaction record while filing to ensure accuracy.

💡If you want to streamline your payment and make GST payments via credit card, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By