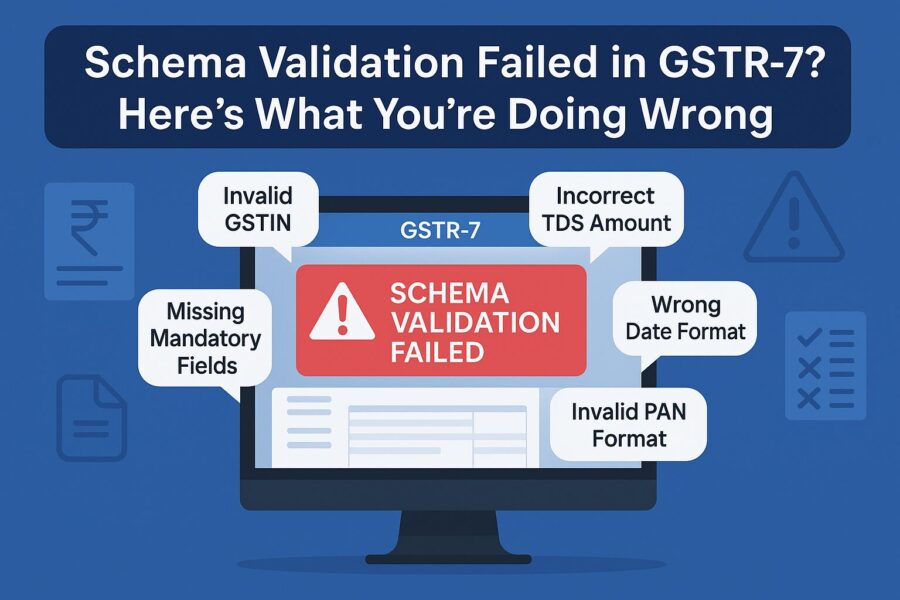

Schema Validation Failed in GSTR 7: 9 Common Errors to Avoid

- 1 Aug 25

- 11 mins

Schema Validation Failed in GSTR 7: 9 Common Errors to Avoid

Key Takeaways

- Incorrect GSTIN entry can block vendor ITC claims and damage business credibility—always validate before filing.

- Mismatches between GSTR-7 and GSTR-9 figures can lead to tax scrutiny—reconcile monthly and annual data diligently.

- Filing under wrong accounting heads or tax categories may trigger interest liability or ITC reversals—review chart of accounts carefully.

- JSON file validation errors occur due to outdated tools or incorrect formats—use updated utilities and validate before upload.

- Delayed GSTR-7 filing attracts daily penalties—set reminders and follow up to ensure timely compliance.

Seamless GST compliance is the ultimate goal for every business and it may be achieved through an error-free GSTR-7 return filing process. Filing GSTR-7 must be a task completed within each tax period. However, doing so may seem challenging, given the ever-changing/updating formats and regulations.

Perhaps, the schema validation failed in GSTR 7 or the annual reports have been mismatched. Even minute lapses may result in notices, which may in turn, impact the business’s working capital or reputation in general.

Refer to this blog to be aware of the 9 most common errors which come up inevitably, while filing the Form GSTR-7. Plus, it shall allow the taxpayer to undertake measures in order to avoid such errors through diligent compliance.

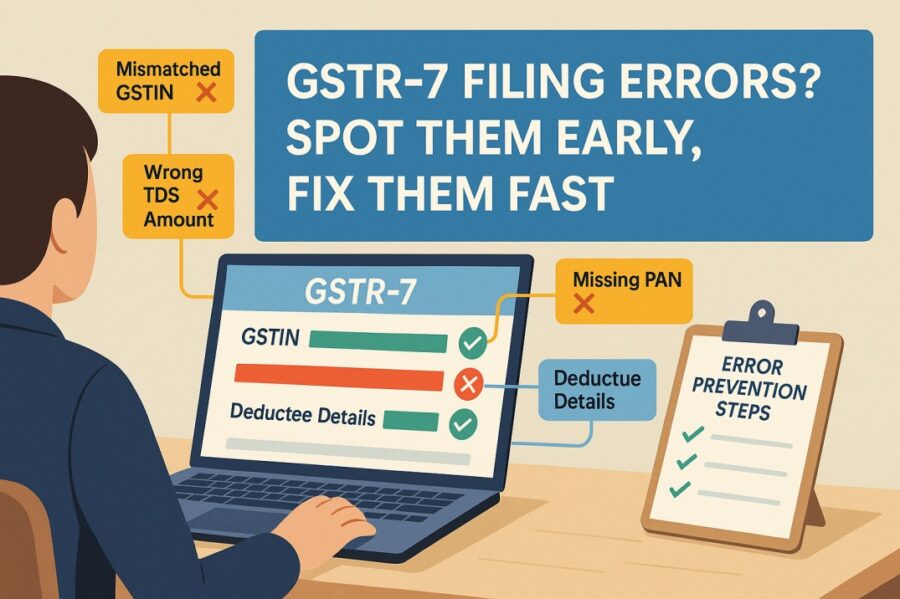

Identifying & Preventing Errors in Filing GSTR-7

Here is a list of the 9 most common mistakes which must be identified to possibly avoid them during accurate GSTR-7 submissions:

1. Reporting Under the Incorrect GSTIN

It is incredibly important to make sure that the taxpayer is reporting the TDS deductions/tax payments under the right GSTIN in Form GSTR-7.

Here’s is the impact that shall result otherwise and possible steps you can take to avoid the error:

| Error | Impact | Prevention |

| Reporting Under The Incorrect GSTIN | The error may result in the blocking of the vendor ITC claim, which will ultimately lead to a limit being put on the working capital.Misrepresentation shall be viewed as tax evasion by tax authorities.Reputational loss/credibility sacrifice may be an outcome for the businesses. | Cross-check the GSTIN with your vendor master prior to capturing TDS-related information.GSTIN validation may be built into the standard templates of data.Enhanced control over master data management via ERP integration shall help avoid the error. |

2. Mismatched Records of Annual Returns

Discrepancies in annual returns often arise from mismatched records, where monthly input figures reported across tax periods in GSTR-7 do not align correctly. Errors also pop up in the consolidated annual returns as filed under Form GSTR-9.

Here’s the impact and steps recommended for prevention for your reference:

| Error | Impact | Prevention |

| Mismatched Records of Annual Returns | · Additional liability may arise owing to differences detected in the reconciliation· Tax authorities may issue scrutiny notices on the mismatches· If clarification is not provided, the further claim of ITC may not be allowed | · Make sure to summarise the monthly values for GSTR-7 in a different register.· Try to understand why the differences have surfaced and make the necessary adjustments on time.· Compare both the returns and search for deviations regularly. |

3. Reporting Under the Wrong Accounting Heads

In case the details are incorrectly reported under the wrong heads in Form GSTR-7, it may lead to interpretation difficulties and misclassification.

Refer to the table below to explore the impact and steps recommended for the prevention of such an error:

| Error | Impact | Prevention |

| Reporting Under the Wrong Accounting Heads | · The misrepresentation of books can lead to unwanted inquiries.· It may trigger a scenario where there is a reversal of specific ITC claims by tax authorities.Interest liabilities may additionally pile up owing to wrong head reporting. | · Aim for clear segregation of interest, TDS-related information, and late fee payments in books.· For enhanced control, keep note of payment references in association with bank statements.· Prioritise accounting scrutiny prior to the filing process in order to avoid errors in reporting. |

4. Calculation Errors in Reference to Interest & Late Fees

While filing the form GSTR-7, a mistake-free computation process must be prioritised. The accurate disclosure of late fees related to delayed GST payments and interest amounts is of utmost importance. Wrong calculations may lead to the piling of penal actions.

The table below discusses the impact and steps for prevention of such miscalculation errors:

| Error | Impact | Prevention |

| Calculation Errors in Reference to Interest & Late Fees | · It may result in short payments, which may, in turn, attract notices and further recovery initiatives.· Relatively high late fees may result in upcoming returns.It shall impose a burden of cost, which may cause working capital to become stagnant for businesses. | · You can automate the process of interest computation in order to avoid the calculation mistakes which usually result from manual work.· Reconcile the interest that is already paid, corresponding with bank advice/books.· Cross-check the late fee payments with the sheet kept aside for penalty calculation. |

5. File Validation Issues

An error may pop up during the generation of the JSON file which is to be uploaded on the GSTN portal during actual filing. Errors in the overall file structure or input details shall make it impossible for the uploaded file to get accepted.

Take a look at the table below to understand the impact and discover the steps for the prevention of such a mistake:

| Error | Impact | Prevention |

| File Validation Issues | · It may lead to the inability to successfully file timely returns if the error is not rectified.· It may cause non-acceptance delays in credit claims on the suppliers’ end.The errors may lead to the locking up of working capital, derailing the concerned business’s compliance timelines. | · Make use of the updated utility with the latest schemas/validation rules.· Go through the JSON file format minutely prior to uploading.· Avoid procedural risks altogether, by ensuring that the sample dummy is operating smoothly. |

6. Discrepancies Detected in Tax Payment Details

Inaccurate breakup of values in the Form Table 3B (which may include cash as well as input tax credit), may result in adjustment-related issues. Debits from the cash ledger may not match with the bank statement records.

Refer to the table below to trace the impact of such an error and ways to prevent its occurrence:

| Error | Impact | Prevention |

| Discrepancies Detected in Tax Payment Details | · Discrepancies shall attract intense scrutiny resulting in the status of an intentional suspect.· Lengthy reconciliation may result across GST returns/books.The error may negatively impact the vendor relationship owing to account settlement delays. | · You can summarise the tax payments, in a table-wise manner, manually.· Prioritise accounting scrutiny alongside the reconciliation of bank statements.· Make use of the automatic liability calculation/payment recording facility. |

7. Reporting Under the Incorrect Supply Category

Errors in the classification of deductions under goods/services instead of the valid supply types may lead to a chain reaction of challenges, prompting further reconciliation for vendors.

Here is a table highlighting the impact of such a mistake and tips to prevent it:

| Error | Impact | Prevention |

| Reporting Under the Incorrect Supply Category | · The misclassification may lead to procedural challenges in reference to ITC claims.· The error may result in the otherwise avoidable blocking of business-specific working capital.Such errors may apply stress on developed business ties with suppliers, causing situational tension. | · You can refer to the actual invoice to be sure of the correct type of supply.· Aim for utmost accuracy with accounting classification in relation to purchases.· Skim through the source data before filing in order to bypass category errors. |

8. Input Tax Credit & Liability Mismatch

When the input tax credit is reclaimed, the error may prop up. The output-related liability of the respective deductor as recorded in the annual returns may not match the aggregate of monthly deductions (as portrayed in Form GSTR-7 across the year). This is when the challenges may arise.

Refer to the table below to understand the impact of the error mistake and the steps you can take to prevent it:

| Error | Impact | Prevention |

| Input Tax Credit & Liability Mismatch | It may lead to the accumulation of scrutiny/inquiry notices for the reconciliation from tax authorities.ITC claim facility may no longer be extended, resulting in overall financial losses.It may lead to the blocking of the working capital of businesses, which could otherwise be avoided. | You can proactively summarise the ITC/liability from monthly GSTR-7 to help the process.Make sure that the closing balances accurately tally with the annual return declarations.Detect and note down the deviations and initiate efforts to make timely adjustments. |

9. Delayed Filing After the Due Date

Filing past the due date is one of the most common mistakes made by taxpayers. If one delays the filing of form GSTR-7, going beyond the 10th of the succeeding month, penalties are likely to result.

Here is an overview of the impact of said error mistake and steps you can undertake to avoid it:

| Error | Impact | Prevention |

| Delayed Filing After the Due Date | It may result in the liability to pay a late fee for every day of delay.The error may cause a hold-up situation of working capital for the vendors.An increase may result in the process, which accounts for inefficiency and otherwise avoidable costs. | You can consciously set up reminders to make sure that you take the filing actions on time.Be sure to follow up in order to oblige by timelines.Request for authorised extensions by citing valid glitches or technical setbacks. |

Conclusion

Filing the Form GSTR-7 accurately is of utmost significance in order to avoid the 9 common mistakes listed above. A critical error to be on the lookout for is the "schema validation failed in GSTR-7," which may occur when the JSON file doesn't align with the respective GST portal's schema requirements. Prevent this by ensuring proper formatting, and accurate data entry and validate the JSON file before uploading.

Plus, verify the deductee information, section codes as well as tax rates/amounts to bypass other common mistakes. Meticulously follow the GST guidelines to effectively file Form GSTR-7, and thus, minimise challenges and ensure a smooth GST compliance process.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By