How to File a Reply for Form GST DRC 22 in GST Portal?

- 17 Jul 25

- 7 mins

How to File a Reply for Form GST DRC 22 in GST Portal?

Key Takeaways

- Form GST DRC-22 is issued for provisional attachment of a taxpayer’s property during GST recovery proceedings.

- The notice requires the taxpayer to submit a written explanation with supporting documents within a specified time.

- The property attached can include bank accounts, immovable assets, or financial holdings of the taxpayer.

- Filing a timely and detailed response via the GST portal is crucial to challenge or clarify the attachment.

- Failure to respond may lead to enforced recovery, penalties, and interest on the outstanding GST dues.

Responding to Form DRC 22 is a vital aspect. It helps stay compliant with the process in GST framework in India. GST authorities for recovery issue the Form DRC 22 in GST upon identifying discrepancies or inaccuracies in a taxpayer's filed GST returns.

As per the provisions of Section 73 or Section 74 of the Central Goods and Services Tax (CGST) Act, 2017, the notice calls for the concerned party to give an explanation in written format within a stipulated period.

In this blog, we will explain the process for replying to Form GST DRC 22 and mention key factors respondents should consider while drafting their reply.

Contents of Notice

The contents of Form GST DRC-22 typically include:

- Basic Details: A reference number and the date of issuance.

- Recipient Information: The notice is addressed to the entity holding the assessee's property, such as a bank, post office, financial institution, or immovable property registering authority. It includes the name and address of this entity.

- Taxable Person's Details: The form specifies the name, principal place of business address, Goods and Services Tax Identification Number (GSTIN) or other identification (ID), and Permanent Account Number (PAN) of the registered taxpayer whose property is being attached.

- Legal Basis: It mentions that proceedings have been initiated against the taxable person under a specific section of the CGST/SGST Act to determine tax or other amounts due.

- Property Details: Crucially, the notice provides specific details of the property being provisionally attached. This could be a bank account (specifying type like savings/current/FD/RD and account number) or a non-movable property (including its ID and location).

- Attachment Order: The form explicitly states the provisional attachment of the specified property/account by the authorized officer (name and designation provided).

- Restrictions: It includes a directive that no debit shall be allowed from the attached account(s), or that the attached property shall not be disposed of, without the prior permission of the GST department.

- Issuing Authority: The signature, name, and designation of the GST officer issuing the attachment order are included.

This shows that unless the said assets go through a disposal or further dealt with by the taxable person by way of negotiation, tax dues could arise and have to be secured for recovery. The attachment may be deemed provisional for one year and if the department so desires, it can be vacated earlier.

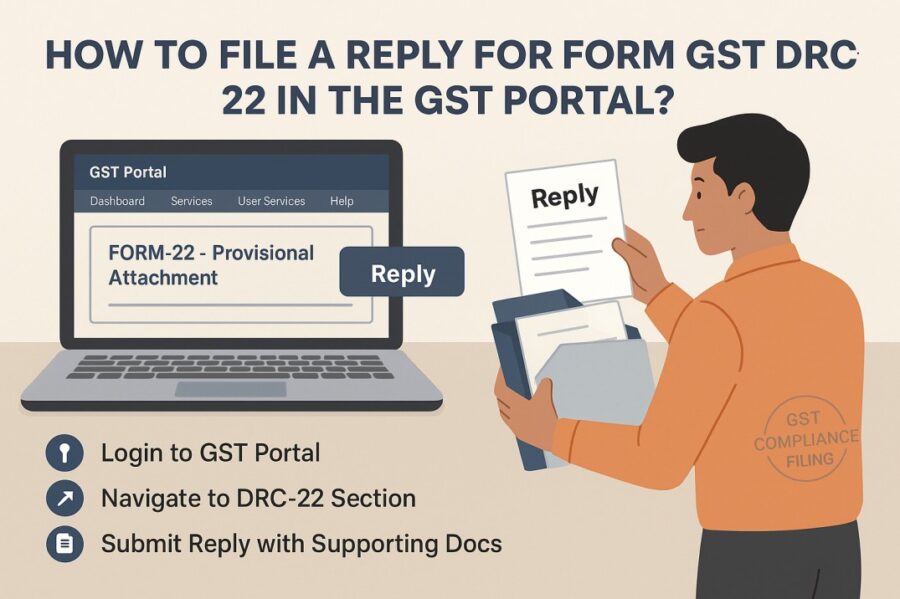

How to File a Response for Form GST DRC 22 According to GST Regime?

Steps Mentioned Below Must Be Followed by the Taxable Person to Reply to Form GST DRC 22 (Provisional Attachment of Property):

Step 1: Go to the official GST website and log in using your registered username and password.

Step 2: Select the 'Services' section, then click 'User Services' option from the visible choices in the drop-down menu. Then click on View Additional Notices/ Orders. Post that, select the View tab and NOTICES option to view the notice. Click the REPLIES option to reply to notice.

Step 3: In next step, choose the link named 'My Applications', and opt for button 'Application for Response to Show Cause Notice' from that list.

Step 4: Find the relevant notice type number to which you intend to respond and select it.

Step 5: Hit 'Proceed' button to open that response form and type all crucial details needed to file the reply.

Step 6: Upload documents that support your response or clarify the discrepancies mentioned in the notice.

Step 7: Authenticate the reply using DSC or Digital Signature Certificate technology registered on GST portal.

Step 8: Submit the response by clicking 'File' button and end the process.

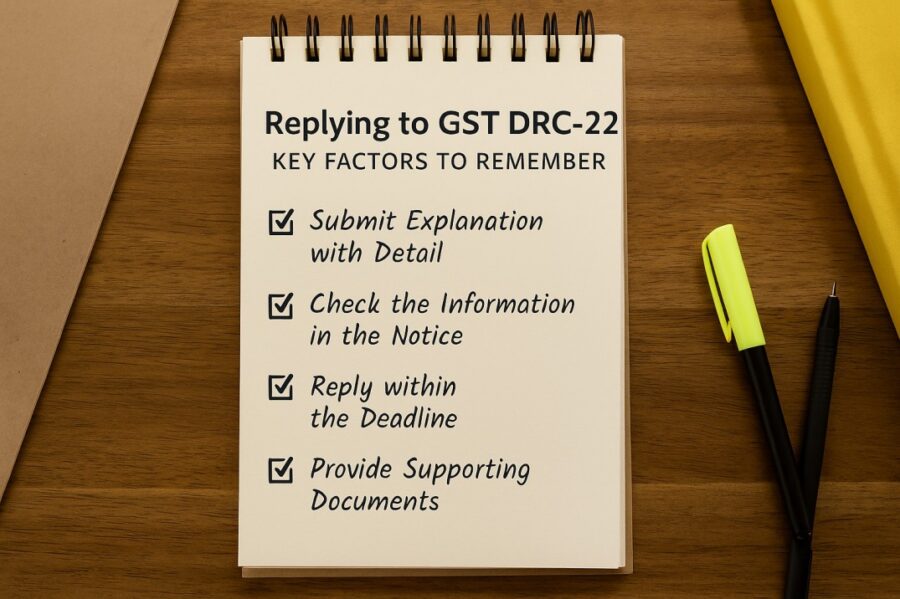

Key Factors That One Should Keep in Mind

When filing a response to Form GST DRC 22 in the GST portal, registered persons need to consider the following factors:

Submit Explanation with Detail: That taxpayer needs to draft a reply, while giving a comprehensive explanation addressing that identified discrepancy. Apart from this, they should support their explanation with pertinent documents to validate the accuracy of that claim being made.

Check the Information: The persons liable to tax should carefully review all the details mentioned in that notice. This step ensures that the reply is accurate and free of any errors or inconsistencies.

Reply within the Deadline: The registered person needs to consider the deadline and draft the response within a specific deadline. It will help prevent any additional penalties or consequences.

Provide Supporting Documents: Do not forget to provide supporting documents that are relevant to the case along with this reply. These may be invoices, bank statements, and other significant documents to prove the accuracy of the claim.

What are the Penalties for Non-Compliance?

If a registered business or individual does not respond to Form GST DRC-22 within the prescribed time, GST authorities can move forward and issue an official order confirming the amount mentioned in that notice. Along with that, the concerned party might also have to pay extra charges, in terms of interest and penalties, on the tax amount due.

Conclusion

Submitting a response against Form GST DRC 22 in GST framework is crucial for a registered person or business to remain compliant with GST rules. It allows the individual or business to clarify discrepancies detected by the Indian tax department when it comes to recovery of taxes and avoid further legal or financial consequences.

Make sure to be aware of the nuances clearly to avoid any issues while filing a reply for Form GST DRC 22.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By