Indirect Tax Collection Before and After GST

- 11 Jul 25

- 12 mins

Indirect Tax Collection Before and After GST

Key Takeaways

- GST unified India’s fragmented indirect tax system by subsuming multiple central and state taxes.

- Before GST, cascading taxes and complex compliance burdened businesses and consumers alike.

- Post-GST, indirect tax revenue increased significantly, with ₹18.07 lakh crore collected in FY 2022-23.

- GST enhanced transparency, reduced evasion, and simplified tax procedures through digital tools.

- The shift to GST improved ease of doing business and regularised previously unorganised sectors.

The Goods and Services Tax (GST) is a revolutionary measure that unifies and simplifies indirect taxation in India. This new regime came into effect on July 1st, 2017. Previously, India’s tax system was multi-layered and complicated, creating a domino impact. VAT, excise duty, entry tax and other types of taxes were a part of the system.

With the introduction of GST, the country’s tax system became transparent, and taxpayers got clarity. In this blog, we will compare indirect tax collection before and after GST and see how it has impacted India.

What are Indirect Taxes?

Before we dive into comparisons, knowing what indirect taxes entail is important. The government levies indirect taxes on goods and services. This tax can be passed on from one person to another. Usually, the end customers bear indirect taxes. These are administered and governed by the Central Board of Indirect Taxes and Customs (CBIC).

For example, the government can levy an indirect tax on wholesalers, who can pass it on to retailers. They can pass this tax on to the customers.

Difference Between Direct and Indirect Tax

The government levies direct tax on people’s incomes, which are not transferable. Therefore, every taxable person must pay taxes on their profits and revenue. Income tax is one of the most important direct taxes.

Let us compare direct and indirect taxes in India:

| Direct Tax | Indirect Tax |

| Tax on wealth, income or profit | Tax on services and goods |

| Tax burden cannot be shifted from one person to another | Tax burden can be shifted from one person to another |

| Governed by the Central Board of Direct Taxes (CBDT) | Governed by the Central Board of Indirect Taxes and Customs (CBIC) |

| Examples include income tax | Examples include GST |

Types of Indirect Taxes Applicable in the Pre-GST Period

To explain indirect tax collection before and after GST, we must first trace the indirect tax structure and types prevailing in India before GST. Earlier, the country had a cascading tax structure, where taxes were levied on top of existing taxes.

The government of India levied taxes at the federal and state levels. The indirect tax system included several different taxes. Here are some of the main types of taxes that existed before GST.

Value-Added Tax (VAT)

The central government levied value-added tax (VAT) on the sale of goods within a state. There were two types of VAT, known as State VAT and Central Sales Tax. The former collected taxes on intrastate sales, while the latter taxed interstate sales.

- Service Tax

Service tax was payable by the provider of a service. It is similar to excise duty, where an amount is charged on manufactured goods. Generally, service tax was collected by the service provider from the recipient directly, but in certain cases, the government may collect the tax from the recipient itself.

- Custom Duty

Before IGST was implemented, customs duty was levied on all imports and exports of goods and services. Therefore, customs duty under VAT refers to the tax imposed on all goods transported across international borders. Basic customs duty charges depend on the predetermined duty rates.

However, people often confuse this with an anti-dumping duty. Anti-dumping duty is a form of tariff imposed on foreign imports priced below the market levels in India.

- Excise Duty

The government of India levied central excise duty on domestically produced goods. It is charged on the production and sale of a particular commodity. It is an indirect form of taxation collected from customers by a retailer or an intermediary.

- Stamp Duty

Whenever you bought a property in the old tax regime, you had to pay stamp duty. The federal government charged this tax according to the market value. It generally ranges from 4% to 7%.

- Securities Transaction Tax (STT)

Securities Transaction Tax (STT) is a form of tax imposed on transactions involving securities such as stocks, mutual funds and other securities in the Indian stock exchanges. The government of India determines and amends the STT rates from time to time.

- Entertainment Tax

Introduced in India in the 1940s, the entertainment tax is a form of tax imposed on several forms of entertainment such as movies, music, dance, sports, theatre and more. The rate of amusement taxes varies from state to state and even from one union territory to the other.

Key Differences Between VAT vs GST

Here is the key difference between VAT and GST that you need to know:

| Point of Difference | VAT | GST |

| Structure | Earlier, central taxes included customs duty, central excise duty and central sales tax on goods and services. The state taxes included VAT, entertainment tax, etc. | Under GST, most central and state taxes are merged into a single tax applicable on goods and services, excluding motor spirit, petroleum, natural gas, and diesel. |

| Registration | Registration under VAT was decentralised | Uniform e-registration is implemented under GST based on the PAN of the entity. |

| Filing of Returns and Collection of Tax | Previously, VAT rates differed across states. | There is a uniform process now, with common deadlines for tax collection, payment and filing return. |

| Service Tax | The Centre levied service tax on a specified list of services under the Finance Act, based on the provision or payment. | The State GST subsumes service tax, based on the Place of Supply rules. |

| Disallowance of Credit | Certain commodities and services were non-creditable | Such restrictions won't apply unless the GST Council decides otherwise |

| Disallowance of Inputs | Not permitted | No such disallowance, unless the GST Council specifies |

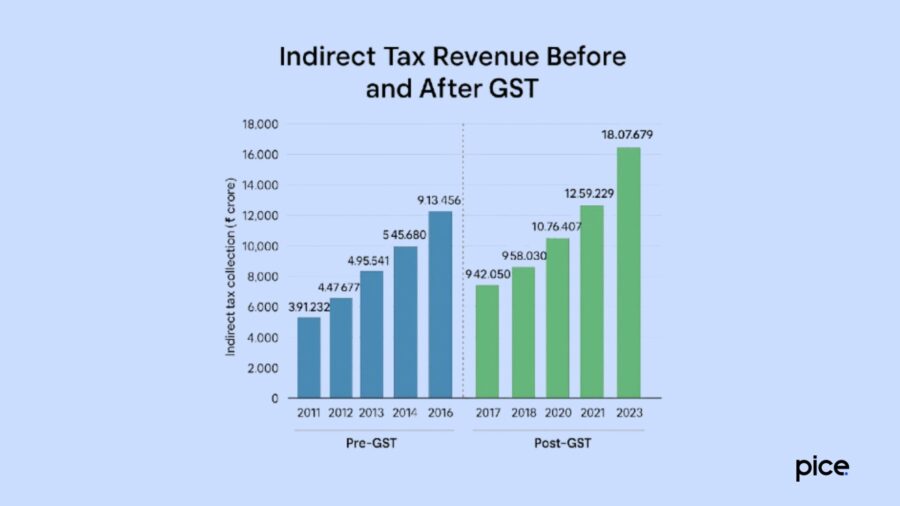

Tax Revenue Collection Before GST

To understand the difference between indirect tax collection before and after GST, it's important to first compare the Indian revenue collection via such taxes. As per a report, there has been a steady increase in indirect tax collection from FY 2011-2012 to FY 2016-2017. In FY 2011-12, India’s indirect tax collection stood at ₹3,91,232 crores.

However, over the course of India’s growth, indirect tax collection saw a 240.31% increase, thanks to GST. Thus, we see a stark contrast in indirect tax collection before and after GST.

Limitations of the Pre-GST Indirect Taxes

The stark contrast points out several limitations of the previous tax structure. Some of those limitations are as follows:

The main limitation of the old tax system was its inability to offset taxes paid at various points in the supply chain. This led to something known as the ‘domino effect of taxes’, which rendered the Indian tax system ineffective.

The disjointed tax structure also restricted the free flow of products across the states.

The central authorities faced significant financial losses as people exploited tax loopholes.

The accumulation of taxes and the imposition of taxes at each stage of production disrupted the manufacturing sector. Products and services saw significant price increases as a result.

Extensive tax evasion was common due to the complex nature of the indirect taxation system and complex tax regulations.

Complexities in tax compliance procedures also resulted in a lot of financial burden, as it increased paperwork and audits.

The VAT system was not only a burden on businesses, but it was also a burden on customers. Both parties faced huge administrative burdens in the previous tax structure.

All this made indirect tax compliance under the previous system a complicated process.

GST Implementation and Its Structure

The introduction of GST in 2017 revolutionised and changed the indirect taxation structure in India. Goods and Services Tax in India follows a four-tier structure and consists of various tax slabs, with differing rates for different goods and services. This simplified version aims to institutionalise and promote ease of doing business in India.

Effectively, the Goods and Services Tax has subsumed all the other forms of indirect taxation. India’s tax system became simpler with GST. The complex and multi-tiered structure was reformed into a four-tiered structure. They are:

- Central GST (CGST): The Central Goods and Services Tax is imposed on the movement of goods and services within the territorial boundaries of India. The central government imposes these central taxes.

- State GST (SGST): The State Goods and Services Tax is levied by the State governments. This tax is imposed on the sale or purchase of goods in the state where the goods are consumed or sold.

- Integrated GST (IGST): Tax authorities levy Integrated Goods and Services Tax on transactions of goods and services across state borders. This tax is imposed on all interstate transactions.

- Union Territory GST (UTGST): As the name suggests, this form of GST applies only to the Union Territories of India. Goods and services in those territories come under UTGST.

Tax Revenue Collection After GST

Now that we have understood the basic structure of GST, let us see how it brought revenues for the government. This will help us understand indirect tax collection before and after GST.

| Month | 2017-18 (₹) | 2018-19 (₹) | 2019-20 (₹) | 2020-21 (₹) | 2021-22 (₹) | 2022-23 (₹) |

| April | - | 103459 | 113865 | 32172 | 139708 | 167540 |

| May | - | 94016 | 100289 | 62151 | 97821 | 140885 |

| June | - | 95610 | 99939 | 90917 | 92800 | 144616 |

| July | - | 96483 | 102083 | 87422 | 116393 | 148995 |

| August | 95633 | 93960 | 98202 | 86449 | 112020 | 143612 |

| September | 94064 | 94442 | 91916 | 95480 | 117010 | 147686 |

| October | 93333 | 100710 | 95379 | 105155 | 130127 | 151718 |

| November | 83780 | 97637 | 103491 | 104963 | 131526 | 145867 |

| December | 84314 | 94726 | 103184 | 115174 | 129780 | 149507 |

| January | 89825 | 102503 | 110818 | 119875 | 140986 | 157554 |

| February | 85962 | 97247 | 105361 | 113143 | 133026 | 149577 |

| March | 92167 | 106577 | 97590 | 123902 | 1492095 | 160122 |

| Total | 719078 | 1177370 | 1222117 | 1136803 | 1483292 | 1807679 |

This table shows the monthly and yearly GST amounts collected. This table is crucial when it comes to understanding indirect tax collection before and after GST. In FY 2017-18, the tax collection amount stood at ₹7,19,078 crore. This increased to ₹18,07,679 in the year 2022-23, showing an increase of 151.39%.

Comparing Pre-GST and Post-GST Tax Collection in India

Now, let us compare the data on indirect tax collection before and after GST. These two can be compared by simply compiling the data into tables, as given below.

| Before GST | After GST | ||

| Year | Indirect Tax Collection | Year | Indirect Tax Collection |

| 2011-2012 | 391232 | 2017-2018 | 913456 |

| 2012-2013 | 474767 | 2018-2019 | 942050 |

| 2013-2014 | 495541 | 2019-2020 | 958030 |

| 2014-2015 | 545680 | 2020-2021 | 1076407 |

| 2015-2016 | 708013 | 2021-2022 | 1259929 |

| 2016-2017 | 866109 | 2022-2023 | 1331420 |

Before the implementation of GST, indirect taxes mainly consisted of service tax, VAT, entertainment tax and others. Once GST subsumed all the existing taxes, the government of India saw a massive revenue surge. The average of GST collection in FY 2022-23 was ₹1.51 lakh crore.

In comparison to the financial year 2016-17, the federal government's overall revenue collection increased by ₹6,41,999 crore in the year 2017-18. This massive increase in revenue, largely attributed to the implementation of GST, brought about several benefits of GST.

Benefits of GST

Here are some of the main benefits of GST:

- GST has subsumed and brought indirect taxation under its umbrella and eliminated the cascading effect of taxation, which was prevalent earlier. Moreover, it streamlined the documentation process and ensured adherence to tax regulations.

- The entire process of GST registration is online, which has made it simple and accessible. This has benefited start-ups and other small businesses in tax payments directly, as paperwork and other costs were eliminated.

- The burden of business compliance is also lower, resulting in less paperwork and timely registrations. Moreover, the tax compliance processes were made easier by the introduction of GST.

- GST has helped regularise sectors like construction and textiles, which remained largely unorganised under the old tax structure.

- The central government introduced various tax automation tools, such as the GST portal and GSTN. This tax automation software made it easier to access and understand. It features real-time reporting systems and an ecosystem for process automation.

- Consumer products saw a decrease in price, and consumer behaviour shifted.

Conclusion

India's shift from the VAT system to the GST scheme is a great initiative by the central authorities. Company operations were enhanced, and taxpayers got clarity about taxation. Moreover, prices related to the production of goods decreased, impacting the maximum retail price as well.

The shift from heavy paperwork to a data and technology-driven tax system was not easy. The federal government faced several challenges.

However, over time, authorities took meaningful steps to smooth out these challenges, affecting indirect tax collection before and after GST. Furthermore, the central government portal helped simplify complex tax regulations.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By