A Guide on Board Resolution for GST Registration

- 22 Apr 25

- 8 mins

A Guide on Board Resolution for GST Registration

- What Is a Board Resolution for GST Registration?

- Significance of Board Resolution Required for GST Registration

- What Are the Key Components of a Board Resolution for GST Registration?

- How to Draft a Board Resolution for GST Registration?

- Sample Board Resolution for GST Registration

- Key Factors to Consider While Making A Board Resolution

- Common Mistakes to Avoid While Drafting a Board Resolution

- Conclusion

Key Takeaways

- Board resolutions legally authorize GST registration processes.

- Include authorization details, signatures, and company seal clearly.

- Use precise language to avoid legal issues.

- Avoid common errors like vague wording and missing signatures.

- Legal review ensures smooth GST compliance.

Goods and Services (GST) registration is a must for businesses in India. The benefits of it are manifold. Not only does the registration help businesses maintain their tax compliance, but it also increases their credibility.

The straightforward process of registering under GST allows businesses to grow and scale. Board resolutions are a key part of this registration process. The document outlines the acceptance of all board members of an organization to be listed under GST.

However, there is a particular format that businesses must follow while making a board resolution. The following overview speaks of all the nitty-gritty that businesses must comply with to make a satisfactory board resolution for GST registration.

What Is a Board Resolution for GST Registration?

A board resolution is an official document that records the decisions made during a meeting by a company's board of directors related to the company's GST registration. For GST registration, a board resolution shows that the board has authorized a specific person or people to handle the GST registration process for the company. It also serves as a clear record of what the company intends to do.

Simply put, this resolution stands as a formal acknowledgement from the board that the company is ready to adhere to the GST laws by authorizing specific persons to take the necessary steps and get registered under the GST regime.

Significance of Board Resolution Required for GST Registration

GST registration is a formal procedure that requires the company’s approval. The decision to register a business under GST holds optimum significance as it incurs certain financial and operational implications. Therefore, the Board of Directors must officially facilitate the process.

The board resolution provides a legal and transparent framework for the company’s actions. It ensures that everything stays in order and complies with statutory requirements. This resolution is crucial for private limited companies and LLPs as it enables them to access benefits such as input tax credits and enhanced market competitiveness.

One copy of the framework must be submitted to the GST authorities. Without this document, the GST registration application cannot be processed.

What Are the Key Components of a Board Resolution for GST Registration?

A board resolution is one of the main parts of the GST registration requirements. It includes several components. All the information collectively states the board decision and makes the document effective. Following is a clear breakdown of each part:

- Title

- Date and Place

- Introduction

- Authorization Clause

- Authority Details

- Resolution Text

- Signatures of Board Members

- Company Seal

How to Draft a Board Resolution for GST Registration?

Let’s break down the process of drafting a board resolution for GST registration in a step-by-step guide:

- Step 1: Title and Heading

The title should be short and simple. It must reflect the purpose of the resolution. Make the title bold and place it on top of the resolution to ensure clarity.

- Step 2: Date and Place

The date and place of the board meeting where the board resolution was passed must be mentioned here. This helps in validating the resolution in terms of its time and location.

- Step 3: Introduction

The introduction explains the company’s intent to obtain GST registration and the need for the board’s approval, thus, it comes under date and time.

- Step 4: Authorization Clause

The next section of the resolution should precisely mention a specific individual or a group of individuals who have been authorized to apply for GST registration on behalf of the company. This clause shows the authority of that individual to complete the registration process.

- Step 5: Authority Details

This section should comprise the details of the authorized person(s). The details include the designation and any particular responsibility that has been given to complete the task.

- Step 6: Resolution Text

The main body of the resolution should express the decision of the board. It is mostly defined in a clear statement.

- Step 7: Signature and Company Seal

The final step is for the resolution to be signed by the Chairman or the Director of the meeting. The resolution then must be sealed with the company’s official seal. This affirms the legal binding of the framework.

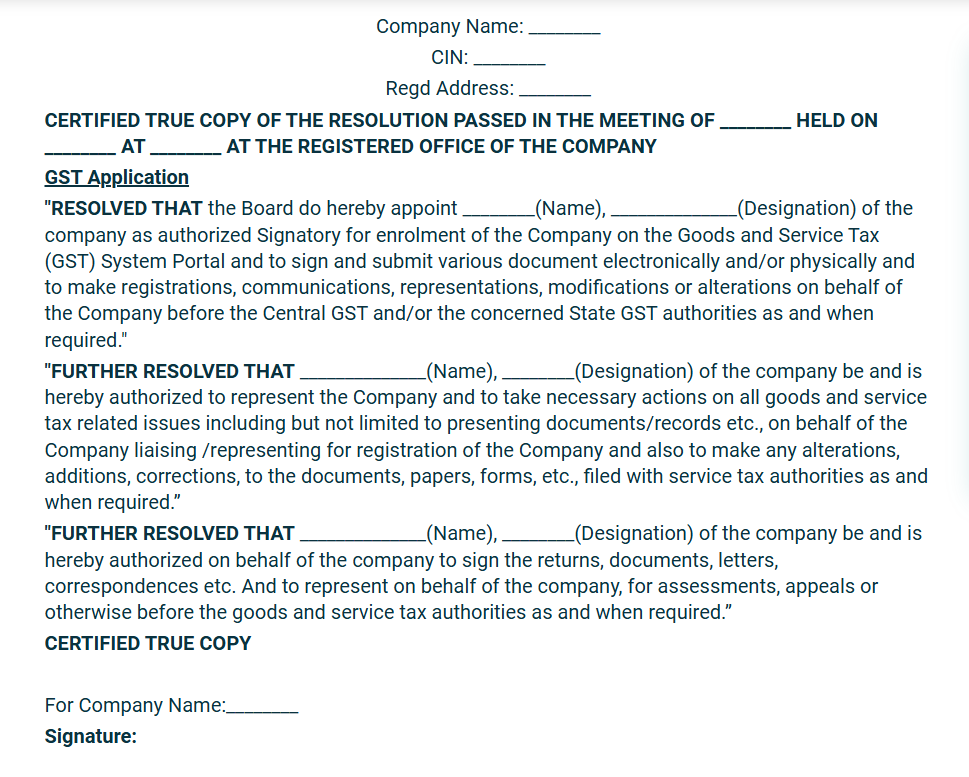

Sample Board Resolution for GST Registration

Here’s an example of a complete board resolution format for GST registration:

Key Factors to Consider While Making A Board Resolution

One must consider certain factors while creating a board resolution to make the document flawless and effective. Take a look:

- Draft Precisely: Ambiguity is a strict no when it comes to drafting a board resolution. Since it serves as proof of compliance, every term mentioned in the document should be easily understandable.

- Comply with Policies: The resolution must align with your corporate policies and the Companies Act 2013 to avoid any legal issues and ensure end-to-end legal compliance.

- Get Reviewed: The legal requirements of the GST ecosystem can be hard to comprehend at times. Thus, companies must review the document with a lawyer before submission.

- Record Quickly: Seamless and fast processing of the resolution will help to prevent filing process delays and encourage the progress of the GST registration process.

Common Mistakes to Avoid While Drafting a Board Resolution

There is no room for error when it comes to board resolution. The person in charge must pay great attention to detail to steer clear of mistakes. Here are some common mistakes that you should be aware of:

- Incorporation of Vague Language: Ambiguous words can confuse authorities on the involved duties. Thus, ensure to frame the document in the simplest diction.

- Insufficient Information: Be sure to incorporate all the required details, like titles and names of the authorised people, to make the document effective.

- Lack of Signatures and Seal: The resolution should include the company seal if necessary and have enough board members sign off on it. It is illegal if a board resolution does not include a company seal, service tax authorities may disqualify it.

Conclusion

A well-drafted board resolution is a formal document of GST application. Creating a board resolution for GST registration is crucial to becoming GST-compliant. By following this guide and focusing on key points and common mistakes, you can write an effective board resolution that helps with a smooth GST registration process.

💡If you want to streamline your payment and make GST payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By