Know the Differences between GSTR-1, GSTR-2 and GSTR-3b

- 21 Aug 24

- 13 mins

Know the Differences between GSTR-1, GSTR-2 and GSTR-3b

Key Takeaways

- GSTR-1, GSTR-2, and GSTR-3B are used for different purposes in GST compliance depending on sales, purchases, and summary tax reporting, respectively.

- It is essential to file GSTR-3B on time in order to prevent penalties and interest charges on unpaid tax bills.

- All registered taxpayers must file GSTR-1, with the exception of those who are eligible for certain programs like the Composition Scheme.

- GSTR-3B for the same period must be submitted before filing GSTR-1.

- The GST portal provides tools for comparing GSTR-1 and GSTR-3B, guaranteeing correctness and uniformity in tax returns.

GST (Goods and Services Tax) returns can be a tiring process, but they're crucial for maintaining compliance and avoiding penalties. In this article, we’ll break down the essentials of three key GST reports: GSTR-1, GSTR-2, and GSTR-3B. By the end, you'll have a clear understanding of what each report entails, who needs to file them, and how to stay on top of your GST obligations.

Handle all your sales and purchase invoices in one place.

Pice’s all-in-one invoice management tool helps you track, send, and organize invoices from a single dashboard. Automatically share new invoices with customers, send timely payment reminders, and keep your collections under control—effortlessly.

Want early access? Fill out this form to get request a demo!

What is a GST Return?

A GST return is a form that businesses registered under India's Goods and Services Tax (GST) system must submit to the tax authorities. This record includes information regarding the company's income, sales, purchases, and taxes payable or receivable.

The primary purpose of a GST return is to ensure that businesses report their financial activities accurately and pay the appropriate amount of tax to the government.

A GST return is a document that businesses registered under the Goods and Services Tax (GST) system in India must file with the tax authorities. This document contains details about the company's income, sales, purchases, and the tax collected or paid. The GST return's primary objective is to ensure that businesses correctly report their financial activity and pay the appropriate amount of tax to the government.

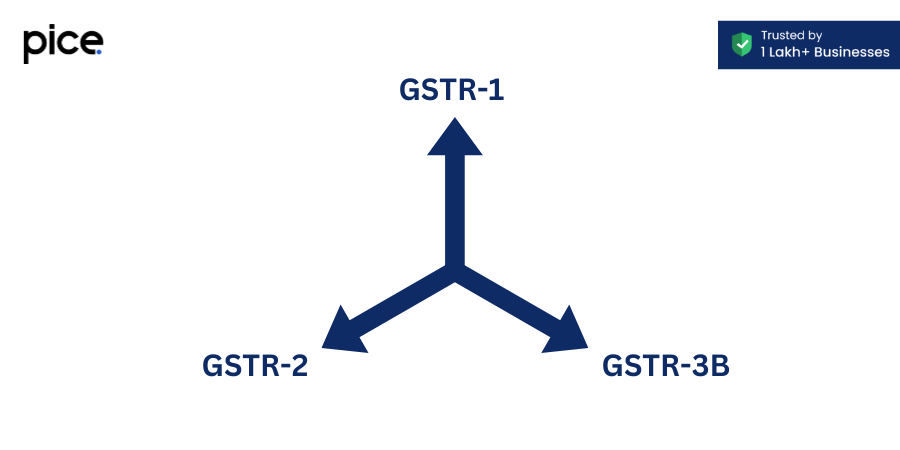

Filing GST return for taxpayers is mandatory for all businesses registered under the GST regime. The returns aid the government in tracking tax liabilities, collecting taxes efficiently, and preventing tax evasion. There are numerous GST returns, each with a distinct purpose, including the reporting of sales (GSTR-1), purchases (GSTR-2), and the presentation of a summary of tax liabilities (GSTR-3B).

Annual Return: Comprehensive Overview and Key Elements

An annual return under the GST regime is a crucial document that provides a consolidated summary of all the business yearly and monthly transactions carried out over the financial year. This includes details of sales, purchases, tax paid, input tax credit (ITC), and other relevant financial activities.

Key Features and Elements:

- Types of GST Returns: Businesses need to file various GST returns throughout the year, including GSTR-1, GSTR-2, and GSTR-3B, on a monthly or quarterly basis. The annual GST return, typically filed as Form GSTR-9, aggregates these periodic returns.

- Input Service Distributor (ISD): ISDs distribute the credit for input services to their units having the same PAN. This needs to be reported accurately in the annual return to ensure proper credit distribution.

- Quarterly Return: Businesses with a turnover below a specified threshold can opt for quarterly filing of their returns, but they still need to file an annual return summarizing all transactions.

- Debit Notes and Credit Notes: Adjustments made through debit and credit notes issued during the year must be reported. These notes help in adjusting the taxable value and tax amounts in the returns.

- Tax Returns: The annual return consolidates all tax returns filed during the year, providing a complete picture of the tax liabilities and credits.

- Unregistered Persons: Transactions with unregistered persons need to be included in the annual return to ensure comprehensive reporting of all business activities.

- E-Way Bill: Details of e-way bills generated during the year should align with the transactions reported in the GST returns, ensuring consistency.

- Non-Resident Foreign Taxpayers: Non-resident taxpayers are also required to file annual returns if they have business operations in India, ensuring compliance with local tax laws.

- Union Territory: Businesses operating in union territories need to report their transactions separately, as different tax rates may apply.

- Monthly and Quarterly Basis: Regular or normal taxpayers need to file GSTR-1 and GSTR-3B either on a monthly or quarterly basis, but the annual return consolidates all these filings.

- Business Transactions: All business transactions, including sales, purchases, and expenses, need to be accurately reported in the annual return to ensure correct tax computation.

- Liability Ledger: The annual return provides a detailed view of the tax liability ledger, showing the total tax paid and any outstanding liabilities.

- Eligible Input Tax Credit: Proper reporting of eligible ITC helps businesses reduce their tax liability and avoid discrepancies in their returns.

- Self-Certified Reconciliation Statement: Businesses with an annual turnover above a certain threshold need to file a reconciliation statement (GSTR-9C), certified by a chartered accountant, to reconcile the annual return with their financial records.

- Common Mismatches: Regular reconciliation helps in identifying common reasons for mismatches in the returns, such as discrepancies in invoice details, ensuring accurate reporting.

The new rule will only apply when there's a mismatch in tax payable between the GSTR-1 and 3B by a certain amount/percentage.

By incorporating these elements into the annual return, businesses can ensure comprehensive and accurate reporting, maintain compliance with GST regulations, and optimize their tax liabilities.

GSTR-1 or Sales Report

GSTR-1 is an essential document for businesses under the GST regime in India. It is an extensive document that includes all sales transactions that a business has conducted within a specific timeline. It can be either monthly or quarterly. This report is essential for the calculation of the tax liability, as it contains information about the external supplies of products and services.

Key Features of GSTR-1:

- Outward Supplies Details: GSTR-1 contains thorough documentation of the company's sales. This covers transactions between businesses and consumers as well as between businesses.

- Invoice-Level Reporting: Reporting at the invoice level is necessary to ensure correctness and openness in every selling transaction.

- Harmonized System of Nomenclature (HSN) Codes: For correct tax classification of the items they sell, businesses must provide the HSN codes for such products.

- Tax Liability: The report helps to establish the tax owing for the sales that took place within the given time range.

Who needs to file GSTR-1?

Every GST-registered firm has to submit GSTR-1. The yearly turnover of the company determines how often it files:

- Quarterly Filing: Companies can choose to file GSTR-1 quarterly if their yearly sales are up to ₹1.5 crore.

- Monthly Filing: GSTR-1 must be filed on a monthly basis by companies with yearly sales greater than ₹1.5 crore.

When the tax payable in the GSTR-1/IFF is greater than the tax payable in the GSTR-3B by a specific amount or percentage, the GST portal will send out these notifications.

Importance of Filing GSTR-1:

Filing GSTR-1 accurately and on time is crucial for several reasons:

- Reconciliation of Input Tax Credit (ITC): Buyers use the data in Form GSTR-1 return to make an input tax credit claim. Any discrepancies can lead to ITC mismatches and disputes.

- Compliance: Regular and timely filing helps businesses stay compliant with GST laws and avoid penalties.

- Business Credibility: Maintaining accurate GST records enhances a business's credibility with customers and tax authorities.

GSTR-2 or Purchase Report

GSTR-2 is a detailed report that captures all purchase transactions made by a business within a specific time period. This report includes information about the inward supplies of goods and services, which is crucial for claiming input tax credit (ITC).

Key Features of GSTR-2:

- Inward Supplies Details: GSTR-2 includes detailed information about all purchases made by the business, ensuring accurate record-keeping of inward supplies.

- Invoice-Level Reporting: Similar to GSTR-1, GSTR-2 requires invoice-level reporting for each purchase transaction.

- HSN Codes: The report requires mentioning the HSN codes for the goods purchased, facilitating proper categorization for tax purposes.

- Input Tax Credit: The primary purpose of GSTR-2 is to claim ITC on the purchases made, reducing the overall tax liability of the business.

Who needs to file GSTR-2?

Every business registered under the GST regime is required to file GSTR-2. This report plays a key role in ensuring that businesses accurately report their purchases and claim the appropriate input tax credit.

Although the filing of GSTR-2 has been suspended since September 2017, understanding its importance and structure is still relevant for compliance with GST regulations.

Importance of Filing GSTR-2 Return:

Even though the filing of GSTR-2 is currently suspended, its significance cannot be overlooked.

- ITC Reconciliation: GSTR-2 helps in reconciling the input tax credit by matching the purchases reported by the buyer with the sales reported by the supplier in GSTR-1.

- Accurate Tax Reporting: It ensures that businesses report their purchases accurately, which is essential for proper tax calculation and compliance.

- Preventing Tax Evasion: By requiring detailed reporting of purchases, GSTR-2 helps minimize tax evasion and maintain the integrity of the GST system.

GSTR-3B or Tax Summary Report

GSTR-3B is a simplified monthly summary return under the Goods and Services Tax (GST) regime in India. It provides a consolidated summary of business sales, input tax credit, and the tax payable by a business. Unlike GSTR-1 and GSTR-2, GSTR-3B does not require invoice-level details, making it easier to file.

Who needs to file GSTR-3B?

All registered taxpayers under the GST regime must file GSTR-3B every month. This includes regular taxpayers, composition scheme dealers, e-commerce operators, and even non-resident taxable persons. Filing GSTR-3B is mandatory for maintaining compliance with GST laws and ensuring accurate tax payments.

Key Features of GSTR-3B:

- Summary of Outward Supplies: It includes details of all outward supplies (sales) made during the month.

- Input Tax Credit (ITC): The report provides a summary of input tax credits claimed on purchases and expenses.

- Tax Liability: It calculates the net tax liability after adjusting the input tax credit against the tax payable on outward supplies.

- Payment of Taxes: Businesses must pay the tax liability shown in GSTR-3B by the due date to avoid penalties and interest.

Deadlines and Penalties:

- Monthly Filing: The deadline for filing GSTR-3B is the 20th day of the subsequent month.

- Penalties: Failure to file GSTR-3B on time attracts a late fee of ₹50 per day (₹20 per day for nil returns), with no maximum limit. Additionally, interest is charged on the outstanding tax liability.

Importance of Filing GSTR-3B:

- Compliance: Timely and accurate filing of GSTR-3B ensures compliance with GST laws, helping businesses avoid legal issues and penalties.

- Tax Credit Utilization: Filing GSTR-3B allows businesses to claim and utilize input tax credits, reducing their overall tax liability.

- Cash Flow Management: By summarizing the tax payable, GSTR-3B helps businesses manage their cash flow more effectively.

- Business Credibility: Regular filing enhances a business’s credibility with suppliers, customers, and tax authorities.

What's the Difference Between GSTR-1, GSTR-2, and GSTR-3B?

Knowing the differences between GSTR-1, GSTR-2, and GSTR-3B is crucial for effective GST compliance. Here's a detailed comparison in tabular format to help clarify their distinct purposes, filing requirements, and features:

| Feature | GSTR-1 | GSTR-2 | GSTR-3B |

|---|---|---|---|

| Purpose | Captures details of all sales (outward supplies) | Captures details of all purchases (inward supplies) | Provides a consolidated summary of sales, input tax credit, and tax payable |

| Type of Report | Sales Report | Purchase Report | Tax Summary Report |

| Who Needs to File | All GST-registered businesses | All GST-registered businesses (currently suspended) | All GST-registered businesses, including regular taxpayers, composition dealers, etc. |

| Filing Frequency | Monthly or Quarterly based on aggregate turnover | Monthly (when active) | Monthly |

| Due Date | 11th of the subsequent month for monthly filers; 13th of the month following the quarter for quarterly filers | 15th of the subsequent month (when active) | 20th of the subsequent month |

| Invoice-Level Details | Yes | Yes | No |

| HSN Codes are required. | Yes | Yes | No |

| Input Tax Credit | No | Yes | Summary included |

| Late Filing Fee | ₹50 per day (₹20 per day for nil returns) | ₹50 per day (₹20 per day for nil returns) (when active) | ₹50 per day (₹20 per day for nil returns) |

| Reconciliation Requirement | No | Yes, with GSTR-1 and GSTR-3B | Yes, ensures correctness of GSTR-1 and GSTR-2 |

| Importance for ITC | Basis for supplier’s output tax declaration and buyer’s input tax credit | Basis for claiming input tax credit | ITC, as claimed and summarized here, needs to match with GSTR-1 and GSTR-2 |

| Impact on Tax Liability | Direct, as it reports sales | Indirect, as it affects the input tax credit details | Direct, as it reports net tax liability, |

| Corrections/Amendments | Can be adjusted in subsequent returns | Can be adjusted in subsequent returns (when active) | No amendments allowed after filing of GST returns; adjustments made in subsequent returns |

Each of these reports serves a distinct purpose and plays a crucial role in the GST return filing period process. Understanding these differences can help businesses manage their compliance effectively.

Conclusion

Keeping up with GST returns might seem like a chore, but it's a crucial aspect of running a compliant business in India. GSTR-1, GSTR-2, and GSTR-3B each have their own role to play, and being aware of their requirements and deadlines can save you from unnecessary stress and penalties. Stay informed, stay compliant, and your business will thrive.

💡Facing delays in GST payment? Get started with PICE today and streamline your GST payments. Click here to sign up and take the first step towards hassle-free GST management.

By

By