A Complete Guide on Delivery Challan Under GST Rule 55

- 22 Jan 25

- 8 mins

A Complete Guide on Delivery Challan Under GST Rule 55

- Delivery Challan Meaning & Requirements Under GST

- Different Delivery Challan Formats and Templates

- Mandatory Components of a Delivery Challan

- When to Issue a Delivery Challan as Per CGST Act?

- Difference Between Delivery Challan & Invoice

- Instances Where a Delivery Challan Can be Issued in Place of an Invoice

- Conclusion

Key Takeaways

- Proof of goods movement without ownership transfer.

- Must include challan number, date, supplier/consignee details, and tax info.

- Issued for job work, transfers, liquid gas, or exhibitions.

- Templates are available in Excel, Word, or digital software.

- Delivery challans lack ownership proof, unlike invoices.

As per the GST Act, when the supply of goods or services does not take place immediately, then the concerned supplier needs to issue a delivery challan. This document signifies that the payment for a supply is yet to be completed.

In this guide, we will discuss the format and mandatory components of a delivery challan under GST Rule 55. Additionally, we will walk you through the main difference between an invoice and a delivery challan.

Delivery Challan Meaning & Requirements Under GST

A delivery challan is an official document that can be issued by a GST-registered supplier to move supplies from one place to another place. Simply put, it serves as a confirmation of delivery. Many often refer to this document as a delivery slip or dispatch challan as well.

A supplier must send the delivery challan along with the products which are being transported and include several important details, such as the delivery address, name of the buyer, product quantity, etc. Section 31 of CGST law, of 2017 mandates a registered taxpayer to issue this document while delivering any purchased product.

Different Delivery Challan Formats and Templates

A standard delivery challan format has to include the name, address and contact details of both the recipient and supplier, product details, transportation specifications and so on. You can modify the format to suit the nature of a transaction.

Additionally, you can use an Excel delivery challan template, a Word format, or take it to the next level by relying on professional digital challans made through software. Let's break it down for a clearer understanding:

- Excel Delivery Challan Template

Many prefer to maintain their delivery challan templates in Excel as it allows them to enter values and perform calculations easily. It is a decent method for individuals who have not yet allocated funds for a delivery challan application.

- Word Delivery Challan Template

Making a delivery challan template using MS Word enables you to personalise your offering by adding a brand logo and other infographics. Thus, it is also a suitable option if you have not yet thought about using an online GST delivery challan service.

- Digital Delivery Challan Template

This is probably the best solution for growing businesses as the high-end software helps you generate personalised challans in a matter of minutes. By using these digital delivery challans, you can pronounce your brand identity and add all the mandatory details without any hassle.

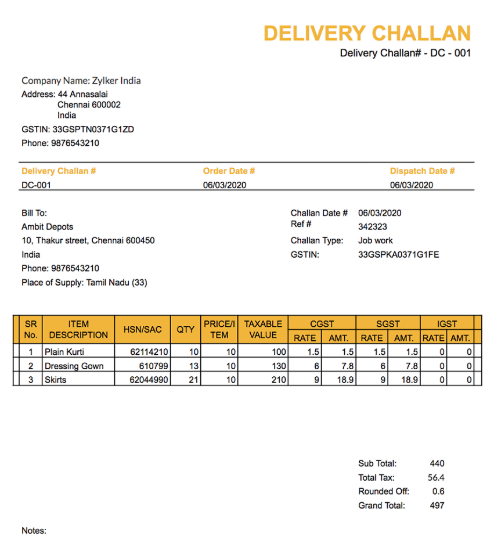

Mandatory Components of a Delivery Challan

If you are a supplier then you must issue delivery challans that are serially numbered. The selected order can be in one or multiple series and the alphanumeric code cannot exceed 16 characters.

The format of your issued delivery challan under GST rule 55 must have these mandatory components:

- Issuing date and challan number

- Name, GSTIN and residential address of the cosigner, whenever applicable

- Name, address details and Unique Identity Number or GSTIN of the consignee, if they are registered. If the entity is unregistered, the supplier needs to mention their name, delivery location and correct address details.

- Description of the supplies

- HSN code for goods being supplied

- Taxable value of supplies

- Quantity of goods supplied (provisional, when the supplier is able to figure out the exact amount)

- Tax rates applicable along with particular breakdowns such as CGST, SGST, IGST and cess

- Place of supply (applicable for inter-state transactions)

- Signature

Note: If the taxable value exceeds ₹50,000, then you will need to issue a GST E-way bill online in place of a delivery challan.

When to Issue a Delivery Challan as Per CGST Act?

Section 55(1) under the CGST Act declares when a supplier can generate a delivery challan in place of an invoice. Here, we have specified the same:

- While supplying liquid gas, especially when the exact quantity cannot be determined

- When goods are transported for job-related work

- Whenever the principal person is sending commodities to a worker

- If a job worker is transferring products to another worker

- If the job worker is transferring goods on a return basis to the principal

- When GST goods are transported before being supplied. This can be the temporary transfer of commodities back and forth between a business's factory and warehouse.

- In case you are carrying out an interstate or intrastate trade where the goods have been removed before the supply, thus necessitating a challan

- When transporting a work of ‘art’ to a gallery

- During the transportation of goods abroad for exhibition or promotion, as per the CBIC Circular No. 108/27/2019, a delivery challan is mandatory, as such transportation does not fall under the 'export' or 'supply' category.

- When issuing a tax invoice is not practical while removing goods, then a delivery challan is essential before the supply

- Whenever an E-way bill is not required

In most of the above scenarios, the delivery challan replaces the bill of supply or complete invoice as per Rule 55A of the CGST Act during a valid transaction.

Businesses that Issue Delivery Challan

The following types of businesses require issuing a delivery challan under GST Rule 55:

- Trading businesses that supply goods from one place to another (particularly the FMCG sector)

- Businesses that have obtained several warehouses where goods are temporarily moved among the godowns or warehouses (this includes textile, apparel and clothing companies)

- Wholesalers of products (under this category falls electronic goods suppliers)

- Suppliers of products (can include furniture or home furnishings suppliers)

- Product manufacturers

Difference Between Delivery Challan & Invoice

In the table below, you can find some major distinctions between a GST invoice and a delivery challan:

| Tax Invoice | Delivery Challan |

| Notifies about ownership proof and lists down the legal responsibilities | Does not include ownership proof or any legal obligation |

| Provides the precise value of supplies | Signifies that the intended consignee buyer has received the goods |

| Lists down the actual values of all goods transported together and also contains the applicable taxes | Displays the product purchase rate but does not disclose the full value of a sale |

| It serves as proof of a sale transaction | Delivery challans may or may not indicate a sale and act as proof of transfer |

Instances Where a Delivery Challan Can be Issued in Place of an Invoice

According to Rule 55(1) of the CGST law, you can send goods to a different location accompanied by a delivery challan instead of a tax invoice in the following cases:

- Supply of liquid gas (only when the quantity is not known at the time of removal from the source)

- When transportation of goods takes place from a principal to job worker

- When material transfer is necessary even before a sale

Conclusion

A delivery challan under GST rule 55 is issued by a seller, and the goods listed on them may or may not indicate a sale. It is essential to be aware of its format and applications if you are a business owner. This will enable you to run trades smoothly and avoid compliance issues while at work.

💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By