What Are E-invoice Formats?

- 12 Dec 24

- 12 mins

What Are E-invoice Formats?

- What Are the Different Types of Invoicing Formats?

- What Are the Benefits of a Machine-Readable Invoice for GST?

- Understanding Digital Invoices

- Understanding Electronic Invoices (e-invoices)

- Why Working With a Third-Party E-Invoicing Specialist is Important?

- E-Invoice JSON - Format

- Sample View of Electronic Invoice (e-Invoice) Format

- What Are The Benefits of Using The E-invoice Format?

- Conclusion

Key Takeaways

- E-invoicing ensures seamless GST compliance with accurate, machine-readable invoices.

- Switching to e-invoicing reduces costs and promotes eco-friendly business practices.

- Real-time data visibility improves accuracy and strengthens supplier-buyer relationships.

- Machine-readable formats like XML and EDI streamline processing and minimize errors.

- E-invoicing prepares businesses for future mandates, enhancing compliance and efficiency.

At present, GST-registered businesses need to follow certain e-invoicing system regulations while issuing tax invoices to their customers. Invoice formats play a major role in achieving optimal business operations.

However, even the most successful businesses may encounter difficulties enrolling on the e-invoice registration portal invoice due to occasional changes in their variety. In this blog, you will find out the essential invoice elements present in a standard e-invoice format that satisfy all business goals and meet direct compliance needs.

What Are the Different Types of Invoicing Formats?

Invoices are produced in various formats that are meant to serve different purposes. Specific objectives and needs of a business determine the type of format that has to be used for certain regions.

Fundamentally, there are two major types of 'true' e-invoice formats which include:

- E-invoicing Without Compliance

An e-invoicing system without compliance is a set procedure that goes as follows:

- The buyer and the supplier must mutually agree on the format and the information that has to be included in the GST bill.

- Data has to be put appropriately in the design (Edifact, XML or X12), implementing modern technology like EDI or simple web forms to support web invoicing.

- Here, the supplier is responsible for sending a virtual invoice via a web-based form or directly through an Accounts Receivable (AR) system.

- E-invoicing without compliance can only take place when the buyer gets the invoice ready to be processed by an Accounts Payable (AP system).

Under these conditions, the e-invoice format merely confirms the data formats for the trading partners. However, the regulatory provisions related to the place of supply are omitted.

- E-invoicing With Compliance

This procedure of maintaining e-invoicing compliance is pretty similar to the method discussed above except for a few changes.

- Here, the invoice format is primarily adjusted based on the legislation of the place where both parties are trading.

- Government-issued guidelines or e-invoice content validation guidelines published on a government portal mainly determine the security and archiving protocols of these e-invoices.

- In this situation, invoices for VAT purposes and auditing are made readily available.

- The usage of paper is totally eliminated from this method.

Organisations that need to meet VAT obligations can readily accept this approach. Unfortunately, there is currently no solid set of regulations in place to govern e-invoicing.

What Are the Benefits of a Machine-Readable Invoice for GST?

If an e-invoice is prepared following the prescribed format, that becomes machine-readable. This type of file format includes JSON, CSV, XML, EDI and more.

Businesses prefer issuing machine-readable GST invoices as computers can process them quickly and simultaneously it helps reduce the load on AP teams.

By incorporating machine-readable invoices, you can enjoy the following benefits:

- Data Insights

It becomes effortless to extract data from machine-readable invoices as they are well-structured. Hence, businesses prefer them for conducting advanced analytics, coining bottlenecks and trends and finally tracking the performance of financial activities.

- Faster Processing Times

Automatic processing of machine-readable invoices eliminates the requirement of elaborate manual data entry and improves overall operational efficiency.

- Increased Accuracy

As computers are involved in the processing of e-invoices, the chances of mistakes are almost NIL. Fewer errors keep the suppliers happy and provide them with peace of mind as they do not need to worry about committing fraud.

- Regulatory Compliance

To comply with regulations and mandates, e-invoices are generated in a standardised format. Thus, as long as you ensure all the mandatory invoice fields are filled, the machine-readable invoices are automatically validated with digital business compliance tools.

- Cost Savings

When businesses deploy automated AP functions, the traditional invoice processing techniques can be stopped, reducing labour costs. Moreover, it allows different teams to focus on areas that will enhance the core development of the organisation.

- Invoice Tracking

Electronic format invoicing platforms can track machine-readable invoices within seconds, eliminating potential delays. It assists businesses in establishing strong supplier-buyer relationships.

Understanding Digital Invoices

To avoid common confusion regarding the filing process, it is better to state beforehand that e-invoices and digital invoices are not the same. A buyer can view digital invoices through their systems and they can be processed by suppliers digitally.

You can find digital invoices as two different types:

- PDF Invoices

It is possible to view PDF (Portable Document Format) invoices and print them through a suitable reader. You may use G-suite or Microsoft Word to create such invoices and effortlessly share them via email address. Teams having limited technical people often settle for this method of invoicing.

- Scanned Paper Invoices

Even in this age of increased digitisation, almost 37% of businesses still continue to use paper invoices, ignoring e-invoice generation. Both supplier and buyer can scan these documents and store them virtually. However, there are many challenges associated with this method that make the process slow and increase the risk of errors.

Both PDF invoices and scanned paper invoices are not machine-readable. In other words, they cannot be automated and hence do not adhere to the latest e-reporting compliance rules.

Understanding Electronic Invoices (e-invoices)

E-invoices are segregated into two major segments:

- EDI (Electronic Documents Interchange)

Being one of the most popularly used invoicing methods, EDI bills are easily machine-readable. Through this process, a business can create, receive and share invoices automatically.

- XML Invoices

XML refers to eXtensible Markup Language. It is the latest e-invoice standard that encodes documents typically in a format that can be understood both by machines and humans. XML is more cost-effective than EDI because it utilises the internet for communication and invoice sharing instead of a private network.

Owing to the simplicity of access, there are no restrictions on XML usage by businesses, thus making it the go-to option for supplier onboarding. Moreover, different systems can easily communicate when you use XML to share billing information.

However, one downside of XML is that it requires technical expertise to maintain transactional records flawlessly. Thus, you may have to hire third-party organisations for this purpose that can professionally handle XML invoices.

Why Working With a Third-Party E-Invoicing Specialist is Important?

Dealing with the continuously evolving electronic invoicing landscape is a challenge that organisations may find difficult to handle single-handedly. Due to each region having its own requirements for invoice formats, it is often challenging to trace the changes in the e-reporting requirements or how to deliver invoices in a specific format such as XML or PEPPOL.

Fortunately, there are third-party e-invoicing solutions that can help streamline all AP tasks and remove uncertainty when it comes to compliance with invoices. These professionals track mandates on a day-to-day level and e-reporting regulations. As a result, you can continue with your core business operations which matter the most.

When working with a third-party GST service provider, you are not required to install rigid software or spend time on its implementation to send e-invoices. With an experienced agency, all you have to do is log into their secure web platform and access a form and the rest will be taken care of. You are perfectly on track as long as you are having a steady net connection.

As mandates continue to grow, after a point only machine-readable B2B invoices will be accepted from eligible taxpayers. Thus, to stay ahead of the curve and evade penalties, it is better to consult a third party for matters concerning invoicing.

E-Invoice JSON - Format

You will find the below-mentioned invoice item details in e-invoice sample format as per the regulations on the e-invoice portal:

| Header Section | Includes the original invoice number, date of issuance, name of sender and recipient, and a reference number (IRN) |

|---|---|

| Transaction Level | Features a transaction category type from the list of prescribed options |

| Document level | States the document type, date, number, etc. |

| Supplier | Lists the GSTIN, address, trade name and other invoice item details of the seller (document creator) |

| Buyer | This section captures a buyer’s GSTIN, address, trade name, etc. |

| Dispatch | Includes dispatch GSTIN, address, trade name and so on |

| Ship-to | This area comprises trade names, ship to GSTIN, addresses, etc. |

| Items on a Bill | In this section, you can see line item information arranged methodically |

| Document synopsis | A document’s overall worth is captured in this area |

| Payment information | This section provides top-to-bottom information about the e-invoice payment terms and conditions |

| Reference Information | Includes a number of references related to the invoice |

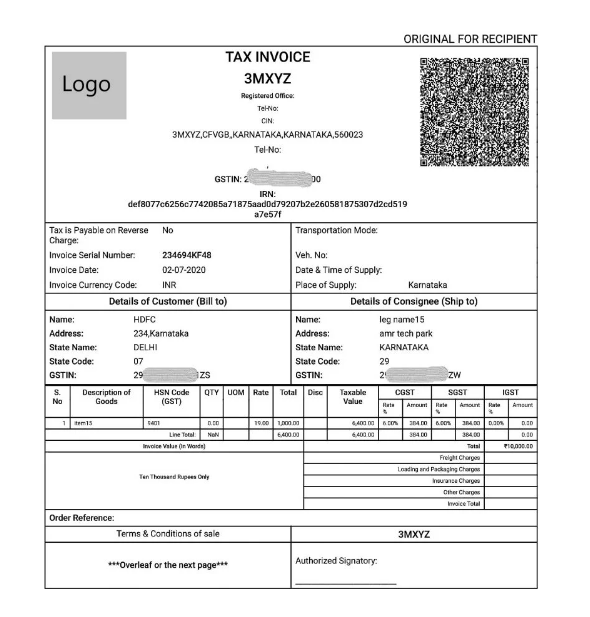

Sample View of Electronic Invoice (e-Invoice) Format

As produced by an ERP software, here’s a standard format of a sample invoice reference:

What Are The Benefits of Using The E-invoice Format?

By using e-invoice formats, organisations can enjoy the following benefits:

- Sync Data Seamlessly

This means business users can easily and with less effort move and accumulate information between two systems by implementing e-invoicing methods. They can even handle other devices without complications for the basic invoice details being displayed there as well.

Implementing e-invoicing actually leads to a much shorter cycle time. It allows the team to let go of such tasks which very often are cyclical and require considerable time to accomplish.

- Better Visibility and Transparency

Electronic invoicing enhances the visibility of the invoices, accumulating paperwork, purchases and contracts. It manages the invoices as well as there are proper records of the audit trails. This functionality can be accessed by native mobile e-invoicing applications.

Moreover, organisations find e-invoicing software essential for streamlining their invoice processing cycles. It assists in decreasing the number of person-hours that are required in handling invoices, approving, tracking and chasing invoices as well as minimising errors.

- Increased Accuracy

You can achieve improved accuracy because of better visibility of all the work and tracing till the last step. You can monitor your invoice validation, approval and payment in real-time. It drastically minimises errors and problems.

So, it helps avoid situations of delayed payments or making similar payments two or more times to duplicate clients. It is for this reason that e-invoicing is an important factor for a closed audit trail. Their proper usage helps businesses streamline tracking and settlement procedures.

- Better Compliance and Green Invoicing

E-invoicing regulations are not simply a filing cabinet for digital bills and are much more than that. With the e-invoicing schema, you get to a higher level of compliance more easily. Additionally, with e-invoice implementation, you can reduce the need for paper-based invoices to the bare minimum. Besides, when using EDI, you can cut down unnecessary expenses tied to paper usage within your supply chain and be eco-friendly at the same time.

- Reduced Risk with Insights

Increased visibility in trade and transactions through e-invoicing processes eliminates potential errors, duplications, invoice frauds and oversights. By implementing an effective system, organisations can greatly reduce the time and resources spent on verifying and conducting due diligence, lowering the risk of errors.

Conclusion

If you are aiming to boost the efficiency of your business then transitioning to e-invoice format is a crucial step. It streamlines every compliance requirement and assists in data management in real-time. However, if you are new to the rules governing e-invoicing, consider this guide as a starting point.

Analysing in depth will help you realise how the associated steps align with your business purposes. Overall, if your holistic business goals are supported by e-invoicing rules, consulting with an expert can actualise the process of modernising your trade.

💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By