Know All About New Invoice Management System (IMS) Under GST

- 18 Sep 24

- 13 mins

Know All About New Invoice Management System (IMS) Under GST

- What is the Invoice Management System (IMS)?

- Date of Implementation of Invoice Management System Under GST

- How Does the Invoice Management System Work?

- Key Features of Invoice Management System (IMS)

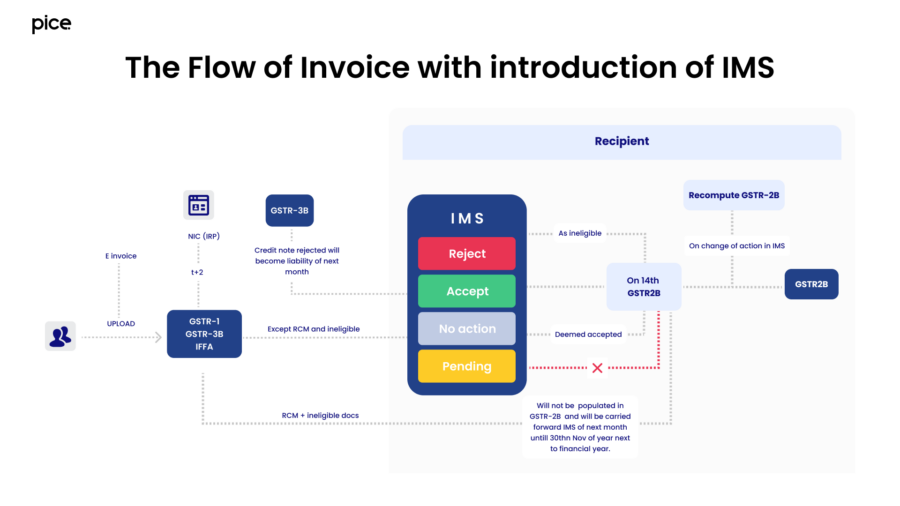

- Flow of IMS

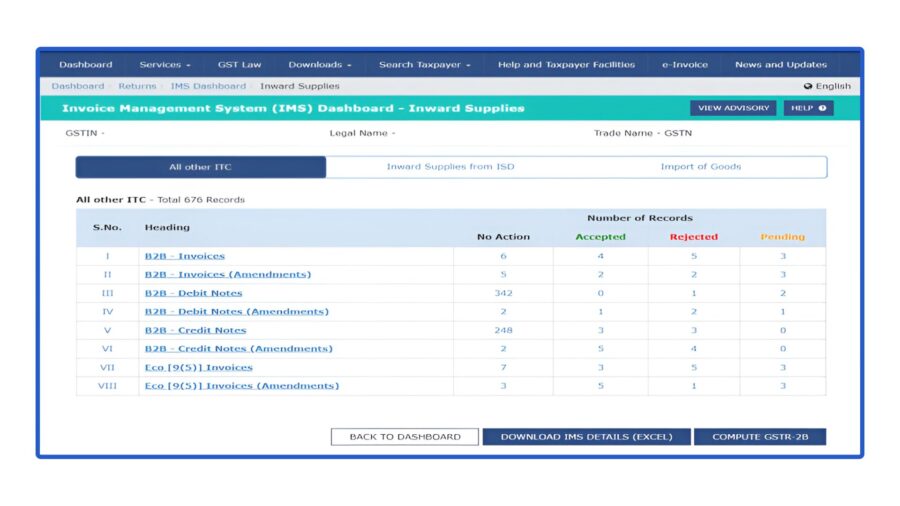

- Invoice Management System (IMS) Dashboard

- How Taxpayers Manage Invoices and Claim Input Tax Credit

- Benefits of Invoice Management System

- Key points of the new Invoice Management System (IMS)

- Conclusion

Key Takeaways

- The GSTN is launching the Invoice Management System (IMS) on October 1st to streamline GST invoicing and ITC claims.

- IMS allows taxpayers to accept, reject, or mark supplier invoices as pending directly on the GST portal.

- The system aims to reduce mismatches between supplier invoices and recipient returns, facilitating smoother ITC claims.

- Key features include communication tools, single-window processing, and automated invoice management without added compliance burden.

- IMS enhances audit efficiency, minimizes errors in GSTR-3B filings, and is available to both regular and QRMP taxpayers.

Are you ready to streamline your GST invoicing and Input Tax Credit (ITC) claims? The Goods and Services Tax Network (GSTN) is rolling out a game-changing feature on the GST portal—the Invoice Management System (IMS).

Starting October 1st, this innovative tool aims to enhance transparency, reduce direct tax compliance burdens, and empower taxpayers like you to manage invoices more effectively and address invoice corrections/amendments with their suppliers through the seamless integration of IMS into their existing workflows.

In this blog post, we'll walk you through everything you need to know about the IMS, from how it works to the benefits it offers.

What is the Invoice Management System (IMS)?

The Invoice Management System (IMS) is a new feature on the GST portal designed to make things easier for recipient taxpayers like you. With IMS, you can accept, reject, or leave pending the invoices your suppliers have filed. This is a big help because many people struggle with mismatches between the invoices suppliers submit and the returns they file themselves, which can cause headaches when claiming input tax credits.

By letting you match your records with the invoices suppliers have issued in their GSTR-1 forms, IMS aims to streamline the whole process of claiming your input tax credits with real time invoice reconciliation.

Once the IMS is launched, it will enable registered recipients to easily match their own records with the invoices their suppliers have filed in their GSTR-1 forms. This will make it much simpler for taxpayers to claim their Input Tax Credits (ITC), streamlining the whole process.

Date of Implementation of Invoice Management System Under GST

The government introduced the IMS in a phased manner to ensure a smooth transition for taxpayers and address the common issuse of mismatches between supplier invoices and recipient returns. And functionality would be a major enhancement in the ITC ecosystem of GST, and it shall be available to the taxpayer from 1st October onwards on the GST portal.

How Does the Invoice Management System Work?

Regardless of the level of GST compliance, the most significant hurdle that any taxpayer faces is to claim ITC. Fortunately, the new IMS is expected to mitigate some of these challenges.

- Suppliers Submit Invoices:

The GSTR-1 form or the Invoice Furnishing Facility (IFF) have to be submitted by the 11th of the month.

If required, amendments in invoices can be done through GSTR-1A on the GST portal. They have up until the time they file their GST return for the said period, GSTR-3B, to make these changes.

- Invoices Appear on IMS Dashboard:

Once the supplier has saved and submitted an invoice, it can be viewed on the IMS of the recipient.

These details include supplier’s GSTIN identification number, trade name, invoice number, and type of supply. These invoices will be reflected in the recipient’s GSTR-2B form submitted in the future.

- Recipient's Action Required:

ACCEPT: The accepted invoice becomes part of your auto-populated ITC statement, known as GSTR 2B, which is prepared on the 14th of every month.

REJECT: The rejection of invoices will be missing from your ITC report.

PENDING: The action on invoices not taken is excluded from the current month GSTR-2B but it is reflected in the subsequent month’s GSTR-2B.

This has to be done between the time the supplier uploads the invoice and the time you file your GSTR-3B by the 20th of the following month. If you act on an invoice after the 14th, you have to recalculate your draft GSTR-2B.

- Automatic Acceptance:

If no action is taken for an invoice, the system treats it as “deemed accepted” and includes the same in the GSTR-2B.

- Amended Invoices:

Any changes made to an accepted or pending invoice from a supplier automatically cancel the previous invoice and replace it with the new one. This updated invoice will require your attention for further review as well as necessary action.

Flow of Updated Information:

Changes made in the supplier’s GSTR-1A will be reflected in your IMS as well as GSTR-2B but in the subsequent month’s statement.

Using Pending Invoices:

This means that you can actually report the ITC on pending invoices in any other month in future, but you have to do so subject to the provisions contained in section 16(4) of the CGST Act, 2017.

In other words, dealing with IMS facilitates the chasing of invoices within suppliers and recipients, which in turn facilitates claims for ITC. Considering your IMS dashboard and acting promptly for verified invoices would help to maintain better business compliance with GST and avoid missing out on the credits.

Key Features of Invoice Management System (IMS)

- Communication Functionality

The most promising aspect of the IMS is the effectiveness of the communication services incorporated into it. It provides visibility in the interaction of suppliers and recipients of the transaction on a single dashboard interface and can allow the identification where there is a difference that can be resolved as to whether the invoice is to be accepted or rejected - Single-Window Processing

IMS provides a unified portal that recipient's with multiple inward suppliers can manage all invoices submitted by all suppliers and auto-generate GSTR-2B. Thereby avoiding the use of different applications or manually keying in data. This helps eliminate chances of errors while at the same time offering business organizations precious time. - Zero Compliance Burden

The IMS also greatly minimizes the compliance costs on the taxpayers, and this is due to the automation of various factors of invoicing. If a recipient fails to respond to an invoice, it will be automatically considered 'deemed accepted,' which helps streamline the inward invoice management process. It helps in keeping compliance with GST rules and regulations without much problems to let the business run smoothly. - Summary view of inward invoices and actions: Using the IMS dashboard, one is provided with a control view of all the invoices and activities undertaken with regard to every invoice. It can assist the management and decision making, as well as the auditing.

- Suppliers can now easily amend submitted invoices: The new functionality has also enabled suppliers to make changes on saved original invoices much easier.

Flow of IMS

All outward supplies reported in the GSTR 1 / IFF / 1A shall populate in the IMS of recipients for

taking the actions.

- Accepted: The recipient has acknowledged and agreed to the invoice that has been produced to become a part of ‘ITC Available’ section of the respective GSTR 2B.

- Rejected: The denial of the invoice by the recipient will fall into the ‘ITC Rejected’ section of respective GSTR 2B.ITC of rejected records will not auto-populate in GSTR 3B.ITC of rejected records will not auto-populate in GSTR 3B.

- Pending: The invoice pending is still waiting the response from the recipient and will not become part of GSTR 2B and GSTR 3B. Such records will remain on IMS dashboard till the time same is accepted or rejected. ‘

This clarity helps in the prediction of expenses and the ITC reclaim procedure, which is more suitable.

Invoice Management System (IMS) Dashboard

The new system has not been implemented yet but as per the advisory by GSTN, the Invoice management system dashboard appears as below –

How Taxpayers Manage Invoices and Claim Input Tax Credit

The IMS guarantees that all the invoices issued at the initial stage are GST-compliant and are matched between the two parties, and by doing so, the ITC claim is facilitated and any possible losses due to mismatch are also eliminated.

In this case, it is very crucial for taxpayers to understand how they process invoices so that they can properly claim Input Tax Credit.

Download GSTR-2B

Taxpayers can download their GSTR-2B, it’s a static statement which gives the consolidated view of ITC available for a particular period. To achieve such, the IMS auto-populates data which makes this process easier.

Match GSTR-2B with GSTR-3B

The IMS helps taxpayer in matching GSTR-2B with GSTR-3B in a way that it matches the credit claimed by a taxpayer with the eligible credit thereby preventing mismatches and penalties.

Precision Audit

By having records that are detailed and having data that is real time, then businesses are able to conduct audits that are exact, compliance is evaluated, and also measures for improvement are established.

Minimal Errors in GSTR-3B

One of the ways that have been used within the IMS to control audit errors related to GSTR-3B filings is automated data population and validation checks.

Benefits of Invoice Management System

- Audit Efficiency: IMS will be able to make it easier for auditors to verify each invoice properly without having to go through several interfaces, thus reducing the chances of audit errors and control risk of errors.

- Minimal error in GSTR-3B: Inward invoices can be viewed in summary format with the aid of this IMS system. Thus, taxpayers are not required to be concerned with any records with invoices issued that they might have missed before furnishing GSTR-3B.

- Less Complexity Pending invoices : Outstanding invoices move to the next tax periods in the process without any change to GSTR-2B and 3B.

- Available for QRMP taxpayers: Small businesses will benefit from the new system for managing invoices, and this innovation is also for QRMP taxpayers. However, it does not fill up GSTR-2B for the first two months of a quarter as a default. For them, the GSTR-2B will be filed on a quarterly basis.

Key points of the new Invoice Management System (IMS)

- The IMS will be implemented on 1st October 2024.

- The system will facilitate an automated way of evaluating every inward received invoice and act individually on them.

- IMS gives you an option to accept, keep pending or reject the invoice in your Dashboard.

- IMS will not result in an increase in the compliance burden because once the invoice is already in the system, it is considered ‘deemed accepted’ when the taxpayer does not act.

- This will enhance audit efficiency and ITC claiming processes for large and small companies, respectively.

- There is no need to have accounting or auditing background to comprehend the interface, as the necessary instructions are clearly indicated.

- After GSTR-3B filings, all the accepted/deemed accepted/rejected records will move out of IMS dashboard.

- The records which are pending will remain on IMS dashboard and these records can be accepted or rejected in future months.

Conclusion

A new IMS is going to be introduced on the GST portal to facilitate GST invoicing and input tax credit (ITC) claims. From the 1st of October, 2024, you are free to either approve or delete invoices or, in case you are still unsure, put it through a pending status so that it matches your suppliers’ records.

It can get rid of mistakes, free up compliance time, and make sure you don’t miss out on the credits you are entitled to.

Make the best of IMS to have a very smooth flow of your GST and have no problems at all. 💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By