ITC and GST on the Sale of Fixed Assets

- 5 Sep 24

- 13 mins

ITC and GST on the Sale of Fixed Assets

Key Takeaways

- GST on Fixed Assets: Rates vary for different assets like machinery, land, vehicles, and buildings, with specific rates for new and used items.

- ITC Eligibility: Businesses can claim ITC on fixed assets if used for business, with proper documentation and timely reporting.

- ITC Reversal: ITC must be reversed when selling assets, based on remaining life or tax on transaction value, whichever is higher.

- Taxable Value: GST is calculated on either the depreciated book value or market value of the asset.

- Compliance: Proper invoicing, documentation, and GST return filing are essential to ensure compliance and avoid penalties.

The Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services across India. It has simplified the tax structure by bringing various indirect taxes under the same bracket. This has made compliance easier for businesses.

GST applies to the entire business, covering all transactions, including those related to the purchase and sale of fixed and capital assets. When selling machinery, equipment or even property, the knowledge of GST on the sale of fixed assets helps businesses plan their tax liabilities on sale and avoid a few pitfalls.

This blog attempts to clear the air on GST rules, rates, and procedures applicable to the sale of fixed assets.

Handle all your sales and purchase invoices in one place.

Pice’s all-in-one invoice management tool helps you track, send, and organize invoices from a single dashboard. Automatically share new invoices with customers, send timely payment reminders, and keep your collections under control—effortlessly.

Want early access? Fill out this form to get request a demo!

What Is Meant by Fixed Assets Under GST?

Fixed assets under GST refer to long-term resources that a business owns and uses for its operations. These are goods that are not for sale, such as machinery, buildings or vehicles. Fixed assets can generally be divided into tangible and intangible assets.

Tangible is probably the most evident, comprising machines or computers and vehicles. Meanwhile, intangible assets are that which exist in a non-physical form such as patents, trademarks and copyrights.

Fixed assets form an important part of the daily operation procedures for businesses, providing benefits in terms of productivity and increased efficiency. Service-based businesses are very tech-dependent and use software to deliver their services, whereas manufacturing units thrive on manufacturing units for production.

What Is the GST Rate on the Sale of Fixed Assets?

The GST rate on a permanent transfer or disposal of business assets varies depending on the type of asset and whether it is new or second-hand. The rates are important to understand for correct tax reporting and compliance.

- Machinery & Equipment: New machinery, and equipment are generally charged at 18% under GST. These rates apply to most equipment that will be used in industrial manufacturing and processing. Machinery used in the renewable energy sector has lower GST rates at 5%. While certain household equipment like printers, air conditioners, washing machines etc. attract 28% GST. The applicable HSN (Harmonised System of Nomenclature) code for such machinery is often 84 or 85, depending on the specific equipment.

- Sale of Land (Agricultural and Non-agricultural): Land sale is normally GST exempt according to Schedule III, however, liability on sale may arise based on type/location/rate on sale conditions from the aggrieved state or centre side This exemption is based on the fact that land has been defined as a non-taxable supply under GST law. Further, if the land is sold under a development agreement or where the cost of the property includes the construction of buildings, 12% GST applies. In such cases, the HSN code used for land transactions for sale is usually 9972.

- Buildings and Real Estate: This includes the sale of any real property as subject to GST if it is sold until a completion certificate has been issued. The GST applicable rate is 1% (without Input Tax Credit) for affordable housing and 5% (without ITC) for other residential properties. The HSN code used for these transactions generally falls under 9972 or 9954.

- Vehicles: The rate of GST on new sales of motor vehicles varies, based on whether the vehicles will be used by an individual or institution. While the GST on most classes of passenger vehicles is 28%, the item’s rate can go up by a compensation cess of up to 22% of the vehicle’s engine capacity. The HSN code for motor vehicles is generally 87. On used items, the GST is fixed at 28%, but certain states offer concessions or rebates.

GST law also provides exemptions and concessions, depending on the type of asset and statutory provisions. In the case of hefty reliance, certain goods provided to charity organisations and goods in some categories may have lower prices or exemptions.

Accurately applying GST rates to fixed asset transactions is essential for compliance and financial accuracy. Businesses must stay updated with GST regulations and rate changes to ensure the correct tax treatment of their asset sales.

GST Input Tax Credit for Fixed Assets

Capital goods, as explained in Section 2(19) of the CGST Act, are basically goods used for business purposes. Input Tax Credit (ITC) is a method under the GST regime that lets businesses claim credit for the GST they paid on things they bought for their business. This input credit can be used to lower the GST they owe on sales, which helps reduce the overall tax they have to pay.

For substantial purchases like equipment and machinery, ITC is crucial as it allows businesses to reclaim the tax paid on these expensive items, helping to reduce overall costs.

Conditions for Claiming ITC on Fixed Assets

Businesses can claim ITC on disposal of capital goods if the following conditions are met:

- Usage for Business: The fixed asset must be used exclusively for business purposes; ITC is not available for assets used partially for personal use.

- Tax Invoice: A valid tax invoice or document must be obtained from the supplier, showing the GST paid.

- Payment of GST: The GST on the purchase must be paid to the government. ITC cannot be claimed if the supplier has not deposited the tax.

- Asset Capitalisation: The fixed asset should be capitalised in the business books. ITC cannot be claimed if the asset is directly expensed.

- Compliance with ITC Rules: The claim for ITC must be made within the prescribed time limits, usually within the financial year or within a specified period from the date of invoice.

Documentation and Compliance Requirements

Here are the documents you need to submit in order to claim ITC on fixed assets:

- Tax Invoices: Maintain proper records of tax invoices issued by suppliers. These invoices must contain all required details, including the GSTIN of the supplier and the buyer, invoice number and GST payable amount.

- Books of Accounts: Record purchase and record sale of the fixed asset purchased in the books of accounts, ensuring it is capitalised and not expensed.

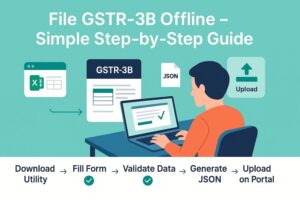

- GST Returns: Include ITC claims in GST returns, specifically in Form GSTR-1 and GSTR-3B. Ensure accurate reporting of ITC and reconciliation with the supplier’s GST returns.

- ITC Reconciliation: Regularly reconcile ITC claims with the GST Portal to ensure that the ITC claim matches the data filed by suppliers.

ITC Reversal of GST on Sale of Fixed Assets

Here's how ITC is reversed from the sale of fixed assets with respect to the following circumstances:

Proportional Reversal of ITC: When certain conditions arise, businesses must reverse a proportionate amount of Input Tax Credit (ITC) previously claimed on the supply of capital goods. Any changes in the way a business pays taxes can affect how it handles its input tax credit (ITC).

Opting for Composition Scheme: If a regular taxpayer chooses to pay taxes under a simplified scheme designed for small businesses, or if their products or services become exempt from tax, they may have to reverse the ITC they claimed on certain types of business equipment.

Cancellation of Registration: When a registered person’s GST registration is cancelled, the inputs tax credit on capital goods must be reversed based on the remaining useful life of the assets. The reversal is calculated on a pro-rata basis, considering the asset’s useful life as five years.

Suppose capital goods were used for 4 years, 6 months, and 15 days, leaving a remaining useful life of approximately 5 months for the taxable person. If the ITC claimed on these capital goods was ₹10,00,000, the proportionate ITC to be reversed is calculated as follows:

Input Tax Credit Attributable to be reversed = C*5/60

ITC to be reversed = 10,00,000*5/60 = 83,333

This amount must be separately computed for Integrated Tax (IGST) and Central Tax (CGST) and added to the output tax liability.

Reporting and Compliance of ITC Reversal

Form GST ITC-03: When a taxpayer opts for the composition scheme or if their goods/services become exempt, the ITC reversal should be reported in Form GST ITC-03 after payment of taxes.

Form GSTR-10: If registration is cancelled, the reversal is to be reported in Form GSTR-10.

Certificate Requirement: The reversal amount must be verified with a Chartered Accountant or Cost Accountant.

If the amount to be reversed (as calculated above) exceeds the tax on the transaction value of the sale, the higher amount must be added to the output tax liability. The details of this reversal are to be furnished in Form GSTR-1.

Taxable Value of the Sale of Fixed Assets

The GST taxable value is the value on which tax has to be added. When fixed assets of business are being sold, for the calculation of taxable value, a number of important aspects are to be kept in mind. According to Section 15 of the CGST Act, such taxable supplies are treated as relevant transactions with consideration for the furtherance of business.

- Explanation and Description: Taxable value is a nominal amount to which the GST rate shall be applied. The value is derived by calculating the relevant sale price, book value and market value based on factors like location-grade, rate of sale, time of sale etc. Section 18(6) of the CGST Act defines taxable amount as the higher of 2 options: attributable input tax credit or the tax on the transaction value of the capital goods.

- Depreciation and Book Value: The taxable value of used fixed assets will usually be the book (table) value, adjusted for depreciation. The depreciation balances the book value of the asset to reflect its wear and tear, etc. So this is an easy-to-understand adjusted figure which can be used in calculating your GST correctly. For example, if an asset is sold after perhaps years of use, the tax value would be based on its current depreciated value.

- Market Value Consideration: If the asset is sold for less than its market value, GST will be based on the market value and not the sales price.

- Invoice and Agreement: The value stated on the sale invoice by the seller is very important as it directly impacts the taxable value. Moreover, the terms agreed upon between the buyer and seller, including any discounts or adjustments, should be included in the sale invoice.

The registered person or business shall complete the disposal of capital goods with consideration to these points.

Example of Calculating the Taxable Value of the Sale of Fixed Assets

When calculating the taxable amount for capital goods under Section 18(6) of the CGST Act, you must determine which is higher: the Input Tax Credit (ITC) attributable to the remaining useful life of the asset or the tax on the transaction value of the asset. Here's an example:

Let us say Mr Y made a purchase of capital asset on June 1, 2016, at a purchase price of ₹60,000 before GST was implemented. The VAT paid at the time was ₹10,800, and he claimed this as ITC. The asset was sold on January 1, 2021.

The asset was used for 56 months, leaving a remaining useful life in months shall be 4 months (considering a 5-year total useful life for ITC calculations). The sale consideration for the asset was ₹5,000. The prescribed rate on this intentional sale at 18% amounts to ₹900.

To calculate the taxable amount:

ITC Attributable to Remaining Useful Life: The ITC that needs to be reversed is calculated by multiplying the ITC availed (₹10,800) by the ratio of the remaining useful life (4 months) to the total useful life (60 months). Thus, the input tax credit attributable is ₹10,800 * 4/60 = ₹720.

Tax on Transaction Value: The GST on the sale price of ₹5,000 is ₹900 (18% of ₹5,000).

Since the tax on the transaction value (₹900) is higher than the ITC attributable to the remaining useful life (₹720), the taxable value for GST purposes is ₹5,000 plus ₹900, which totals ₹5,900.

For invoicing and reporting, if the tax on the transaction value is higher, the invoice should reflect the total amount of ₹5,900. This amount should be reported in GSTR-1. The taxable value reported will be ₹5,000, and a GST of ₹900 will be added.

In the case of damaged, lost, or stolen assets where no transaction value is available, the ITC attributable to the remaining useful life (₹720) must be added as output tax liability. This amount should be reported separately for Central Tax, State Tax, Union Territory Tax, and Integrated Tax.

Conclusion

Businesses need to accurately determine their tax obligations based on asset value, depreciation, and market conditions. Adhering to GST rules and documentation requirements is crucial for maintaining transparency and efficiency. Staying informed and diligent in these practices will help businesses navigate the complexities of goods and service tax effectively.

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for paying all your business expenses.

By

By