What is GST in India: Types, Slab Rates, and More

- 24 Oct 25

- 15 mins

What is GST in India: Types, Slab Rates, and More

Key Takeaways

- Goods and Services Tax (GST) in India is a unified indirect tax system introduced on 1st July 2017, replacing VAT, excise, and service tax.

- GST is a multi-stage, destination-based tax levied on value addition at every step of the supply chain until the final consumer purchase.

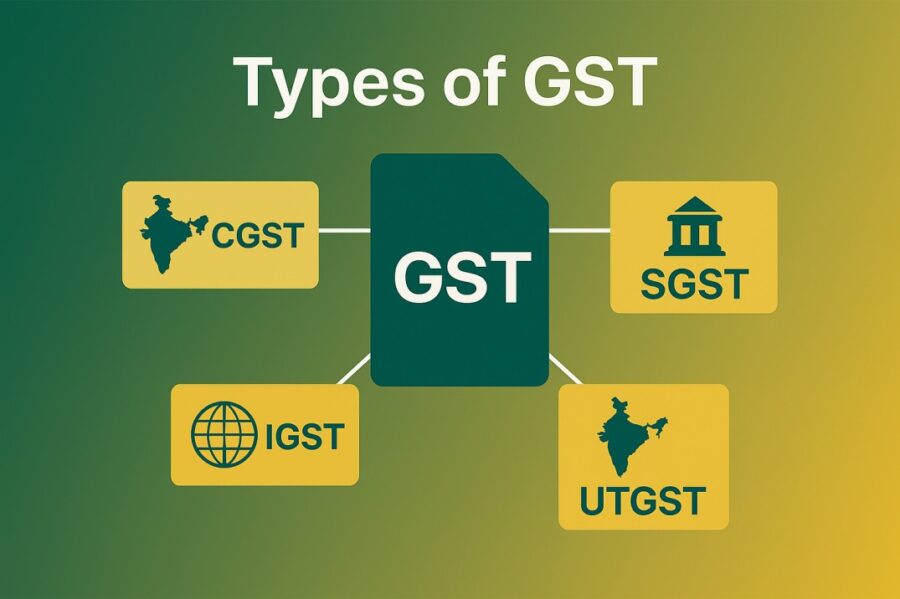

- There are four types of GST in India – CGST, SGST, IGST, and UTGST – ensuring fair tax distribution between the Centre and States.

- GST rates in India are divided into 0%, 5%, 12%, 18%, and 28% slabs, covering essential goods, daily-use items, and luxury products.

- GST benefits include reducing cascading taxes, improving compliance with an online system, supporting businesses, and making products affordable.

The Goods and Services Tax (GST) in India is a system that plays a vital role in unifying the indirect tax structure of the country. Both businesses and consumers should understand its framework to ensure GST compliance and informed decision-making.

So, to fully grasp what is GST, one must explore its various types, slab rates, and applicability across goods and services.

This article will walk you through a clear overview of GST in India, its history, objective, advantages, current slab rates, and more. So keep reading to navigate its core components and practical impact.

What is GST?

GST, or goods and services tax, is a kind of indirect tax regime in India. Replacing multiple previous tax regimes such as service tax, VAT, excise duty, and more, GST was passed by the Indian parliament on 29th March 2017 and imposed since 1st July 2017.

The Indian Government levies this tax on the supply of services and goods. The country enforces GST Law as a comprehensive, multi-stage, destination-based tax applied on every value addition. It replaces most indirect taxes, creating a unified domestic indirect tax law for the whole country.

To understand what is GST in detail, let us go through the specific parts of its definition, which are ‘multi-stage’, ‘destination-based’, and ‘value addition’.

Multi-stage Nature of GST in Supply Chain

The supply chain of all products that are sold to customers eventually goes through multiple stages of purchase. These change-of-hands stages are as follows:

- Raw material purchase

- Manufacturer or production

- Finished goods warehouse

- Sale to wholesalers

- Selling the product to retailers

- Final sale to the end consumers

On each of these stages, GST is levied; therefore, it is a multi-stage taxation system.

Destination-based Aspect of GST

The final destination for the product also plays a role in GST. For instance, Maharashtra manufactures a good and sells it to a final customer who is in Karnataka. In this case, the complete revenue of tax will go to Karnataka and not Maharashtra, as GST will be levied at the final point of consumption.

GST in Value Addition

GST is also levied on value addition, which means GST is levied on every such stage in which extra monetary value is added to an item. To understand this in a better way, here is an example:

- There is a manufacturer 'X', who buys sugar, flour, and other raw materials to make biscuits (an item).

- The process of making the biscuit by X refers to adding value to the raw materials to achieve a result, which is the biscuit.

- Thus, when X sells these biscuits warehousing agent for packaging, GST is levied on the ‘value addition of making biscuits’.

- Similarly, when the warehousing agent packs those biscuits and sells them to a retailer to brand them, GST is levied on the ‘value addition of packaging’.

- Further, when the retailer brands the biscuits and markets them to the final customers, GST is levied on the ‘value addition of marketing and branding’.

- Finally, when the customer purchases the biscuits, they pay GST for consumption.

History of GST (Goods and Services Tax)

In 2000, the idea to introduce GST in the Indian tax structure took shape. Since then, it took 17 years to really implement it. Below is the timeline for all the years from 2000 to 2017.

- 2000: The Prime Minister of India, Atal Bihari Vajpayee, formed a committee to draft the framework for the Goods and Services Tax (GST) law.

- 2004: A government task force emphasised the urgent need to implement GST to streamline India’s existing indirect tax system.

- 2006: The Finance Minister announced the proposed GST launch date as April 1, 2010.

- 2007: The government decided to gradually phase out the Central Sales Tax (CST) and reduce the CST rate from 4% to 3% as part of this transition.

- 2008: The Empowered Committee (EC) finalised a dual structure for GST, allowing both central and state governments to levy GST through separate legislation.

- 2010: The government postponed the implementation due to structural and technical challenges and launched a project to computerise commercial tax systems across the country.

- 2011: The government introduced the Constitution Amendment Bill in Parliament to enable GST legally.

- 2012: The Standing Committee began discussions on the bill. However, its progress is stalled because of vagueness in Clause 279B.

- 2013: The Standing Committee submitted its detailed report on the GST proposal.

- 2014: The Finance Minister reintroduced the revised GST Bill in Parliament to revive the reform process.

- 2015: The Lok Sabha passed the GST Bill. However, the Rajya Sabha did not clear it due to political disagreements.

- 2016: The Goods and Services Tax Network (GSTN) became operational, and Parliament approved the updated GST model, which later received the President’s assent.

- 2017: The Cabinet approved four supplementary GST Bills, and both the Lok Sabha and the Rajya Sabha passed them. On 1st July 2017, the government officially implemented the Goods and Services Tax law across India, transforming the country’s indirect taxation system.

Objective of GST

Now that you have an answer to what is GST and its history, let us answer why it was introduced. The introduction of GST in India is due to various objectives, which are as follows:

To Unify the Taxation System

In comparison with the last taxation system in India, GST has unified the indirect taxes in the country. Unification of taxes and the idea of one nation, one tax provide a very crucial advantage to the taxation system of the country.

With the same rates in every state, the governance of taxes and any decisions regarding policies and rates of taxes have become easier for the central government tax administration. The government is also able to introduce common laws such as e-way bills and e-invoicing.

To Incorporate All of the Indirect Taxes Applicable in India

The grouping of various indirect taxes, such as central excise, VAT, and service tax, has made the supply chain stages more efficient. Previously, there were some taxes which were overlooked by the centre and some by the state, which increased confusion and complexity of GST return filing.

With GST, all primary indirect taxes of India are grouped into one system. This helps both the taxpayers as well as government tax administration, making their work easier.

To Limit and Mitigate Tax Evasion

In comparison with previous indirect tax laws, GST is stricter. Under GST, claiming input tax credit (ITC) can only be done by uploading invoices from suppliers, which mitigates the possibility of claiming ITC through fake invoices.

Moreover, as GST is a nationwide taxation system and has centralised processing, it is easier for the authorities to know if there are any defaulters. This idea has made tax evasion and tax fraud very difficult and minimised them.

To Remove Cascading of Taxes

Earlier, India had different indirect taxes. These taxes were not connected, so businesses could not use the tax they paid in one stage to reduce the tax in another. This meant tax kept getting added at every stage (cascading effect), making goods more expensive.

Now, GST applies only to the value added at each stage. Businesses can use the tax they paid earlier to reduce their tax at the next step. This makes the tax process smoother, reduces costs, and avoids double taxation.

To Add to the Taxpayer Base

In the past, for different tax laws, there was a different threshold limit for registration of a business. The registration limit was on the basis of the annual turnover of the business.

The introduction of GST brings in a unified taxation system with the same tax rates for both services in goods. This brings multiple industries together and also increases the number of businesses that register themselves under GST.

To Ease Businesses through Online Practices

Previously, it was difficult for businesses and individuals to deal with each tax authority, especially as it was offline. Moreover, the process took more time as they were offline, leading to inefficiency.

The idea behind the introduction of Goods and Services Tax Act was also to support an online taxation system to help the taxpayer. With this, they are able to easily pay their taxes online in one place. This also improves tax compliance and supervision of taxes in India.

To Improve Distribution and Logistics

GST with businesses do not have to deal with so much paperwork when moving goods due to unification. With fewer stops and checks, trucks spend less time on the road, enhancing distribution systems.

This saves time, improves the supply chain, and helps deliver products quickly. Moreover, the e-way bill system under GST has removed the need for interstate checkpoints, which helps reduce high logistics and storage costs.

To Increase Consumption and Promote Competitive Pricing

Before GST, goods were more expensive because of the “tax on tax or cascading” effect. This made Indian products costlier than those in global markets.

Now, with uniform GST rates across all states, prices have become more consistent throughout the country. This has made goods more affordable and competitively priced. Thus, consumption has increased along with government tax revenue.

Types of GST

There are four types of GST in India. They are as follows:

Central Goods and Services Tax (CGST)

This is a tax which the central government collects on intra-state/union territory (UT) transactions. This means if both the supplier and buyer are in the same state/UT, then this is a 50% component of GST, which the centre collects.

State Territory Goods and Services Tax (SGST)

This is the same as CGST, and the only difference is that 50% of the GST component goes to the state. SGST applies when the selling and buying of any service or product happens in the same state.

Union Territory Goods and Services Tax (UTGST)

In case a sale is happening in a union territory (UT), then this type of taxation applies. It reciprocates the SGST and is also 50% of the total GST component on intra-state tax.

Integrated Goods and Services Tax (IGST)

If a service or product is sold by a seller of a state/UT and bought by the buyer of another state/UT, then the tax levied on this particular transaction is grouped under IGST. Both the state and central governments share this tax revenue. The collection of tax is done at the place of consumption (state of consumption) of the product or service.

GST Registration Procedure

Any business that was liable to pay central excise, VST, or service tax in the past now needs to register itself under the GST Council. The procedure of GST registration for them goes as follows:

- They need to visit the GST portal and initiate the registration process by filling out some details.

- After application submission, they receive ARN instantly. The use of application reference number (ARN) is to track the GST registration process for businesses.

- After receiving the ARN, in a week, applicants receive their GSTIN and GST registration certificate. All registered taxpayers receive a GSTIN, which is a 15-digit.

- In case any interruption or queries occur in these procedures, they can post queries on the portal.

All of the businesses that have a yearly turnover of more than Rs. 20 lakhs need to legally register under GST.

Documents Required for GST Registration

Different applicants require different kinds of documents to register under GST. The applicants can be grouped into four categories as follows:

| Applicants | Documents |

| Individual or Sole Proprietor | PAN Address proof Owner’s Aadhaar card Bank account details Owner’s photograph |

| Company (Indian/Foreign and Public/Private) | Company’s PAN Bank details Address proof for principal business place Aadhaar card and PAN of authorised signatories Address proof and PAN of company directors Memorandum of association or article of association Appointment proof of an authorised signatory Photographs of the authorised signatory and directors Certificate of incorporation by Ministry of Corporate Affairs |

| Hindu Undivided Family (HUF) | HUF’s PANAddress proof Details of bank account Owner’s photograph Owner’s PAN/Aadhaar card |

| Partnership Firms Inclusive of LLP | PAN Proof of address of business place and partners Details of bank account Partnership deed copy Board resolution (only for LLP) or registration certificate Photographs of partners and authorised signatories Appointment proof of authorised signatory |

GST Registration Fees

There is no fee for GST registration online. However, seeking help from any GST practitioner or an authorised chartered accountant requires a fee for the professional services they provide.

Advantages of GST

GST provides several advantages, which are as follows:

- Mitigation of tax cascading effect.

- Feasibility in the form of online portal access.

- Ease for start-ups and small businesses through composition scheme.

- One GST return policy replaces multiple others from the past.

- Attention to e-commerce and the unorganised sector.

How do you log into the GST Account?

To log into your GST account, you just need to follow these simple steps:

- Visit the GST portal at https://www.gst.gov.in/.

- On the landing page, in the right-hand corner, will be the login button.

- Click on it and enter your username, password, and CAPTCHA.

- Finally, click on login.

Current GST Rates Slabs

The primary slabs under current GST regime are 0%, 5%, 12%, 18%, and 28%. The items under these slabs are in the following table:

| Items | Current GST Rates |

| Milk, eggs, kajal, curd, educational services, lassi, children’s colouring and drawing books, health services, unbranded maida/atta, unpacked foodgrains, unpacked paneer, besan, gur, natural unbranded honey, salt, fresh vegetables, prasad, phool bhari jhadoo, and palmyra jaggery | 0% |

| Sugar, packed paneer, tea, coal, edible oils, raisin, domestic LPG, roasted coffee beans, PDS kerosene, skimmed milk powder, cashew nuts, footwear (< Rs. 500), milk food for babies, apparels (< Rs. 1000), fabric, coir mats, floor and matting covering spices, agarbatti, mithai/ mishti (indian sweets), life-saving drugs, and coffee (except instant) | 5% |

| Butter, ghee, processed food, almonds, mobile phones, fruit juice, preparations of vegetables, fruits, nuts or other parts of plants (including pickle murabba), chutney, jam, jelly, packed coconut water, and umbrella | 12% |

| Hair oil, capital goods, toothpaste, industrial intermediaries, soap, ice-cream, pasta, toiletries, corn flakes, soups, printers, and computers | 18% |

| Small cars (+1% or 3% cess), high-end motorcycles (+15% cess), consumer durables such as fridge and AC, luxury & sin items like BMWs, cigarettes and aerated drinks (+15% cess) | 28% |

There are other slabs under GST which are not common, including 3% and 0.25%. The items in that list are as follows:

| Items | Current GST Rates |

| Imitation jewellery, items of metal layered with precious metal, items of precious metal, cultured or natural pearls (worked/not worked) (graded/ not graded) (not strung, mounted, set, or temporarily strung), diamonds (worked/not worked) (not set or mounted) (excluding non-industrial), semi-precious stones, precious stones which are not diamonds, silver, gold, and scrap and waste of precious metal or metal layered with precious metal | 3% |

| Non-industrial diamonds, semi-precious stones/ unworked precious, reconstructed or synthetic semi-precious or precious stones | 0.25% |

Conclusion

By knowing what is GST, along with its other intricate details, businesses and individuals can manage their tax liability responsibilities more effectively. GST simplifies the taxation process, reduces cascading taxes, and brings uniformity to the Indian market.

This well-informed approach to GST ensures better business compliance, smoother operations, and improved financial planning.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is GST in India and when was it implemented?

What are the main types of GST in India?

CGST (Central GST): Collected by the Centre on intra-state sales.

SGST (State GST): Collected by the State on intra-state sales.

UTGST (Union Territory GST): Collected on sales in union territories.

IGST (Integrated GST): Levied on inter-state sales and imports.

This classification ensures fair distribution of tax between central and state governments.

What are the GST slab rates in India?

0% for essentials like milk, curd, and fresh vegetables.

5% for daily-use items like packed paneer, tea, and edible oils.

12% for processed food and household products.

18% for industrial goods, soaps, and IT products.

28% for luxury items, cars, and sin goods (with cess).

What are the key objectives of GST in India?

Create a unified indirect tax system under “One Nation, One Tax.”

Remove the cascading effect of multiple taxes.

Improve compliance through an online GST portal.

Expand the taxpayer base with uniform registration rules.

Promote competitive pricing, enhance consumption, and simplify logistics with e-way bills.

By

By