What Happens When You Stop Paying Your Credit Cards Bills?

- 31 Oct 25

- 9 mins

What Happens When You Stop Paying Your Credit Cards Bills?

Key Takeaways

- Even a single missed payment can trigger late fees, interest rates of up to 42–45% annually, and a drop in your credit score.

- Being 30 days late can cause your CIBIL score to fall by 60–100 points, and the delinquency remains visible for up to seven years.

- Expect frequent calls and reminders from creditors after 30 days of default. Ignoring them can escalate the issue and even lead to legal notices.

- After 180 days, the issuer may close your account and hand it to a debt collection agency, further hurting your credit profile.

- Options like balance transfers, debt consolidation, one-time settlements (OTS), or professional credit counselling can help manage or resolve your credit card debt before it becomes unmanageable.

Ever wondered what happens when you stop paying your credit card bills in India? Just one missed payment can snowball fast. Late interest rates can reach as high as 42–45% annually, and late payment fees can easily exceed hundreds or even thousands of rupees, depending on the outstanding amount.

Credit card negligence increased by a massive 44% year-on-year, reaching approximately ₹33,886 crore in the 91–360 days overdue category by March 2025. Not only do fees and charges accumulate, but your CIBIL or credit bureau score also gets affected, and that mark remains visible for up to seven years.

Let us keep reading to know more in detail.

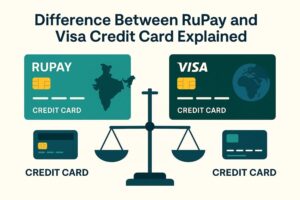

Stages of Consequences of Not Paying Your Credit Card Bills

All credit card issuers have separate policies to handle credit card delinquencies. However, if you fail to pay your bills in full, here is a summary of what happens when you stop paying your credit card bills.

| Time Period (Late) | Consequences |

| 1 Day Late | Might have to pay a late fee and interest on the overdue amount. |

| 30 Days Late | A 60 to 100 points drop in credit score.Creditors might call you. |

| 60-180 days Late | Your additional interests and charges may rise due to an increase in APR.Further drop in credit scores. |

| More than 180 Days Late | Your account will be closed and transferred to debt collection agencies hired by your creditors.Further damage to credit scores. |

Consequences of Not Paying Your Credit Card

When you are facing a credit card debt, you must find a resolution to it as soon as possible. Not taking your creditor’s calls or ignoring this problem can make it bigger in no time. Here is what happens when you stop paying your credit card bills.

- Late Fees and Interest Charges

Most credit cards offer a certain interest-free credit period. Once you cross this period without paying, your creditors will levy a late fee and a high interest rate on the due amount. The amount of your late fee depends on your outstanding amount due.

- Reduction in Credit Scores

After 30 days of being late in paying your credit card bills, your creditors will report your delinquency to the credit bureau. Based on your overdue amount, your credit score might take a fall of 60 to 100 points.

After this, every month, or whenever the creditors report to the credit bureau, your credit scores will drop further.

- Constant Calls from Creditors / Issuers

Once your interest-free credit period ends, you can expect calls from creditors asking about your whereabouts. After 30 days, they might call you to discuss ways to repay your debt.

It is better to accept the calls and clarify your situation. This will help to push back the probability of increased APR and lawsuits.

- Increase in APR

Once you are over 60 days late in repaying your debt, your Annual Percentage Rate (APR) may rise. This can impose additional charges like processing fees and increase your interest rate by up to 55.55%.

- Account Closure and Transfer to Debt Collection Agencies

If you cross over 180 days without paying your debt, your issuer might close your account and transfer it to a hired debt collector who will then try to recover the amount on behalf of the issuer.

- Legal Actions

In extreme cases, the bank may file a lawsuit in your name. Although you cannot be arrested or put into jail unless it is a case of forgery. The court may summon you for legal proceedings, which will increase legal costs for you.

The court may also make a legal judgment on the terms of your debt repayment, which can be stressful and not in your favour.

What Should You Do When You Are Going Under a Credit Card Debt?

When you are caught in credit card debt, making poor decisions is easy. For instance, many people avoid calls from creditors, but ignoring them can lead to legal notices or recovery action. With interest rates on Indian credit cards often between 35% and 45% p.a. plus late fees, acting early is essential. Here’s how to take each step carefully to minimise damage.

Develop a Fresh Monthly Budget

List your monthly income and expenses to understand your repayment capacity. If you’re falling short, cut discretionary costs immediately. Always try to pay at least the minimum due to avoid extra penalties. Even partial or minimum payments signal good intent and reduce additional late fees while you negotiate.

Prioritise Your Debts

After calculating your repayment capacity, focus on paying some credit card bills in full rather than spreading small payments across all cards. This approach lowers late fees and interest on high-balance cards. Closing or clearing some cards also helps reduce your overall liability faster.

Don’t Ignore Your Creditor’s Calls

Avoiding creditors’ calls creates miscommunication and can lead to escalation or legal notices. Instead, contact your issuer, explain your situation and ask for a repayment plan, waiver or a lower-interest option. Many banks are open to temporary relief if you’re upfront.

Try to Get a Secondary Source of Income

While you’re cutting costs, the high interest and late fees can still wipe out savings. Look for a part-time job, freelance work or selling unused assets to generate additional income. This extra cash can help you pay down balances faster and avoid compounding charges.

Know Your Rights

Some debt collectors may pressure or harass borrowers. Understand your rights under RBI’s fair practices code and know the exact repercussions of default. This knowledge gives you confidence to handle collection agents correctly.

Research Options to Settle Your Debt

Credit card defaults hurt your credit score more severely than many other debts. Before the damage deepens, consider balance transfers, personal loans at lower interest, or formal debt consolidation. This works best if done early, before your score declines.

Get Professional Advice

Credit counsellors or financial advisors can guide you on the most cost-effective settlement routes, including one-time settlements (OTS) or structured repayment plans. Professional help can save time, money and protect your credit health.

4 Ways To Settle Your Credit Card Debts

Ignoring your credit card debt can make matters worse. Acting quickly with a smart plan can protect your finances and credit score. Here are four practical ways to settle your debt efficiently.

- Balance Transfers

You can get a 0% balance transfer card and use its credit balance to pay off your credit bills. This will provide you with some extra time to gather your debt amount. However, this option may levy an added 3-5% fee on your balance.

Make sure to calculate whether you have the payback capacity to repay the debt in such a low amount of time. This is a good option if your debt is low and manageable.

- Debt Consolidation

All credit cards have different due dates, interest rates, late fees, and credit limits. Handling multiple credit cards during a financial crisis is too much to handle. It is hard to keep track of.

Hence, before your credit score deteriorates, you must get a personal loan or a secured loan to pay your credit card bills. With this, you will only have to handle one loan with certain EMIs and reasonable interest rates of approximately 10-15%.

- Debt Settlement or (OTS)

Another option is that you can negotiate with your creditor to settle your entire debt for a lower amount than what you owe. You can opt for this option if your payback capacity is not enough to pay the entire debt. This option can significantly.

- Declaring Bankruptcy

Declaring bankruptcy must be your last resort. It is a legal way to wipe all your debts away. However, the court may verify your payback capacity to approve your declaration. Declaring bankruptcy will severely affect your credit score, and this information will remain in your credit report for up to 10 years.

💡If you want an easy and secured way to pay your credit card bills, use the PICE App.

Conclusion

These days, almost everyone with a stable job can get a credit card. Having a credit card offers financial flexibility and convenience, along with additional cashback and rewards like airport lounge access, milestone benefits, introductory benefits, etc. Using a credit card can prove economical when used responsibly.

However, banks offer credit cards with a large credit limit. One should keep tracking their payback capacity regularly and set their credit cards on autopay to avoid missing due dates. Otherwise, increased debts every month is what happens when you stop paying your credit card bills.

By

By