What Happens If Credit Card Holder Dies in India?

- 27 Oct 25

- 7 mins

What Happens If Credit Card Holder Dies in India?

Key Takeaways

- When a credit card holder dies in India, their outstanding dues are settled through their estate, i.e., the total assets and savings they leave behind.

- Spouses, children, or parents are not legally required to pay the deceased’s dues from their own income or savings.

- The executor (if there’s a will) or the court-appointed administrator (if there isn’t) must use the estate’s funds to clear debts before distributing the remaining assets to legal heirs.

- When the deceased’s assets can’t cover the dues, the credit card issuer writes off the remaining balance as a loss.

- In India, add-on cards become invalid after the cardholder’s death, and dues are recovered from the estate. However, for joint cards (if any), the surviving holder is liable for full repayment.

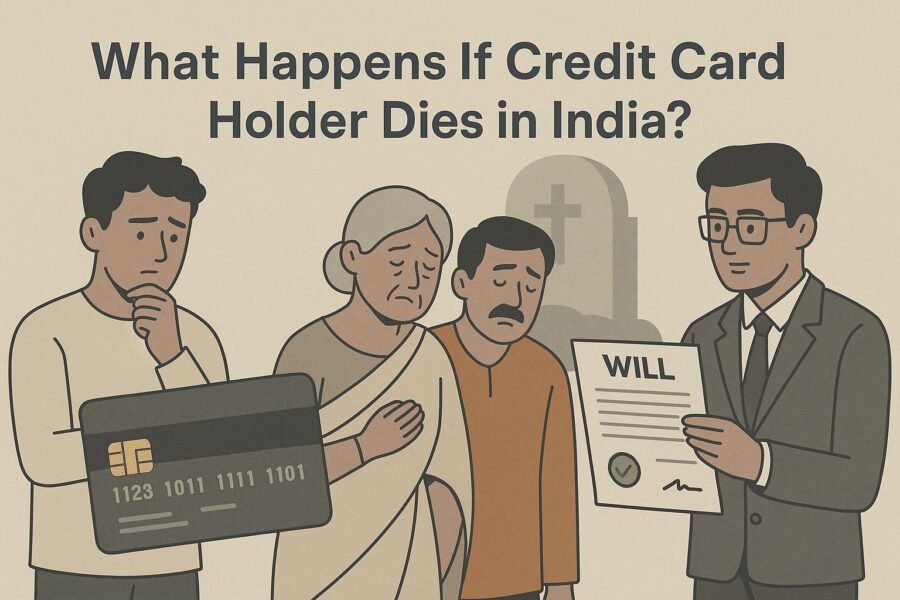

Losing a loved one is an emotional and difficult time. Along with grief, many responsibilities fall on the family, including handling the financial affairs of the deceased. Among these, credit card debt often raises questions and concerns. Families want to know: what happens if credit card holder dies in India?

The answer is not always straightforward, but one thing is certain that credit card debt does not simply vanish. According to the Reserve Bank of India’s data, Indians collectively owe over ₹2.91 lakh crore in credit card outstanding balances. So, what happens to this debt? Let us carefully understand.

Can You Inherit Credit Card Debt if the Cardholder Dies?

The first point to understand is that no family member personally inherits credit card debt. A spouse, child or parent is not directly liable to pay from their own income. However, that does not mean the debt disappears.

In case of the death of a cardholder, his/her liability of settling his/her dues is transferred to his/her estate. This involves their savings, fixed deposits, property and any other assets that they leave behind. The credit card company is allowed by the law to claim the dues on these assets before they can be claimed by legal heirs.

Although you will not need to provide your own funds to pay the debt, you may not be able to access the deceased person's assets until the dues are paid.

Who is Responsible for the Debt?

The executor or manager of the estate is the legal heir or the administrator of the estate who takes the responsibility of settling the financial liabilities of the deceased. This does not imply that they have to pay out of pocket. They are supposed to pay off the debts of the deceased person with the estate and then pay out what is left.

The responsibility is divided as follows:

- When there is a will: The executor of the will makes sure the debts are paid and then the heirs receive their portion of the estate assets.

- When there is no will: An administrator appointed by the court administers the property, pays off the debts and hands over any leftover property to relatives.

Liability to a different person only occurs in certain circumstances: in the case of joint credit card accounts or where a person was a co-applicant.

What Happens if the Estate is Bankrupt?

Sometimes, the estate may not have enough funds to cover the debt. For example, if the deceased owed ₹3 lakh in credit card dues but left behind assets worth only ₹1.5 lakh, then only that ₹1.5 lakh will be used for repayment.

Creditors cannot force family members to pay the balance from their own money. When this happens, the issuer of the credit card will write off the remaining debt as a loss.

Nevertheless, when legal heirs seek to get access to the estate without paying the debt, there could be legal tussles. Banks can go to court to recover and legal heirs may wait before they get the inheritance.

💡Pay your credit card bills in an easy and secured way with the PICE App.

Steps to Take After a Family Member Passes Away

Dealing with financial matters while grieving can be overwhelming, but promptly handling credit card accounts is crucial. Here are the key steps you should take:

Inform the Credit Card Issuer

The initial one is to inform the bank or credit card company of the death. You shall be required to submit a copy of the death certificate. After this, the bank will suspend any additional transactions and freeze the account to prevent misuse.

Stop Using the Credit Card

You are not supposed to use the credit card of the deceased, though you are a recognised user. The unnecessary expenditure undertaken post-death is unauthorised and can be treated as identity theft.

Collect All Financial Documents

Get information on the bank accounts, insurance, investments and debts of the deceased. This helps in mapping the full financial picture and prevents missed obligations.

Request a Statement from the Bank

Request the issuer of the card to make a final statement of existing dues. This will provide certainty about the actual size of the debt and enable budgeting for repayment out of the estate.

Check for Credit Card Insurance or Protection Plans

Some cards come with “credit shield” or “credit protection” insurance, which covers dues in the event of the cardholder’s death. If such a feature is available, submit the necessary documents to claim it.

Consult a Lawyer if Needed

If there is confusion regarding liabilities or disputes among legal heirs, taking legal counsel can help. A lawyer can guide you on inheritance laws and ensure that the process is completed fairly.

What Happens to Joint Credit Cards?

In India, joint credit cards are rare, but add-on or supplementary cards are common. Here is how liability works:

- Add-on Cards: These cards are linked to the primary cardholder’s account. If the primary holder dies, the add-on card automatically becomes invalid. The dues are payable from the deceased’s estate, not by the add-on user.

- Joint Accounts (if any): In rare cases where a credit card is issued jointly, both applicants are equally liable. This means that if one dies, the surviving holder is responsible for the full repayment.

It is important to understand this difference because many people wrongly assume that using an add-on card makes them liable for debt.

Conclusion

Losing a loved one is never easy and financial matters are often the last thing you want to think about. However, tackling them at an earlier stage prevents greater issues in the future. To put it simply, what happens if a credit card holder dies in India is that the debt does not vanish, but it also does not pass on to family members personally. Instead, it is settled through the estate left behind.

In the case of sufficient assets in the estate, the dues are paid and the remaining is bequeathed to the legal heirs. If not, the debt is written off. Members of a family do not need to pay out of pocket, except spouses who were joint account holders.

By

By