Signature vs Platinum Credit Card: Key Differences Explained

- 22 Oct 25

- 7 mins

Signature vs Platinum Credit Card: Key Differences Explained

Key Takeaways

- Visa's Signature vs Platinum credit cards have a variety of features suited for users with difference financial needs

- Visa Platinum suits everyday users, while Visa Signature is ideal for frequent travellers and high spenders.

- Visa Platinum cards start around ₹1,00,000, while Signature cards typically start from ₹3,00,000 or more.

- Platinum offers simple, flat rewards; Signature gives accelerated rewards like 3x–5x points on travel and dining.

- Signature cards include premium perks such as airport lounge access, concierge, and enhanced travel insurance.

- When comparing Signature vs Platinum credit card, pick based on your spending pattern, lifestyle, and how much you’ll actually use the benefits.

When you open your credit card statement at the end of the month, does your heart race a little? Choosing between a Visa Signature vs Platinum credit card may leave you feeling that same emotional tug. Credit card adoption in India has jumped significantly, with over 108 million active cards as of December 2024. This is nearly double the count from five years ago.

In this context, understanding the difference between Signature vs Platinum credit card becomes deeply practical (and emotionally reassuring). If you aim for higher limits, richer travel perks and rewards flexibility, or simply want to avoid overwhelm and pick what fits your lifestyle, read on.

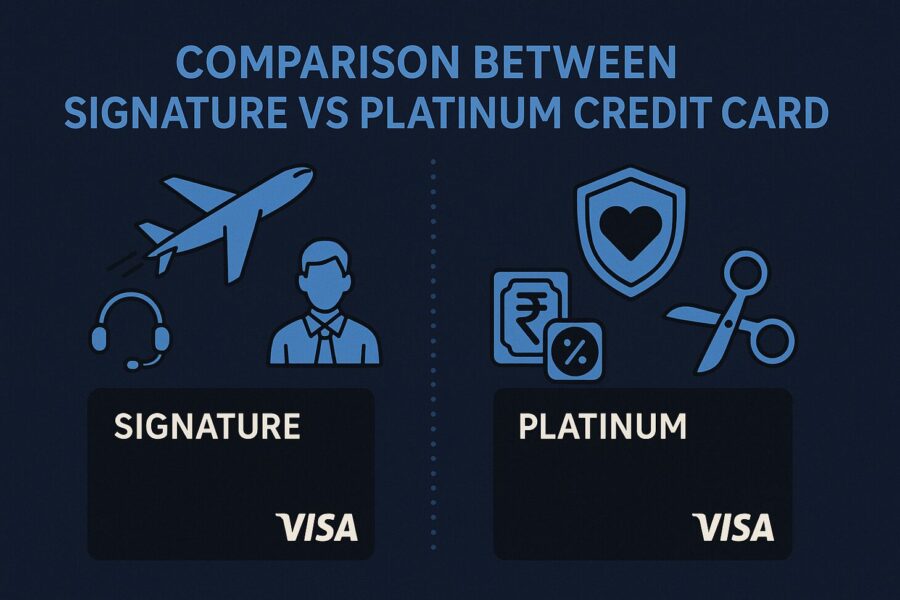

Comparison Between Signature vs Platinum Credit Card

To make the choice more straightforward, let us put the two cards side by side.

| Feature | Visa Platinum Card | Visa Signature Card |

| Target Audience | Everyday users, first-time premium cardholders | Frequent travellers, high spenders |

| Credit Limit | Moderate (starting around ₹1,00,000) | High (starting from ₹3,00,000+) |

| Key Benefits | Purchase protection, extended warranty | Airport lounge access, 24/7 concierge |

| Rewards Program | Simple, flat-rate rewards (e.g., 1% cashback) | Accelerated, multi-tier rewards (e.g., 5x points) |

| Annual Fee | Often low or waived for the first year | Generally higher, but justified by benefits |

| Eligibility | Good credit score (700+) and moderate income | Excellent credit score (750+) and high income |

| Feature | Visa Platinum Card | Visa Signature Card |

Visa Platinum Credit Cards: The Reliable All-Rounder.

Premium cards on the market, such as Visa Platinum cards, are considered one of the most common and accessible. They are tailored for the users who desire more than a simple credit line.

Key Features and Benefits

A Visa Platinum card is designed to be reliable and convenient. Although the specific benefits may slightly differ depending on the issuing bank, the Visa Platinum platform often includes:

- Purchase Protection: If an item is stolen or accidentally damaged using your card within a specified time frame (typically 90 days), you may be eligible for a refund.

- Extended Warranty: This option allows the manufacturer to extend the warranty coverage of qualified products by up to one further year.

- Travel and Emergency Assistance: Although not as generous as the Signature tier, Platinum cards often include basic travel accident insurance and access to a 24/7 helpline for medical or legal referrals when you are not at home.

- Deals and Promotions: You will get a list of offers on restaurants, shopping, and entertainment.

Rewards and Credit Limits

Visa Platinum cards have simple rewards programs. You will usually receive a fixed rate of cash back or points when spending usually between 1% and 1.5%. It is not the most profitable rate, but it is constant and simple to follow.

Platinum cards have moderate credit limits. They are typically more than basic or classic cards, with a minimum value of about ₹1,000,000 or more, depending on your credit profile. Most individuals will normally find this limit adequate in their monthly spending, family purchases, and other smaller travel arrangements.

Who Is It For?

The Visa Platinum card would suit:

- People in need of their initial high-quality credit card.

- Users seeking practical benefits without an excessive annual fee.

- Individuals who have a good credit score (700 and above) and desire to use a reliable card that they can use on a daily basis.

Visa Signature Credit Cards: The Ultimate Lifestyle Upgrade

The Visa Platinum card is the dependable sedan, and the Visa Signature is the upscale upgrade. The level is structured to target individuals with increased spending power, who travel frequently, and desire a premium experience with exclusive privileges. The step between Platinum and Signature is huge, with a major emphasis on lifestyle and travel perks. Understanding Signature vs Platinum credit card features helps you make the best choice.

Key Features and Benefits

Visa Signature cards are loaded with an impressive package of benefits that can be of significant value should you have one. These usually add on top of the Platinum tier, including:

- Free Airport Lounge Access: This is a significant distinguishing factor. Many Signature cards include a limited number of complimentary visits to local and occasionally international airport lounges annually.

- 24/7 Concierge Service: Your own personal assistant. A concierge would assist you with making a last-minute reservation, reserving a table at a restaurant, or even getting tickets to a sold-out concert.

- Premium Travel Insurance: This insurance cover is much more detailed, typically comprising trip cancellation/interruption insurance, baggage delay cover, and increased medical emergency limits.

- Hotel and Car Rental Privileges: This includes special services such as automatic room upgrades, complimentary breakfast, late check-out at luxury hotels, and discounts with luxury car rental agencies. Eligible bookings enable cardholders to receive discounts of up to 15-20%.

Rewards and Credit Limits

The Visa Signature cards rewards program is a big attraction. They usually have faster earning rates such as triple or fivefold points on travel, food, and online shopping. To illustrate, a Signature card that costs ₹50,000 a month might be two or even three times as rewarding as a Platinum card. Understanding Signature vs Platinum credit card differences helps maximise these perks.

The credit limits are quite high too. The standard Visa Signature card is often provided with a minimum credit limit of ₹3,000,000 or more, catering to a higher-income and higher-spending demand segment.

Who Is It For?

The Visa Signature card fits well with:

- Frequent fliers who can optimise on lounge access and travel insurance cover.

- The high-income individuals spend enough to cover the annual fee and receive substantial rewards.

- All those who appreciate convenience and high-end lifestyle amenities such as concierge services.

💡Pay the bills of your Visa Signature or Platinum credit cards in an easy and secured way with the PICE App.

Conclusion

Both Visa Platinum and Visa Signature cards are excellent products, but they serve different purposes. The Platinum card is your dependable workhorse, strong, reliable, and accessible. The Signature card, on the other hand, is a luxury vehicle, packed with premium features that enhance your lifestyle, especially when you are on the move.

Evaluating Signature vs Platinum credit card details can guide you to the right choice. By evaluating your spending habits, travel frequency, and financial goals, you can confidently decide which card is the right fit. The best credit card is not the one with the most benefits, but the one whose benefits you will actually use.

By

By