Discover Updates on Sale Through E Commerce Operator in GSTR 1

- 22 Jul 25

- 9 mins

Discover Updates on Sale Through E Commerce Operator in GSTR 1

Key Takeaways

- Tables 14 and 15 in GSTR-1 simplify reporting of supplies made through or by e-commerce operators, especially under Sections 52 and 9(5) of the CGST Act.

- Table 14 is meant for registered taxpayers to report supplies made via e-commerce platforms, while Table 15 is used by e-commerce operators to report supplies under reverse charge.

- Details reported in Tables 14(b) and 15 are auto-populated into GSTR-3B (Table 3.1.1) for streamlined compliance and tax calculation.

- A new ‘ECO-Documents’ table in GSTR-2B helps recipients view ITC details related to Section 9(5) transactions made through e-commerce platforms.

- These changes enhance reporting accuracy, transparency, and regulatory control over growing digital and e-commerce transactions in India.

The Goods and Services Tax Network (GSTN) has introduced changes to the return filing process to simplify compliance for both suppliers and e-commerce businesses under GST. As part of these updates, the GSTN introduced modifications to the GSTR-1 form, effective from January 2024. It added two new tables to GSTR-1, referred to as Tables 14 & 15.

The tables are relevant in the context of taxpayers who make their taxable supply/sale through e-commerce operators in GSTR 1. It also applies to ones who interact with e-commerce operators, liable to make payment of taxes under the CGST Act’s Section 9(5).

Exploring the Impact of New Tables on GSTR 3B

The GSTN incorporated Table 3.1.1 into GSTR-3B, effective from 1st August 2022. It is where e-commerce operators as well as E-commerce sellers shall report the supplies made under the CGST Act’s Section 9(5). Previously, there was no specific way to get the table auto-populated, not even by drawing information already input while filing the GSTR-1.

The inclusion of the new tables 14 and 15 within GSTR-1 will facilitate the auto-population of Table 3.1.1 under GSTR3B. This shall, in turn, streamline the timeline of reporting e-commerce-based outward supplies and the payable tax.

A Brief Description of E-Commerce Operator Under GST

The phrase ‘E-Commerce Operator’ signifies an individual or an entity that owns, runs and manages a particular digital platform. Said platform shall facilitate the supply of goods/services, fuelling transactions between customers and suppliers.

The e-commerce operator may be liable to pay GST under the following scenarios:

- E-commerce operators must collect TCS (Tax Collected at Source) at a pre-determined rate based on the consideration sellers receive from consumers, as per Section 52 of the CGST Act.

- Goods/services supply takes place between the supplier and the consumer via an e-commerce platform; the e-commerce operator shall charge a commission fee on which GST will apply.

- E-commerce operators must pay tax amounts under reverse charge as per Section 9(5) of the CGST Act. This obligation applies regardless of the supplier’s GST registration status in India.

Table 14- Supplies Made through E-Commerce Operators

Registered taxpayers use Table 14 to report outward supplies made through the e-commerce operator channel.

Note that Table 14 is divided into 2 sections, namely:

- Table 14 (a)- Supplies Made Through E-Commerce Operators – u/s 52 (TCS)

- In Table 14 (a), the taxpayer must report a summary of the supplies made through e-commerce operators, ECO-GSTIN-wise. On these supplies, the e-commerce operator is obliged to collect TCS under the GST ACT Section 52.

- Next, the registered taxpayer must report the supplies within this section itself, which have already been reported in Table 4 - 10 of the GSTR-1.

- The portal will not auto-populate the tax-related liabilities and taxable value from this table in the GSTR-3B.

2. Table 14 (b)- Supplies Made Through E-commerce Operators – u/s 9(5)

- In Table 14 (b), the registered taxpayer must report the supplies net of credit and debit notes which they have initiated via the e-commerce operators. The e-commerce operator must pay tax on these supplies under Section 9(5) of the CGST Act.

- The portal will auto-populate the values reported in Table 14(b) into Table 3.1.1(ii) of the GSTR-3B.

- The taxpayer must submit all necessary details in Table 14, including the legal name/trade name, GSTIN of the e-commerce operator, net value of supplies, and applicable SGST, IGST, CGST and Cess.

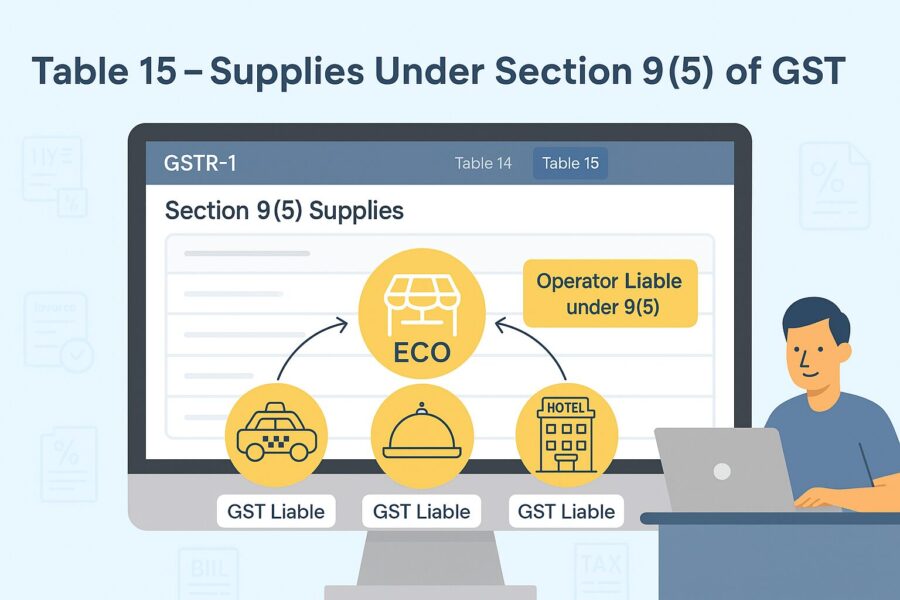

Table 15- Supplies Under Section 9(5)

E-commerce operators use Table 15 to report outward supplies on which they are required to pay tax under the reverse charge mechanism, as per Section 9(5) of the CGST Act. They report these supplies only in the GSTR-1/IFF.

The GST portal will auto-populate the taxable amounts and tax liabilities entered in the table into Table 3.1.1(i) of the GSTR-3B.

Table 15 is divided into 4 parts based on the type of recipient and supplier involved.

- Between Registered Supplier & Registered Recipient

This section of Table 15 requires reporting supplies at the original invoice level where both the supplier and receiver are registered. In these cases, the taxpayer must report the debit note or credit note in Table 9B of the GSTR-1.

2. Between Registered Supplier & Unregistered Recipient

This section of Table 15 must be reported by the e-commerce operator with supplier-level details, including place of supply (POS) and rate-wise information, for e-commerce transactions where a registered supplier makes a supply to an unregistered recipient. One must report these details net of any credit or debit notes. In addition, note that these details will not be available through the IFF.

3.Between Unregistered Supplier & Registered Recipient

One must report this section of Table 15 with the document details and the recipient’s GSTIN. Report the debit note or credit note in Table 9B of GSTR-1 in this case. One can also view this section in the IFF.

4.Between Unregistered Supplier & Unregistered Recipient

E-commerce operators must report the POS and GST rate-wise details of transactions where an unregistered supplier makes supplies to an unregistered recipient through the ECO platform. They must report these details net of any credit or debit notes. Note that the information will not be available through the IFF.

GSTN Advisory for the Recently Introduced Tables

- Auto-population of the E-invoice

According to the Advisory, as issued by GSTN on the 15th of January, 2024, the auto-population feature shall no longer be available for the e-invoice in Table 15. The portal will populate the e-invoices reported for supplies under Section 9(5) in the GSTR-1 based on the existing functionality.

E-commerce operators should examine, analyse and add the necessary records related to supplies u/s 9(5) mentioned in Table 15.

- New Table Added in GSTR 2B, Titled “ECO-Documents”

The advisory also states that it now provides a new facility allowing taxpayers to transfer Input Tax Credit to registered recipients for supplies made through e-commerce operators under Section 9(5) of the CGST Act.

The new table shall be added to GSTR-2B under the ‘All Other ITC’ sub-section, titled ‘ECO-Documents’. As per this table, the recipient can access the document wise details regarding the supplies as received via the e-commerce operators. They must pay tax on these values under Section 9(5) of the Act.

The portal will auto-populate the amounts from the B2B and URP2B sections of Table 15 in GSTR-1 into the new 'ECO-Documents' section of the GSTR-2B table.

Conclusion

The e-commerce sector is constantly and notably expanding globally. As a result, there is a growing need to simplify and standardise regulatory requirements for different categories of e-commerce operators and sellers.

With the introduction of new tables in the GSTR-1 for e-commerce-based transactions, there has been a significant advancement in the efficiency of the process to file returns. Operators have been provided with a convenient auto-population mechanism for certain tables in GSTR-3B. The input information for such supplies will appear in GSTR-2B under a separate dedicated table.

The modification of table addition shall not only simplify compliance for individuals who make sales through e-commerce operators in GSTR 1, but also allow the Indian government to keep track of online transactions and establish transparency.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

What is the purpose of Tables 14 and 15 in GSTR-1?

Table 14 is for registered taxpayers who make sales via e-commerce platforms.

Table 15 is for e-commerce operators reporting supplies under Section 9(5) of the CGST Act.

These tables enable better categorization and compliance in the return filing process.

What is the difference between Table 14(a) and 14(b)?

The taxpayer must report these ECO-GSTIN-wise, and the data will not auto-populate in GSTR-3B.

Table 14(b), however, includes supplies under Section 9(5) where the ECO is liable to pay tax, and these values auto-populate into Table 3.1.1(ii) of GSTR-3B.

This ensures tax accountability at the platform level.

Who is required to fill Table 15 of GSTR-1?

This table captures transaction details based on the supplier and recipient’s registration status.

The information helps ensure proper tax payment under reverse charge and supports auto-population in GSTR-3B.

What is the 'ECO-Documents' section in GSTR-2B?

It shows document-wise details of inward supplies made through e-commerce platforms under Section 9(5).

This helps registered recipients claim Input Tax Credit (ITC) related to such supplies.

The data is pulled from Table 15 of GSTR-1 submitted by e-commerce operators.

Will the GSTR-1 Tables 14 and 15 auto-populate other GST returns?

Additionally, the details from Table 15 also feed into the ECO-Documents section of GSTR-2B to help recipients view ITC.

However, Table 14(a) values do not auto-populate and must be manually reconciled.

By

By