Everything About RuPay Credit Card Lounge Access

- 13 Oct 25

- 13 mins

Everything About RuPay Credit Card Lounge Access

Key Takeaways

- The new RuPay credit card lounge access system (effective January 2025) offers tiered benefits based on quarterly spending, ranging from 2 to unlimited visits.

- A dedicated RuPay lounge has been launched at Delhi IGI Airport Terminal 3, offering premium facilities for elite cardholders.

- Lounge access eligibility now depends on transaction activity, with higher spending unlocking more complimentary visits.

- All RuPay lounge access benefits reset every quarter, allowing cardholders to upgrade privileges based on their spending.

- Leading options include the HDFC RuPay Diners Club, Reliance SBI PRIME, Bank of Baroda Eterna, and Canara Bank RuPay Select Credit Cards.

The relaxing benefits of airport lounges are well-known to frequent flyers. In 2022, about 57.23 million Indians used lounge facilities with their debit and credit cards, based on industry data. According to a report by an airport lounge operator, this number is expected to increase significantly by the end of 2025.

Moreover, by January 2025, significant changes have been announced regarding free visits and the eligibility requirements for RuPay credit cardholders. For optimal travel enjoyment, it is essential to stay informed about the latest policy changes regarding RuPay credit card lounge access. Read on to know more.

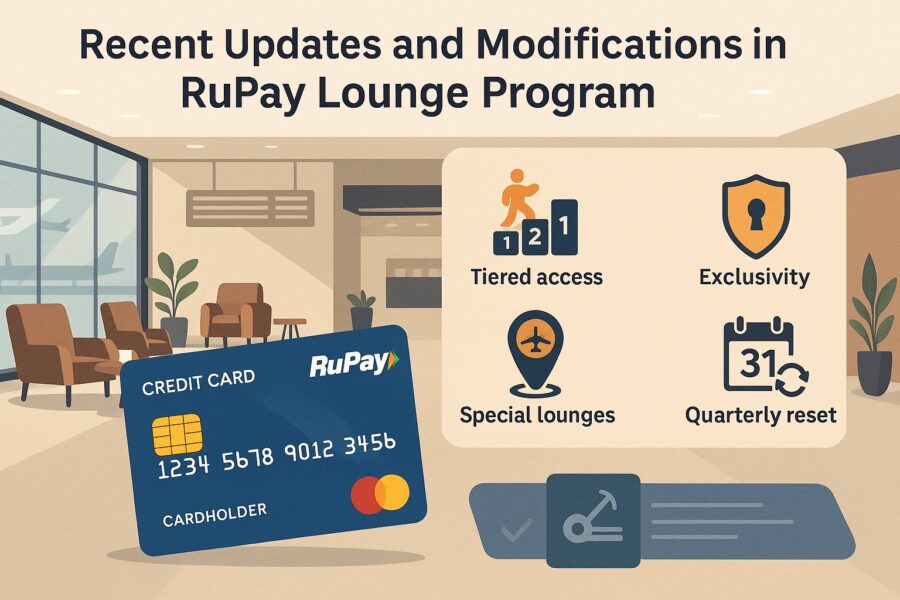

Recent Updates and Modifications in RuPay Lounge Program

In an effort to make airport lounge access more structured and rewarding for active cardholders, the National Payments Corporation of India (NPCI) introduced a tier-based access policy for RuPay credit card lounge access, effective from January 1, 2025.

The announcement is made because of high increases in the issuance of cards and rising visits to the lounges and aims to reward customers depending on transaction activity.

The 2025 updates include some of these main highlights:

- Tiered Access

Lounge access is being upgraded to be tiered, with a certain number of free visits dependent on spending in segments of quarters.

As an illustration, a Tier I cardholder (spending ₹10,000–₹50,000) will receive 2 visits. Whereas, Tier II (spending ₹50,001–₹1,00,000) will receive 4 visits. Similarly, Tier III RuPay credit cardholders (spending ₹1,00,001–₹5,00,000) will receive 8 visits and Tier IV (spending more than ₹5,00,000) will get unlimited quarterly visits.

- Exclusivity

Certain benefits can be availed only by the owners of Platinum, Select or other higher-end qualifications of RuPay cards. As of 2025, lower ranks of cards do not get airport lounge access.

- Special Lounges

The first exclusive RuPay lounge has opened at Delhi IGI Airport’s Terminal 3, offering premium food, entertainment and comfort against standard lounges.

- Quarterly Reset

All kinds of credit card benefits are reset on a quarterly basis. That way, you can adjust your privileges frequently as you change your spending patterns.

- Online Tracking and Validation

The verification of access is conducted within the RuPay Benefit Management System (RBMS). Additionally, card issuers are required to communicate with cardholders by regularly updating their eligibility information.

- Spend Waiver for New Cards

Spending requirements are waived for new cards during the quarter they are issued. However, transfers or upgrades do not qualify for this waiver.

- Guest Policy and Charges

Complimentary domestic and international airport lounge access is for the primary cardholder only. Guests incur standard lounge access fees.

These developments ensure RuPay lounge access remains a highly desired feature, helping banks control misuse, while rewarding genuinely active card spenders.

RuPay Lounge Access Rules Based on Different Credit Card Types

To enable RuPay serve lounge experiences with focus and a fair footing, the various credit cards are differentiated based on their type. Each one of them has distinct lounge access regulations.

- RuPay Platinum Credit Cards

If you use a RuPay Platinum Credit Card for domestic airport lounge visits, you will get 2 free visits per quarter. For overseas trips, 2 complimentary lounge access are allowed in a year. Users are charged at the normal lounge rate beyond the mentioned limit.

The use is not transferable at all, and the benefits are solely for the primary cardholder. Special benefits usually include discounts at various restaurants and access to online libraries. However, the lounge facility remains the major attraction.

- RuPay Select Credit Cards

Rupay Select cards enhance benefits and feature 8 free visits to domestic lounges per calendar year. These cards also provide 2 free international lounge access every year.

Moreover, access to railway lounges is valuable to business and leisure travellers. These cards also typically offer high insurance coverage, lifestyle benefits and digital wellness subscriptions on selected cards.

General Terms and Conditions

The following general rules apply to RuPay credit card lounge access, regardless of variant:

- Access is approved via successful card authorisation (₹2 is charged as a non-refundable validation fee).

- Free airport lounge access will expire if it is not utilised within the quarter.

- Complimentary lounge privileges are available only to the main cardholder, guests require a separate payment.

- Lounges are expected to request your valid boarding pass and government ID.

- NPCI or the issuer has the discretion to vary features or partner lounges with or without short notice.

- Overutilisation (beyond the free quota) results in standard rates being charged.

💡Paying your credit card bills is completely easy and secured now with the PICE App.

List of 10 Popular RuPay Credit Cards for Lounge Access

| Card Name | Joining Fee | Annual Fee | Lounge Benefits | Best Suited For |

|---|---|---|---|---|

| Reliance SBI Card PRIME | ₹2,999 | ₹2,999 | 8 domestic and 4 international visits per year | Wellness, insurance, lifestyle, golf |

| HDFC RuPay Diners Club | ₹10,000 | ₹10,000 | Access across 1,000+ lounges across India | Rewards, concierge, golf |

| Axis Bank Fibe | NIL | NIL | 4 domestic per year | Movie, shopping cashback |

| ICICI Bank Coral RuPay | ₹500 | ₹500 | Get 1 complimentary access to select airport lounges in India each quarter | Fuel surcharge waiver |

| Bank of Baroda Eterna | ₹2,499 | ₹2,499 | Unlimited domestic visits per quarter (on spending ₹40,000 or more in the previous quarter) | Milestone benefits |

| Canara Bank RuPay Select | ₹1,000 | ₹1,000 | 2 domestic airport lounge visits per quarter + 2 international airport lounge access per year | Insurance, shopping discounts |

| Union Bank RuPay Platinum | NIL | ₹350 | 2 domestic per quarter | Cashbacks, UPI integration |

| Punjab National Bank RuPay Select | ₹500 | NIL | Lounge access available but need to connect with a bank representative | Wellness perks, vouchers |

| Ixigo AU RuPay Platinum | NIL | NIL | 16 domestic per year, 1 international per year | Shopping and dining offers |

| IDFC FIRST RuPay Select | 199 | 199 | 2 domestic per quarter | High rewards, low forex markup |

Note: Your complimentary lounge benefits are subject to change based on your spending in the previous quarter and the latest policies of the card issuer.

A Detailed Overview of 10 Popular RuPay Credit Cards for Lounge Access

- Reliance SBI Card PRIME

Credit card users can now earn welcome benefits worth ₹3,000 by opting for the Reliance SBI PRIME. This card is known for its extensive airport lounge benefits and exclusive rewards for shoppers. If you frequently shop at Reliance Fresh, JioMart or Trends, this card can help you save big.

Airport Lounge Access: A maximum of 2 free lounge visits in a quarter (for domestic terminals)

Interest Rate: 3.50% per month

Additional Benefits

- You can get 1 free movie ticket on BookMyShow worth ₹250.

- Reliance Retail Store spending can help you obtain 10 reward points for every ₹100.

- Other expenses give you 5 reward points for every ₹100 spent.

- HDFC RuPay Diners Club

For foodies, this is one of the best credit card options as it provides 2X reward points on every weekend dining. Plus, you can choose between Ola vouchers, BookMyShow coupons or a 1-month live subscription after spending a total of ₹80,000 in a month.

Airport Lounge Access: Cardholders have unlimited free access to both international and domestic airport lounges.

Interest Rate: 1.99% per month

Additional Benefits

- On retail spends worth ₹150, you get 5 reward points.

- If you spend via SmartBuy, you get up to 10X rewards.

- 1% fuel transaction surcharge is waived.

- Axis Bank Fibe

You may link your Fibe card to an active UPI ID to enjoy seamless transactions. Moreover, it allows you to take advantage of complimentary airport lounge benefits depending on your spending over the last three months.

Airport Lounge Access: 4 free lounge accesses are allowed at some of the chosen airports across India. However, your offer will expire within a year.

Interest Rate: 3.75% per month

Additional Benefits

- You are eligible for 3% cashback on transactions made under the entertainment, food delivery and transportation heads.

- A maximum fuel surcharge waiver of ₹400 is offered in a month.

- The card has no renewal fee.

- ICICI Bank Coral RuPay

Besides free airport lounge visits, this card offers 1 complimentary railway lounge access every quarter. You can redeem its reward points as gifts or cash as well.

Airport Lounge Access: If you spend ₹5,000 or more in a quarter, you receive a complimentary lounge access for the next quarter.

Interest Rate: 3.40% per month

Additional Benefits

- Movie ticket purchases become eligible for a discount of 25% on purchasing two tickets or more.

- On bills of ₹3,000 or above, you can get a 20% discount (up to ₹750).

- Cardholders get 2 reward points for every ₹100 spent (except for fuel expenses).

- Bank of Baroda Eterna

Bank of Baroda rewards its Eterna cardholders with 10,000 bonus reward points if they spend ₹50,000 or more in the first 60 days. Similarly, you can achieve the milestone benefit of 20,000 reward points on crossing transactions worth ₹5 lakh in a calendar year.

Airport Lounge Access: Travel enthusiasts can use the Eterna card for unlimited access to domestic airport lounges throughout the year.

Interest Rate: 3.49% per month

Additional Benefits

- As a welcome gift, you get a six-month free membership of Fitpass Pro.

- 12 reward points are credited to your account for every ₹100 spent on dining.

- You spend every ₹100 on online shopping and earn 15 reward points against it.

- Canara Bank RuPay Select

Customers can use this card for high-ticket purchases and easily convert their bills into flexible payment terms through the Canara ai1 app. This RuPay Select card offers you 24/7 concierge services and ensures complementary insurance benefits.

Airport Lounge Access: Travellers get 2 free domestic lounge accesses per quarter. Similarly, 2 complimentary lounge visits are reserved for one year.

Interest Rate: 2.50% per month

Additional Benefits

- Users get up to 5% cashback on dining across restaurants.

- 5% cashback is also offered on paying utility bills (both online and offline).

- A ₹10 lakh insurance is offered along with the card.

- Union Bank RuPay Platinum

People who want to upgrade their credit card services at every phase of life can opt for this card. It offers you RuPay credit card lounge access upon paying an annual fee of ₹350. However, professionals and salaried individuals applying for this card should have a minimum CIBIL score of 700 to be eligible in the first place.

Airport Lounge Access: Card users can avail 2 complimentary domestic airport lounge visits in a year.

Interest Rate: 1.33% per month

Additional Benefits

- The card provides you with easy EMI facilities over 3 months, 6 months, 9 months and 12 months.

- On using it, you get a fuel surcharge waiver of 1% (can be up to ₹100 per month).

- You get personal accidental coverage of a maximum of ₹2 lakh.

- Punjab National Bank RuPay Select

The Punjab National Bank RuPay Select Card is ideal if you use your credit card wisely and want to make the most of limited-time offers. By using it on PNB GENIE, a one-stop shopping solution, you can earn great rewards.

Airport Lounge Access: Those using the card get 2 complimentary domestic lounge accesses in a quarter.

Interest Rate: 2.95% per month

Additional Benefits

- While using the card, you earn 2X reward points on retail purchases.

- On completing the first transaction, you get 300+ reward points.

- Furthermore, you become eligible for 300+ merchant offers and comprehensive life insurance.

- ixigo AU RuPay Platinum

Frequent flyers, whether travelling for work or adventure, can save a lot of money by using this card. The ixigo AU card allows you to enjoy discounts on bus tickets and flight fares, and it offers you the luxury you have always longed for.

Airport Lounge Access: One can obtain up to 16 complimentary domestic airport lounge visits upon spending ₹20,000 in a quarter. However, only 1 free international lounge access is allowed in a year.

Interest Rate: 3.75%

Additional Benefits

- You receive a flat 10% off on hotel and flight bookings made via ixigo.

- No gateway charges need to be paid for railway ticket bookings.

- Plus, you receive 10 reward points for every ₹200 spent online. For the same amount spent offline, you earn 5 points.

- IDFC FIRST RuPay Select

Especially tailored for UPI payments, this credit card provides you with 3X rewards for any UPI transaction above ₹2,000. However, it is ‘digital-only’ and you won’t get a physical card.

Airport Lounge Access: Users can be assured of 8 free airport lounge visits in a year (up to 2 per quarter).

Interest Rate: 0.71% to 3.85% per month

Additional Benefits

- You get 1X reward points for any UPI spending.

- Additionally, the card gives you 1X reward points for insurance and utility bill transactions.

How to Check RuPay Credit Card Lounge Access Benefits?

Making sure you can access RuPay credit card lounges is a breeze with these straightforward steps:

Step 1: Head to Your Bank or the RuPay Website

Start by going to your bank's official website or the RuPay lounge portal. Log in to your internet banking or card management dashboard and navigate to the credit card section to find information about lounge benefits and the lounges that participate. Keep in mind that each bank presents this information a bit differently, so take your time to review it.

Step 2: Look for ‘Lounge Access’

Search for a “Lounge Access” tab or link in your card’s benefits summary. This is where you will discover your current remaining complimentary visits, the eligible airport and railway lounges, and any spending requirements that apply to your specific card.

Step 3: Monitor Your Quarterly Spending

Many banks require you to meet a minimum spending threshold to keep enjoying lounge benefits. Check your monthly statement, app dashboard or reach out to customer service to confirm your spending for the last quarter. If you have not met the minimum, you will not be able to access the airport lounges for free.

Step 4: Verify at the Airport Lounge

Before you travel, it is a good idea to double-check your eligibility with the lounge itself. Usually, a quick ₹2 swipe on your card will do the trick. The lounge staff can also check your visit balance in real time using their point-of-sale system, so you can check in without any hassle.

Conclusion

If you analyse closely, you will notice that the updates to RuPay credit card lounge access in 2025 have made it more rewarding than ever. With tier-based benefits, quarterly resets and special perks for premium cardholders, it is a game-changer.

Whether you fly once in a few weeks or just travel occasionally, picking the right RuPay card can really elevate your overall experience. By keeping an eye on your spending and knowing the eligibility rules, you can save some cash and have a smooth journey because of the thoughtfully designed lounge facilities.

By

By