Reverse Charge Mechanism (RCM) in Commercial Property Rentals

- 16 Aug 24

- 13 mins

Reverse Charge Mechanism (RCM) in Commercial Property Rentals

- Reverse Charge Mechanism Under GST

- RCM Under GST for Commercial Properties

- Benefits of Forward Charge Mechanism

- Taxation of Rental Income Before the Implementation of GST

- GST Applicability on Property Rentals

- Registration Requirements for Property Owners Renting to Businesses

- GST Implications for Properties Used for Commercial Purposes

- Methods for Calculating GST on Rental Properties

- Input Tax Credit (ITC) Rules for Properties Under GST

- Eligibility of ITC for Repairs and Renovations on Rented Properties

- Income Tax Deduction Provisions for Properties Earning Rental Income

Key Takeaway

- RCM shifts GST liability from sellers to buyers, ensuring tax compliance when dealing with unregistered suppliers.

- RCM is crucial for businesses renting from unregistered landlords, mandating them to handle GST payments.

- There is no transaction value threshold for RCM applicability; it depends on the transaction nature and supplier status.

- Rent payments under RCM must be reported in GSTR-1 to maintain compliance and accurate tax records.

- Businesses with rent income exceeding INR 20 lakhs (or INR 10 lakhs in special states) must register for GST.

Reverse Charge Mechanism Under GST

The Reverse Charge Mechanism (RCM) under the Goods and Services Tax (GST) introduces a unique shift in tax liability from the seller to the buyer, a pivotal change aimed at enhancing tax compliance. In standard scenarios, the supplier is tasked with collecting and submitting GST to the government.

However, under RCM, this duty is transferred to the recipient of the goods or services. This mechanism is particularly strategic for managing transactions involving unregistered suppliers or those in sectors where tax compliance is traditionally low. It ensures that the government secures its tax revenue by obligating registered recipients to account for the GST, thus broadening the tax base and securing compliance from those who might otherwise evade tax responsibilities.

RCM Under GST for Commercial Properties

In the context of commercial properties, RCM becomes particularly critical. Businesses renting commercial property from landlords who are not registered under GST must take on the responsibility of calculating, collecting, and remitting the GST themselves. This scenario often occurs when small property owners who fall below the GST registration threshold lease their premises to larger, GST-registered businesses.

For these businesses, RCM mandates that they must self-assess the GST due on their rental payments and pay it directly to the government. This ensures the continuous flow of tax revenue in situations where the landlord is either exempt from GST registration due to lower turnover or chooses not to register. Thus, RCM closes a potential gap in the tax system, ensuring that all due taxes are collected and remitted, thereby minimizing tax leakage and promoting a level playing field among businesses that pay rent for commercial spaces.

Benefits of Forward Charge Mechanism

The Forward Charge Mechanism (FCM) is the standard method of tax levying in the GST system where the supplier of goods or services is responsible for collecting and remitting the tax to the government. This approach offers several advantages. Primarily, it simplifies compliance for buyers, as they do not have to deal with the complexities of tax payments directly. It also enhances transparency and accountability in business transactions, as tax details are clearly outlined on invoices.

Furthermore, FCM facilitates better cash flow management for suppliers, since they collect tax along with the payment for goods or services provided. This mechanism is particularly beneficial in fostering a straightforward and predictable taxation environment, encouraging compliance and easing administrative burdens for businesses.

Taxation of Rental Income Before the Implementation of GST

Prior to the implementation of GST, the taxation of rental income in India was primarily governed under the Service Tax regime for services related to renting of immovable properties. Commercial properties rented out for use in business attracted Service Tax, which was levied at the applicable rate. This tax was imposed on the owner of the property, who was responsible for collecting it from the tenant and remitting it to the government. Residential properties, however, were generally exempt from Service Tax, mirroring the exemption maintained under GST.

This system, while straightforward, often resulted in multiple indirect taxes imposed across different stages of service provision, leading to a cascading tax effect. The introduction of GST aimed to consolidate these various taxes into a single tax framework, streamlining the process and reducing the tax burden on business operations involving rented properties.

GST Applicability on Property Rentals

GST applicability on property rentals is determined based on the type of property and its intended use. Commercial properties, including office spaces, shops, and factories, are typically subject to GST. The tax is imposed on the lease, rent, or tenancy of these properties, making it a significant consideration for businesses that rent such premises.

In contrast, residential properties are generally exempt from GST unless they are rented for commercial purposes or provided with services that classify them as commercial accommodations, such as serviced apartments. Understanding these distinctions is crucial for property owners and tenants alike to ensure compliance with GST regulations and to manage financial planning effectively.

Registration Requirements for Property Owners Renting to Businesses

Property owners who rent out commercial spaces to businesses are required to register for GST if their total taxable revenue crosses the set threshold limit, which currently stands at INR 20 lakhs nationally and INR 10 lakhs for special category states. This registration is mandatory because it allows the government to track GST payments and compliance more effectively.

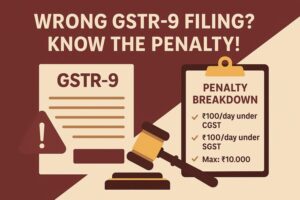

Once registered, property owners are obligated to charge GST on rents received, file regular GST returns, and maintain accurate financial records. It is important for property owners to stay informed about changes in GST regulations as they pertain to commercial rentals to avoid penalties and ensure they meet all legal obligations.

GST Implications for Properties Used for Commercial Purposes

Properties used for commercial purposes, such as office spaces, retail shops, or any premises operated for business activities, are subject to GST when put on rent. The rental income generated by property owners from such commercial leases is taxable under GST, contrasting with residential rent, which is generally exempt unless significant services are provided that qualify the residence as a commercial entity. Property owners, especially those registered under GST, need to ensure they apply the correct GST rate—typically 18%—and issue compliant invoices. This requirement ensures proper tax documentation and facilitates straightforward tax compliance and auditing processes.

Methods for Calculating GST on Rental Properties

To calculate GST on rental properties, including those leased for commercial use by registered persons, follow these steps:

- Determine the Taxable Value: This is usually the total amount charged for the property on rent. Include any service charges or ancillary fees associated with the rental agreement.

- Apply the Appropriate GST Rate: Commercial property rentals typically attract a GST rate of 18%. This rate should be applied to the total taxable value of the rental service.

- Calculate the GST Amount: Multiply the taxable value by the GST rate. For example, if the rent is INR 1,00,000 per month, the GST at 18% would calculate to INR 18,000.

- Issue a Compliant Invoice: The invoice should list the base rent, the applied GST rate, and the total amount due including GST. It should also include the property owner’s GSTIN and other details required by GST regulations. This ensures clarity and compliance, particularly important when dealing with unregistered persons who may not automatically handle GST implications.

For properties that serve both residential and commercial purposes, the owner must prorate the GST based on the extent of commercial usage. Maintaining accurate records and adhering to GST reporting requirements are essential, enabling property owners to report their tax liabilities accurately and claim any applicable input tax credits.

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

Input Tax Credit (ITC) Rules for Properties Under GST

Input Tax Credit (ITC) under GST offers property owners the ability to offset their tax liabilities with the GST paid on goods and services used to maintain or improve their rental properties. This is particularly advantageous for properties used for commercial purposes but does come with specific conditions and restrictions.

For properties rented out for commercial use, the GST paid on expenses directly related to the earning of rent income can be claimed as ITC. This includes expenses such as maintenance, repairs, or renovation services. Property owners who are registered persons under GST can claim ITC on these expenses, which effectively reduces the net GST cost on their tax liabilities. The mechanism ensures that only the value addition at each stage is taxed, which in turn reduces the tax burden on the end consumer.

However, it's important to note that ITC is not available for properties used solely for residential purposes or for expenses related to exempt supplies. For instance, if a property is used both for residential and commercial purposes, the registered person can only claim ITC proportionate to the part of the property that generates taxable rent income. Similarly, the GST paid on monthly rent or services for properties that are leased for residential purposes generally cannot be claimed as ITC.

In practice, maintaining detailed and accurate records of all expenses and the corresponding GST invoices is crucial. These records support the claims for ITC during the filing of GST returns. Property owners must ensure that the invoices clearly specify the GST charged and are in the name of the registered person claiming the ITC, aligning with GST compliance requirements to facilitate smooth credit claims.

Eligibility of ITC for Repairs and Renovations on Rented Properties

The eligibility to claim Input Tax Credit (ITC) for GST paid on repairs and renovations largely depends on the type of property on rent and the purpose of the rental. For commercial properties where the property owner is a registered person under GST, ITC can be claimed for GST incurred on repairs and renovations. This is because these costs are considered direct expenses that enhance the value of the property and are linked to the taxable income generated from commercial rent.

However, for residential properties, the situation is different. GST paid on services related to the maintenance or renovation of a property solely used for generating residential rent, which is exempt from GST, does not qualify for ITC. This aligns with the general GST rule that disallows ITC on expenses incurred for exempt supplies or non-business purposes. Property owners must carefully consider the purpose and use of the property to determine the eligibility for claiming ITC on such expenses.

Income Tax Deduction Provisions for Properties Earning Rental Income

For property owners generating rental income, both from commercial and residential properties, there are specific income tax deduction provisions that can be utilized to reduce taxable income. Expenses incurred on repairs, maintenance, and renovations can generally be deducted from the rental income derived from the property, whether it's a commercial or residential property. This lowers the net rental income subject to tax.

Furthermore, property owners can also deduct property taxes paid and interest on loans taken out to purchase or renovate the property. These deductions are available irrespective of whether the property is used for residential or commercial purposes. However, it's important for property owners to maintain meticulous records and receipts of all such expenses, as these are required to substantiate the deductions during income tax filings.

By understanding these provisions, property owners can effectively manage their tax liabilities and ensure compliance with both GST and income tax regulations, maximizing their financial benefits while adhering to legal requirements.

By

By