HDFC Pixel Go Credit Card: Benefits, Fees, and Eligibility

- 11 Dec 25

- 5 mins

HDFC Pixel Go Credit Card: Benefits, Fees, and Eligibility

- Key Benefits of The HDFC Pixel Go Credit Card

- Other Features and Benefits of The HDFC Pixel Go Credit Card

- Fees and Charges of The HFC Pixel Go Credit Card

- Who Should Get the HDFC Pixel Go Credit Card

- Things To Know While Using the HDFC Pixel Go Credit Card

- Example of How to Use the Pixel Go Credit Card Effectively

- Total Annual Savings

- Conclusion

Key Takeaways

- The Pixel Go credit card offers 1% cashback on eligible spends and 5% via SmartBuy.

- Joining and renewal fees are easily waivable with minimal annual spending.

- Cashback is earned as CashPoints and managed through PayZapp.

- RuPay variant enables 1% cashback on UPI transactions.

- Ideal for beginners wanting low-cost credit access and simple rewards.

The Pixel Go Credit card is specifically designed credit card for new users who are still learning to use their credit card in the best way possible. The low and waivable entry barrier makes it easily accessible. Moreover, you can manage your earned cashback via Payzapp, which offers easy accountability of your accumulated cashback over time and helps to assess your ROI.

Now, let’s jump right into the specifics of the HDFC Pixel Go Credit Card!

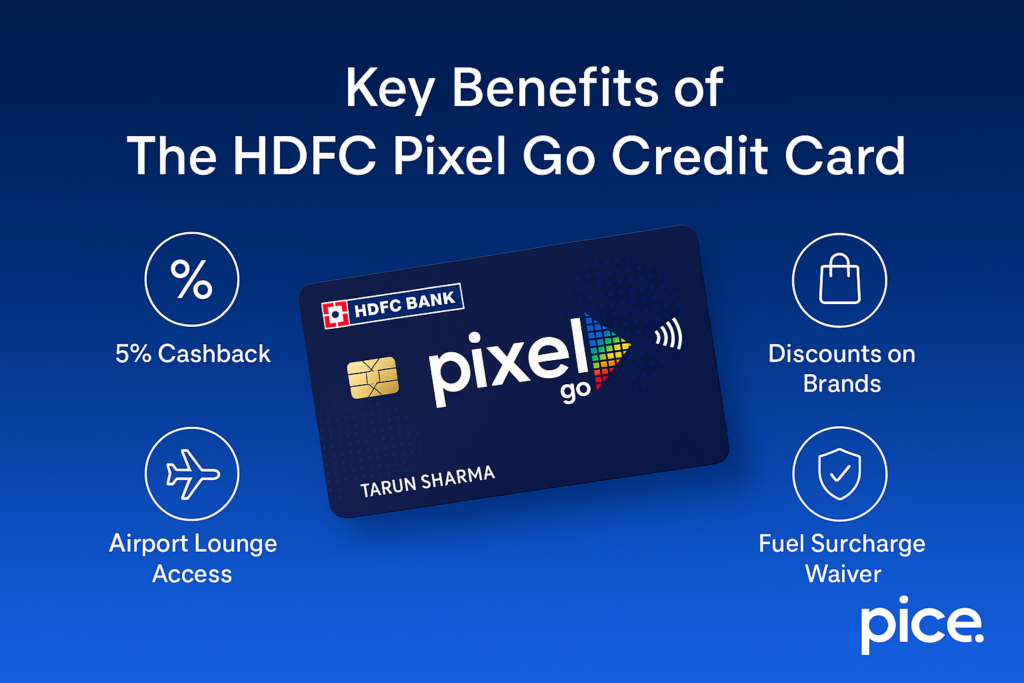

Key Benefits of The HDFC Pixel Go Credit Card

The HDFC Pixel Go Credit card offers cashback to its customers along with milestone benefits that can make your card truly free. Let us explore the Pixel Go credit card benefits in detail.

Rewards Program

- Get 1% cashback on eligible transactions.

- Enjoy 5% cashback on selective spends on SmartBuy.

- Enjoy 1% cashback on selective UPI transactions. This feature is applicable to HDFC Pixel RuPay Credit card holders only. Cashback on UPI is capped at 500 CashPoints.

Note: Click here to know more about the eligible transactions and what kind of spends are excluded from the cashback facility.

Milestone Benefits

- Get your joining fee reversed for spending ₹10,000 within the first 90 days of issuance.

- Get your renewal fee waived for spending ₹50,000 on this card in a membership year.

Other Features and Benefits of The HDFC Pixel Go Credit Card

The HDFC Bank also offers some special discounts and offers on this card. Here is a list of them.

- Save 10% on all your restaurant bill payments and Swiggy Dineout up to ₹200.

- Easily convert your one-time purchases to flexible EMIs with PayZapp.

- Manage all your EMIs, cashback and other features of your Pixel Go Credit Card with the PayZapp app.

- Get 1% fuel surcharge waiver for fuel transactions between ₹400 and ₹5,000.

- Enjoy convenient features like UPI and “Tap and Pay” to easily transact without OTP.

Fees and Charges of The HFC Pixel Go Credit Card

| Types of Fees and Charges | Amount and Conditions |

| Joining Fee / Annual Renewal Fee | ₹250 (both waivable) |

| Cash Withdrawal Fee | 2.5% of the withdrawal amount or ₹500, whichever is higher. |

| Forex Fee | 1% |

| Interest on Late Payments | 3.6% per month (43.2% per annum) |

💡Want to avoid paying HDFC Pixel Go credit card charges and interest? Use the PICE App.

Who Should Get the HDFC Pixel Go Credit Card

The HDFC Pixel credit card provides cashback to its customers in the form of CashPoints, and people can redeem their CashPoints on PayZapp, a payments app. Moreover, the low milestones for bonus rewards and easy-to-understand features make the Pixel Go a good credit card for beginners. Read more for details. The card suits you if:

- You want to start your credit card journey.

- You aim to build a solid credit score.

- You don't want to handle the pressure of high joining and renewal fees.

- You are comfortable with normalising the use of SmartApp for purchases and PayZapp for payments.

Things To Know While Using the HDFC Pixel Go Credit Card

Here are a few things you should know before getting the Pixel Go credit card.

- The 1% cashback you get on UPI spends is available for RuPay credit cards only.

- You do not get CashPoints for spending on items that are excluded from the list.

- Your CashPoints are valid for 2 years from the date of redemption, after which they will lapse.

- There is a cap of up to 500 CashPoints in a month on 1% cashback on UPI and 5% cashback on using SmartBuy.

Example of How to Use the Pixel Go Credit Card Effectively

The Pixel Go Credit Card is designed to offer uniform cashback benefits across most types of purchases, making it ideal for everyday spending. Let’s look at how a beginner cardholder can maximise savings in a year.

Assume you spend a total of ₹2 lakh annually using your Pixel Go card. Out of this, ₹10,000 is spent on select categories available through SmartBuy, while the remaining ₹1,90,000 is spent on other eligible purchases.

Here is how your savings would work:

- SmartBuy Purchases

SmartBuy offers a higher reward rate. With 5% cashback, your ₹10,000 spending earns 500 SmartPoints.

- Other Eligible Spends

All remaining eligible purchases earn 1% cashback.

So, ₹1,90,000 spent across regular categories earns 1,900 SmartPoints.

- Joining and Renewal Fee Savings

Depending on the card’s fee structure, the accumulated cashback can help recover a portion of your joining or renewal charges, further increasing the card’s net value.

Total Annual Savings

By combining rewards from all categories, you accumulate 2,400 SmartPoints in a year, equivalent to saving ₹2,400. This example shows how consistent spending across categories can help you maximise the Pixel Go Credit Card’s benefits effortlessly.

Conclusion

The Pixel Go Credit Card is an excellent entry-level option for beginners seeking simple rewards, low fees, and effortless cashback tracking through PayZapp. With easy milestone waivers, everyday cashback, and SmartBuy benefits, it helps new users build credit while maximising savings through responsible and consistent spending.

By

By