New GST Rates List 2025: Revised GST Slabs from 22 Sept

- 9 Sep 25

- 10 mins

New GST Rates List 2025: Revised GST Slabs from 22 Sept

- What are the New GST Slabs?

- What are the Things That Will be Cheaper from 22 September 2025?

- What are the Things that will be Costlier from 22 September 2025?

- Things with No Changes in GST Rate

- Who Will Benefit From the GST Reform Bill?

- Who Will Suffer From the GST Reform Bill?

- Why is the GST Slab Change Happening?

- Importance of the Change for the Indian Economy: Positives and Negatives

- Conclusion

Key Takeaways

- The New GST Rates List 2025 simplifies taxation into 3 slabs—5%, 18%, and 40%—effective from 22nd September 2025.

- Essential goods under the 5% GST slab and many items moving to 0% GST will make daily essentials cheaper for consumers.

- Luxury and sin goods face a steep 40% GST rate, ensuring responsible consumption and higher revenue from premium sectors.

- The reform benefits MSMEs, FMCG, auto, and healthcare sectors while easing compliance for businesses.

- Consumers enjoy affordability, businesses get simplified invoicing, and the economy moves toward a more inclusive GST regime.

As a festive Diwali gesture, the Indian government has announced a significant modification of GST slabs to benefit consumers. Effective September 22, 2025, the existing GST structure will be replaced with simplified slabs, designed to make goods and services more affordable, particularly for middle- and lower-income households.

According to the Finance Minister, this reform marks a key step toward easing the tax burden and boosting purchasing power for all. The new GST rates list 2025 introduces 3 main revised Goods and Services Tax slabs. This article breaks down these changes in detail to help you understand what is coming next!

What are the New GST Slabs?

The new GST rate slabs that will be introduced will include the following 3 categories:

- 5% for essential goods

- 18% for standard goods and services

- 40% for sin and luxury goods

The older GST rate slabs that were implemented were:

- 5% for mass consumption items

- 12% for processed foods

- 18% for technical accessories and self-care items

- 28% for luxury goods

Implications of New GST Rates 2025 for Businesses, Consumers, and Government

For businesses, this means that the invoicing process will be more straightforward. Along with this, the classification of goods disputes is expected to decrease due to the introduction of simpler and fewer categories.

On the other hand, for consumers, this means that there will be less confusion regarding the similar products that are taxed separately. Overall, mass-use items will be taxed at a lower rate compared to before.

Lastly, for the government, the revenue may fluctuate slightly at first, but the planning supports long-term stable revenue.

What are the Things That Will be Cheaper from 22 September 2025?

Goods and Services Covered Under 0% GST Rate

| Current GST Rate | Future GST Rate(Applicable from September 22, 2025) | Items |

| 5% | 0% Nil | Ultra-High Temperature (UHT) milkPaneer or chena, labelled and pre-packagedPizza breadRoti or chapati and khakhraErasers |

| 12% | 0% Nil | Graph book, exercise book, notebooks, and laboratory notebookHydrographic and maps (printed charts) of all kinds, such as wall maps, atlases, globes, and topographical plansPaperboard or uncoated paper is used for making graph books, exercise books, notebooks, and laboratory notebooksPencils (sliding or propelling), pencil sharpeners, pastels, crayons, tailor's chalk, and drawing charcoals |

| 18% | 0% Nil | Parotta/paratha or other similar Indian breadsPolished and Natural Cut Diamonds up to 25 cents (1/4 carats) imported under the Diamond Imprest Authorisation SchemeArt and antique worksCommunication devices, including software-defined radios with components and accessoriesMilitary transport aircraft |

Goods and Services Covered Under 5% GST Rate

| Current GST Rate | Future GST Rate(Applicable from September 22, 2025) | Items |

| 12% | 5% | Medical Grade OxygenTractorsDairy Spreads, Butter, Cheese, and GheeSewing Machines and Their PartsDried NutsGlucometer with Test StripsNapkins for Babies, Feeding Bottles, and Clinical DiapersDrip Irrigation Systems and SprinklersAll Types of Diagnostic Kits and ReagentsIndian Railway or tramway sleepers of woodFuel cell motor vehiclesUtensilsCorrective SpectaclesSpecified Bio-Pesticides and Micro-NutrientsAgricultural, Forestry, or Horticultural Machines for Harvesting, Cultivation, Soil Preparation, and ThreshingPackaged Namkeens, Mixtures, and BhujiaNon-packaged or packaged coconut water |

| 18% | 5% | Shampoo, Hair Oil, Toilet Soap Bar, Toothpaste, Shaving Cream, and ToothbrushesThermometerTractor Parts and TyresNatural HoneyCocoa Powder purely from Cocoa Beans |

Items That Will be under 18% GST

| Current GST Rate | Future GST Rate(Applicable from September 22, 2025) | Items |

| 28% | 18% | *BidiAir-conditioning (AC) machines, which include an electric motor-driven fan and elements for changing the temperature and humidityDish washing machinesTelevision sets, including LCD and LED televisions, monitors and projectors, and similar goodsNew pneumatic tyres, of rubber [other than of a kind used on/in bicycles, cycle-rickshaws and three-wheeled powered cycle rickshaws; rear tractor tyres; and of the type used on aircraft.Road tractors for semi-trailers with an engine capacity of more than 1800 ccPetrol, liquefied petroleum gases (LPG) or compressed natural gas (CNG) driven motor vehicles of engine capacity not exceeding 1200cc and of length not exceeding 4000 mm.Three-wheeled vehiclesChassis fitted with engines, for the motor vehicles of headings 8701 to 8705Bodies (including cabs), for the motor vehicles of headings 8701 to 8705Motorcycles of engine capacity (including mopeds) and cycles fitted with an auxiliary motor, with or without side-cars, of an engine capacity not exceeding 350cc; side carsRowing boats and canoes, Seats of a kind used for motor vehiclesAll dutiable articles intended for personal use |

What are the Things that will be Costlier from 22 September 2025?

Goods and Services Covered Under 18% GST Rate

| Current GST Rate | Future GST Rate(Applicable from September 22, 2025) | Items |

| 5% | 18% | Coal, ovoids, briquettes, and similar kinds of solid fuels that are manufactured from coalLignite, excluding jetPeat and peat litter |

| 12% | 18% | Articles of apparel and clothing accessories, which are knitted or not knitted/ crocheted or not crocheted, of sale value more than ₹2500/pieceOther manufactured textile fabrics and cotton quilt articles or sets with a sale value of more than ₹2500/piece.Dissolving grades and chemical wood pulpUncoated paper and paperboard, of a kind used for printing, writing, or other graphic purposesNon-perforated punch-cards and punch tape paper, in rolls or rectangular (including square) sheets, of any size, other than paper of heading 4801 or 4803Uncoated kraft paper and paperboard, in rolls or sheets, other than that of heading 4802 or 4803Other uncoated paper and paperboard, in sheets or rolls, not further processed or worked than as specified in Note 3 to this ChapterGreaseproof papers, Glassine papers |

Goods and Services Covered Under 40% GST Rate

| Current GST Rate | Future GST Rate(Applicable from September 22, 2025) | Items |

| 18% | 40% | Other non-alcoholic beverages |

| 28% | 40% | *Pan masalaAll goods (Including aerated waters), containing added sugar or other sweetening matter or flavouredCaffeinated BeveragesCarbonated BeveragesCigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutesMotor cars and other motor vehicles principally designed for the transport of personsMotorcycles of engine capacity exceeding 350 ccYachts and other vessels for pleasure or sports |

Things with No Changes in GST Rate

| Items | Current and Future GST Rate |

| Apparel articles and clothing accessories which are knitted or not knitted/ crocheted or not crocheted of sale value not more than ₹2500/pieceOther manufactured textile articles or sets of sale value not more than ₹2500/pieceCotton quilts for sale, with a value of not more than ₹2500/piece | 5% |

| Footwear of sale value no more than ₹2500/pair | 18% |

Who Will Benefit From the GST Reform Bill?

The common people or consumers of the country will primarily benefit from this GST Reform Bill. Other groups in the Indian economy that will also benefit from this tax structure reform include:

- FMCG Sector

- Auto Sector, including small car makers, two-wheeler makers, and garages, as parts become cheaper

- Healthcare and Insurance Sector

Who Will Suffer From the GST Reform Bill?

The ones who might suffer a loss due to these changes include:

- Sugary Beverage Companies

- Luxury Car Makers

Why is the GST Slab Change Happening?

According to India’s Finance Minister Nirmala Sitharaman, these GST rate cuts are guided by the principle of making daily-use items more affordable for the middle and lower-class households of the country.

This change also benefits Micro, Small, and Medium Enterprises (MSMEs) in India and aims to promote national independence. All items that contribute to the Indian economy at large have seen changes in their tax rates, including life and health insurance.

This change also highlights India’s Seven Pillars of Next Generation GST Reforms:

- Building on the success of GST

- Rationalising rates for fairer taxation

- Simplifying filing through technology

- Putting consumers first

- Empowering MSMES and manufacturers

- Stronger states, stronger Bharat

- Lower taxes = Higher spending

Furthermore, the reforms as per the GST council are expected to influence nearly all these pillars, with the possible exception of the technology sector. In the coming months, the main focus will be on how this reform shapes the financial landscape of the country.

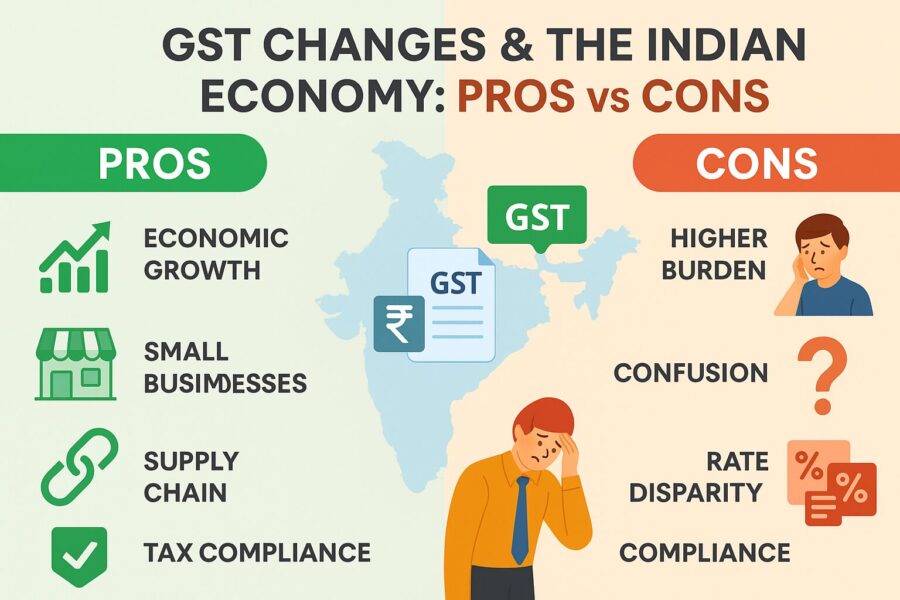

Importance of the Change for the Indian Economy: Positives and Negatives

The new GST rates list 2025 that has been announced brings forth the thought of making goods more affordable. There are particular positives that this change brings, which are as follows:

- Lower GST rates in India will lead to lower prices and increased consumption.

- Lower rates will also help boost manufacturing and MSMEs.

- There will be increased incomes for farmers and food processors, as many food items have seen a decrease in tax rates.

On the other hand, it becomes necessary to observe how these changes will unfold in the future. Some of its potential negative impacts can be as follows:

- This change can lead to potential revenue loss for the government, as taxes on many day-use items with constant demand have decreased.

- Businesses in lower-tax brackets may face Input Tax Credit (ITC) challenges, as they will not be eligible to file for ITC, which can impact their profit margins.

- The sudden shift in tax rates will cause operational challenges for businesses, which may include issuing credit notes according to the new structure or relabeling products.

Conclusion

The New GST Rates List 2025, effective from 22nd September, simplifies taxation with three slabs while reducing costs on essential goods. This reform eases consumer spending, supports MSMEs, and streamlines business operations, though some industries may face short-term challenges.

By taxing luxury and sin goods more heavily, the government strikes a balance between inclusivity and responsible consumption. Ultimately, the reform aims to boost affordability, encourage local growth, and create a more consumer-friendly economy.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By