Latest Amendments in GST 2025: Key Changes & Impact

- 23 Oct 25

- 9 mins

Latest Amendments in GST 2025: Key Changes & Impact

Key Takeaways

- The GST Council introduced 10 major amendments in 2025 to enhance compliance, transparency, and ease of doing business.

- New measures like Multi-Factor Authentication (MFA) and biometric verification strengthen GST portal security and prevent fraud.

- Businesses must now file GSTR-7 sequentially and follow new invoice series and turnover calculation rules from April 2025.

- The ISD mechanism and credit note compliance ensure accurate ITC distribution and reduce mismatches in tax reporting.

- Amendments such as GST Waiver Scheme 2025 and rate revisions for hotels and used cars promote efficiency and fairness in taxation.

Did you know that the GST council has amended the law more than 9 times in just 5 years to match it to the country’s economic state? Similarly, the latest amendments in GST reflect continuous efforts of government to refine and streamline the tax framework.

It helps increase transparency and promote businesses’ entrance into the formal Indian economy. These changes are crucial in promoting tax compliance, simplifying taxation procedures, and addressing long-standing issues of taxpayers and businesses.

This article will provide you with information regarding 10 such recent amendments which reflect economic developments, technological progress, and stakeholder feedback.

10 Recent GST Amendments in India

Several GST Amendments were made in the Indian GST regime for 2025. These amendments were to support the improvement of the taxation system in the country. These latest amendments in GST are as follows:

1. E-Way Bill Restrictions

E-Way Bill restriction came into effect from 1st January 2025. In this amendment, E-Way Bill generation is only allowed for invoices that were issued within the past 180 days. This has a maximum extension of 360 days. The National Informatics Centre (NIC) was set to launch new versions of the E-Way Bill and e-invoice systems for the use of taxpayers.

This was done to enhance security for the taxpayers and businesses, along with ensuring better compliance with the tax regulations. Due to this change, companies need to adjust their logistics and invoicing processes to meet these new timelines and system changes.

2. Multi-Factor Authentication (MFA) for All Taxpayers

All of the registered taxpayers need to compulsorily go through a multi-factor authentication process to log in to their GST account. Multi-Factor Authentication, or MFA, is a security system that requires users to provide two or more verification factors to gain access to a resource/ account. This mandate is one of the latest amendments in GST and was made effective from April 1, 2025.

The goal that the Government wants to achieve with this mandate is to enhance the security of sensitive financial information and prevent access for unauthorised personnel. For businesses, this change means that their authorised personnel have the right knowledge and tools to comply with this mandate.

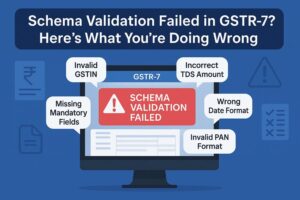

3. Mandatory Sequential Filing of GSTR-7

After the amendment, as a taxpayer, you need to follow a sequential filing order without skipping any numbers for filing GSTR-7. This means you will need to submit your returns in an orderly manner without skipping any previous returns. However, if you have not filed a previous return, the system will automatically block you from filing your current return.

The main objectives of this amendment are to streamline the collection of TDS and strengthen Input Tax Credit (ITC) reconciliation. This change made it mandatory for entities to maintain business compliance by aligning their filing processes accordingly. They also need to ensure that they do not skip or miss any of their return filing dates.

4. New Invoice Series and Turnover Calculation

From 1st April 2025, businesses need to use a new invoice series to maintain accurate records and ensure a smooth transition into the new financial year. This provision is similar to Rule 49 of the Central Goods and Services Tax Act 2017 regarding the bill of supply.

The businesses will also need to recalculate their aggregate turnover to check GST registration eligibility and confirm whether they must issue e-invoices. If they fail to do so, they can face issues with tax compliance along with the generation of E-Way Bills.

5. Biometric Authentication for Company Directors

From 1st March 2025, all promoters and directors of companies, including public, foreign, and private entities, need to complete biometric authentication at any GST Suvidha Kendra (GSK) in their home state. They receive an intimation email to select a GSK and then book a slot.

The individuals then need to visit the GSK for biometric authentication and photo capture. They just need to make sure that this process is complete before the PAS visits the GSK for their document verification. This step is taken to simplify the authentication process and allow businesses to comply without visiting specific jurisdictional GST Suvidha Kendras.

6. Enhanced Credit Note Compliance

When a business receives credit notes, it needs to accept or reject them through the Integrated Management System (IMS) to avoid mismatches in ITC claims. In short, it means that you will need to take action on IMS to receive a credit note and keep the ITC claims valid.

This amendment aims to match records between suppliers and buyers, and prevent mistakes or fraud in claiming ITC. Moreover, it also helps in ensuring transparency and accuracy, lowers discrepancies in tax filings, and improves ITC management.

7. Mandatory Input Service Distributor (ISD) Mechanism

Starting from April 1, 2025, businesses must use the ISD mechanism to distribute ITC on common services. These services can include advertising, professional fees, and rent across various GST registrations under the same PAN. ISD is not to be confused with the input of goods or equipment, as it is only for services.

If any business fails to do so, it will attract penalties and block ITC claims. To make sure that businesses are able to adapt to this, they need to update their internal processes, use software to track ITC, and train staff properly.

8. GST Rate Adjustments for Hotels and Used Cars

The latest amendments in GST were also in the hotel industry, as well as, the used vehicle industry. The removal of the ‘Declared Tariff’ concept is done by the Government. The application of GST will now be on the actual amount that hotels charge their customers. Furthermore, the hotels that charge more than ₹7,500 per unit per day for accommodation will attract an 18% GST rate on restaurant services. However, they will enjoy ITC benefits.

The GST rate on the sale of used cars will go up from 12% to 18%. This increase has a very high chance of influencing the pre-owned car market as it will result in higher tax liability for businesses involved in used vehicle sales.

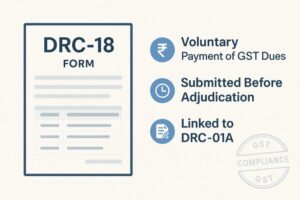

9. GST Waiver Scheme 2025

Businesses that have cleared all of their tax dues up to 31st March 2025 will have a chance to qualify for a GST waiver. This waiver is under the schemes SPL01 or SPL02.

The Indian government will grant them a waiver if they apply within three months of the new fiscal year. This initiative aims to provide relief to compliant taxpayers and motivate businesses to settle their dues on time.

10. Changes in GST Registration Process

The Government authorities have also applied changes to Rule 8 of the CGST Rules of 2017 in the latest amendments in GST. This change points out that applicants who are choosing Aadhaar authentication must complete biometric verification and photo capture at a GSK. Then they should also go through document verification for the Primary Authorised Signatory.

For the applicants without Aadhaar, this process remains the same. They also need to visit a GSK for verification. In case any delays happen in finishing these steps, it will stop the generation of the application reference number (ARN) and cause business registration delays.

Conclusion

The latest amendments in GST mark another step forward for the Indian economy. It creates a more transparent, efficient, and business-friendly tax system. These changes favour the practical needs and digital advancements of the country regarding its economy.

These latest amendments aim to improve revenue collection, encourage broader compliance across sectors, and make tax filing easier for people. So, it becomes the responsibility of every taxpayer to stay informed about these changes and adapt accordingly to ensure their smooth implementation.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By