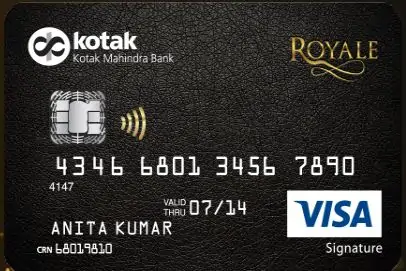

Kotak Royale Signature Credit Card: Features and Benefits

- 8 Jan 26

- 4 mins

Kotak Royale Signature Credit Card: Features and Benefits

Table of Contents

- Key Privileges of Kotak Royale Signature Credit Card

- Kotak Royale Signature Credit Card Rewards Redemption

- Other Benefits of the Kotak Royale Signature Credit Card

- Fees and Charges of the Kotak Royale Signature Credit Card

- Who Should Opt for the Kotak Royale Signature Credit Card?

- Terms and Conditions Associated with Kotak Royale Signature Credit Card

Key Takeaways:

- Get 4 reward points per ₹150 on travel, dining, hotels and international spends.

- Comes with an annual fee of ₹999, which can be waived off.

- Earn up to 30,000 bonus reward points on annual spends of ₹8 lakh.

If travel, dining, and lifestyle upgrades are a regular part of your spending, the Kotak Royale Signature Credit Card fits right in.

It rewards you every time you book flights, stay at hotels, dine out or plan a holiday. Read on to know all about what this credit card entails.

Key Privileges of Kotak Royale Signature Credit Card

Here are a few Kotak Royale Signature credit card benefits you need to know about:

- Get a milestone benefit of up to 30,000 bonus reward points on annual spends of ₹8 lakh or 10,000 reward points on annual spends of ₹4 lakh.

- Get accelerated 4 points for every ₹150 spent across categories such as restaurants, hotels, travel agencies and tour operators, airline and air carriers, international spends and package tour operators.

- Earn 2 reward points on every ₹150 spent across the other eligible base categories.

Kotak Royale Signature Credit Card Rewards Redemption

- The bonus points you earn are credited to your account at the end of the anniversary period, provided you are eligible.

- If your card is issued before 25th Feb, 2017, your milestone program will run from 1st Feb to 31st January every year.

- If your card is issued post-25th February 2017, the milestone program will run from the date of issuance till the next anniversary date.

- Effective from 1st June, 2025, any spends on Utility, Fuel, Wallet Load, Insurance, Online Skill-Based Gaming, Education, Rent and Government are not considered towards the calculation of milestone benefits.

Must reads

Other Benefits of the Kotak Royale Signature Credit Card

- Kotak Royale Signature credit card lounge access offer includes 2 complimentary domestic visits per quarter to select Dream Folks Lounge in India.

- Avail a 1% fuel surcharge waiver, which is applicable on transactions that range between ₹500 and ₹5,000. This allows you to get the maximum fuel surcharge waiver of up to ₹3,500 in an anniversary year.

- Get a railway surcharge waiver of 1.8% for transactions on the IRCTC platform and on Indian Railways Booking Counters. The maximum railway surcharge waiver which you can avail yearly is ₹500.

Fees and Charges of the Kotak Royale Signature Credit Card

| Charges | Amount |

| Joining Fees | ₹1,499 |

| Annual Fees | ₹999 |

| Interest Charges on Outstanding Balance | 3.75% (monthly) |

| ATM Cash Withdrawal Fees | 2.5% of the Advance Amount |

| Foreign Currency Markup Fee | 3.5% |

| Fee for Cash Payment at Bank | ₹100 |

Who Should Opt for the Kotak Royale Signature Credit Card?

- If you are someone who spends frequently on dining and shopping, the Kotak Royale Signature credit card is ideal for you.

- If you prefer redeeming reward points instead of cashback points, this credit can be a great option.

- People who are looking for a card that rewards accelerated travel spending should also get this credit card.

Must reads

Terms and Conditions Associated with Kotak Royale Signature Credit Card

- You can redeem your reward points across a wide variety of categories such as shopping, mobile recharge, movies (BookMyShow), e-vouchers and more.

- When redeemed as cashback, each reward point is worth ₹0.20.

- You require a minimum of ₹2,000 worth of reward points for a cash value redemption.

- For shopping and mobile recharges, each reward point is worth ₹0.25 on redemption.

Having trouble paying your due credit card bills on time? Get the Pice app for a seamless and hassle-free credit card bill payment process.

Footnote:

Depending on the Payment Due Date, the interest-free credit period of the Kotak Royale Signature credit card can range up to 51 days.

FAQs

Can I earn rewards on fuel spent with my Kotak Royale Signature credit card?

This credit card does not offer reward points on select categories, including rent, wallet load, online skill-based gaming spends and fuel.

What to do if I lose my Kotak Royale Signature credit card?

If your card is stolen or lost, you need to immediately report it to Kotak Mahindra Bank either via net banking or by mobile banking.

Are the annual fees of the Kotak Royale Signature credit card waivable?

Yes, the annual fees of the Kotak Royale Signature credit card are waivable. You can waive off your annual fees on yearly retail spends of ₹1 lakh.

What is the spending limit of the Kotak Royale Signature credit card?

You can set the spending limit of your add-on card as you desire. Track your add-on card spending separately for each of your add-on cards.

Read More About Credit Card

About the author

By

By