A Detailed Guide on Common Issues in GSTR 9 Filing

- 1 Sep 25

- 5 mins

A Detailed Guide on Common Issues in GSTR 9 Filing

Key Takeaways

- Businesses often face data compilation challenges in GSTR-9 filing due to high transaction volumes and ITC categorization.

- Reconciliation issues in GSTR-9 arise from mismatches between GSTR-1, GSTR-3B, books of accounts, and GSTR-2A/2B.

- Errors in earlier GST returns can impact accurate GSTR-9 reporting and ITC claims, leading to penalties.

- ITC reversal and RCM reconciliation problems are common hurdles in the GSTR-9 audit process for businesses.

- Timely filing with proper records and updated compliance practices ensures error-free GSTR-9 return filing.

Form GSTR-9 entails all tax returns during a financial year by a specific business. As a business, you might face certain issues in the GSTR-9 return filing process, which need to be addressed. Know about the common issues and the ways to resolve the same, to enjoy a hassle-free journey in the return filing process.

Common Issues in GSTR-9 Filing

Here are the common issues reported by the taxpayers during their GSTR-9 return filing:

Data Compilation Challenges

Several businesses that want to consolidate the entire year's data might face challenges pertaining to higher transaction volume. Categorising the transactions into exempt, taxable, nil-rated or zero-rated supplies requires extensive analysis. Further, determining eligible and ineligible ITCs for adjustment and reversal is time-consuming.

Reconciliation Problems

There might be discrepancies among GSTR-1, books of accounts and GSTR-3B for taxpayers. There can be erroneous data entry, mismatch in timing and other errors. Further discrepancies might occur between the claimed input tax credit and GSTR-2A/2B due to delays by vendors or missed data.

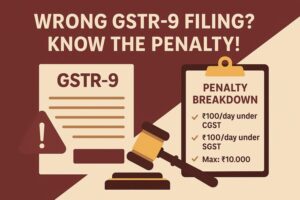

Errors in Last Tax Returns

As incorrect details in GSTR-1, GSTR-3B and GSTR-4 cannot be rectified while filing GSTR-9, the possibility of inaccurate reporting exists. If you are unable to report input tax credit accurately, you might face penalties levied on you or underreporting of ITC.

Input Tax Credit (ITC) Reversal

Challenges in ITC reversal might result due to non-payment to suppliers within the stipulated 180 days. Further, a lack of tracking vendor payments can be an additional issue in ITC reversal. Accurate reversal provision, reporting ITC reversal in GSTR-9 and precise computation of the amount of ITC reversal can be other issues.

ITC Reconciliation and RCM

Businesses often face challenges aligning tax fields under RCM (Reverse Charge Mechanism) with the ITC that has been claimed for specific supplies.

Input Tax Credit on Exempt and Blocked Supplies

Ensure you compute input tax credit on exempt supplies while you prevent incorrect computation on restricted supplies, as inaccuracy leads to compliance issues.

Time Constraints and Technical Challenges

Businesses often find it challenging to meet the annual due date of filing returns during peak seasons. In addition, technical issues on the GST portal can be another challenge for businesses in GSTR-9 filing. Regular non-compliance additionally leads to audit, investigation and adverse action.

Methods to Correct and Avert Errors or Mistakes

Here are the ways to rectify mistakes in GSTR-9 return filing:

● Ensure you keep records of all transactions, including payments, invoices and tax-related documents.

● You can use reliable GST and accounting software to automate calculations and improve accuracy in reports.

● If needed, you can consult Chartered Accountants or tax professionals for guidance.

● Ensure you are updated about the changes in GST rules and regulations. Knowing the updates that the Council issues helps you adhere to Indian tax laws.

● You can choose to prepare GSTR-9 prior to the last date to avoid penalties, and audit risk, and ensure timely filing.

Conclusion

There are certain common issues in the GSTR-9 return filing process pertaining to reconciliation, reporting reversal of ITC, timing and technical constraints. You need to avoid these issues to ensure the timely filing of GSTR-9 returns.

Late filing leads to additional penalties while timely filing ensures a smooth cash flow in the concerned business. Ensure you keep records of invoices, reconciliation statements, annual turnover and tax payments for timely annual return filing and GST compliance process.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By