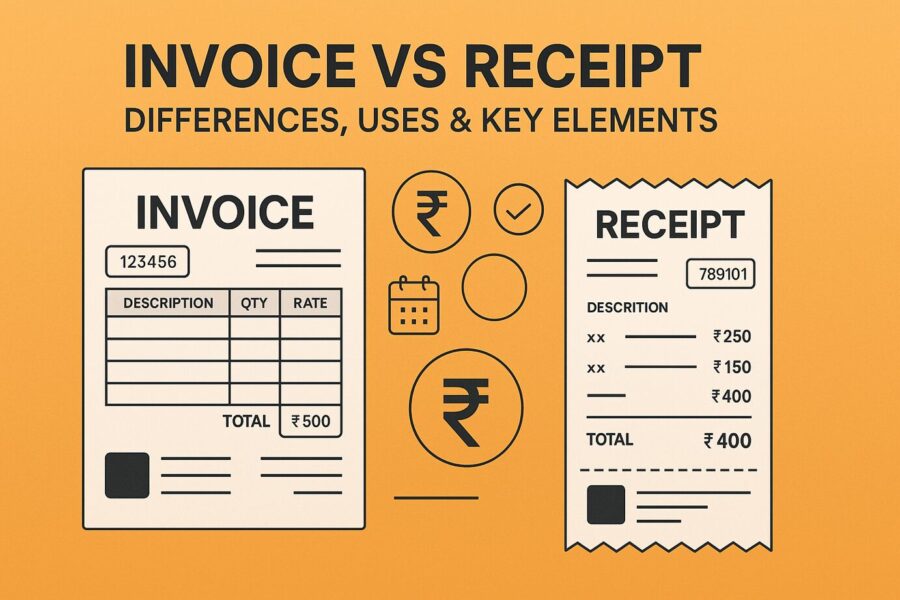

Invoice vs Receipt: Differences, Uses & Key Elements to be Included

- 3 Nov 25

- 7 mins

Invoice vs Receipt: Differences, Uses & Key Elements to be Included

Key Takeaways

- An invoice is a request for payment, while a receipt is a confirmation of payment received. Essentially, an invoice starts the transaction process, and a receipt completes it.

- A seller issues an invoice after delivering goods or services but before receiving payment. In contrast, a receipt is generated after payment to acknowledge that the transaction is settled.

- An invoice includes details like goods/services provided, due date, taxes, and payment terms. A receipt lists payment details such as method, amount paid, and transaction date — serving as proof of payment.

- Both documents are crucial for financial tracking. Invoices help manage accounts receivable, while receipts serve as proof for tax deductions and reimbursements.

- Understanding invoice vs receipt ensures proper financial documentation, reduces errors, and promotes transparency between buyers and sellers.

Are you getting mixed up between invoices and receipts? You are not alone, but this mix-up can disrupt your financial records and lead to inefficiencies. Within the business realm, it is important to have a grasp of the difference between the two documents to stay organised and efficient.

Invoices as well as receipts serve distinct purposes, understanding the differences appropriately can save you from headaches. Especially, with an accountant processing 4-5 invoices and receipts per hour, and an automated system handling 360 of them daily, they are surely crucial!

So, let us dive into the differences between invoice vs receipt and explore how the knowledge can help streamline your financial management measures.

Invoice vs Receipt: An Overview of the Key Differences

For starters, a seller issues the invoice document to make a formal request to the consumer for the payment of the goods/services extended. On the other hand, the receipt is handed over to confirm the completed payment.

Refer to the table below to get an idea about the key differences between invoices vs receipts:

| Parameter | Invoice | Receipt |

| Purpose Served | Requesting the payment for services or goods | Confirms that the owed amount has been received |

| Issued by | Seller | Seller or the service provider |

| Issued to | Buyer | Buyer |

| Details Mentioned | Information about goods or services, terms and conditions, and amount owed | Information regarding the payment terms, date of payment, and paid amount |

| Indicates | Costs owed | Costs settled |

| Who Sends/Receives the Funds | Buyer to the Seller (Funds are to be received by the seller) | Buyer to the Seller (Funds have been received already) |

Detailed Idea about Invoice vs Receipt

To provide context on the briefly mentioned differences above, this section shall go further into the meanings and other associated details about both types of documents.

1. Meaning

A buyer issues an invoice to the buyer. It is a formal document used for commercial purposes. The document lists relevant details regarding the goods/services extended, the costs, and various payment conditions. It acts as a payment request as well as a comprehensive transaction record.

A business may issue a receipt to establish a transaction's completion. It acts as the purchase proof. Further, it lists the items acquired, the cost covered, and the date of the business transaction. Receipts help in the maintenance of precise financial records. They also offer protection by serving as proof against return/dispute claims.

2. How They Are Used

Invoices are widely used by businesses to sell products/services on credit, and they may be personalised. The seller may issue an invoice for a singular sales process or even for recurring purchases.

The receipt acts as a proof of payment for the services/items purchased. A consumer may use their receipts to ask for refunds/replacement services for goods/services they are dissatisfied with.

3. Time of Generation

Invoices are generated after the delivery of goods or the completion of the service delivery that had been opted for. They are important for maintaining precision with financial tracking and having a reliable history of transactions.

Receipts, on the other hand, are generated after the payment is complete. They allow businesses and business owners/runners to demonstrate professionalism and transparency while aiming for 100% customer satisfaction.

4. Ways to Write

While formulating an invoice, it is incredibly important to include certain elements to ensure proper documentation of the business transaction and a prompt response to the payment request. Writing up an elaborate receipt also demands careful consideration and undivided attention.

Well-constructed invoices and receipts shall properly communicate the transaction-related information, acting as a reference document for the parties involved.

The key inclusions under both documents are mentioned in the tables below:

| Invoice Key Elements | Details |

| Header | Mention the term “Invoice” clearly Feature a unique invoice number/code of reference Write the date of the invoice (it shall be the issuance date) Mention the payment due date |

| Details of the Seller | Logo Company name Contact details Address of Business Tax identification number, if applicable |

| Details of the Buyer | Name of the customer name Contact information of the customer Billing address (given that it’s different from the documented shipping address) |

| Itemised List of the Goods/Services | A description of each and every item/service opted for Quantity/units Price of the Unit Total cost of each line item |

| Total Invoice Value | Subtotal of the items Taxes, if applicable (like GST or VAT) Discounts Adjustments (if applicable) Pending grand total |

| Payment Terms & Conditions | Mention the payment conditions Particularly mention the payment methods that are accepted |

| Payment-related Information | Bank information for e-transfers Contact details for any payment-related queries |

| Any Additional Details (This is optional) | Order number for the purchase, if applicable Shipping/delivery information Contact details for customer service Terms & conditions |

| Receipt Key Elements | Details |

| Header | Business name, logo, and contact information Receipt number or transaction ID Date of purchase |

| Details of the Buyer | Customer name (optional, but recommended for loyalty programs) |

| Itemised List of the Goods/Services | Easy-to-comprehend description of the products/services opted for Quantity of products purchased Cost of a unit Total cost of every item |

| Total Value | Subtotal of the items Fees and Taxes, if applicable Promotions/discounts if they have been applied Total sum |

| Payment-related Information | Payment method opted for Tendered amount Change provided, if applicable |

| Footer | Address of the business Return policy Warranty details, if applicable Contact information for the purpose of inquiries/returns |

💡Use the PICE App for all your payment needs and tracking business transactions.

5. How They Help

Invoices come in handy for tax purposes and accounting purposes.

Receipts, on the other hand, allow sellers to file their taxes and claim any tax deductions applicable to various business expenses. As the receipts are used as proof of payment, buyers are required to keep them close in case they feel the need to have any purchased item returned or replaced. They have to present the receipt to the vendor in such a case.

Conclusion

A seller or vendor initiates the delivery of items to their customers. After this, they must raise an invoice (a request for payment) to collect the associated amount. The customer shall proceed to pay the seller. Once this is done, the seller shall have to generate a receipt that acknowledges the settlement of the payment.

From the point of view of the customer, the invoice that they receive from the seller acts as a bill. After clearing the bill, they receive an acknowledgement in the form of a receipt. We hope this clears up your confusion regarding the topic of invoice vs receipt.

By

By