Struggling to Manage Invoices Efficiently? Pice has a Solution

- 5 Nov 24

- 10 mins

Struggling to Manage Invoices Efficiently? Pice has a Solution

Key Takeaways

- Pice provides a single platform to manage and track all invoices, eliminating the hassle of using multiple platforms.

- Make full or partial payments instantly with various payment modes like bank transfer, credit card, or UPI.

- Share consolidated, detailed statements with your CA or accountant in one click, saving time and reducing errors.

- Easily import GST invoices from the GST Portal directly into the Pice app for quick access and tracking.

- Monitor payment statuses in real time and avoid late fees by automating due date alerts and updates.

Tired of handling B2B invoices through different platforms and losing track of the invoice payment while sharing the invoice payment records with your CA/Accountant? If so, then you're not alone. Unfortunately, most companies encounter these issues when dealing with invoices.

In the fast-paced business world, we’re sure that you are also facing a fair share of hurdles when it comes to managing your supplier invoice payments, such as

- Multiple Platforms for Invoice Management: When invoices are managed across multiple platforms, it becomes difficult to track and manage the flow of financial transactions as some data get lost along the way.

- Manual Payment Methods: A lot of organizations still use methods such as checks or bank transfers that are manual, and this leads to many invoice payments delay or being paid after the due dates.

- Spreadsheet-Based Tracking: Payments are usually recorded in spreadsheets, which are manual, not easily updated in real time, and can be a nightmare when dealing with many invoices.

- Lack of Payment Automation: With manual payment processing, companies are bound to miss payment deadlines and, in the process, pay for late fees, which affects vendor relations and credit rating.

- Difficulty Sharing Records with Accountants: Using invoice and payment records for reporting to accountants or CAs becomes a problem when working with different formats and missing information, which leads to the creation of additional, time-consuming, and error-prone reports.

These challenges may be quite difficult, especially when dealing with a significant volume of invoice payments.

But what if there was a better way to handle it all from a single platform?

Imagine having a system where you could:

- Pay to suppliers through any payment mode means (bank transfer, credit card, online wallets, etc.).

- Pay multiple invoices at once, rather than making individual invoice payment.

- Process partial payments or full payments in a few clicks.

- Seamlessly track all transactions and records in one place, experience no more hassle while sharing invoice data with your CA in the future.

- View supplier-generated invoices registered against your company and many others with ease.

Introducing Invoice Manager & Payment by Pice

With Pice integrated invoice payments, all of these features are within your reach. You no longer have to manage between multiple applications or worry about missed payments. This system enables you to make payments for several invoices at once, choose the payment method that you want, and make full or partial payments towards those selected invoices.

Moreover, since records are available in a consolidated manner, it is easy to share information with your accountant anytime, anywhere, without spending much time.

The 4 key Benefits of Pice Invoice Manager & Invoice Payment

1. Auto-Import Purchase Invoices

Easily import all of your GST invoices from the GST Portal into the Pice app, and save time and effort, of entering manually every time.

2. View And Manage Invoices

After the invoices have been imported, you will be able to view all the invoices in one place. Making an easier job for you to track the outstanding, paid, and overdue bills so that you do not miss any payment.

3. Make Invoice Payments

You can choose one or multiple invoices to make payments either partially or fully, depending on your preference. This flexibility helps streamline the payment process, reducing manual work and errors.

Once payment is completed, the user may specify the payment method utilized, such as UPI, bank transfer, credit card, Pice, or any other way, right in the app. This allows you to trace how each invoice was paid in detail.

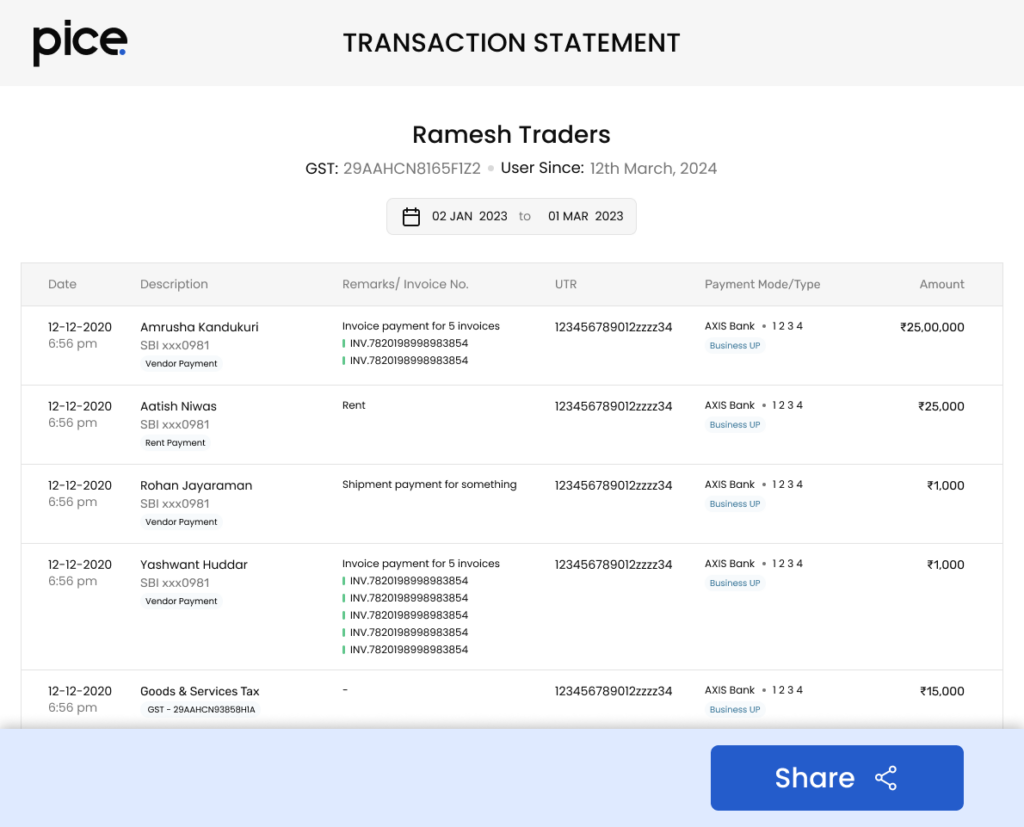

4. One - Click Statement Sharing

Get access to the consolidated records of the invoice payment available in any format, which can be shared with your accountant in just one click.

How to Get Started with Invoice Payments?

Paying your invoices is now easier and more convenient with the help of the Pice app’s invoice payment features. Here’s a quick guide to help you get started

Step 1: Open the Pice app.

Firstly, open the Pice app on your device. Navigate to the Payments section and click invoices.

Step 2: Access the Invoice Payment Page

When you click on Invoices, it will redirect you to the Invoice Payment Introduction page, giving you an overview of features for managing your invoices payments.

Step 3: Securely Sync Invoices

To import your invoices, select Import Invoices. You will be asked to provide your GST Portal username and password. After you submit your credentials, an OTP will be issued to your registered phone number. Enter the OTP to proceed further.

Step 4: Automatic Invoice Import and Supplier Data Collection

Once validated, the app will start integrating your GST invoices and getting supplier information from the GST website. This process might take a few minutes. Once completed, your invoices will display in the Pice app and be accessible for viewing. To automatically import the invoice follow the below steps.

- Enter GST portal login credentials: Securely log in to the GST portal using your registered credentials.

- Authenticate with OTP: Complete authentication by receiving and entering an OTP for added security.

- See all invoices from all suppliers in one place: Access all raised invoices as per supplier-wise in the same place.

Auto import is only valid for 30 days and will expire soon. To get the invoices again, use the GST portal username and password again.

Note: If you see an error when retrieving supplier data, don't worry! Just click Contact Support, and the team will assist you in resolving the issue.

View & Manage Invoices

Access and manage all your invoices effortlessly in one place. Simply follow the below steps.

- Click on any invoice to see full invoice details: Select any invoice to view its full details, including key information like the supplier's name, GST number, phone number, state, and a complete cost breakdown of the invoice.

- View supplier-wise categorized Invoices: Effortlessly access all imported invoices, neatly organized by supplier in one screen. Simply click on a supplier’s name to view all invoices they have issued. The paid invoices are labelled as ‘paid’ making it easy to track and manage your unpaid invoices.

- View All Imported Suppliers: With just one click, access a comprehensive list of all your suppliers in one place. This will help you stay organized and ensure timely payments to all your suppliers.

- Add Supplier Bank Details for Payment: Quickly add your supplier's bank account details to streamline future payments. This will save them as a beneficiary, making it easier for you to make payments without re-entering their details every time.

Make Invoice Payment

Effortlessly manage your invoice payments with Pice.

- Select One or Multiple Invoices: Choose one or several invoices from a particular supplier for payment at once.

- Choose Your Payment Mode: Select the payment method that suits you best and complete the transaction.

- Earn Cashback on Every Payment: Enjoy higher cashback rewards on each invoice payment you make.

- Automatic Payment Status Update: Once payment is successful, the invoice is instantly marked as paid.

- Manual Payment Option: If you paid outside Pice, manually mark the invoice as paid to keep records accurate.

- Access Payment Receipts: View detailed payment receipts alongside corresponding invoice information for easy tracking.

One-Click Statement Sharing

Instantly download or share detailed statements for smooth financial tracking and reporting.

- View All or Supplier-wise Payments: Quickly access a complete list of all your invoice payments or filter them by supplier.

- Download Statements in One Click: Easily download your payment statements in PDF or CSV format with just one click.

- Share with your CA or accountant: Effortlessly share your payment statements directly with your CA or accountant for hassle-free bookkeeping.

In conclusion, managing invoices doesn’t have to be a stressful, multi-platform ordeal. With a Pice centralized invoice payment solution, you can streamline your invoice management process, make payments effortlessly to your suppliers, and keep your records well-organized—saving both time and effort in the long run.

Still having trouble managing invoice payments? Then why not make the switch to Pice and simplify your invoice payment workflow today.

By

By