Ineligible ITC: Situations Where Input Tax Credit Under GST Is Not Permitted

- 31 Aug 24

- 8 mins

Ineligible ITC: Situations Where Input Tax Credit Under GST Is Not Permitted

Key Takeaways

- Input Tax Credit (ITC) helps reduce tax liability by offsetting GST paid on business inputs against GST collected on outputs.

- ITC is not available for certain business expenses like vehicles for personal use, food, catering, beauty treatments, and construction services.

- ITC cannot be claimed for personal consumption, gifts, free samples, or goods lost, stolen, or damaged.

- Non-resident taxable persons and those under the composition scheme are ineligible for ITC claims on most transactions.

- Fraudulent ITC claims can lead to significant penalties, emphasizing the importance of accurate compliance with GST rules.

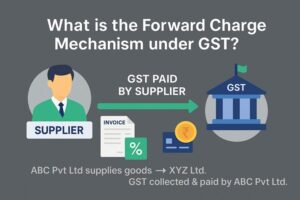

While breaking down the various components of Goods and Services Tax (GST), you eventually come across Input Tax Credit (ITC). It is a feature allowing a registered person to nullify their GST liabilities on the supply of goods or services that are utilised to meet purposes of business.

As an example, let's say you had paid ₹15,000 in input tax for specific raw material purchases. Next, you had gathered ₹32,000 as output tax on selling the end products. In this case, as per the GST rules, your net tax payable amount will be ₹17,000 (output tax charged minus Input Tax Credit).

ITC greatly assists in reducing the tax burden for manufacturers and suppliers by eliminating double taxation. However, you must be aware of ineligible Input Tax Credit under GST to make valid return claims. These are some specific input taxation credits blocked by the Indian Government.

In Which Case Input Tax Credit Is Not Available?

According to Section 17(5) of the GST Act, certain purposes of business are to be held as ineligible input tax credit under GST. Such items include:

Vehicles for Transportation

ITC is not allowed for transportation vehicles that have a seating capacity of 13 or less (including the driver). Moreover, the GST law excludes vessels & aircraft from claiming ITC.

In this case, let’s say you bought a car for your business purposes. Here, the conveyance costs involved won’t be eligible for valid ITC claims.

Some exceptions to ITC on vehicle renting cover:

- Motor vehicle, aircraft, or vessel-related expenses that are utilised to supply additional vehicles, aircraft or vessels

- Training costs involved to teach someone on how they can drive a vehicle, vessels & aircraft

- Transportation of passengers using vehicles with a seating capacity of more than 13

In addition to renting and purchasing, Input Tax Credit is not available for leasing a particular vehicle. On the other hand, when cab rental services are used to fulfil an outward taxable supply, the expenses are not held eligible for ITC.

💡 If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

Food, Catering and Others

When the supply of services or goods falls under the following heads, a claim reversal is not possible:

- Food & beverages

- Outdoor catering

Suppose XYZ Ltd. has arranged catering for its annual function. In this case, the event will not be considered ‘obligatory’ and the ITC will remain blocked. However, if the employer mandatorily provides the above-mentioned supplies within the working time frame, then ITC remains valid.

Input Tax Credit is further not applicable to the supply of the goods and services outlined below:

- Beauty treatment

- Health services

- Cosmetic and plastic surgery

However, a registered person can claim ITC if the category of inward and outward supplies matches, or if the component is part of a mixed or composite supply.

Building Construction

ITC is not meant to be available for any sort of work contract services. Therefore, you cannot avail ITC whenever it is associated with the construction of immovable properties. However, there is an exception where ITC can be claimed if input services are used further for the purpose of a work contract.

Imagine, XYZ Contractors builds a business unit to utilise it as their headquarters. In this case, ITC won’t be available. Contrarily, if Y Construction company hires XYZ Contractors to complete a certain portion of a works contract then the company can claim ITC against the GST levied by XYZ Contractors.

Selling of Membership Subscriptions in Fitness Centres, Clubs, etc.

No ITC is claimable on the sale of membership in a health fitness centre or club.

Let’s say, you, as a Managing Director of ABC company, have joined a gym and the company wishes to pay the membership fee. In this case, ITC will not be available to the company.

Insurance, Servicing, Repairing and Maintenance of Motor Vehicles

Wherever general or car insurance is involved apart from servicing or maintenance costs of vehicles, vessels or aircraft, the ITC will be ineligible. Similarly, if a company decides to offer cab or travel benefits for employees then such an expense is also not covered for ITC consideration.

Nevertheless, ITC is available for the following business expenses:

- Services that are obligatory towards each employee working for a company. For instance, let's say the government mandates a complimentary cab service for all female workers working night shifts for a company. In that case, ITC on travel concession will be available for those companies on the GST amount paid to the rent-a-cab company.

- General or health insurance bought individually by a registered taxpayer.

- A taxable individual producing vessels, aircraft or motor vehicles.

Non-resident Indians

A non-resident taxable person is ineligible to avail ITC on goods or services inherited by them. Only supplies that are being imported by an NRI are considered eligible for ITC claims.

Composition Scheme

Goods or services on which tax has already been paid under the composite supply are considered under blocked input tax credit.

Personal Consumption

If a supply of goods/services is intended to meet personal purposes, no ITC will be available on such transactions. Only selected purposes of business qualify for valid ITC claims. It is essential to assimilate this aspect to avoid unnecessary friction in legal disputes. Furthermore, disregarding norms and incorrectly asserting blocked credits can result in major fines and, in certain situations, even litigation.

Free Sample and Lost Goods

No ITC is available for lost, stolen, vandalised or written-off supplies. Additionally, gifts to employees and free samples do not qualify for ITC claims.

Fraudulent ITC Claims

Finally, you cannot claim ITC on any tax furnished due to fraud cases. However, these cases either result in:

- Short or non-tax payment

- ITC utilised

- Excessive refund

Fraudulent instances arise from willful misstatements/seizure of supplies/suppression of invoice details.

The Bottom Line

Although Section 16 of the CGST Act allows registered persons to claim ITC for supplies used in business, it is essential to learn the subject of ineligible input tax credit under GST to avoid discrepancies. A concerned taxpayer must also be aware of the due date for filing monthly returns and annual returns for a tax period.

FAQs

What is an ineligible input tax credit?

Which transaction is not eligible for input tax credit?

What are the restrictions for input tax credit under GST?

In which of the following cases input tax credit is not allowed?

Motor vehicles with seating capacity of 13 or fewer used for personal or business purposes.

Food and beverages, outdoor catering, and beauty treatments not mandated by law.

Construction services unless used in furtherance of another work contract.

Memberships to clubs, health centers, and fitness centers.

Personal consumption or goods given as gifts or free samples.

By

By