A Guide to Top Indian Overseas Bank Lifetime Free Credit Cards

- 1 Dec 25

- 5 mins

A Guide to Top Indian Overseas Bank Lifetime Free Credit Cards

- Types of Indian Overseas Bank Lifetime Free Credit Card

- What Are the Benefits of Indian Overseas Bank Lifetime Free Credit Cards?

- Who Is Eligible to Apply for an Indian Overseas Bank Lifetime Credit Card?

- How to Make a Monthly Payment of the Indian Overseas Bank Lifetime Free Credit Cards Bill?

- Conclusion

Key Takeaways

- Indian Overseas Bank lifetime free credit cards charge no joining or annual fees, making them cost-effective for long-term use.

- These cards offer global acceptance, flexible spending limits and interest-free periods of 20–50 days.

- Users earn 0.20 reward points per ₹100 spent, automatically adjusted against monthly outstanding balances.

- Eligibility depends on income, credit score (700+), employment stability and valid PAN details.

- Payments for Indian Overseas Bank lifetime free credit cards can be made easily via UPI, NEFT, net banking or branch deposits.

Indian Overseas Bank lifetime free credit cards offer the perfect blend of convenience, security and savings. With no annual or joining fees, these cards are ideal for anyone seeking long-term financial flexibility. Enjoy global acceptance, easy online management and exciting rewards without worrying about any renewal charges.

Types of Indian Overseas Bank Lifetime Free Credit Card

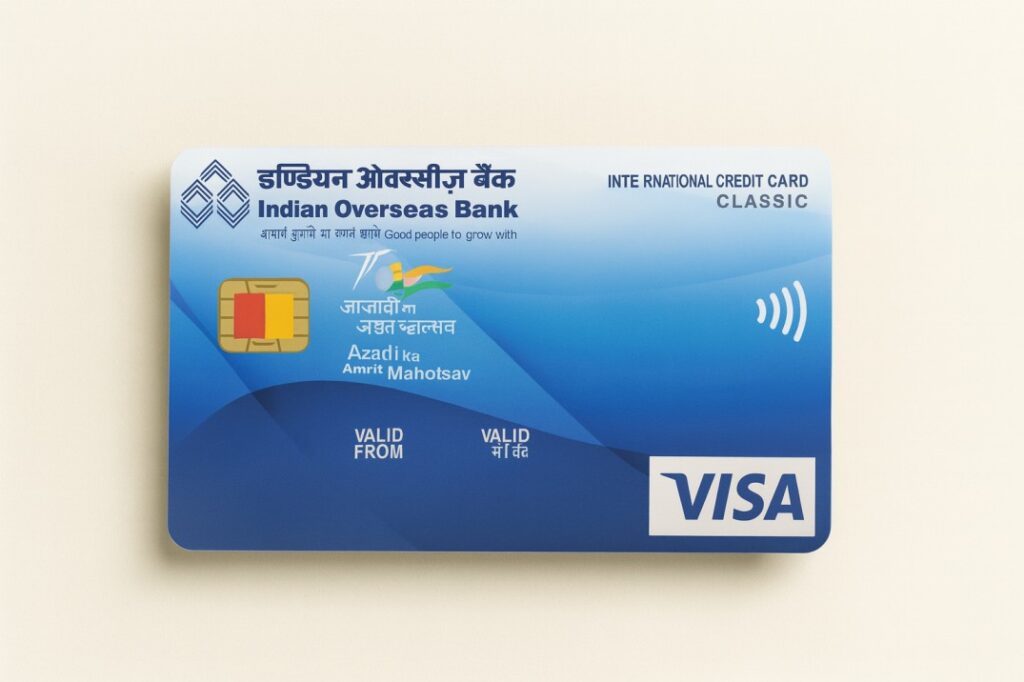

- IOB Visa Classic

The IOB Visa Classic is an entry-level Visa card from Indian Overseas Bank offering worldwide acceptance, rewards on retail and online spends, SMS alerts and optional add-on cards.

It provides credit and ATM cash withdrawal limits with flexible payment options and net-banking bill pay for convenient management and secure payments.

- IOB Visa Gold

IOB Visa Gold is a mid-tier Visa card that upgrades limits and benefits compared with a classic higher credit card. It offers a richer rewards program, add-on cards and insurance covers such as personal accident or baggage (where applicable).

What Are the Benefits of Indian Overseas Bank Lifetime Free Credit Cards?

Here is a list of the Indian overseas bank lifetime free credit cards benefits:

- The credit limit is from ₹10,000 to ₹50,000.

- This credit card has a daily transaction limit of 100% of the available balance or card limit on E-Com and POS transactions.

- The daily cash withdrawal limit is 40% of the total available balance or credit card limit (whichever is less).

- An interest-free purchase is available on this credit card for 20-50 days. It depends on the date of purchase.

- You get an IOB credit card rewards cashback of 0.20 points for every ₹100 that is spent. It is adjusted towards the outstanding balance (monthly) during the time of bill generation.

- These credit cards have a lower rate of interest at 30% per annum.

Note: The list of benefits is subject to change at any point in time at the sole discretion of Indian Overseas Bank. Make sure to visit the official site for updated information.

Who Is Eligible to Apply for an Indian Overseas Bank Lifetime Credit Card?

Here are a few set criteria for Indian Overseas Bank credit card eligibility:

For Individuals:

- In order to issue IOB credit cards, the credit bureau and net monthly income are the main criteria.

- The bank will verify the employment stability and credit history of applicants. They may also do a field investigation when necessary for understanding an applicant's existing debt obligation.

- Providing PAN (Permanent Account Number), email ID and mobile number of the applicant are mandatory.

- Applicants need to have a minimum credit score of 700 or above to avail an unsecured credit card.

- Applicants need to have a minimum gross income of ₹15,000 per month for salaried people and a minimum gross income of ₹300,000 for self-employed applicants to apply for credit cards at Indian Overseas Bank.

For NRIs:

- The applicant must hold an Indian passport and provide a written undertaking to the bank, confirming that if they ever lose Indian passport status, they will immediately surrender the card.

- Providing a valid PAN number is mandatory.

- Applicants must provide both their overseas address and a local address in India.

- For NRI cardholders, the cash withdrawal limit is set at 40% of the total card limit. If the withdrawal is made in a currency other than INR, it will be equivalent to 40% of the card limit in that currency.

- The applicant must also maintain an NRE or NRO account with the bank. All credit card dues and charges will be settled by debiting this NRE or NRO account.

How to Make a Monthly Payment of the Indian Overseas Bank Lifetime Free Credit Cards Bill?

- By Visiting a Bank Branch

Cardholders can make their due bill payments by depositing cash at any of the bank branches of Indian Overseas Bank.

- Through the UPI App

Customers can make due payments through UPI apps like Gpay, BHIM, PhonePe, CRED and so on.

- Internet Banking

Customers also have the option to register the credit card by visiting the official site of Indian Overseas Bank. The steps to follow once on the site are: IOB Cards > IOB Credit Cards > Register Card.

After which, payment can be done by visiting IOB Cards > IOB Credit Card > Make Payment.

- By Doing an NEFT

Customers also have the option to make payments with credit cards from other bank accounts through NEFT by entering their 'card number' and 'account type' information.

💡Pay your credit card bills in an easy and secure way with the PICE App.

Conclusion

Indian Overseas Bank lifetime free credit cards combine affordability with accessibility, making them a smart choice for daily transactions. Whether you are a first-time cardholder or a regular spender, Indian Overseas Bank ensures financial freedom through rewarding benefits, secure payments and zero annual maintenance costs.

By

By