How to Stop Unauthorized Credit Card Charges?

- 31 Oct 25

- 9 mins

How to Stop Unauthorized Credit Card Charges?

Key Takeaways

- About 43% of Indian households have reportedly fallen victim to credit card fraud and it is a problem that needs to be addressed.

- Several types of frauds like phishing, keylogging, hacking, and dumpster diving are performed on unsuspecting credit card users.

- One of the primary ways from stopping unauthorized credit card charges is to protect your personal information and not share sensitive details like Aadhar number or card details.

- Using strong passwords that are also protected securely, as well as tracking credit card transactions help in identifying unauthorized charges.

- In case you find fraudulent charges in your credit card, then you can submit the details and request for a bank chargeback.

In recent years, credit card fraud has become an increasingly alarming issue. About 43% of Indian households have reportedly experienced credit card fraud in the last 3 years. The issue is quite popular, with 7 out of 10 credit card holders reporting having encountered fraudulent transactions or incorrect charges.

So, the real question is how to stop unauthorized credit card charges? Continue reading this blog to learn more about this.

Ways to Stop Unauthorized Credit Card Charges

According to Forbes Advisor, India is facing an increase in credit card fraud, with 12,069 cases reportedly in FY 2023-24, leaving credit card holders wondering how to stop unauthorized credit card charges. Here are some useful ways to stop fraudulent or unauthorized credit card charges:

- Protect Personal Information

One of the most common reasons for facing unauthorized credit card charges is sharing personal information through unknown phone calls or links. Such information includes sharing Aadhaar number, PAN number, bank account details or card details.

Scammers use this information to generate the authorised transaction from your credit card. Therefore, protect personal information and do not share it if you receive an unknown call or a suspicious link through a message or email.

Useful Tip: Avoid using public Wi-Fis for financial transactions, as it can lead to sharing personal information unwantedly.

- Double-Check All Credit Card Transactions

You should monitor all credit card transactions at periodic intervals to keep track of the payments you have authorised. Always verify the website’s authority and legitimacy by checking if a similar site exists with a different domain name. A general rule of thumb, in case you are wondering how to stop unauthorized credit card charges, is to check if the website has ‘https://’ in its address bar.

Useful Tip: Avoid phishing threats through email links posing as a legitimate bank with official logos.

- Use Unique and Strong Passwords

A fundamental and easy way to stop authorised credit card charges is to create unique and strong passwords. This includes setting your password with at least one capital letter, a special character and a combination of numbers. Therefore, set your password using this combination rather than setting a predictable password using your name and birthday.

Useful Tip: Try to memorise the password instead of noting it down on a piece of paper.

- Set a Personal Payment Limit

You can easily log in to your account with the bank or financial institution and set a personal payment limit for your credit card. This way, next time you make a transaction, you will stay within the transaction limit. Any payment beyond this limit that you did not make will be immediately notified.

Useful Tip: Set the minimum limit of the credit card for better safety against credit card fraud.

- Keep the Physical Card Safe

India has faced credit card fraud amounting to ₹630 crores in FY 2023-24. This has left many wondering how to stop unauthorized credit card charges. So, one of the easiest ways is to keep the physical card safe.

Always keep your credit card in a safe place, like a small wallet and beware of snatchers or pickpockets. Put away your card immediately after the purchase because fraudsters can make a digital imprint of your card.

Useful Tip: Always check if the welcome kit for your credit card is in new condition and does not have signs of tampering.

- Invest in RFID-Blocking Wallets

Nowadays, almost all credit cards come with an inbuilt RFID (Radio Frequency Identification) chip, which the merchant scans for contactless payment. The card does not need to be swiped. However, fraudsters can scan this RFID chip simply by standing next to you in a cash counter queue.

Investing in an RFID-blocking wallet will protect you from unknown credit card chip scanning. These wallets use carbon fibre and aluminium material to block electromagnetic signals, which scanners use to scan chips and make payments.

Useful Tip: Look for passive shielding RFID wallets, which are more affordable than active wallets and will not compromise on providing security.

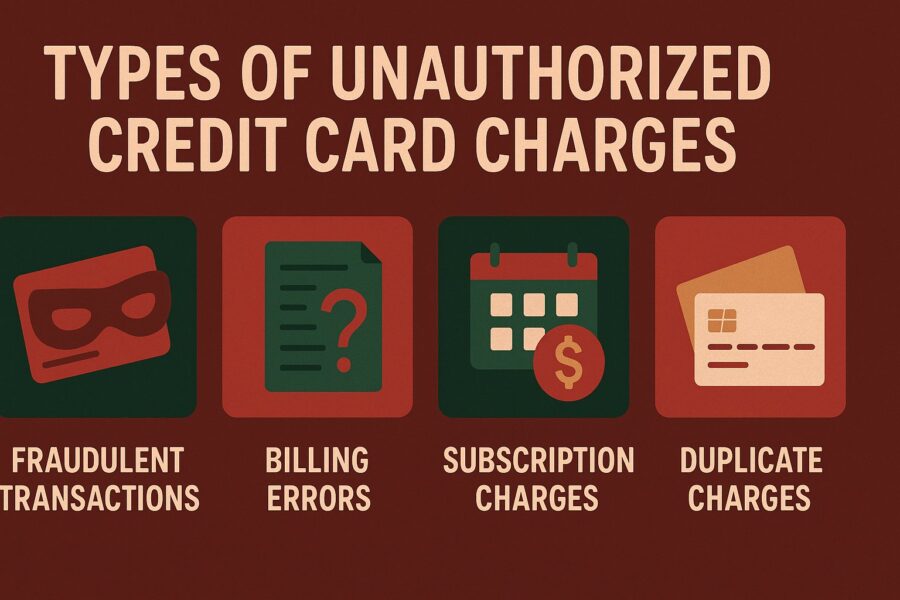

Types of Unauthorized Credit Card Charges

The credit card industry in India is growing rapidly with a CAGR of 20% over the past 5 years. Furthermore, the Reserve Bank of India has predicted that in 2025, the credit card accepting touchpoints will reach 250 lakh. However, this is fuelling the number of unauthorized credit card charges, which are categorised as follows:

- Phishing

Fraudsters pose as legitimate banks or credit card providers, asking you to provide credit card information or personal information. Generally, such calls create a sense of urgency, scaring you into sharing personal and credit card information.

- Dumpster Diving

Before you wonder how to stop unauthorized credit card charges, you need to know about dumpster diving. This fraud occurs when you discard pre-approved credit card offers, receipts or discarded billing statements containing sensitive information. Such information is used to open fake accounts or make unauthorized payments.

- Keylogging

This is also known as keystroke capturing, where malware in your device captures what you type to record sensitive information. Then, criminals use such information to conduct credit card fraud.

- Hacking

One of the most common ways to conduct credit card fraud is hacking into the databases of a credit card provider. Such databases contain sensitive customer information, which criminals use for unauthorized transactions.

- Skimming

Fraudsters can conduct skimming using a small device to scan the credit card details. Criminals can easily install it in sales counters or ATM counters to steal sensitive information and use it for unauthorized transactions.

- Card Not Present (CNP) Fraud

A credit card scammer uses stolen card information to make purchases remotely. Such scams are difficult to detect, making it essential to know how to stop unauthorized credit card charge.

- SIM Swap

A credit card fraudster convinces your SIM provider to swap your phone number to another SIM card. The fraudster controls this SIM. Then all your personal information, like OTPs and passwords, is shared with the scammers. This enables them to control all your transactions, leading to unauthorized credit card charges.

Role of Credit Card Companies in Disputes of Unauthorized Credit Card Charges

One of the most crucial roles of banks and NBFCs in disputes of unauthorized credit card charges is providing a bank chargeback. In case you are wondering how to stop unauthorized credit card charges, here are the steps to issue a bank chargeback:

- Submit Transaction Details

You need to provide all transaction details if you suspect a fraudulent transaction. These include purchase receipts and all communication made with the seller to submit your chargeback request.

- Provide the Chargeback Request

The card issuer sends the chargeback request information to the seller. However, if the merchant denies the transaction, then they need to provide evidence for doing so. The team reviews evidence from both sides to either deny or process the chargeback request.

- Wait for Completing the Processing

If the seller accepts the chargeback request, the processing begins. However, the card issuer may go into further enquiry or may require additional documents for generating the chargeback. You will get the refund within 1 to 2 days, which will reflect in your account within 7 to 14 days.

💡Track your credit card spends and pay your bills with the PICE App

Conclusion

Knowing simple ways of how to stop unauthorized credit card charges will help you avoid significant financial fraud. This is because protecting sensitive customer information should be given the foremost priority while selling credit cards.

Stay aware while using a credit card for financial transactions and steer clear of any suspicious phone calls or messages. Therefore, financial institutions and banks must implement a multi-layer security strategy for their customers for a better experience.

By

By