How to file GSTR 4A Using Offline Utility: A Complete Guide

- 15 Sep 25

- 5 mins

How to file GSTR 4A Using Offline Utility: A Complete Guide

Key Takeaways

- GSTR-4A is an auto-drafted, view-only GST return that reflects invoice details uploaded by suppliers for composition dealers.

- Taxpayers cannot edit or file GSTR-4A, as it is generated automatically from GSTR-1, GSTR-5, and GSTR-7 returns filed by suppliers.

- The GSTR-4A JSON file can be downloaded from the GST portal and viewed using the GSTR-4 offline tool in Excel for reconciliation.

- Viewing GSTR-4A offline helps overcome online issues like slow loading, format switching delays, and limited analysis options.

- Composition dealers must use GSTR-4A as a reference document to track inward supplies and maintain GST compliance in India.

GSTR-4A is an auto-drafted document generated on the GST portal that contains details of the supplies for composition dealers. It includes details of inward supplies and outward supplies. Since it is automatically prepared based on data submitted by suppliers, you cannot make any changes to this document.

There is no need to worry about how to file GSTR-4A using the offline utility, as it is a view-only document meant solely for reference.

Learn how to file GSTR 4A using offline utility here to experience a seamless journey.

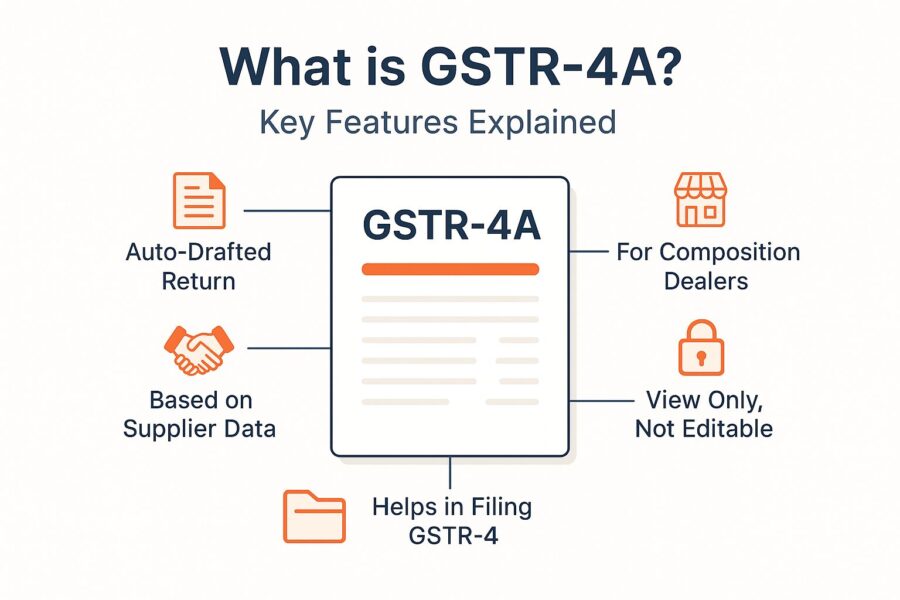

What is GSTR-4A?

Form GSTR-4A is an auto-generated statement that reflects details submitted by suppliers in Forms GSTR-1, GSTR-5, and GSTR-7, where a dealer is the recipient under the composition scheme.

This form serves as a read-only summary, showing all invoices received from different suppliers during a specific tax period. Composition dealers cannot edit or take any action in GSTR-4A. It is purely for reference.

How to View GSTR-4A?

Here is the process to view GSTR-4A for a return filing period:

Step 1: Log in to the unified GST portal.

Step 2: Go to the ‘Returns Dashboard’.

Step 3: Choose the applicable financial year and month for filing taxes.

Step 4: Select the ‘View’ option on GSTR-4A.

Problems in Viewing GSTR-4A Online

Here are the issues that you might encounter in viewing GSTR-4A online:

● You require an internet connection to access JSON files.

● It requires at least 2-5 seconds to view every single bill and 10-20 seconds to change from one format to another.

● You cannot directly analyse bills by viewing them on the website. As a result, you need to convert them into Excel and reconcile data.

What Is a JSON Format?

The full form of JSON is JavaScript Object Notation. It is a standard data interchange file format that utilises text readable by humans. A JSON file further transmits data objects, including array data types and attributable-value pairs. It is a replacement for XML format.

This file occupies less space to store data and transmit it through simpler means. As humans might take adequate time to analyse and interpret data, GSTN uses JSON files in Excel sheets to transmit and read data.

How to View the GSTR-4A JSON File in Excel?

Here are the steps to view JSON data till the financial year 2017-18:

Step 1: Navigate to the official GST portal, ‘Downloads’ and click ‘GSTR-4 Offline Tool (Quarterly Filing).

Step 2: Download the GSTR-4 offline tool and extract the zip folder.

Step 3: Open the Excel worksheet in the folder.

Step 4: Fill in GSTN, financial year and the necessary quarter, which is the tax period.

Step 5: Open the downloaded GSTR-4 offline tool JSON file and the previously downloaded GSTR-4A JSON file.

Step 6: You will receive a pop-up message on Excel stating ‘Downloaded GSTR-4 File Successfully Opened’.

Step 7: Navigate to the necessary sheets, such as 4-A&B (B2B), to view bills and JSON data.

Here are the steps to view JSON files after the financial year 2018-19:

Step 1: Download the GSTR-4A JSON file for the necessary quarter and extract the zip folder.

Step 2: You will find the JSON file in the extracted folder.

Step 3: Use Notepad to open the JSON file.

Step 4: Change the year and open the file to read.

Step 5: Ensure you save the file.

Step 6: Follow the steps mentioned for the JSON file with records of 2017-18 to view the purchase bills in Excel.

Conclusion

Composition taxpayers do not need to worry about how to file GSTR-4A using the offline utility since it is an auto-generated, view-only document. It simply provides purchase invoice details uploaded by suppliers. For easy reference and better business tracking, you can extract the JSON file to view all invoice information.

💡If you want to streamline your payment and make GST payments via credit, debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By