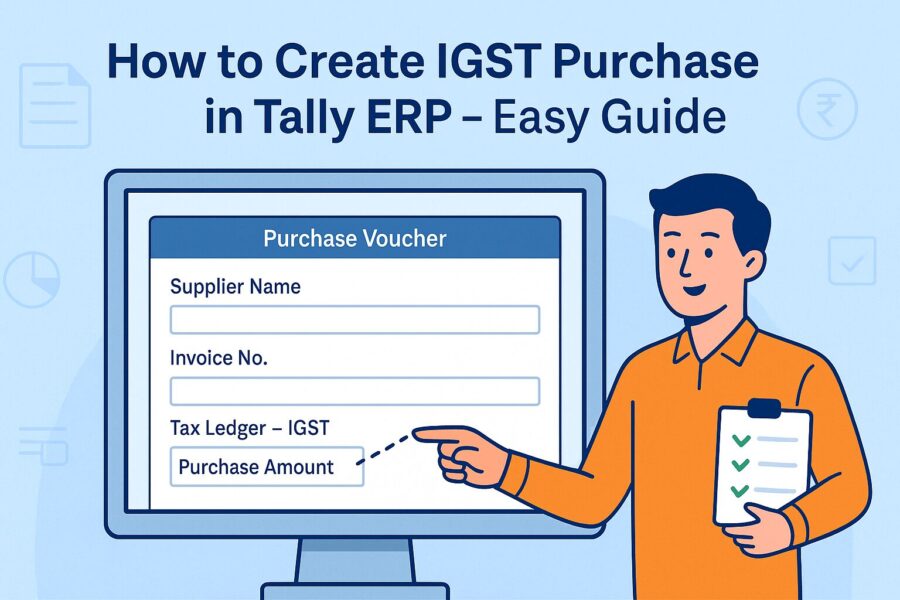

Easy Guide on how to Create IGST Purchase in Tally ERP

- 22 Jul 25

- 9 mins

Easy Guide on how to Create IGST Purchase in Tally ERP

Key Takeaways

- Correctly recording IGST purchases in Tally ensures error-free GST compliance and smooth return filing.

- Local purchases attract CGST and SGST, while interstate transactions must be recorded with IGST in Tally ERP.

- Use Item Invoice mode for goods and Accounting Invoice mode for services, with proper GST-configured ledgers.

- Tally’s GST Portal View helps users preview invoices in the same format as seen on the GST portal.

- Always verify Place of Supply, GST rates, and ledger applicability to prevent mismatches during GST reconciliation.

This blog explains how to create IGST purchase in Tally ERP for local and interstate transactions in the easiest way possible.

Purchase of Goods and Services with GST

Purchases in GST are of 2 tax types: Local and Interstate.

● Local purchases are taxed with CGST and SGST.

● Interstate purchase invoices are taxed with IGST.

In Tally ERP, it is essential to choose the right GST type while you record purchases.

How to Enable GST?

Enable GST in Tally by going to:

- Gateway of Tally > Press F11 (Features).

- Select Statutory & Taxation on the Company Features Menu.

- Set Enable Goods and Services Tax (GST) to Yes.

- Enable Set/Alter GST details to Yes.

- Enter GST details in the Company GST Details screen.

How to Record Local Purchase of Goods and Services?

Follow these steps to record local taxable purchases for goods and services easily.

In the Case of Local Purchase of Goods

Here is a step-by-step guide you need to follow in order to record local purchases of goods in Tally:

- Open the Purchase Voucher in Item Invoice Mode

- Navigate to Gateway of Tally > Vouchers > F9 (Purchase).

- Press Ctrl + H (Change Mode) and choose 'Item Invoice'.

- Enter Supplier Invoice Number and Date

Enter the Invoice Number provided by the supplier and the date from the invoice.

- Provide Supplier Details

- In Party A/c Name, select the Supplier Ledger or Cash Ledger, depending on the payment mode.

- Enter the Dispatch Details and Order Details if applicable.

If you do not see these fields, press F12 (Configure) and enable the required options.

- Select the Place of Supply

● Choose the Place of Supply, i.e., the location where goods are being delivered. This is usually auto-filled based on your company’s state. For local purchases, make sure the Place of Supply matches the supplier’s state under Party Details.

- Enter Receipt Details and Order Details (If Needed)

Add Receipt Details and Order Details if your workflow requires them. Press F12 (Configure) to enable these fields if they are not visible.

- Select the Purchase Ledger

- Choose the relevant Purchase Ledger you have already created for local purchases.

- Ensure that the GST Applicability is set to Applicable.

If you prefer setting GST rates at the ledger level, refer to the section titled “Create/Update Sales & Purchase Ledgers As Per GST Rate.”

- Enter Stock Item Details

- In the 'Name of Stock Item', select the product you are purchasing.

- Make sure the item has been configured with the correct GST rate or GST will not be calculated properly.

- Enter the Quantity and Rate for the item.

- Select Tax Ledgers (CGST and SGST)

- Choose the appropriate Central Tax (CGST) and State Tax (SGST) ledgers.

- GST is calculated automatically based on the tax rates defined in the stock item ledger.

- Save the Voucher

Once all details are verified, press Ctrl + A to save the purchase voucher.

In case of Local Purchase of Services

To record local purchase of services, one must again navigate to the Gateway of Tally > Vouchers > F9 (Purchase). Here's what to do next:

1. Change to Accounting Invoice Mode

Press Ctrl + H and select Accounting Invoice mode instead of Item Invoice. Followed by this, enter the supplier invoice date, supplier details and receipt details as outlined above.

2. Enter Service Ledger Instead of Stock Items

Under the particulars section, select a Service Purchase Ledger (already configured with the correct GST rate). Enter the amount charged for the service.

8. Apply CGST and SGST Ledgers

Choose the appropriate CGST and SGST ledgers. The taxes will be automatically calculated based on the values and GST rates defined in the service ledger.

9. Add Other Taxable Charges (If Any)

Include any additional taxable charges related to the service, such as professional fees or processing charges.

10. Save the Voucher

Once you have verified all entries, press Ctrl + A to save the service purchase voucher.

How to Record Interstate Purchase of Goods and Services?

The first 5 steps are identical to those for recording local purchases of goods. For interstate purchases, just ensure that in step 5, the Place of Supply is different from your company's state. This selection determines the applicability of IGST.

Interstate Purchase Transaction of Goods

6. Enter Receipt and Order Details (If Needed)

- Fill in the receipt and order details if they are part of your process.

- Use F12 to enable these fields if needed.

7. Select the Purchase Ledger

- Choose a ledger created specifically for interstate purchases.

- Ensure GST Applicability is marked as “Applicable.”

- You may also define GST rates directly in the ledger settings.

8. Enter Stock Item Details

- Select the item being purchased.

- Make sure the item has the correct GST rate applied.

- Enter the quantity and rate.

9. Select Tax Ledger (IGST)

- Choose the Integrated Tax (IGST) ledger.

- The tax will be calculated automatically based on item setup.

10. View GST Tax Analysis (Optional)

- To review tax details, press Ctrl + O and select GST Tax Analysis.

- Press Alt + F5 to view it in detail.

- If using an older release, press Ctrl + I to access the tax report.

11. Save the Voucher

- After confirming all details, press Ctrl + A to save.

Interstate Purchase of Services

The first 5 steps are the same as for Local Goods and services, just like Interstate Goods. The last few steps are specific to interstate services.

Enter Receipt and Order Details (If Needed)

- Include these details if required for your records.

- Use F12 to display the fields if hidden.

Select the Service Ledger

- In the particulars section, select the appropriate service ledger with GST configured.

- Enter the transaction amount.

Select Tax Ledger (IGST)

- Choose the correct IGST ledger.

- Tax will apply based on the setup in the ledger.

9. Add Other Taxable Charges (If Any)

Enter any other charges related to the service, such as processing or convenience fees.

10. Save the Voucher

Press Ctrl + A to save the completed voucher.

Record Purchase of Items with Different Tax Rates in a Single Voucher

Many businesses buy products with different tax rates in one purchase. In such cases, Tally ERP allows item-wise purchase entry to be recorded in a single voucher.

- In Item Invoice mode, go to 'Name of Item' and select the stock items included in the supply.

- Enter the applicable GST rates and quantity of each item.

- Choose the appropriate tax ledgers (CGST & SGST for local and IGST for interstate purchases).

- GST will be auto-calculated based on the GST rates set in each stock item.

- Fill in any other necessary details (e.g., dispatch info, order number, etc.).

- Press Ctrl + A to save the purchase voucher.

This is another reason why it is important to understand how to create IGST purchases in Tally ERP. It helps in handling real purchase scenarios smoothly.

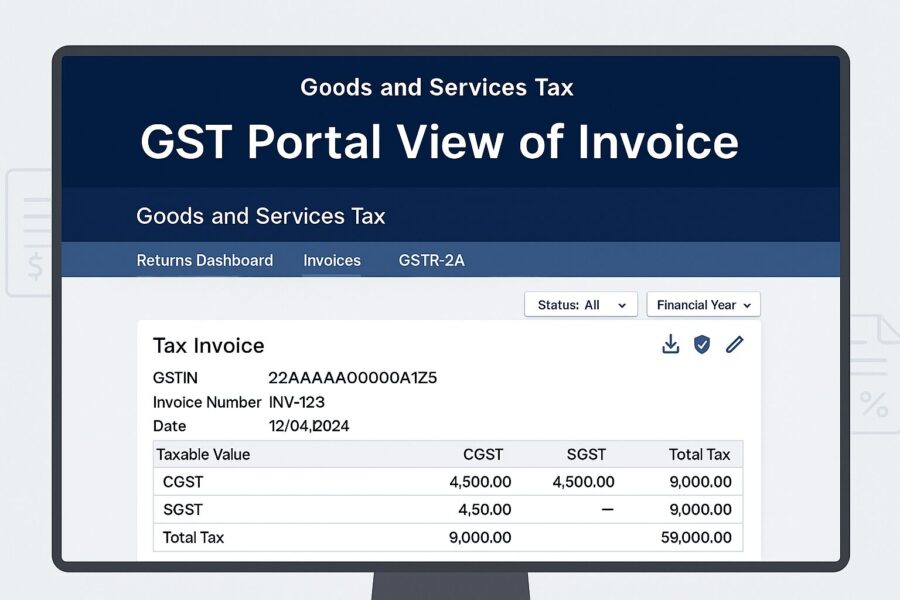

GST Portal View of Invoice

Tally displays your GST-related data in the same format as it appears on the GST portal, allowing you to visualise exactly how your information will look upon upload at the end of the return cycle. You can also preview the GST Portal view of invoices before exporting transactions.

Simply open the relevant voucher. Press Ctrl+O (Related Reports) and choose GST Portal View of Invoice. You can also access this view while recording a voucher by using the same shortcut and selecting the appropriate option.

Conclusion

Knowing how to create IGST purchase in Tally ERP helps avoid confusion during GST filing. For local suppliers, use CGST and SGST. Ensure ledgers are set up correctly with proper tax rates. Create separate purchase ledgers for goods and services. Also, make sure GST is enabled and GSTIN details are entered for every party.

This process ensures accuracy in business compliance, whereby businesses can save time, avoid errors and maintain GST-compliant records.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

FAQs

How do I enable GST in Tally ERP before recording purchases?

Set Enable Goods and Services Tax (GST) to Yes.

Then enable Set/Alter GST details and enter your GSTIN, state, and registration type.

This must be done before recording GST-compliant transactions.

When should I apply IGST instead of CGST and SGST in Tally?

For purchases within the same state, use CGST and SGST.

Always verify the Place of Supply field to ensure correct tax application.

Incorrect tax type may lead to filing errors on the GST portal.

What is the difference between Item Invoice and Accounting Invoice in Tally?

Use Accounting Invoice mode for services where stock tracking isn’t required.

You can toggle between modes using Ctrl + H.

Each mode determines how entries and taxes are applied and displayed.

How do I record purchases involving multiple GST rates in one voucher?

Ensure GST rates are set up in the stock item master.

Tally will calculate taxes item-wise based on defined rates.

Choose the correct tax ledgers (CGST/SGST or IGST) as per supply type.

Can I preview how my invoice will appear on the GST portal from Tally?

Select GST Portal View of Invoice to preview your transaction in GST return format.

This helps you verify all fields before exporting returns.

It ensures smoother filing and reduces mismatches or rejections.

By

By