How to Correct Error in GSTR 1 Return Form?

- 1 Apr 25

- 10 mins

How to Correct Error in GSTR 1 Return Form?

Key Takeaways

- GSTR-1 errors are fixed in future returns, not revised.

- Watch for wrong invoices, HSN codes, and missed entries.

- Accurate supply reporting avoids GST mismatches.

- Use correct tables for B2B, B2C, and export details.

- RCM isn’t part of GSTR-1—it’s reported by recipients.

GSTR-1 is a registered taxpayer’s monthly or quarterly return statement using which they summarise their entire sales. When addressing the fields of this form, a person must notice whether they have carefully entered the valid GST number and other details.

However, errors may still occur due to clerical mistakes, incorrect invoices, or misreporting of sales data. In such a scenario, the GSTR-1 form cannot be revised once filed, but the errors can be rectified in subsequent returns. Thus, in this guide, we will have a detailed discussion on how to correct errors in GSTR-1 and the time limit for rectification.

Common Mistakes and Errors in GSTR-1

Businesses sometimes encounter difficulties due to ever-changing taxation rules and regulations. Therefore, those responsible for filing Form GSTR-1 need to implement best practices and act with diligence to ensure GST compliance.

Still, some common mistakes can happen, and some of them are listed below for your quick reference:

- Wrongly Reporting Sales Data and Supplies

Businesses need to maintain precision, especially when reporting outward supplies. They must ensure accuracy for both exempted and taxable resources. If any mistakes happen, the whole tax audit procedure may be jeopardised.

- Oversight in Reporting

It is also essential to correctly report entries associated with non-GST supplies to avoid frequent enquiries from tax authorities. The commissions involved in these transactions, if not reported, can trigger the rightful authorities and may lead to penalties.

- Incomplete Understanding of the Service Accounting Codes and GST Nomenclature

Let us say a business does not have a clear understanding of Service Accounting Codes (SACs) or the Harmonised System of Nomenclature (HSN). If this is true, it can cause trouble while filing of returns form. At times, when a person wrongly puts the incorrect codes to supplies, such instances lead to miscalculated GST. These scenarios result in mismatches and, thereafter, rectification.

- Invoice Reconciliation Mistakes

This type of common error is frequently noticed in filing form GSTR-1. When the invoice generated by a supplier does not align with a recipient’s purchase details, it causes an error. If you are not able to manage this mistake, it can raise suspicion regarding GST evasion.

- Overlooking the Addition of Debit Notes and Credit Notes

An inaccurate or incomplete tax return file happens when a business mistakenly avoids the inclusion of debit and credit notes. However, to avoid this mistake, you should verify the financial transactions and documents carefully.

- Lack of Awareness

If a certain mistake happens while amending or rectifying annual returns on the common portal, it can lead to major concerns. Businesses can face unwarranted legal repercussions due to a lack of awareness if similar mistakes continue to happen time and again.

Below, you may refer to some more common mistakes along with their consequences:

| Careless Error/ Mistake | Details |

|---|---|

| Mismatch in HSN/ SAC codes | These discrepancies often cause clarification mismatches. Therefore, they can hugely impact tax calculations within the current tax period for a person or entity. |

| Ignoring Amendments | Discrepancies between GSTR-1 and GSTR-2A statements can occur if a taxpayer neglects to amend sales invoices and other related details. |

| Late Filing of GSTR-1 | When a business misses deadlines for monthly returns, it can impact its overall reputation and lead to penalties. |

| Incomplete B2B invoices | This type of mistake happens when one or more invoices related to B2B transactions are omitted while submitting the monthly GST statement. This leads to incomplete reporting of taxes. |

| Non-compliance with E-Invoicing | Some businesses need to maintain e-invoicing. Not being able to maintain online invoice details can potentially cause GSTR-1 filing issues. |

Now that you have a brief idea about some common GSTR-1 filing mistakes, let us walk through how to correct errors in GSTR-1.

Process of Correcting GSTR-1 Mistakes

Bringing changes to an already declared form GSTR-1 needs a systematic approach. For people who do not have in-depth knowledge regarding the GST framework, rectifying the return mistakes can be complicated.

Let us see how professionals correct any mistakes in the GSTR-1 form effectively to ensure accurate reporting:

Step 1: First, the designated person finds out the extent and severity of mistakes. Occasionally, it may be a straightforward numerical error, or the entrusted person may have recorded the wrong HSN code. Thus, first, you need to identify the root cause of the error.

Step 2: Next, you have to file an amendment form designed for GSTR-1 correction. You can find this by logging into your GST account and opening the ‘Returns’ sections under the ‘Service’ tab. From there, you must visit the returns dashboard and select a relevant return period to start amending.

Step 3: Be very careful while amending your records. Make sure to double-check the invoice numbers, dates, tax values, etc. to avoid further discrepancies.

Step 4: If any correction is needed in the tax amount, the business needs to issue debit or credit notes addressing the recipient. The main objective of these documents is to point out the corrections made to the original invoices.

Step 5: After updating the returns, reconciliation takes place, and the concerned person matches the new numbers with the internal records of the company.

Step 6: To ensure utmost transparency, the business also keeps proper records of the new amendments. These corrected entries and the revised documents allow the business to smoothly go through the auditing stages.

What is 4A, 4B, 4C, 6B, 6C in GSTR-1?

Tables 4A, 4B, 4C, 6B and 6C in the GSTR-1 return statement sum up specific details about supplies that are transferred to other registered businesses.

Section 4A includes particulars of any taxable B2B outward supplies that are specifically made to registered dealers. For example, when a company engages a registered dealer for services or consultation and is required to pay tax instead of the supplier, those transactions are reported in Table 4A.

Next, Table 4B includes all those taxable outward supplies made to registered taxpayers where the supplier does not have to pay any tax as per the existing tax rate. In these transactions, the recipients also do not have to worry about tax liabilities.

Moving forward, section 4C features the list of exports completed under a letter of undertaking or LUT. It declares all the outward supplies made to international markets.

Sections 6B and 6C detail amendments and adjustments made to invoices from previous tables. They also emphasise the requirement for accurate documentation of all transaction amendments.

What is 5A and 5B in GSTR-1?

As far as GSTR-1 is concerned, Sections 5A and 5B cover B2C (large) invoices. These segments act as an important source of information for taxable outward interstate supplies where unregistered persons or consumers are involved.

From August 1, 2024, businesses are required to report all interstate sales exceeding ₹1 Lakh made to unregistered parties. This helps ensure transparency and accuracy in the method of taxation.

What are 8A, 8B, 8C, 8D Nil-rated Supplies?

Both sections 8A and 8B summarise the particulars of all nil-rated supplies made to registered taxpayers. Simply put, these sections include all the commodities and services that attract a 0% tax rate under the GST law.

On the other hand, Section 8C holds information related to exempted supplies, which are different from nil-rated supplies. It is essential for any business under the GST framework to mark clear distinction between the exempted and nil-rated supplies while calculating taxes and input tax credit.

Finally, Section 8D provides a description of all non-GST supplies. These transactions do not attract any service tax, fall outside the purview of GST, and are not currently taxed by the government.

What is 9B in GSTR-1?

Section 9B is utilised by tax filers to report credit or debit notes that are generated to amend invoices which have already been processed. Registered dealers use this table to declare the following details of a recipient:

- GSTIN of the recipient

- Debit/ Credit note number

- Original invoice number

- Invoice issuing date

- The correct value of refund/ credit

- Nature of amendment (whether debit note, credit note or refund voucher)

Altogether, this table helps wrap up every sale’s particulars thereby ensuring precise action reporting through any registered seller.

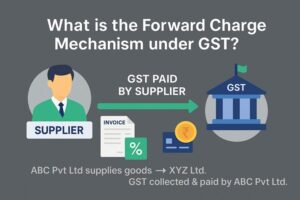

Is RCM Shown in GSTR-1?

No, RCM or reverse charge mechanism transactions cannot be reported via any GST return. The GSTR-1 return primarily emphasises the information about the outward supplies completed by a business.

Nonetheless, RCM transactions are very important to state that the recipient must pay GST in place of the supplier in certain cases. Therefore, businesses need to acknowledge that recipients share responsibility for accurate GST compliance by taking care of this part.

Conclusion

To avoid fines and continue to comply with GST laws, it is essential to understand how to correct errors in GSTR-1 and be aware of the reporting dates. If taxpayers encounter any issues uploading their annual GST reports, they can request assistance from the official GST portal. For appropriate GST reporting, they can also get advice from any GST practitioner or consultant.

💡If you want to streamline your payment and make GST payments via credit or debit card, UPI consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By