GSTR-3B: Filing Deadlines and Process

- 25 Aug 24

- 13 mins

GSTR-3B: Filing Deadlines and Process

Key Takeaways

- GSTR-3B is a crucial monthly self-declaration summary return for businesses to report sales, ITC claimed, and net tax payments, ensuring GST compliance.

- Filing GSTR-3B on time is essential to avoid penalties and interest charges, which can impact business financial planning.

- Taxpayers with an annual turnover exceeding ₹5 crore must file GSTR-3B monthly, while those with a turnover up to ₹5 crore can opt for quarterly filing under the QRMP scheme.

- The GSTR-3B filing process has been simplified with online and offline methods, making it easier for businesses to submit accurate returns and manage their tax liabilities.

- Recent updates to GSTR-3B include the introduction of new tables for e-commerce supplies, automated ITC utilization, and a streamlined verification process, enhancing the overall filing experience.

While it is a challenge to deal with all the aspects of GST, it is crucial for the business to understand the importance of GSTR-3B filing. Missing the GSTR-3B due date attracts penalties and hampers the business’s financial planning. Here you will find all the necessary information about GSTR-3B filing so that you can remain compliant and relaxed.

Overview of GSTR 3B

Form GSTR-3B is a monthly self-declaration summary return for both inward and outward supplies mandated by the Government of India. It allows businesses to fulfil their GST obligations by reporting summary figures of sales, Input Tax Credit (ITC) claimed, and net tax payments.

Earlier, filing returns for taxpayers was a bit of a problem for small and medium businesses, especially when done manually and within a validity period. In order to make the payment of tax more manageable, the Indian Government initiated GSTR-3B which is basically a return form.

Eligibility for Filing GSTR-3B

If you are registered under the current GST system, the annual return filing of GST is compulsory, regardless of whether you have any tax liabilities for the current month. However, certain categories of registrants are exempt from filing GSTR-3B. These include:

- Businesses registered under the composition scheme

- Overseas suppliers of Online Information Database Access and Retrieval (OIDAR) services

- Entities collecting Tax Deducted at Source (TDS) and Tax Collected at Source (TCS)

- Input service distributors

- A non-resident taxable person

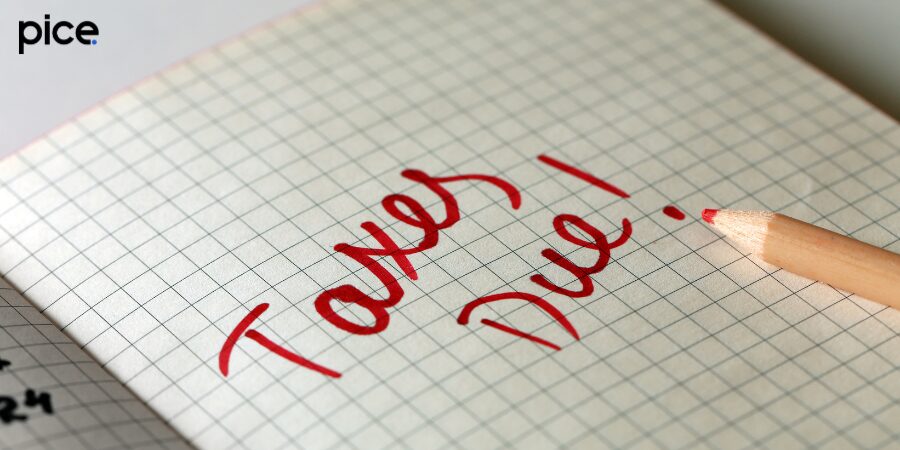

Filing Deadlines for GSTR-3B

The GSTR-3B due date filing depends on the taxpayer's aggregate turnover in the preceding financial year.

- Taxpayers with an aggregate turnover of more than ₹5 crore in the previous financial year:

| Month | GSTR-3B Due Date |

| April 2024 | 20th May 2024 |

| May 2024 | 20th June 2024 |

| June 2024 | 20th July 2024 |

| July 2024 | 20th August 2024 |

| August 2024 | 20th September 2024 |

| September 2024 | 20th October 2024 |

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

- Taxpayers with an aggregate turnover of up to ₹5 crore in the previous financial year who have not opted for the Quarterly Returns with Monthly Payment scheme:

| Month | GSTR-3B Due Date |

| April 2024 | 20th May 2024 |

| May 2024 | 20th June 2024 |

| June 2024 | 20th July 2024 |

| July 2024 | 20th August 2024 |

| August 2024 | 20th September 2024 |

| September 2024 | 20th October 2024 |

- Taxpayers with an aggregate turnover of up to ₹5 crore under the Quarterly Returns with Monthly Payment scheme

| Quarter | GSTR-3B Due date |

| April to June 2024 | For States/Union Territories mentioned in Group A: 22nd July 2024 |

| For States/Union Territories mentioned in Group B: 24th July 2024 | |

| July to September 2024 | For States/Union Territories mentioned in Group A: 22nd October 2024 |

| For States/Union Territories mentioned in Group B: 24th October 2024 |

The Form GSTR-3B return filing period can be extended by the Government of India through a notification, if necessary.

- Group A

Regular taxpayers whose main place of business is in Madhya Pradesh, Chhattisgarh, Maharashtra, Gujarat, Goa, Karnataka, Tamil Nadu, Andhra Pradesh, Kerala, Telangana, Daman and Diu, Dadra and Nagar Haveli, Andaman and Nicobar Islands, Puducherry, or Lakshadweep.

- Group B

Regular taxpayers whose main place of business is in Delhi, Odisha, Uttarakhand, Arunachal Pradesh, Himachal Pradesh, Chandigarh, Mizoram, Tripura, Nagaland, Rajasthan, Meghalaya, Assam, Punjab, Haryana, Bihar, Uttar Pradesh, Sikkim, West Bengal, Jharkhand, Manipur, Ladakh or Jammu and Kashmir.

GSTR-3B Format Details

The following provides a detailed format of the GSTR-3B form:

Section 1: Business Activities and Tax Liabilities

This section includes a questionnaire about your business activities and the tax you owe for the current month.

Section 2: GST-Related Information

Here you will find the information regarding your GST and your return status.

Section 3.1: Inward and Outward Supplies and Reverse Charge

It has details of the tax applicable on the inward and outward supplies including those for which reverse charge mechanism is applicable. Here is a detailed breakdown of Section 3.1:

- Outward taxable supplies (excluding zero-rated, nil-rated and exempted)

- Zero-rated outward supplies

- NIL-rated and exempt supplies

- Inward supplies under reverse charge

- Non-GST outward supplies

Section 3.2: Inter-State Supplies

This part covers details of inter-state supplies made to UIN holders, unregistered persons and composition dealers.

Section 4: Eligible Input Tax Credit (ITC)

This section shows the amount of Input Tax Credit you are eligible to claim.

Section 5.1: Exempt Supplies

Information about any supplies exempt from GST is provided here.

Section 5.2: Interest and Late Fees

This section includes details regarding any applicable interest and late fees.

Section 6: Payment of GST Liabilities

The final section lists all information related to the tax payable on your outward supplies and inward supplies for the month or quarter. It also provides the break-up of payment of taxes through ITC utilisation and cash deposits. Furthermore, TDS (Tax withheld by the Government establishment) and TCS (Tax withheld by E-commerce operator) are mentioned here.

Online Filing Guide for GSTR-3B

Follow the steps mentioned below to file GSTR-3B online:

Step 1: Go to the official GST portal and log in to your account.

Step 2: Under the ‘Services’ tab and select ‘Returns’.

Step 3: Select ‘Returns Dashboard’ and select the financial year and the return filing period.

Step 4: Click on the ‘Search’ button to display all the returns that you have to file.

Step 5: Tap on the ‘Prepare Online’ button on the GSTR-3B tile.

Step 6: Read the message about the improved user-friendliness of GSTR-3B filing that will appear and hit the ‘OK’ button.

Step 7: Next, answer the questions about your business activities and tax liabilities for the current tax period.

Step 8: Click on the 'Next’ button to view the GSTR-3B monthly return or quarterly return page showing return-related information and status.

Step 9: Scroll down to see options to go back, save your entries or reset the form.

Step 10: Choose the first tile (Section 3.1 link) to begin the GSTR-3B filing process. Input the details of your various outward and inward supplies, then click ‘Confirm’.

Step 11: After being redirected to the Returns page, click the second tile and enter the necessary details, ensuring the total amount of integrated tax in Section 3.2 is less than or equal to that in Section 3.1.

Step 12: Provide details on all other pages of the form, saving the draft GSTR-3B form periodically.

Step 13: Tap on ‘Preview draft GSTR-3B’ and if you find no errors in the draft, select ‘Proceed to Payment’.

Step 14: Scroll down to see the ‘Cash Ledger’ balance with return-related liabilities, auto-populated with taxes to be paid using ITC.

Step 15: If your Electronic Cash Ledger balance is low, you will be prompted to create a challan and choose ‘Yes’.

Step 16: On the 'Create Challan' page, select your payment method and click 'Generate Challan' to proceed with the payment.

Step 17: Select ‘Continue’ and preview the draft GSTR-3B. You must ensure the ‘Additional Cash Required’ column is zero.

Step 18: Tap on ‘Make Payment/Post Credit to Ledger’ and click ‘Yes’.

Step 19: Click on ‘Proceed to File’.

Step 20: Tick the declaration checkbox and tap ‘File GSTR-3B with EVC/DSC’ (Electronic Verification Code/Digital Signature Certificate).

Step 21: Lastly, click the ‘Proceed’ button.

A successful filing message with an Acknowledgement Reference Number (ARN) will appear. Note this number for future reference. To view the filled monthly return form, click on the ‘Download Filed GSTR-3B’ option.

Offline Filing Method for GSTR-3B

To file GSTR-3B offline either on a monthly or quarterly basis follow the steps mentioned below:

Step 1: Go to the ‘Downloads’ section on the GST portal.

Step 2: Look for Offline Tools and select ‘GSTR3B Offline Utility’.

Step 3: Extract the excel utility from the downloaded zip file and open the excel sheet.

Step 4: Find the ‘Enable Editing’ button in the excel sheet.

Step 5: Provide the legal name of the registered person, GSTIN, Financial Year (FY) and the month.

Step 6: Fill out details in Section 3.1 for tax on outward and reverse charge inward supplies.

Step 7: Enter details in Section 3.2 for inter-state taxable supplies. Ensure that the total integrated tax declared in Section 3.2 does not exceed that in Section 3.1.

Step 8: Mention details in Section 4 for eligible Input Tax Credit (ITC).

Step 9: Provide information in Section 5.1 for exempt, nil-rated, and non-GST inward supplies.

Step 10: Input details in Section 5.2 regarding interest and late fees.

Step 11: Validate all the provided details using the ‘Validate’ button.

Step 12: Generate a JSON file by clicking the ‘Generate File’ button.

Step 13: Upload the JSON file to the GST portal by selecting the ‘Prepare Offline’ option on the returns dashboard.

Checking GSTR-3B Filing Status

Follow the steps for checking the status of the GSTR-3B filing:

Step 1: Sign in to the GST portal using your user ID and password.

Step 2: Access the 'Returns Dashboard' from the main homepage.

Step 3: Choose the applicable financial year and the period for which you filed the return, then click 'Search'.

Step 4: You will then see a list of all your filed GST returns for that relevant month, including their current filing status.

Penalties and Late Fees for GSTR-3B Non-Compliance

You must always file GSTR-3B returns on time. Late fees for GSTR-3B are penalties imposed when tax returns are filed after the due date. The fees vary depending on whether the return is nil or normal.

| Late Fees for Nil Returns | ₹20 Per Day |

| Late Fees for Normal GSTR 3B Returns | ₹50 Per Day |

Furthermore, all taxpayers are subject to 18% per annum interest on any unpaid tax amount. The maximum fee for late filing of Form GSTR-3B (excluding nil returns) is determined by the taxpayer's annual turnover.

| Name of the Act | If the Annual Turnover Limit is Less Than ₹1.5 crore | If the Annual Turnover Limit is Between ₹1.5 Crore and ₹5 Crore | If the Annual Turnover Limit is Over ₹5 crore |

| CGST | ₹1,000/return | ₹2,500/return | ₹5,000/return |

| SGST | ₹1,000/return | ₹2,500/return | ₹5,000/return |

| Total Fee paid | ₹2,000/return | ₹5,000/return | ₹5,000/return |

Furthermore, it is important to note for nil tax liability on GSTR-3B returns, the maximum late fee is ₹500 per return (comprising CGST ₹250 and SGST ₹250).

Recent Updates to GSTR-3B

During the 26th GST Council meeting, the Central Board of Indirect Taxes and Customs (CBIC) implemented significant updates that are mandatory for all taxpayers to follow.

- New Table for E-commerce Supplies: There has been a new addition in Table 3.1.1 which mandates taxpayers to declare the taxable supplies facilitated by e-commerce operators (ECO).

- Revisions to Table 4 in GSTR-3B: Part B of Table 4 now includes details on ITC reversals and Part D is dedicated to ITC reporting.

- Draft Return Download Option: Taxpayers can download a draft of their returns at any stage of the filing process.

- Automated Input Tax Credit Utilisation: Instead of manually entering the amount for Input Tax Credit utilisation, taxpayers can now generate the challan automatically with a few clicks.

- Simplified Verification: All details can be reviewed in a single tab view before submitting returns, making verification easier.

GST Return Payments

Previously, taxpayers had to submit their return to know their tax payable amount and once submitted, no changes could be made. Now, all details including the current balance of ITC, the current balance of cash, tax liability by type, and suggested methods for using ITC will be shown in a single table view before submission. This change makes it simpler for taxpayers to monitor their ITC, calculate outstanding tax liabilities, and decide how much tax they need to pay in cash or credit before finalising the return.

Challan Generation Process

Previously, taxpayers had to manually enter the amount of input tax credit to use and the cash payment needed, then generate a challan. Now, taxpayers can edit the ITC utilisation suggested by the system. Once they adjust the ITC utilisation, the required payment amount automatically updates.

It allows for an auto-generation of the tax payment challan by simply clicking a button, after performing the adjustment for Input Tax Credit in the credit ledger. This change eliminates the risk of taxpayers entering incorrect tax amounts or selecting the wrong tax category when manually filling out the challan.

The Bottom Line

Missing the GSTR-3B due date can lead to penalties, so it is important to file it within the time limit. Earlier the filing process used to take a lot of time but with the latest update on various GST software available in the market it has reduced more than 70% of the time required earlier.

These advancements not only streamline the process but also ensure business compliance with tax regulations. Hence, it is important to make sure that you file your taxes before the stipulated time and use the available technology to ease your direct tax compliance process.

By

By