GSTR-3B and GSTR-1 Reconciliation Using Excel

- 22 Aug 24

- 16 mins

GSTR-3B and GSTR-1 Reconciliation Using Excel

- What Does GSTR-1 and GSTR-3B Reconciliation in Excel Entail?

- Causes of Mismatches Between GSTR-3B and GSTR-1

- Why is Reconciling GSTR-3B and GSTR-1 Necessary?

- Steps to Reconcile GSTR-3B and GSTR-1 in Excel

- Importance of Using an Excel Format for GST Reconciliation

- Benefits of Using Excel for GST Reconciliation

Key Takeaways

- Systematic Reconciliation: Using Excel for GSTR-3B and GSTR-1 reconciliation allows for systematic and organized comparison of GST data, ensuring accurate tax filings and compliance.

- Identifying Discrepancies: Excel helps quickly identify discrepancies between GSTR-3B and GSTR-1, such as timing differences and incorrect reporting, facilitating prompt corrections.

- Effective Data Management: Excel's robust features enable businesses to manage large datasets efficiently, ensuring all transactions are accurately reflected in the GST returns.

- Enhanced Accuracy: Regular reconciliation using Excel enhances the accuracy of GST submissions by ensuring that all discrepancies are identified and resolved.

- Compliance and Penalty Avoidance: Proper reconciliation of GSTR-3B and GSTR-1 ensures compliance with GST regulations, reducing the risk of penalties and interest due to errors in tax filings.

What Does GSTR-1 and GSTR-3B Reconciliation in Excel Entail?

GSTR-1 and GSTR-3B reconciliation in Excel involves comparing the data reported in Form GSTR-1 (details of outward supplies) with GSTR-3B returns (summary of sales and input tax credit). This reconciliation helps identify discrepancies between the two forms, ensuring GST compliance and accurate tax liability. Using Excel for this process allows businesses to organize their GST details systematically, making it easier to spot differences and correct them promptly. The reconciliation format in Excel includes comparing invoice-wise details, credit notes, and tax amounts for each reporting period.

Handle all your sales and purchase invoices in one place.

Pice’s all-in-one invoice management tool helps you track, send, and organize invoices from a single dashboard. Automatically share new invoices with customers, send timely payment reminders, and keep your collections under control—effortlessly.

Want early access? Fill out this form to get request a demo!

Reconciliation ensures that the data filed in GSTR-1 return matches the summary in GSTR-3B report. It is crucial for businesses engaged in inter-state supplies and those using the reverse charge mechanism. The reconciliation status helps in maintaining accurate records for the annual return filing and facilitates smooth GST compliance. Excel's file format is ideal for managing large datasets and performing detailed tax calculations, making the process of filing returns more efficient.

Differences in Reporting Outward Supplies

One major aspect of reconciliation is identifying differences in reporting outward supplies between GSTR-1 and GSTR-3B. GSTR-1 captures detailed invoice-level data, whereas GSTR-3B summarizes the total sales. Discrepancies can arise due to errors in invoice entry, different reporting periods, or omissions. By using Excel, businesses can align these figures, ensuring that inter-state supplies and local transactions are accurately reported in both forms. This step is critical for generating accurate e-way bills and maintaining GST compliance.

Reconciling Input Tax Credit (ITC)

Reconciling input tax credit (ITC) involves matching the credit claimed in GSTR-3B with the eligible credit available in GSTR-2B and the actual invoices. Differences can occur due to delays in supplier filing, incorrect reporting, or ineligible ITC being claimed. Using Excel helps in systematically verifying ITC entries against actual invoices and credit notes, ensuring that the ITC claimed is accurate and compliant with GST laws. Proper ITC reconciliation helps avoid interest and penalties on excess credit claimed and ensures correct tax liability.

Causes of Mismatches Between GSTR-3B and GSTR-1

Timing Differences: Timing differences occur when sales are reported in one return period in GSTR-1 but in a different period in GSTR-3B. This can happen due to delayed invoicing or late receipt of information. Using Excel for reconciliation helps businesses track these timing differences and adjust their records accordingly to reflect the correct tax amounts for the current return period.

Incorrect Reporting: Incorrect reporting includes errors in entering invoice details, tax amounts, or incorrect GST registration numbers. These errors can lead to mismatches between GSTR-1 and GSTR-3B. Excel helps identify these discrepancies by allowing detailed comparisons of the data reported in both forms, ensuring accurate tax return filing and compliance with GST regulations.

Non-Filing or Late Filing: Non-filing or late filing of returns by the supplier can cause mismatches as the purchaser's records will not match with the supplier’s filed data. Excel can be used to track the reconciliation status and follow up with suppliers to ensure timely filing. Regular reconciliation ensures that all transactions are reported correctly in the quarterly return and annual return filings.

Reversal or Modification of Transactions: Reversal or modification of transactions through credit notes or debit notes can cause mismatches if not correctly reflected in both GSTR-1 and GSTR-3B. Excel helps track these modifications, ensuring that both forms reflect the accurate tax amounts. This is essential for maintaining accurate records and avoiding discrepancies in the reconciliation process.

ITC Discrepancies: ITC discrepancies arise when the input tax credit claimed in GSTR-3B does not match the credit available in GSTR-2B or the actual invoices. These can result from errors in reporting or claiming ineligible ITC. Using Excel for reconciliation helps identify and correct these discrepancies, ensuring that only eligible credit is claimed and maintaining GST compliance.

Technical Issues: Technical issues on the GST portal, such as data upload errors or system glitches, can lead to mismatches. Excel provides a reliable offline method to compare and verify data, ensuring that all discrepancies due to technical issues are identified and corrected. Regular reconciliation helps in mitigating the impact of such technical issues on GST compliance.

Why is Reconciling GSTR-3B and GSTR-1 Necessary?

Ensuring Accurate Tax Liability: Reconciling GSTR-3B and GSTR-1 ensures that the tax liability reported is accurate, reflecting the actual sales and input tax credits. This process helps avoid underpayment or overpayment of taxes, which can lead to penalties and interest. Accurate reconciliation is essential for maintaining compliance with GST laws and ensuring that the tax return reflects the correct liability.

Reconciling Input Tax Credit (ITC): Reconciling ITC ensures that the credit claimed in GSTR-3B matches the eligible credit available, as per GSTR-2B and the actual invoices. This helps avoid claiming excess credit, which can attract penalties and interest. Proper ITC reconciliation is crucial for maintaining the flow of credit and ensuring that the business's GST details are accurate.

Download in Excel Format: Download Now

Identifying Errors: Reconciliation helps identify errors in reporting, such as incorrect invoice details, tax amounts, or misreporting of transactions. By identifying and correcting these errors, businesses can ensure accurate tax filings and avoid discrepancies in their records. Regular reconciliation helps maintain accurate records for annual return filing and facilitates smooth GST compliance.

Complying with GST Regulations: Regular reconciliation ensures compliance with GST regulations by aligning the data reported in GSTR-1 and GSTR-3B. This process helps avoid penalties and interest due to discrepancies and ensures that the business adheres to GST laws. Compliance with GST regulations is essential for maintaining the credibility and financial health of the business.

Facilitating Smooth GST Return Filing: Reconciling GSTR-3B and GSTR-1 facilitates smooth GST return filing by ensuring that all transactions are accurately reported and any discrepancies are resolved. This helps avoid delays and issues in filing returns and ensures that the business meets its GST compliance requirements. Efficient reconciliation using Excel helps streamline the filing process and ensures accurate tax submissions.

Steps to Reconcile GSTR-3B and GSTR-1 in Excel

Reconciling GSTR-3B and GSTR-1 in Excel involves a series of systematic steps to ensure accuracy and compliance with GST regulations. Here is a detailed guide on how to perform this reconciliation effectively:

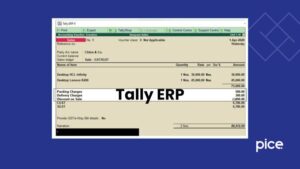

Step 1: Download GSTR-1 and GSTR-3B Data from the GST Portal

The first step is to download the GSTR-1 and GSTR-3B returns data from the GST portal. Log in to the GST portal using your credentials and navigate to the 'Returns Dashboard.' Select the relevant tax period and download the detailed GSTR-1 and GSTR-3B reports in Excel format. This data will form the basis for your reconciliation process.

Step 2: Import the Data into Excel

Open Excel and import the downloaded GSTR-1 and GSTR-3B files. Create separate sheets for each return to keep the data organized. Ensure that the data is correctly formatted and each column is properly labeled, making it easier to compare and analyze the information. Include all relevant fields such as invoice number, date, taxable value, and tax amounts.

Step 3: Organize the Data for Comparison

Organize the data in Excel by sorting and filtering it based on key fields such as invoice number, date, and GSTIN. This organization helps in systematically comparing the data between GSTR-1 and GSTR-3B. Use Excel functions like VLOOKUP or INDEX-MATCH to match corresponding entries from both returns, making it easier to spot discrepancies.

Step 4: Compare Outward Supplies

Compare the details of outward supplies reported in GSTR-1 with those in GSTR-3B. Look for any differences in invoice values, tax amounts, and credit notes. Highlight any discrepancies found and investigate the reasons for these differences. Ensure that all inter-state supplies and local transactions are accurately reflected in both returns.

Step 5: Reconcile Input Tax Credit (ITC)

Reconcile the input tax credit claimed in GSTR-3B with the eligible ITC available as per GSTR-2B and the actual invoices. Check for any discrepancies in ITC amounts, and verify that only eligible ITC is claimed. Use Excel formulas to calculate the total ITC claimed and compare it with the ITC reported in GSTR-3B, ensuring that the figures match.

Step 6: Identify and Rectify Discrepancies

Identify any discrepancies in the data, such as differences in tax amounts, timing issues, or incorrect entries. Categorize these discrepancies based on their nature, such as timing differences, incorrect reporting, or non-filing. Rectify these discrepancies by making the necessary adjustments in your records and ensuring that the corrected data is reflected in the subsequent returns.

Step 7: Prepare Reconciliation Statements

Prepare reconciliation statements in Excel that summarize the discrepancies identified and the actions taken to resolve them. These statements should include details of mismatched invoices, corrected entries, and any adjustments made. This documentation helps in maintaining transparency and provides a clear audit trail for future reference.

Step 8: Update Records and Make Necessary Adjustments

Update your accounting records and GST returns based on the reconciliation findings. Ensure that any necessary adjustments, such as corrections to invoice values or tax amounts, are made in the current return period. This step is crucial for ensuring that your GST returns accurately reflect your business transactions and tax liabilities.

Step 9: Verify and Validate Reconciled Data

Verify and validate the reconciled data to ensure its accuracy. Double-check the reconciled figures against the original data to confirm that all discrepancies have been addressed. Use Excel's data validation tools to ensure that the final figures are accurate and consistent with the GST regulations.

Step 10: Report and File Corrected Returns

Finally, report the reconciled data and file the corrected returns on the GST portal. Ensure that the GSTR-1 and GSTR-3B returns reflect the accurate, reconciled figures. Timely filing of corrected returns helps in maintaining compliance with GST regulations and avoids penalties or interest due to discrepancies.

By following these detailed steps in Excel, businesses can effectively reconcile their GSTR-3B and GSTR-1 returns, ensuring accurate tax filings and compliance with GST laws. This systematic approach helps in identifying and resolving discrepancies, maintaining accurate records, and facilitating smooth GST return filing.

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

Importance of Using an Excel Format for GST Reconciliation

Streamlining the GST Reconciliation Process: Using Excel streamlines the GST reconciliation process by allowing businesses to organize and compare data systematically. The Excel format helps in quickly identifying discrepancies and resolving them, ensuring that the data in GSTR-1 and GSTR-3B matches accurately. This streamlined process reduces the time and effort required for reconciliation and enhances the efficiency of tax return filing.

Ensuring Accuracy in Tax Filings: Excel helps ensure accuracy in tax filings by providing a clear and organized format for comparing data. By identifying and correcting discrepancies, businesses can ensure that their tax returns are accurate and compliant with GST regulations. Accurate tax filings help avoid penalties and interest and maintain the credibility of the business.

Identifying Inconsistencies and Errors: Excel allows businesses to identify inconsistencies and errors in their GST data quickly. By comparing the details reported in GSTR-1 and GSTR-3B, businesses can spot and rectify errors, ensuring accurate tax submissions. Regular reconciliation using Excel helps maintain accurate records and ensures smooth GST compliance.

Complying with GST Regulations: Using Excel for reconciliation helps businesses comply with GST regulations by ensuring that all transactions are accurately reported and discrepancies are resolved. This compliance is essential for avoiding penalties and interest and ensuring that the business adheres to GST laws. Excel provides a reliable method for maintaining accurate and compliant GST records.

Effectively Managing Large Data Sets: Excel is an effective tool for managing large datasets, allowing businesses to organize and compare data systematically. This is particularly useful for businesses with high transaction volumes, as it helps in efficiently reconciling the data reported in GSTR-1 and GSTR-3B. Managing large datasets effectively ensures accurate tax filings and compliance with GST regulations.

Reducing Tax Penalties and Audit Risks: Regular reconciliation using Excel helps reduce tax penalties and audit risks by ensuring that the data reported in GSTR-1 and GSTR-3B is accurate and compliant with GST regulations. By identifying and correcting discrepancies, businesses can avoid penalties and interest due to errors in tax filings. This proactive approach helps maintain the financial health and credibility of the business.

Benefits of Using Excel for GST Reconciliation

Organizing and Managing Data Easily: Excel allows businesses to effectively organize and manage their GST data, providing a structured format for easy comparison and reconciliation. This organization ensures that all relevant details, including tax invoices and credit notes, are systematically arranged, facilitating efficient data management and retrieval.

Quickly Identifying Discrepancies: With Excel, businesses can quickly identify discrepancies between GSTR-1 and GSTR-3B returns by performing detailed comparisons of reported data. Excel’s robust features enable swift detection of mismatches in tax amounts, invoice details, and input tax credits, allowing prompt resolution and accurate reporting.

Integrating Seamlessly with Accounting Software: Excel integrates seamlessly with various accounting software, enabling smooth data import and export for reconciliation purposes. This integration helps maintain consistency in financial records and ensures that GST data is accurately reflected across all accounting platforms, enhancing overall financial management.

Enhancing Accuracy in GST Submissions: Using Excel for GST reconciliation enhances the accuracy of tax submissions by providing a clear, organized format for data comparison. Accurate reconciliation ensures that all reported transactions, including inter-state supplies and reverse charge mechanisms, are correctly accounted for, reducing the risk of errors in GST filings.

Making the Reconciliation Process Efficient: Excel streamlines the reconciliation process by allowing businesses to systematically organize and compare large datasets. This efficiency reduces the time and effort required for reconciliation, enabling businesses to focus on other critical aspects of GST compliance and tax return preparation.

Providing Clarity in Tax Filings: Excel offers clarity in tax filings by allowing businesses to clearly document and compare their GST data. This clarity helps in identifying and resolving any discrepancies, ensuring transparent and accurate tax submissions that comply with GST regulations and requirements.

By

By