Difference Between GST and VAT

- 4 Sep 24

- 10 mins

Difference Between GST and VAT

Key Takeaways

- GST, implemented in India in 2017, is a comprehensive and unified tax system that has replaced multiple indirect taxes like VAT, simplifying the tax structure.

- VAT is a consumption tax applied at each stage of the supply chain, but unlike GST, it varies across states, leading to inconsistencies and higher costs for consumers.

- GST has streamlined tax compliance by introducing a uniform tax structure, reducing the cascading effect of taxes, and allowing for easier online processes.

- The introduction of GST has enhanced logistical efficiency, benefiting businesses by eliminating the need for multiple warehouses and reducing transportation costs.

- GST offers a significant advantage over VAT by centralizing the tax collection system, promoting better regulation, and encouraging competitive pricing across India.

Understanding the differences between Goods and Services Tax (GST) and Value Added Tax (VAT) is important for policy-makers, consumers and businesses. Both are indirect taxes that operate to streamline the taxation system. Both of these taxes have different impacts on the Indian economy, positives and negatives.

In this blog, we will focus on GST vs VAT and discuss the advantages of GST, its advantages and many more.

Understanding GST

Goods and Services Tax or GST, which came into effect on 1st July 2017 is an indirect tax that is levied on certain goods and services in India. The tax is added at every stage of value addition, and the end-consumer is required to pay GST in addition to the price of the product. Businesses transfer the portion of the tax they collect to the government.

It is a comprehensive, destination-based and multi-staged tax which aims to promote a single unified structure in the country. Merging various indirect taxes like service tax, VAT, and excise duty under the same head, it is now the single domestic indirect tax law of India.

Understanding VAT

VAT or Value Added Tax is a consumption tax that was introduced with an aim of a single integrated market structure. It applies to goods and services at every stage of the supply chain. The amount of VAT that a consumer is required to pay is the product's cost and then deducting the taxes of the previous stage.

Unlike progressive income tax, VAT is applicable equally on every purchase transaction, whether wealthy or not. As per research, approximately 160 countries use the value-added tax system.

Reasons for Introducing GST

The primary reasons for introducing GST were:

- Higher Registration Threshold: Before the implementation of Goods and Services Tax, businesses with an annual turnover of ₹5 lacs were required to pay tax, varying from state to state. However, for businesses with an annual turnover of less than ₹10 lacs, the tax was waived. After the implementation of GST, the threshold is raised to ₹20 lacs. This allows many small traders to have tax exemptions.

- Unified Taxation Structure: The previous tax regime of India had several additional taxes. For example, there was Service Tax, Value Added Tax (VAT), Central Excise, and so on. These were collected at different stages. Under the GST regime, all indirect taxes are included in one centralised tax payment method.

- Higher Compliance Rate: Earlier, taxpayers were unable to set off the credits of one tax against another, owing to the indirect tax laws. This led to a major decline in compliance among taxpayers. Under GST, tax is levied only on the net value added at each supply chain stage. This helps maintain a smooth flow of input tax credits for both goods and services.

- Benefits of Online Procedures: Taxpayers had a lot of difficulties dealing with different tax authorities under each tax law previously. GST makes sure that the entire process is done online. From registration to e-way bill generation, everything is done in a computerised

- Eliminating Multiple Documentation: GST, being a centralised indirect tax, negates the need for multiple documentation for the supply of goods. It also reduces transportation cycle time, improves supply chain and turnaround time, and leads to warehouse consolidation. Removing interstate checkpoints, and e-way bills under the GST regime improve transit and destination efficiency.

- Reducing Double Taxation System: Cascading effect of taxes prevailed under the previous tax regime. This led to a higher price of goods. The lower VAT rates led to disproportionate purchases even within the states. After GST has come into effect, it has helped in competitive pricing in India and abroad. This, in turn, has increased consumption and revenues.

💡If you want to pay your GST with Credit Card, then download Pice Business Payment App. Pice is the one stop app for all paying all your business expenses.

What Advantages Does GST Offer Over VAT?

Goods and Services Tax (GST) brings the entire country together in terms of tax collection. It is designed to be a comprehensive, destination-based tax method.

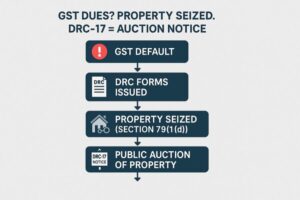

On the other hand, Value Added Tax (VAT) is an indirect tax levied on consumption whenever it adds any value at any stage of the supply chain. The following are the disadvantages of VAT against GST:

- Different VAT rates in different states, while GST is a centralised taxation method with one set of laws.

- VAT laws vary from one state to another in India. On the other hand, GST offers a unified method of tax collection. It is governed by the Central Government. Therefore, the laws remain the same all across India.

Benefits of Implementing GST

Let us go through some of the key benefits of implementing GST:

- Improved Logistical Efficiency: Earlier, operators needed to run more than one warehouse to avoid the strict compliance of inter-state movements. Now, with the implementation of Goods and Services Tax, the restrictions on interstate supplies are lesser. This also led to more generation of revenues and profits.

- Simpler Compliance for Small Taxpayers: Small businesses with annual turnover that ranges between ₹20 lacs and ₹75 lacs, are likely to benefit from GST. They can utilise the benefits of the Composition Scheme. This further helps to reduce the business complexities.

- Defined Treatment for E-Commerce Companies: Before the GST regime, there did not exist separate laws for e-commerce operators. Different rules were applicable, depending on the state of the transaction. The introduction of GST has led to the applicability of common provisions throughout the country, irrespective of the state.

- Overruling Cascading Effect of Taxes: Cascading effect of taxes is referred to as tax-on-tax. Before GST, if a customer bought goods or services for ₹20,000, service tax will be applicable on the goods, upon which VAT will be levied. GST eliminated this double taxation system.

- Better Regulation: Some of the sectors, like the construction and textile industries lacked proper regulations. However, with the ease of online payments and the rule of availing of Input tax Credit benefit only upon the acceptance of payment by the supplier, these sectors have become much more organised.

Illustrative Examples

Let us compare the indirect taxation system pre-GST regime and post-GST regime by two illustrations:

Under Pre-GST Regime:

| Stage of Sale | Cost (₹) | Rate of Taxation@ 5% ( ₹) | Invoice (₹) |

| Manufacturer | 1,000 | 10 | 1,100 |

| Labelling and packaging ₹ 400 | 1500 | 150 | 1,650 |

| Advertisement by retailer ₹ 600 | 2,250 | 225 | 2,475 |

| Total | 2000 | 475 | 2475 |

Under post-GST regime:

| Stage of Sale | Cost (₹) | GST rate @10% (₹) | Tax liability (₹) | Invoice (₹) |

| Manufacturer | 1,000 | 100 | 100 | 1,100 |

| Labelling and packaging ₹400 | 1,400 | 140 | 40 | 1,540 |

| Advertisement by retailer ₹600 | 2,000 | 200 | 60 | 2,200 |

| Total | 2,000 | 200 | 2,200 |

As we can see, there is a significant price reduction under the post-GST regime.

Calculation Methods for VAT and GST

To understand the difference between the calculation of VAT and GST, let us consider an example. In this example, we will see the different stages of production and distribution that a product undergoes.

We will calculate VAT and GST at each stage before it finally reaches the consumer. For ease of understanding, let's consider the rate of VAT to be 15% and that of GST to be 18%.

The difference in calculations between the two types of taxes are in table below:

| Stages | VAT Calculation (₹) | GST Calculation (₹) |

| Manufacturer to Wholesaler | Product Cost: 1,000 Output VAT = 1,000 * 10 / 100 = 110 Input VAT = 0 (assuming the manufacturer didn’t make any purchase transactions) Net VAT payable = 110 – 0 = 110 | Product Cost: 1,000 Output GST = 1,000 * 15 / 100 = 150 Input GST = 0 (assuming the manufacturer didn’t make any purchase transactions) Net GST payable = 150 – 0 = 150 |

| Wholesaler to Retailer | Product Cost: 1,200 Output VAT = 1,200 * 10 / 100 = 120 Input VAT = 110 (the VAT paid) Net VAT payable = 120 – 110 = 10 | Product Cost: 1,200 Output GST = 1,200 * 15 / 100 = 180 Input GST = 180 (the GST paid) Net GST payable = 180 – 150 = 30 |

| Retailer to End Consumer | Product Cost: 1,500 Output VAT = 1,500 * 10 / 100 = 150 Input VAT = 120 (VAT paid to wholesaler) + 10 (VAT paid to manufacturer) = 130 Net VAT payable = 150-130 = 20 | Product Cost: 1,500 Output GST = 1,500 * 15 / 100 = 225 Input GST = 180 (GST paid to the wholesaler) + 30 (GST paid to the manufacturer) = 210 Net GST payable = 225 – 210 = 15 |

The Bottom Line

Having discussed GST vs VAT, we can conclude that GST streamlines the Indian taxation system by subsuming various taxes under one umbrella. It not only eliminates the possibility of double taxation but also increases the rates of tax compliance. VAT, on the other hand, comes with some complications, and finally results in higher purchase prices.

By

By