Process to Claim GST Refund Excess Balance in Cash Ledger

- 18 Jul 25

- 10 mins

Process to Claim GST Refund Excess Balance in Cash Ledger

Key Takeaways

- GST refund can be claimed for any excess amount reflected in the electronic cash ledger due to overpayment or TDS/TCS credits.

- There is no time limit to claim a refund of excess cash balance, and the unjust enrichment clause does not apply.

- Refund applications must be filed using Form GST RFD-01 through the official GST portal.

- Taxpayers must submit supporting documents and complete Aadhaar authentication to process the refund.

- Once submitted, the refund application is scrutinized by the tax authority and disbursed directly to the taxpayer’s bank account.

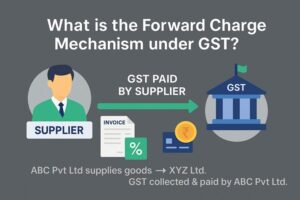

Goods and Services Tax (GST) is levied on the supply of goods and services, whether within a state (intra-state) or between states (interstate). If your electronic cash ledger reflects an excess balance due to excess tax paid, you can claim a refund of the same.

GST refund of the excess balance in the cash ledger has a specific process, which you need to use for compliance with Indian GST laws. Learn about the process here in detail for a seamless journey.

What Is an Electronic Cash Ledger?

An electronic cash ledger includes the details of deposits and payments that a taxpayer makes. You can access it after you log in to the GST portal. Navigate to the 'Services' option, then 'Ledgers' and then 'Electronic Cash Ledger'. You can generate a challan in Form GST PMT-06 on the portal, and fill in the amounts deposited towards tax, interest, fees and penalty or additional applicable amounts.

What Is a GST Refund?

Section 54 of the CGST or SGST Act highlights details about GST refunds. Here are the aspects included under the GST refund:

● If there is any excess payment in the electronic cash ledger that you claim in your returns

● Unutilised input tax credit (ITC) pertaining to zero-rated supplies made without payment of tax, or if a credit has accumulated due to a higher tax rate on input tax credit compared to the tax rate on output services (excluding nil-rated or fully exempt supplies).

● If tax is paid by a special agency of the United Nations or other Multilateral Financial Institution and Organisation mentioned by the United Nations (Privileges and Immunities) Act, 1947. It further includes tax paid on inward supplies by the Consulate or Embassy of countries other than India.

Different important sections of the GST Act highlight the refund mechanism. For instance, Section 49(6) of the Act states that the excess amount will be refunded as per the provisions of Section 54 of the CGST Act. Section 54(6) of the CGST Act, read together with Rule 91 of the CGST Rules, pertains to the issuance of provisional refunds.

Reason for Excess Amount in Cash Ledger

Maintaining a balance in the electronic cash ledger helps an individual meet their GST obligations. You might find an excess balance in your Electronic Cash Ledger, which can be for various reasons.

Here are the reasons for the excess balance in the electronic cash ledger:

● If you pay excess taxes by mistake

● In case there is a TDS (Tax Deducted at Source) or TCS (Tax Collected at Source) credit in your account. Notably, under Section 51/52 of the CGST Act (Central Goods and Services Tax Act), you can claim a refund of TDS or TCS credit in your electronic cash ledger, as they are considered excess balances in your Electronic Cash Ledger. However, a registered person is not required to use TDS/TCS amounts in the electronic cash ledger solely for tax payment. They may discharge tax liability using either the electronic credit ledger or cash ledger, based on preference and available balance.

Moreover, if there is an incorrect tax mentioned, such as CGST, SGST or IGST (Central Goods and Services Tax, State Goods and Services Tax or Integrated Goods and Services Tax), the GST authorities will verify the details.

However, a taxpayer can claim refunds for such incorrect and excess taxes, which will be refunded as per the GST law upon successful verification. The excess amount of tax paid further can be adjusted or carried forward for future payments.

Time Period to Claim GST Refund

Section 54, sub-section 1 of the CGST Act highlights the time period pertaining to GST refund. It states that there is no time limit applicable to a refund application for the excess balance in the electronic cash ledger of an individual. This section further presents that the unjust enrichment clause does not apply in such a scenario.

Step-by-Step Guide to Claim Refund of Excess Balance in Electronic Cash Ledger

The GST regime provides a standardised form for filing of refund claim. Here are the simple steps to claim a refund under the GST system:

Step 1: Log in to the official GST portal using valid user credentials.

Step 2: Go to the ‘Services’ option, then ‘Refunds’ and then ‘Application for Refund’.

Step 3: On the next redirected page of ‘Select Refund Type’ to clarify the types of refunds, choose the reason as ‘Excess Balance in the Electronic Cash Ledger’.

Step 4: Select ‘Create Refund Application’.

Step 5: You will find the ‘GST RFD-01 - Excess Balance in the Electronic Cash Ledger’ page.

Step 6: The balance amount will auto-populate on Form GST RFD - 01.

Step 7: In Table ‘Refund Claimed’, fill in the amount of refund claimed for Central Tax, State/Union Territory Tax or Integrated Tax. Notably, the amount you fill in cannot exceed the balance in your electronic cash ledger.

Step 8: To check outstanding details or tax liability, you can check the Electronic Liability Ledger.

Step 9: From the drop-down list, choose ‘Select Account Number’ where you wish the refund of tax paid to be credited.

Step 10: Ensure you upload supporting documents such as challans, payment receipts or additional proof. You can upload 10 documents at a maximum, each with a maximum size of 5 MB.

Step 11: Fill in the document description and choose ‘Add Document’ to upload.

Step 12: If you want to delete any document, click on the ‘Delete’ option.

Step 13: In case you have completed uploading documents, click ‘Save’.

Step 14: You can see a confirmation message on your screen mentioning ‘Your Application Has Been Saved’. Notably, you can retrieve and submit the application within 15 days. To further access the application, navigate to the GST portal and find ‘Services’, ‘Refunds’, ‘My Saved/Filed Applications’ and then the concerned file.

Step 15: Select the ‘Preview’ option to download the form in PDF format.

Step 16: Select the ‘Proceed’ option.

Step 17: Choose the ‘Declaration’ checkbox.

Step 18: From the drop-down list, select the name of the authorised signatory.

Step 19: To verify the application, select ‘File with DSC’ or ‘File with EVC’. For DSC, you need to verify with a digital signature certificate and for EVC, you need to verify with an OTP.

Step 20: You can view the success message on the screen and the status as submitted. Ensure you keep the Application Reference Number (ARN) downloaded. You will receive it via your email and registered mobile number.

Important Things to Remember While Claiming GST Refund for Excess Balance in Cash Ledger

Here are the important things to remember about the refund process:

● If your application is complete, you will receive an acknowledgement in Form GST RFD - 02.

● Once you file a debit entry in the refund application, the Electronic Cash Ledger will reflect the amount claimed.

● You can download the file applications (ARNs) in PDF format using ‘My Saved/Filed Applications’.

● Under the ‘Refund’ option, you can track your application using the ‘Track Application Status’ option.

● As soon as you generate the ARN of the refund application in Form RFD-01, the refund application is assigned to the Refund Processing Officer for further processing.

● Once the application is processed, the Jurisdictional Authority disburses the refund after scrutiny.

● After the Tax Official processes and sanctions the application for a refund, the Tax Official disburses the refund.

● Ensure you consider Aadhaar authentication for the refund application.

● There is no minimum limit to the refund for the excess balance in the electronic cash ledger.

● Under Rule 89(2)(l) or 89(2)(m) of the CGST Rules, 2017, you do not need to furnish certifications or declarations for not passing the tax incidence to any other person if the refund of the balance in the electronic cash ledger as unjust enrichment is not applicable.

Conclusion

To claim a GST refund for the excess balance in the cash ledger, you must follow the procedure prescribed by the GST authorities. All you need to do is navigate to the ‘Services’ option on the common portal (unified portal) to claim for refund and go through the above-outlined steps.

Even though there is no timeline to claim the eligible refund, you need to raise the claim as early as possible. The GST authorities provide the refund after scrutiny to your bank account for other uses. This ensures seamless vendor payments, vendor management and vendor delight in the complete supply chain solution and business compliances.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By