Trending Blogs

Must Read

by Key Takeaways The export of goods refers to the movement of goods outside India. Under GST, such transactions are classified as zero-rated supplies. However, the Central Government has the authority to notify specific categories of goods supplies that qualify as deemed exports. This implies that these supplies are treated as exports even though the goods […]

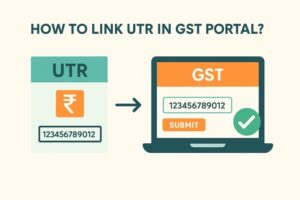

One App for all Business Payments

Pay your Vendors, Suppliers, Rent or GST using UPI and Credit Card

Download Now