GST on Branded and Unbranded Products

- 24 Jul 25

- 10 mins

GST on Branded and Unbranded Products

Key Takeaways

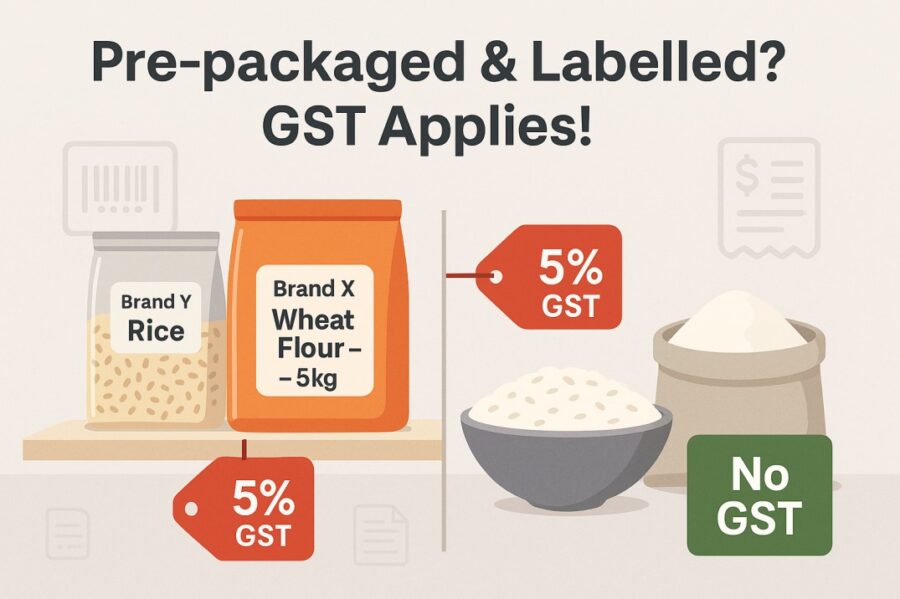

- Post 18th July 2022, GST is applicable on all ‘pre-packaged and labelled’ goods, regardless of branding.

- GST exemptions for unbranded goods were withdrawn to standardise taxation across packaged commodities.

- Only goods not meeting the definition of ‘pre-packaged and labelled’ under the Legal Metrology Act remain exempt.

- A uniform 5% GST applies to several food staples like rice, wheat, pulses, paneer, honey, and more when pre-packaged.

- The GST shift impacts both small sellers and end consumers, but fosters formalisation and better compliance in trade.

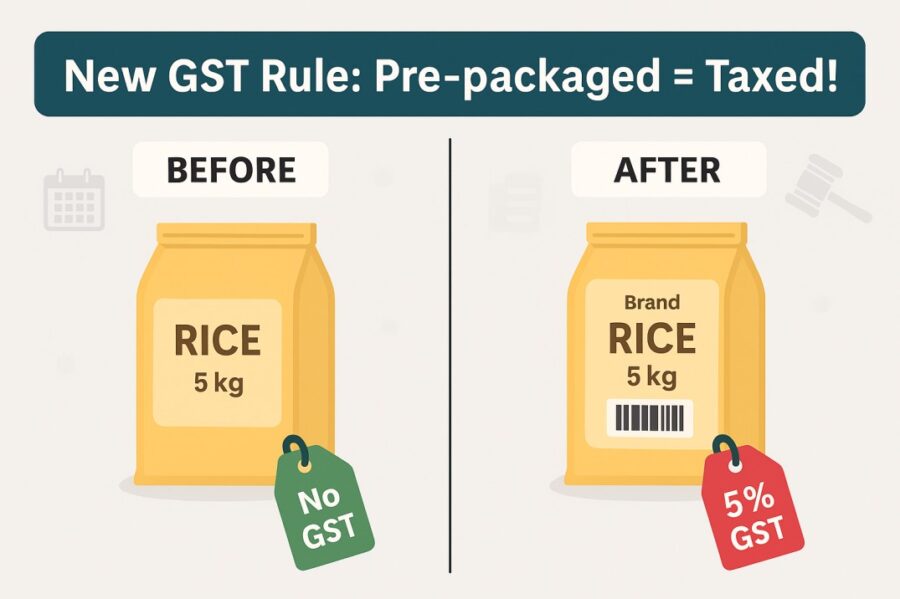

Finance Minister Nirmala Sitharaman chaired the 47th GST Council Meeting, recommending the revision of GST exemptions for pre-packaged as well as labelled goods. Before, food items, including wheat, rice, honey, etc., were exempt from taxes if they were sold under unregistered brand names or with no enforceable rights.

This article shall delve into GST applicability on pre-packaged goods, the conditions which apply and other details. Understand the nuances of GST on branded and unbranded products in depth, as well as the corresponding impact on businesses/consumers.

Applicability of GST on Pre-packaged & Pre-labelled Goods

This section lists the actions undertaken by the Indian Government, with the aim of implementing the 47th GST Council’s recommendations. Regarding GST applicability on pre-labelled and pre-packaged items, here are the proceeds:

- Issue of notification no. 6/2022: On the 13th of July, 2022, a fresh notification (amendment of notification no. 1/2017- Central Tax of 28th June 2017) was issued with updates made to the GST rates for 'pre-packaged and labelled' commodities. This change in tax rates applies to certain food items, introducing new GST rates for such products. The changes were aimed at clarifying and standardising the tax structure for packaged goods. It has also had an impact on how businesses/consumers are taxed on such items.

- Issue of notification no. 7/2022- A fresh notification issued on the 13th of July, 2022, removed tax exemption on certain pre-packaged/labelled goods. This meant that the tax-free items prior to the change, like particular food products, were now subject to the GST rates.

- Issue of Frequently Asked Questions (FAQs): This issue is dated 17th July, 2022 and clarifies GST applicability on various pre-packaged/labelled goods.

GST Position on Packaged and Labelled Items Till 17th July, 2022

Here is an overview of the position of GST on various packaged as well as labelled commodities as applicable up to 17th July, 2022:

| Particulars | Condition 1: Particular types of goods put in unit containers; |

| Particulars | Condition 2: It must either have a registered brand name or a brand name with regard to which an actionable claim in a court of law is available. |

| GST Applicable or Benefit of Exemption is Granted | GST is applicable |

| Particulars | Condition 1: Particular types of goods put in unit containers; |

| Particulars | Condition 2: It must either bear an unregistered brand name or a registered brand name with regard to which an actionable claim is forgone. |

| GST Applicable or Benefit of Exemption is Granted | Exemption under GST is granted |

Note: Earlier, the applicability of GST was based on whether certain products were unbranded or branded food products. Later, with the effect starting 18th of July 2022, the whole concept of GST applicability on the branded/unbranded product basis was erased. Currently, GST applicability relies on the ‘pre-packaged and labelled’ goods phrase.

What is a Pre-packaged Commodity?

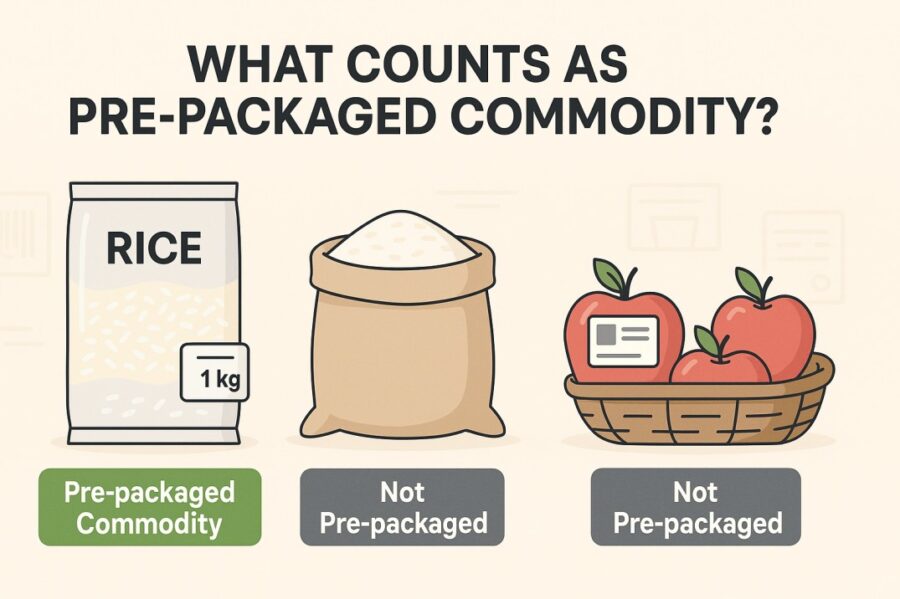

Understanding the meaning of the phrase 'pre-packaged and labelled' goods is crucial in the context of comprehending the new change in GST applicability. The 2 notifications, i.e. notification no. 6/2022- Central Tax and the notification no. 7/2022- Central Tax (13th July 2022) define the phrase ‘pre-packaged and labelled’.

So, the following section discusses what ‘pre-packaged and labelled’ goods imply.

Section 2(l) of the Legal Metrology Act, 2009 defines ‘Pre-packaged commodity’ as mentioned below:

It is a package that must bear the declaration corresponding to the provisions under the Legal Metrology Act and associated rules.

This is what the above means, in simpler terms:

- 'Pre-packaged commodity’ refers to a commodity that is packaged without the presence of the purchaser.

- The commodity is put in a package form, which may either be sealed or unsealed.

- The commodity is packaged in a way that the goods contained in it have a predetermined value/quantity.

The Legal Metrology Rules, 2011 feature a specific Rule 6, which requires the following details regarding every package to be declared:

- Name of the commodity

- Details of the manufacturer (including name as well as the address of manufacturer)

- Quantity

- Retail sale price

- Month as well as year of manufacture/ pre-packing/ import, etc.

- The Legal Metrology Rules, 2011, feature rule 3, which insists the declaration may not be required in relation to:

- Packages of such commodities which contain a quantity of above 25 kg or 25 litres and Packages of such commodities are kept aside for institutional consumers or industrial users.

Change in the Position of GST Applicability on 'Pre-packaged and Labelled Goods'

Applicability of GST depends completely on the scope of the phrase ‘pre-packaged and labelled’, with effect from the 18th of July, 2022. Here are the nitty-gritty details in regards to GST rate of tax applicability and exemption, effective from the 18th of July, 2022 onwards:

| Particulars | GST Applicable or Exempted |

| Specified items as mentioned within the scope of ‘Pre-packaged and labelled’ goods | GST is applicable |

| Specified items not included within the scope of ‘Pre-packaged and labelled’ goods. | Exemption in Respect to GST |

Refer to the table below for the list of particular goods mentioned alongside their HSN, taxable under GST if mentioned within the scope of ‘pre-packaged and labelled’:

| HSN Code | Goods’ Description | Applicable GST Rate |

| 0202/ 0203/ 0204/ 0205/ 0206/ 0207/ 0208/ 0209/ 0210 | · Meat· Edible meat offal | 5% |

| 0303/ 0304/ 0305/ 0306/ 0307/ 0308/ 0309 | · Fish· Crustaceans· Molluscs and other aquatic invertebrates | 5% |

| 0403 | · Curd· Lassi· Buttermilk | 5% |

| 0406 | · Chena· Paneer | 5% |

| 0409 | Natural honey | 5% |

| 0504 | · Guts· Bladders and stomach of animals (except for fish)· Whole and pieces which may be frozen/smoked fresh/ dried/chilled/salted/in brine | 5% |

| 0713 | · Dried leguminous vegetables, shelled (may or may not be skinned or split | 5% |

| 0714 | · Manioc· Arrowroot· Salep· Jerusalem· Artichokes· Sweet potatoes, other similar roots and tubers which have a high starch or inulin content; may be frozen (may or may not be sliced; may or may not be in the form of Pellets) | 5% |

| 08 | Dried makhana (may or may not be shelled/ peeled) | 5% |

| 1001 | Wheat and meslin | 5% |

| 1002 | Rye | 5% |

| 1003 | Barley | 5% |

| 1004 | Oats | 5% |

| 1005 | Maize Corn | 5% |

| 1006 | Rice | 5% |

| 1007 | Grain sorghum | 5% |

| 1008 | · Buckwheat· Millet and canary seed, other cereals including Bajra, Jawar, Ragi | 5% |

| 1101 | · Wheat· Meslin flour | 5% |

| 1102 | Cereal flours other than meslin, wheat, Rye flour, maize flour, etc. | 5% |

| 1103 | · Cereal groats, meal and pellet | 5% |

| 1105 | Flour/ granules/ powder/ pellets/ flakes of potatoes | 5% |

| 1106 | Flour of:Dried leguminous vegetables of 0713 heading (pouch of pulses) (Does not include 1106 10 10 (guar meal) and 1106 10 90 (guar gum refined split));Roots, sago or tubers of heading 0714;Products mentioned in Chapter 8, including tamarind, mango flour, singoda, etc. | 5% |

| 1701/1702 | Jaggery of all types, which includes cane jaggery (gur, palmyra jaggery), Khandsari sugar | 5% |

| 1904 | · Puffed rice (also known as Muri)· Flatted or beaten rice (also known as Chira)· Parched rice (also known as khoi]· Parched paddy, rice coated with sugar, gur (also known as Murki) | 5% |

| 3101 | · Animal or vegetable fertilisers (may or may not be mixed together/chemically treated), fertilisers by mixing/ chemical treatment of the animal or vegetable products· Organic manure | 5% |

| 53 | Coir pith compost | 5% |

| 2009 89 90 | Tender coconut water | 12% |

Conclusion

We can thus conclude that the implementation of GST on branded and unbranded products has triggered significant alterations within the taxation structure in India. With specified products now being subject to GST rates, the aim of leveling the playing field and boosting tax revenues has been achieved.

On the other hand, the shift has impacted smaller businesses as well as consumers. Yet, it’s important to note how the changes have also promoted an organised and formal overall market.

The GST framework continues to evolve, and it's incredibly important to monitor its impact across various industries, make spontaneous adjustments, etc. These shall be done with the goal of ensuring a smooth transition in the long run and gaining optimal benefits for every stakeholder.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By