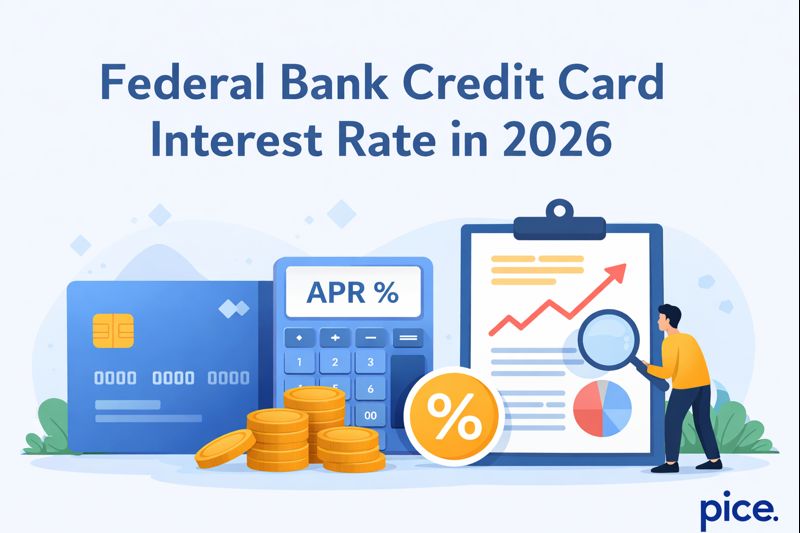

Federal Bank Credit Card Interest Rate in 2026

- 22 Jan 26

- 7 mins

Federal Bank Credit Card Interest Rate in 2026

- Federal Bank Credit Card Interest Rate

- Federal Bank Credit Card Interest-Free Grace Period

- 11 Features of Federal Bank Credit Cards

- Eligibility Criteria for Federal Credit Cards

- How to Apply for a Federal Bank Credit Card?

- Documents Required for Federal Bank Credit Cards

- Fees and Charges on Federal Bank Credit Cards

- Conclusion

Key Takeaways

- The Federal Bank credit card interest rate ranges from 8.28% to 45% annually, depending on your outstanding balance.

- Paying the full bill within the interest-free period (up to 48 days) helps avoid the interest rate entirely.

- Higher average balances attract a lower interest rate, making disciplined usage rewarding.

- Cash withdrawals and partial payments can significantly increase costs due to the Federal Bank credit card interest rate.

- Smart spending, EMI conversion, and balance transfers help reduce the impact of the Federal Bank credit card interest rate.

Looking to make the most of your credit card without overspending? Understanding Federal Bank credit card interest rates is the key. With rates ranging from 8.28% to 45% annually, knowing how and when interest is charged can help you manage your finances smartly.

By staying informed about your interest-free period and outstanding balance, you can enjoy maximum benefits while avoiding extra charges.

Explore the latest rates, exclusive perks, and smart ways to use your Federal Bank credit card to your advantage.

Federal Bank Credit Card Interest Rate

| Average Monthly Balance in the Previous Quarter | Monthly Interest Rate | Annual Percentage Rate |

| Less than ₹50,000 | 3.75% | 45% |

| ₹50,000 to ₹3,00,000 | 2.69% | 32.28% |

| ₹3,00,001 to ₹10,00,000 | 1.69% | 20.28% |

| Above ₹10,00,000 | 0.69% | 8.28% |

Understanding the interest rate also helps in better management of your credit limit and other financial products associated with your credit card.

Federal Bank Credit Card Interest-Free Grace Period

An interest-free period on credit cards refers to the time frame between the date of the transaction and the bill due date. During this period, Federal Bank does not levy any interest on transactions. As a result, if you pay your bill within this period, you can avoid additional interest payments.

The interest-free period on Federal Credit Cards can go up to 48 days. Notably, the interest-free period for all the transactions is not the same. It varies based on the transaction date and the bill due date.

11 Features of Federal Bank Credit Cards

- You can use your Federal Bank credit card for international transactions at over a million outlets, including travel bookings and utility bill payments.

- As a cardholder, you can get the joining fee waived if you meet the spend criteria within the first 3 months.

- You can avail an annual membership fee waiver by meeting the annual spend criteria.

- As a cardholder, you can earn reward points on your spending using Federal Bank credit cards and enjoy exclusive Reward Points Benefits.

- You can get a fuel surcharge waiver of 1% up to ₹150 per month on spends between ₹400 and ₹5,000 on Imperio and Celesta cards.

- As a primary cardholder, you can apply for up to 4 add-on cards with Signet, Celesta and Imperio variants.

- You can withdraw cash using your credit card in case of emergencies (chargeable).

- As a cardholder, you can pay bills, make digital payments, and book tickets online.

- You can consider a balance transfer to cards with lower interest rates.

- As a cardholder, you will be able to convert your spending into convenient EMI (Equated Monthly Instalments) on your credit card.

- Lounge access is also provided by many Federal Credit Cards in both domestic and international airports, and this makes travelling easy.

Eligibility Criteria for Federal Credit Cards

- In the case of secured credit cards, one must be of age 18 or more.

- You should be 21 years old to apply for an unsecured credit card.

- You may be a resident Indian or a non-resident Indian.

- Make sure that you have a good credit score of 750 and above.

- Credit Limit will vary according to your income profile and creditworthiness.

How to Apply for a Federal Bank Credit Card?

Step 1: Access the Federal Bank LTD official site, navigate to the Cards section, and visit the closest branch of the Federal Bank or go to the Federal Bank Cards section.

Step 2: Select your preferred credit card and proceed to click on the ‘Apply Now’ button.

Step 3: Enter details of the online application form including personal and financial details.

Step 4: Post the required documents including identity proof, address proof and income proof.

Step 5: Click on the Submit button and the process is complete.

A confirmation of the application will be sent via email. You may have to go through vKYC in case you are a new customer. Once the process is completed, you will receive your credit card. You can also track your Application Process through Mobile Banking.

Documents Required for Federal Bank Credit Cards

- Identity proof such as PAN card, Aadhaar card, driving license, passport, voter's ID card, NREGA-issued job card or a person of Indian origin card

- Address proof such as Aadhaar card, passport, voter’s ID card, driving license, bank account statement and others

- Income proof such as Form 16, pay slip for the previous 3 months, and bank statement for the preceding 3 months

Fees and Charges on Federal Bank Credit Cards

| Parameter | MasterCard/ VISA Signet Credit Card | MasterCard/ VISA Imperio Credit Card | MasterCard/ VISA Celesta Credit Card | Wave Card |

| Minimum Amount Due | 5% or a minimum of ₹100 | |||

| Joining Fee | ₹750 (waived off on spending ₹10,000 within the first 3 months) | ₹1,500 (waived off on spending ₹20,000 within the first 3 months) | ₹3,000 (waived off on spending ₹30,000 within the first 3 months) | Not Applicable for virtual cards; ₹199 for physical cards |

| Annual Fee | ₹750 (waived off on spending ₹75,000 in the previous year) | ₹1,500 (waived off on spending ₹1.5 Lakh in the preceding year) | ₹3,000 (waived off on spending ₹3 Lakh in the previous year) | ₹199 |

| Add-on Credit Card Fee | ₹100 per card | |||

| Cash Advance Limit | 10% | 20% | 25% | As per the primary card variant |

| Cash Advance Fee | 2.5% of the withdrawn amount or ₹500, whichever is higher | |||

| Foreign Currency Mark-up Fee | 3.5% | 3.5% | 2% | 3.5% |

| Overlimit Charges | 2.5% of the overlimit amount with a minimum of ₹500 | |||

| Late Payment Fee | ₹0 to ₹250: Not Applicable₹251 to ₹1,000: ₹250₹1,001 to ₹5,000: ₹500₹5,001 to ₹25,000: ₹1,000Above ₹25,001: ₹1,250 | |||

The mark-up fee applies to foreign transactions and may vary depending on the card variant. If you hold a Federal Bank Scapia Credit Card, you may also enjoy lower mark-up fee and better benefits on international travel expenses.

💡Pay your credit card bills in an easy and secure way with the PICE App.

Conclusion

If you have a low outstanding balance, the Federal Bank credit card interest rate will be low. However, to avoid paying additional interest charges, ensure you pay the total bill amount within the due date.

If you are unable to pay the entire bill amount, pay at least the minimum due amount (found on the billing statement) or a partial amount to reduce your interest charges.

Avoiding cash withdrawal with your credit card can further help you reduce the interest amount payable. Managing your Credit Limit wisely, using the rewards program effectively, and leveraging digital payments will help you make the most of your Federal Credit Cards.

By

By