Trending Blogs

Must Read

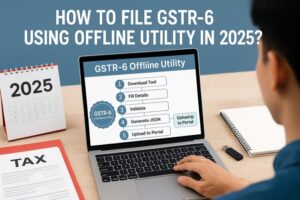

by Key Takeaways Input Service Distributors (ISDs) need to file GSTR-6 monthly return. This helps them furnish input service details of distribution and ISD credit follwed by invoices for tax compliance on applicable returns. Knowing how to file GSTR-6 using an offline utility can help you experience a smooth and hassle-free process while filing the same. […]

One App for all Business Payments

Pay your Vendors, Suppliers, Rent or GST using UPI and Credit Card

Download Now