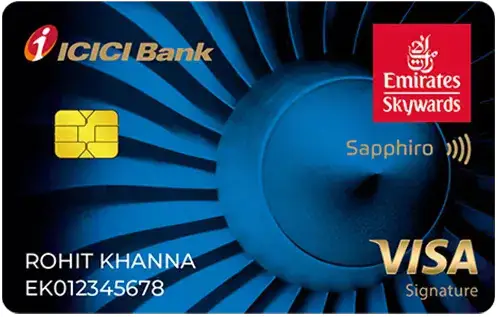

Emirates Skywards ICICI Bank Sapphiro Credit Card: Features & Benefits

- 12 Dec 25

- 3 mins

Emirates Skywards ICICI Bank Sapphiro Credit Card: Features & Benefits

Key Takeaways

- Earn 2 Skywards Miles per ₹100 spent, making it ideal for frequent Emirates flyers.

- Get 5,000 bonus miles and Silver Tier Membership, adding value from day one.

- Enjoy international and domestic lounge access, with spend-based unlocks.

- Save more with cashback, fuel surcharge waiver, and BookMyShow offers.

- At ₹5,000 + GST annual fee, it delivers solid travel rewards at a reasonable cost.

The Emirates Skywards ICICI Bank Sapphiro Credit Card suits Emirates loyalists who want solid travel value at a fair fee.

You earn 2 Skywards Miles on every ₹100 spent, both domestic and international. Miles credit at the end of each billing cycle.

You can earn miles on dining, travel and entertainment. These miles can be redeemed for flights, upgrades, hotel stays and more.

Emirates Skywards ICICI Bank Sapphiro Credit Card Benefits

The benefits begin with basics, such as 4% cashback on iShop and 1% surcharge waiver for fuel spends of ₹400–₹4,000.

These benefits offer quick savings.

The other core benefits are:

- 5,000 Skywards Miles and Silver Tier Membership

- 5,000 miles on annual renewal

- Enjoy 2 international lounge visits each year

- Unlock 2 domestic lounges after ₹75,000 quarterly spends

- Get up to ₹500 off on the second BookMyShow ticket

ICICI Emirates Sapphiro Credit Card Fees and Charges

The joining and annual fee of the Emirates Sapphiro Credit Card is ₹5,000 + GST. However, if you have a supplementary card, you would need to pay another ₹199.

A few other important charges are:

| Parameters | Charges |

| Card Replacement | ₹200 |

| ATM Withdrawal | 3.75% |

| Finance Charges | 3.75% (monthly); 45% (annually) |

| Overlimit Charges | 2.50%; (min. ₹550) |

| Late Payment Fees | ₹100 - ₹1,300 depending on the amount |

Never pay a late fine again! Download the Pice App and let it manage your credit card bill payments. Automated, timely reminders will ensure you never pay anything extra.

Footnotes: You must spend ₹5 lakh each year to keep your Emirates Silver Tier status active.

By

By