Form DRC 19 in GST: Application to the Magistrate for Recovery

- 16 Jul 25

- 5 mins

Form DRC 19 in GST: Application to the Magistrate for Recovery

Key Takeaways

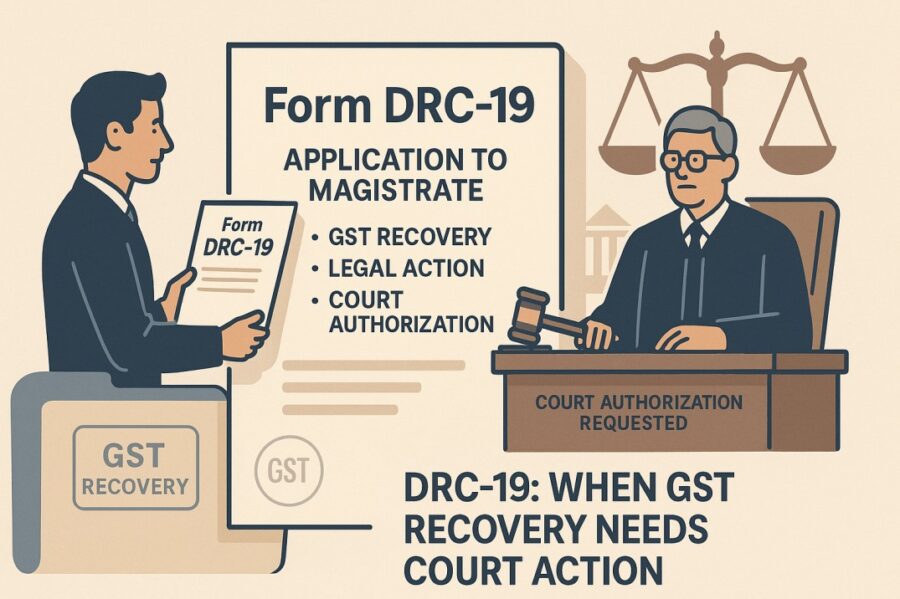

- Form DRC-19 is an application submitted by a GST officer to a Magistrate for recovering tax dues as a fine under the Code of Criminal Procedure.

- It applies when GST dues are unpaid, short-paid, or wrongly refunded, including incorrect ITC claims.

- The form includes taxpayer details, order summary, payable amount, penalties, and interest, ensuring transparency.

- DRC-19 enables legal recovery through judicial intervention, treating tax dues like court-imposed fines.

- Understanding DRC-19 helps taxpayers respond appropriately to official orders and avoid legal consequences.

When the registered taxpayer has to deal with obligations under the GST (Goods and Services Tax) regime, they often have to navigate different forms and procedures. The DRC-19 in GST is one such crucial form. It is related to the order summary passed under Section 73/Section 74 of the GST Act.

Within this context, having an understanding of the purpose and application of Form DRC-19 becomes necessary for taxpayers. Equipped with the appropriate information, one can ensure compliance and conveniently manage their tax obligations in the process.

What is Demand and Recovery under the GST Regime?

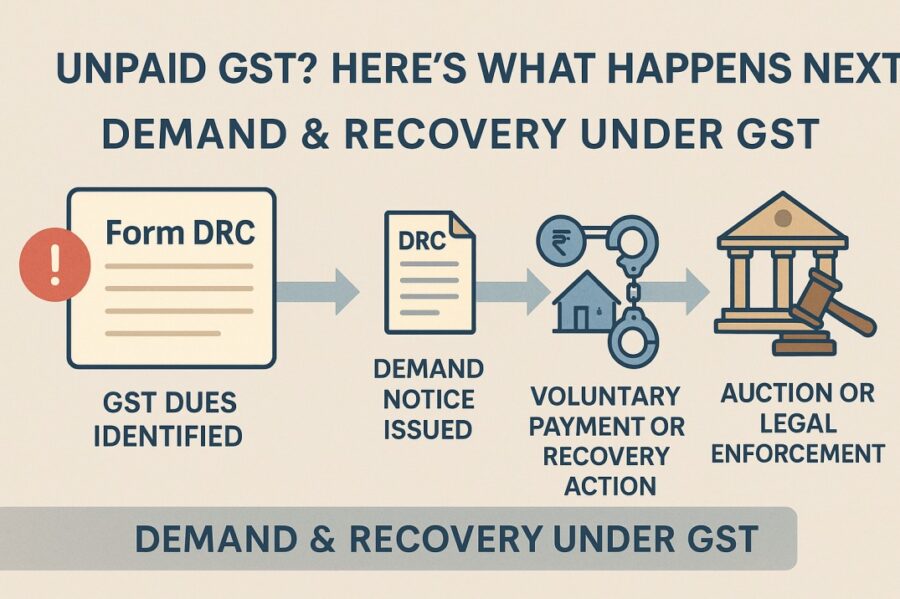

A Demand and Recovery Case (DRC) is a legal process, as a part of which, the tax department issues a notice to an entity. If a business group is unable to pay the accurate amount of GST, the respective notice shall be issued. DRC is the tool wielded by the Indian government to ensure the transparent workings of various businesses based within the country.

If the taxpayer owes more money compared to the GST amount they have paid, the Indian government will proceed to issue the DRC. The legal body will demand the payment of the pending amount. This notice will also mention the applicable penalty/interest values.

The taxpayer shall request the facility of payment in instalments. They may alternatively submit an application for extension of the due date within which they are to make the full payment.

DRC plays an important role within the GST framework. It prompts the seamless operation of the tax collection system and minimises the risk of tax evasion. It also ensures that the businesses are making timely payment of taxes, thus allowing the government to track and recover any residual dues.

About DRC 19 in GST

The DRC 19 application is meant for the Tax Official. It is the “Application to the Magistrate for Recovery as Fine”.

If an amount is to be recovered as though it were a fine imposed under the Code of Criminal Procedure, 1973, the proper officer shall submit an application in FORM GST DRC-19 to the appropriate Magistrate, requesting recovery of the specified amount from the defaulter as if it were a fine imposed by the Magistrate.

It deals with the scenarios where taxes are short paid, not paid at all, refunded, or in case the input tax credit is wrongly availed/utilised. Any case of non-payment of tax can call for the use of DRC.

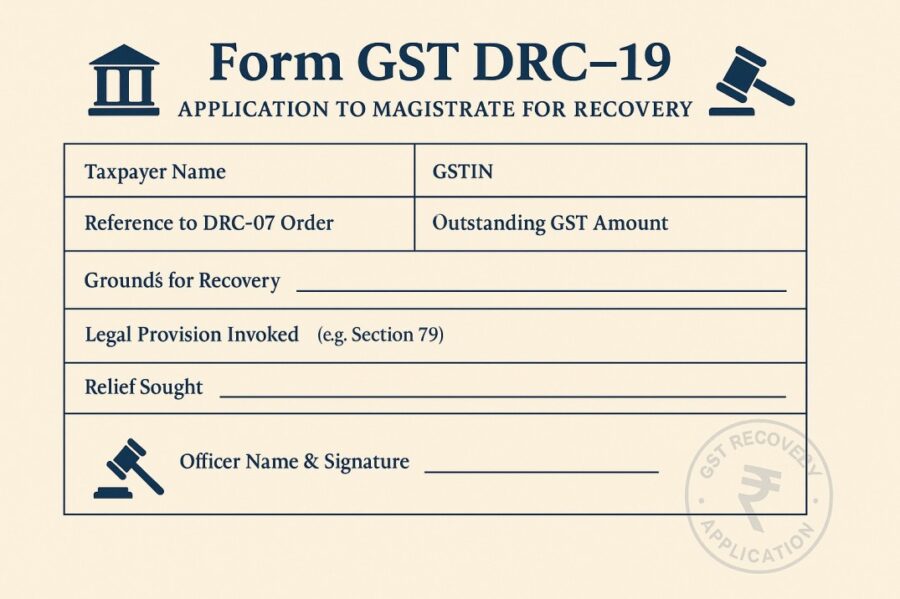

The DRC-19 is a document which summarises the crucial details in association with the order, including:

- Taxpayer-related information

- Details about the tax demand

- Amount payable

- Penalty (if applicable)

- Interest (if applicable)

The Form DRC-19 in GST serves the purpose of providing a dependable and concise summary of the order. This essentially enables the registered taxpayer to have an aided understanding of the tax demand and, therefore, initiate the necessary moves to comply with the GST regulations.

The Form GST DRC-19 facilitates transparency and enhanced clarity regarding tax demands, allowing the taxpayer to smoothly manage their tax liabilities.

Format of Form GST DRC–19

Here is the official format of the Form GST DRC–19:

Conclusion

To conclude, the Form GST DRC-19 assumes an important role in summarising tax demands and orders under the GST regime. This extends clarity and transparency on the taxpayers’ end. With a better understanding of the DRC-19 in GST, taxpayers can ultimately manage their tax obligations and ensure compliance with the GST regulations.

💡If you want to streamline your invoices and make payments via credit or debit card or UPI, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By