Difference Between RuPay and Visa Credit Card Explained

- 16 Oct 25

- 7 mins

Difference Between RuPay and Visa Credit Card Explained

Key Takeaways

- The primary difference between RuPay and Visa credit card lies in their operation areas — RuPay functions mainly in India, while Visa has global acceptance in over 200 countries.

- RuPay processes transactions within India, offering enhanced data security and faster approvals. Visa, on the other hand, processes data internationally, which may lead to slightly higher risk and slower transaction speed.

- RuPay credit cards are fully integrated with UPI, allowing tap-and-pay and scan-and-pay features directly through apps. Visa credit cards do not currently support UPI integration in India.

- RuPay credit cards generally have lower joining, processing, and transaction fees, while Visa cards may carry slightly higher costs due to global network charges.

- If you frequently make domestic transactions, RuPay is a better choice for cost efficiency and security. However, if you travel abroad or make frequent international payments, Visa offers better global reach and acceptance.

Did you know that the credit card market surged to its highest in India in 2024, with 100 million active credit cards? Multiple banks issue millions of credit cards every year. If you are also deciding to become a member of the credit card community, it might be difficult to choose a card.

You can choose from multiple options such as RuPay, Visa and more. This read will provide you with the primary difference between RuPay and Visa credit cards, which will help you in deciding.

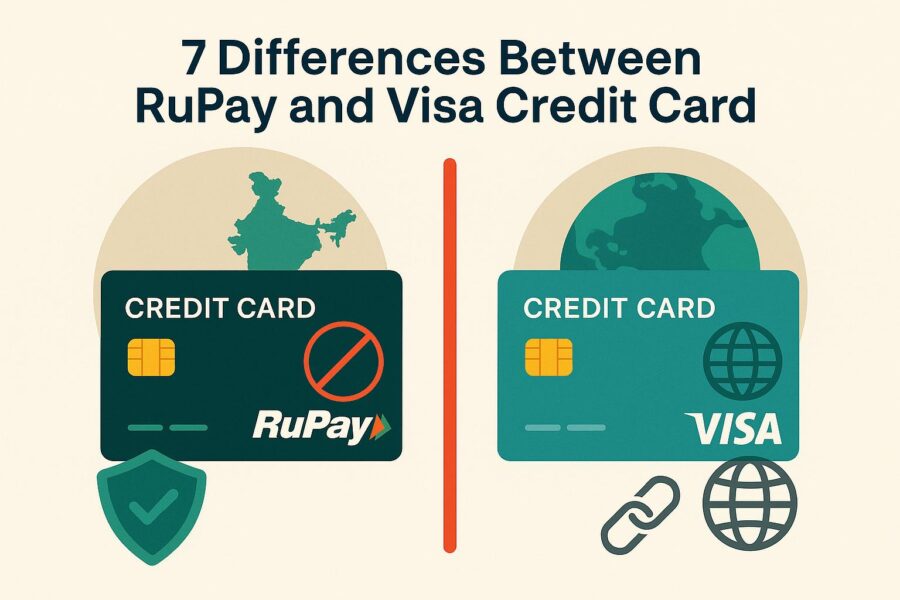

7 Differences Between RuPay and Visa Credit Card

| Factors | RuPay | Visa |

| BIHM UPI Integration | Yes | No |

| Data Processing | Verified and processed in India | Overseas processing required |

| Security | Lower data theft risk with more security in India | Due to international processing risks are a little bit higher |

| Operating Cost | Service charges, processing fees and transaction fees in India are lower | Moderate service charges, processing fees and transaction fees |

| Joining Fees | Minimal or free, depending on the bank | Foreign/ global payment network joining requires a quarterly fee |

| Transaction Speed/Processing Time | Faster than Visa | Comparatively higher due to international processing |

| Issuing Banks | State Bank of India (SBI)HDFC BankICICI BankPunjab National BankAxis BankUnion Bank of India | American ExpressHSBC BankAxis BankCitigroup BankHDFC BankICICI BankState Bank of India (SBI)Bank of Baroda (BoB)IndusInd BankUnion Bank of India |

What is a RuPay Card?

The National Payments Corporation of India Ltd (NPCIL) launched RuPay, which is a multinational financial service and payment system. It offers several cards to its customers, such as credit, debit, prepaid and more.

RuPay offers credit cards to its customers on the basis of factors like joining fee, spend limit, features and more. These varieties of credit cards serve different needs and categories of customers. Some of its cards include:

- Airtel Axis Bank RuPay Credit Card

- HDFC RuPay Shoppers Stop Credit Card

- ICICI Bank HPCL Super Saver RuPay Credit Card

- Union Bank Select RuPay Credit Card

- Axis NEO RuPay Credit Card

- Divaa RuPay Credit Card

4 Benefits and Features of RuPay Card

- Easy Transactions

RuPay cards simplify payments for retail shopping, bills, online purchases and e-commerce. They also enable cash withdrawals and balance inquiries at ATMs.

- Convenience and Transaction Security

These credit cards use advanced measures such as EMV chip technology and two-factor authentication for secure transactions. Cardholders receive instant SMS alerts after every transaction. It also has a contactless payment feature that adds more ease, allowing you to complete purchases by simply tapping the card on POS terminals.

- Travel Benefits

RuPay credit cards extend travel advantages. For every ₹100 spent on dining, travel and international purchases, you earn 10 reward points. Additionally, you receive one complimentary airport lounge visit every calendar quarter.

- Rupay Rewards

RuPay also offers exclusive rewards to cardholders. With the ‘RuPay Scan and Score program’, you can earn 1 RuPay Coin on every ₹100 spent using RuPay Credit Card UPI. With these coins, you can then unlock attractive prizes.

💡Pay your credit card bills in an easy and secured way and experience smooth transactions with the PICE App.

What is a Visa Card?

Visa operates as a US-based multinational company that provides payment gateway and card solutions. It ranks among the most popular card and payment networks, reaching more than 200 countries and working with over 14,500 financial institutions globally. They issue a wide variety of prepaid, credit and debit cards.

You can choose a Visa card that delivers traditional benefits or premium rewards. Besides flexible payment options, these cards also provide benefits such as cash back, travel rewards or additional perks. Some of its cards include:

- Visa Classic Credit Card

- Visa Gold Credit Card

- Visa Platinum Credit Card

- Visa Signature Credit Card

- Visa Infinite Credit Card

4 Benefits and Features of a Visa Card

- Widespread ATM Network

Its credit cards allow you to purchase items, pay bills or withdraw cash from more than 2 million ATMs worldwide with both convenience and security. It has over 200 countries in its network, which is increasing its international acceptance.

- Visa Rewards

Visa cards also give their customers exciting benefits, such as free tickets for movies and events when booking on BookMyShow. It also provides complimentary entry to both domestic and international airport lounges. You can earn up to six reward points for every ₹200 spent.

- Global Customer Assistance Service

When the customers have any kind of questions or concerns, the Visa Global Customer Assistance Service responds immediately. It operates 24 hours a day, seven days a week.

- Safe and Secure

Visa credit cards assure their security features, including a password-protected authentication system. Visa also protects all of its customers’ transactions, which are linked to their cards.

RuPay vs Visa Credit Card: Which Should You Prefer?

If your transactions are primarily domestic, RuPay credit cards can be a good choice for you. However, if you have both domestic transactions as well as international transactions, then going for a Visa credit card will be good.

Both of them offer different kinds of credit cards for different customer needs. They also enable digital payments and cashless transactions. So always remember to first list all you want from a credit card and then go searching for one that suits you!

Conclusion

Credit cards can prove to be very useful if you get the right one for your financial needs. This is the reason why knowing the primary difference between RuPay and Visa credit cards is essential before you even get one.

A RuPay credit card has higher security and lower operating charges than a Visa credit card. However, Visa credit cards provide attractive options for individuals who have both national and international transactions. So, select one for you wisely!

By

By