What’s the Difference Between Quotation and Invoice?

- 6 Nov 25

- 12 mins

What’s the Difference Between Quotation and Invoice?

- What Are the Key Differences Between a Quote and an Invoice?

- What Quotes Are and How They Fit into the Sales Process?

- 3 Tips To Prepare a Proper Quote

- 4 Benefits of Providing a Quote

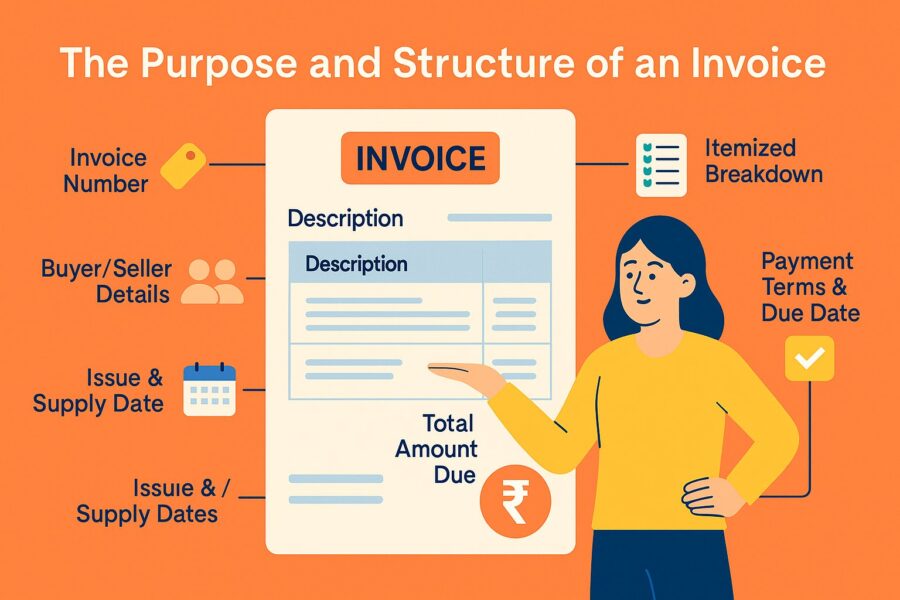

- The Purpose and Structure of an Invoice

- How Does the Invoice Process Work?

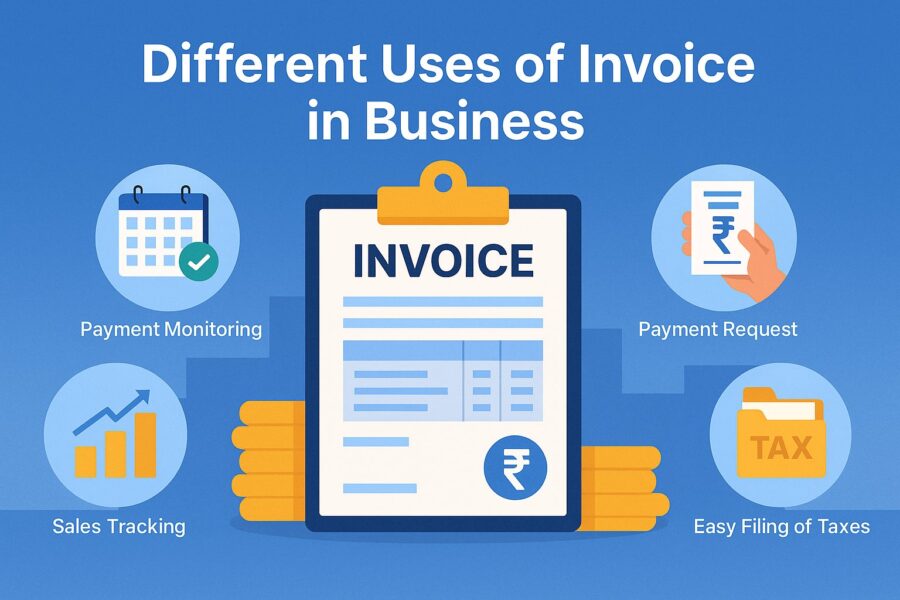

- 6 Different Uses of Invoice in Business

- Conclusion

Key Takeaways

- A quotation (quote) is issued before providing goods or services to estimate costs, while an invoice is issued after delivery to formally request payment.

- A quote is a proposal; an invoice is a payment request. Quotes outline estimated prices, scope, and validity periods, whereas invoices include final charges, payment due dates, and legal obligations.

- Proforma invoices act as a bridge between quote and invoice. Businesses may issue a proforma invoice to confirm terms and prices before sending the final invoice, ensuring both parties agree on expectations.

- Using digital invoicing and quoting software improves accuracy and efficiency. Automation tools like Zoho Invoice reduce manual errors, streamline processes, and help businesses respond quickly to client requests.

- Clear, transparent documentation builds trust and speeds up payments. Detailed quotes and invoices foster customer confidence, prevent disputes, and can reduce payment delays by up to 30%.

A quote and an invoice are not the same and serve different purposes in business transactions. A quote provides an estimated cost before finalising a product or service, whereas a final invoice is sent after delivery of goods and services, showing the final amount to pay.

For instance, a graphic designer might quote ₹20,000 for a particular design and later invoice ₹22,500 upon the addition of extra work. Sometimes, a proforma invoice may be issued before the final invoice to confirm the agreed terms.

Thus, knowing the difference between quotation and invoice is essential to prevent confusion and improve cash flow for any business owner. Continue reading to learn more.

What Are the Key Differences Between a Quote and an Invoice?

| Parameters | Quotation | Invoice |

| When Used | This is a pre-sale document issued before finalising the delivery of goods and services. | This is a post-sale document issued after delivery of goods and services. |

| Purpose | To provide cost estimation, define the scope of work and treat it as a proposal for winning business. | Formally requests payment for goods and services supplied. |

| Legal/Binding Nature | Legally binding only upon acceptance by customers. Unless accepted, it is a proposal or offer that can be accepted or rejected. | Legally binding upon issuance of goods and services delivered as agreed. Also, a formal payment request for work completion. |

| Content | Focused mainly on materials, labour costs, projected costs and scope of work. Also, includes a period of validity. | Includes details of incurred actual costs, rendered services and payment terms, including the due date. |

| Terms of Payment | Outlines the payment schedule or requirement of deposits if the quotation is accepted, but doesn't ask for payment. | Clearly outlines the payment due date, mentions the methods of acceptable payment and lists penalties for late payments. |

What Quotes Are and How They Fit into the Sales Process?

To clearly understand the difference between quotation and invoice, let us understand each aspect in detail.

A quote, also known as a quotation, provides an estimate of the cost of goods and services offered to a potential buyer by a seller. Requesting a quote gives you accurate details of what’s being offered, the price of goods, and the duration of the offer.

Quotes are not binding contracts until formally accepted. They serve as vital tools for a business owner, as they convey the estimated project cost along with the terms and conditions.

A formal quote typically includes:

- Branding of the company and logo

- Pricing related to materials, taxes, labour costs, and applicable discounts

- Company name and contact information

- Requested products and services

- Additional options to inform the customer of available offerings

Quotations in business generally remain valid for 30 days from the date of issuance. Moreover, according to industry data, approximately 60% of small businesses issue quotes before finalising a contract.

For instance:

- A wedding photographer quotes ₹80,000 for full-day coverage, valid for bookings confirmed within 30 days.

- A home repair contractor quotes ₹45,000 for kitchen repairs, inclusive of labour and materials.

Quotes are used in the early stages when a customer wants to know the estimated cost before finalising a purchase. They are also issued when customers compare price quotes or negotiate between vendors. Quotation is used regularly in professional services, construction, and consulting where there is a need to understand the exact costs before making a commitment to an agreement.

They are especially useful during the sales process, as they create trust between a business owner and a customer and develop long-term relationships. For instance, a graphic designer might ask for quotation after discussion of a branding project, or a construction company might prepare quotation for kitchen remodeling based on materials used, labor and square footage.

3 Tips To Prepare a Proper Quote

For accuracy and efficiency, here are the tips to prepare quotes that every business owner should follow for maintaining transparency and accuracy:

1. Software Use

Use of automated quoting or invoicing software fastens the process, alongside ensuring accuracy by calculation of margins, taxes and discounts.

Example: A travel company using Zoho Invoice software can automate costs of packaging, service tax and other special discounts for corporate clients. This saves time and reduces the chances of error compared to manual calculations.

2. Accurate Pricing

Avoid under-pricing to attract customers, as this can reduce long-term profitability. For example, an interior design company may reduce costs to secure a project, but realistic pricing, factoring in labour and materials, satisfies both customers and the business.

Example calculation:

- Labour: ₹40,000

- Design fee: ₹20,000

- Materials: ₹1,00,000

Total: ₹1,60,000

3. Quick Responses

Responding quickly to quotation requests reflects professionalism. Indian businesses in competitive sectors benefit from invoicing software that enables sending accurate quotes within hours. For example, an event planner who prepares a quote promptly has a higher chance of winning the client over competitors.

4 Benefits of Providing a Quote

Providing a well-structured and transparent quote offers advantages that go beyond simply stating a price.

1. Builds Confidence and Trust

An itemised quote is transparent and customers are assured that there are no hidden costs. When you publicly disaggregate the costs of materials, labour, taxes, and discounts, you are showing honesty and professionalism, both of which play an important role in building long-term business relationships.

2. Enhances Customer Experience

A good quote must describe the scope, schedule and deliverables of the project. Maintaining this transparency provides customers the chances to get realistic expectations, plan resources and gain confidence in agreement that might yield an overall better experience.

3. Streamlines Project Delivery

Quoting forces businesses to think through project requirements in detail. This early planning stage helps identify potential challenges, allocate resources effectively, and assign tasks efficiently, ensuring timely and organised project completion.

4. Reduces the Risk of Scope Creep

By clearly defining deliverables and boundaries in the quote, you minimise the chances of scope creep. A proforma invoice can be used to summarise agreed-upon costs before work begins, reducing disputes.

In essence, a well-prepared quote sets the foundation for trust, efficiency, and successful project outcomes.

💡For your bill payments and tracking business transactions, use the PICE App.

The Purpose and Structure of an Invoice

An invoice is more than just a payment request; it is a legally recognised document that confirms a transaction between a seller and a buyer. It formally records the details of goods or services provided, the agreed price, the payment method, and the due date for settlement.

A quotation provides an estimated cost prior to starting work. Whereas, an invoice is provided after delivery of goods or completion of a service, indicating that payment is due.

An example is when a web designer finishes a project on behalf of a client, the web designer may issue an invoice to the client. The invoice includes the cost breakdown, scope of work and terms of payment. According to GST rules in India, an invoice should also contain the amount of tax, GSTIN, HSN/SAC codes and Unique Invoice Number.

Apart from payment request, invoices assist in filing tax returns, keeping proper business records and tracking of pending dues. Many of these business owners use invoice

templates, or invoice software to produce accurate documents within a short

time.

As you have understood the difference between quotation and invoice, read below to know that a well-structured invoice typically contains the following elements:

1. Name of the Document: The document should clearly indicate that this is an invoice in order to prevent confusion with other financial documents such as quotations, receipts or purchase orders.

2. Invoice Number: Every invoice must have its own reference number. This facilitates effective tracking, prevents duplication and eases accounting record-keeping.

3. Buyer and Seller Details: Mention the full name, contact details and address of both the parties. Incorporating these information changes the invoice into a formal document, essential during conflicts.

4. Issue and Supply Date: Include a proper invoice date along with the date of supply of goods and services. These dates are critical to accounting, tax reporting, and fulfilling the terms of payment.

5. Itemised Breakdown of Goods or Services: List each product or service provided, along with quantities, unit prices, and applicable charges such as labour or delivery.

For example: 5 T-shirts @ ₹1,500 each + ₹100 delivery = ₹7,600.

This clarity helps prevent billing disputes, especially since around 40% of invoice-related disagreements arise from unclear cost details.

6. Total Amount Due: Present the total payable amount after applying any taxes, discounts, or additional fees. This ensures the buyer knows exactly what they owe.

7. Payment Terms and Due Date: Indicate the payment deadline (e.g., “Due within 15 days”) and specify acceptable payment methods. This reduces the need for repeated reminders and encourages timely settlement.

A professional, accurate, and complete invoice not only accelerates payments but also strengthens business credibility. When drafted correctly, it acts as both a financial record and a safeguard in commercial transactions.

How Does the Invoice Process Work?

Here is a breakdown of how the invoicing process works:

- Invoice Received

The invoice process starts as soon as a product or service is delivered. Suppliers send invoices to buyers in paper format or PDFs. Further, when the accounts payable department receives the invoice, it is scanned and entered manually into the accounts payable system.

- Checking Accuracy

Once digitised, invoices are checked against existing delivery receipts to ensure accuracy and legitimacy. If there are further discrepancies on the amount of the purchase order and invoice, the invoice process stops here unless resolved from the supplier's end.

- Approval of Invoice

If the details on the invoice are correct, it can be further sent to an authorised individual for payment approval. These details differ across companies, but the approval process usually takes place digitally rather than manually.

- Payment to Supplier

Finally, upon approval of the invoice, the exact payment is made to the supplier. Payment is processed following the terms of payment. Sometimes, early payment programs are used to avail attractive discounts.

6 Different Uses of Invoice in Business

An invoice is a formal document between the buyer and seller about the sale of goods and services. Other uses of an invoice include:

- Payment Request

Invoices are bill statements with a clear outline of the due amount and terms of payment. This allows for easy management of cash flow, ensuring on-time payment.

- Providing Accurate Information

Invoices entail detailed information of goods and services provided that includes descriptions, quantities and payment terms. Maintaining this transparency enables customers to gain a clear understanding of the billing process.

- Sales Tracking

Invoices allow close monitoring of sales trends and performance over the period. It is possible to identify the peak period of sales by thoroughly reviewing your invoices. Accordingly, you can also adjust your strategies.

- Accounting

Invoices play a crucial role in bookkeeping purposes. You can maintain a record of sales through invoices. Also, it enables businesses to monitor their revenue closely and manage finances accordingly.

- Payment Monitoring

Invoices record payments with outstanding due amounts. This way, you can manage receivable accounts and follow up on payments overdue.

- Easy Filing of Taxes

Invoices are significant for tax filing. It provides the documentation for accurate reporting of income and claiming deductions, making the tax filing process smooth and straightforward.

Conclusion

Quotations, as well as invoices are necessary documents in the present-day business. By familiarising with the difference between quotation and invoice, a business owner can make effective use of these two concepts. Quotations enable businesses to give customers prices that will make them make an informed choice. Invoices generally requests for payment and proper monitoring of product delivery.

Giving clear quotes (occasionally with proforma invoice) and proper invoices prepared by using quality invoicing software will help minimise payment delays by as much as 30%.

By

By