Difference Between Credit Card and Debit Card EMI: Everything You Need to Know

- 11 Nov 25

- 7 mins

Difference Between Credit Card and Debit Card EMI: Everything You Need to Know

Key Takeaways

- Understanding the difference between credit card and debit card EMI helps you choose the right financing option for big purchases.

- Credit card EMI is based on a pre-approved credit line, while debit card EMI is linked directly to your savings account.

- Credit card EMIs offer greater flexibility, longer tenure, and rewards, whereas debit card EMIs have simpler eligibility and documentation.

- Debit card EMIs suit users without credit cards, while credit card EMIs benefit those with good credit history seeking added perks.

- Knowing the difference between credit card and debit card EMI enables smarter budgeting and debt-free shopping.

Buying expensive items become easier and hassle free if you go for EMI options. Both debit and credit cards are popular among users in India and have helped millions in managing expenses without paying a heavy amount at once.

For instance, during 2023, 76% of no-cost EMI purchase took place in India specifically for electronics and smartphones. Whereas, approximately, 65% of young adults have continued using EMI option. Credit card EMI works well based on a pre-approved credit line, whereas debit card EMI is linked with your savings account.

Continue reading this blog to learn about the difference between credit card and debit card EMI, which one to choose, when and more.

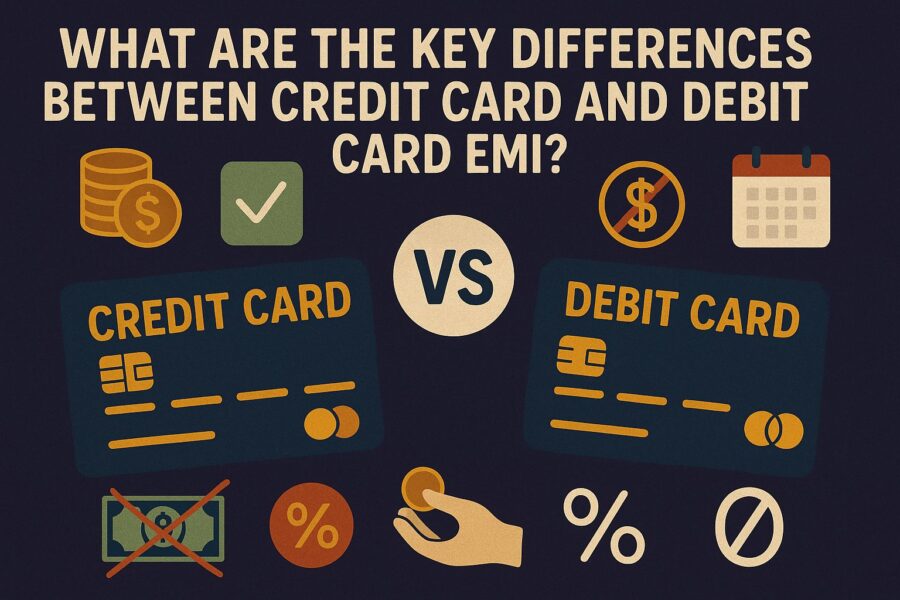

What are the Key Differences Between Credit Card and Debit Card EMI?

| Parameters | Credit Card EMI | Debit Card EMI |

| Method of Payment | The issuer provides the credit limit | Payment takes place through the linked bank account |

| Eligibility Criteria | A good credit score with a strong credit history | Depends on the account balance, transaction history and other criteria |

| Transaction Limit | Based on the available credit limit on the credit card | Depends on the balance available in the linked bank account |

| Documentation Process | Might require more than one documentation | Minimal documentation to none |

| Process of Conversion | Can be converted to EMI after purchase | Must choose the EMI option at the time of purchase |

| Availability | Widely acceptable | Limited to specific brands and platforms |

| Flexibility | Offers longer tenure with flexible repayment plans | Limited tenure options |

| Interest Rates | Varies according to the issuers of credit cards | Varies as per the bank and EMI scheme |

| Additional Rewards and Benefits | Offers attractive rewards points, cashback and other benefits | Rewards and benefits vary depending on the debit card |

Now that you have an idea about the difference between credit card and debit card EMI, let us go through each in detail to understand which one is better as per your needs.

What is Credit Card EMI?

A credit card EMI is a facility of breaking down your huge purchase into small and fixed payment over a specified period. By choosing this EMI option, you can thus split the entire amount into 3,6,9 and 12 months respectively instead of completing full payment at once.

In case, you are buying any high priced items, go for this EMI option. It eases your financial burden and make you debt free. For example, if you buy a laptop worth ₹30,000, you can choose to pay ₹2,500 each month consecutively for 12 months instead of paying the full amount at the time of purchase. For this, banks might charge an annual interest rate. Choosing this option makes the purchase of expensive products affordable.

How Does Credit Card EMI Work?

When you purchase any product with your credit card, you can convert the purchase amount into EMI either instantly or later on through the bank’s official portal. The bank calculates the EMI amount further based on the tenure, purchase amount and interest rate.

For instance, if you spend ₹50,000 and choose a 12-month EMI at 14% interest, you can find out the monthly EMI amount, which will be ₹4,490. There are also some banks offering no-cost EMI, where the seller pays the interest. Once conversion takes place, the EMI amount is reflected on your monthly credit card bill.

💡Pay your credit card bills in an easy and secure way with the PICE App.

What is Debit Card EMI?

A debit card EMI is a convenient payment option that allows customers to make periodic payments for purchases. Customers can choose to divide the total cost into smaller amounts, rather than paying it all at once. It is a rather convenient option for converting payments into monthly instalments. This applies only to payments made through debit cards. Unlike credit cards, there is no need for a pre-approved credit line.

How Does Debit Card EMI Work?

To avail a debit card EMI, here are the necessary steps to follow:

Step 1: Before applying for a debit card EMI, ensure you meet the eligibility criteria set by the bank. The eligibility conditions typically include maintaining a minimum balance in your account with a strong credit history.

Step 2: Purchase from any merchant store that offers the EMI facility. These merchants can be electronic stores or online retailers.

Step 3: During the payment process, you will be offered the option to convert your purchase into EMI. Choose your preferred EMI tenure from the options available, ranging from a few months to a couple of years.

Step 4: Once you choose the EMI tenure, the bank will offer you the terms and conditions of the EMI scheme. This includes the processing fee, interest rate and other additional charges.

Step 5: Upon approval of confirmation of conversion amount, the bank deducts your required EMI amount from your linked savings account every month. Therefore, ensure that you maintain sufficient funds in your account to avoid penalties and other charges.

Which One to Choose: Credit Card or Debit Card EMI?

Before you make an informed choice, familiarising yourself with difference between credit card and debit card EMI is essential. With a credit card EMI, you can avail high limit of purchase, flexibility and rewards option.

For example, buying a ₹50,000 smartphone on a 12-month credit card EMI may cost around ₹4,500 per month, depending on the bank’s charges. On the other hand, a debit card EMI is beneficial if you have no credit card but a well maintained savings account.

The EMI amount is auto-debited from your account each month, ensuring to maintain a disciplined repayment system. There are also many banks offering no-cost EMI option. Thus, go for a credit card EMI if you prefer rewards option and flexibility, but choose a debit card EMI if you want to control your spending.

Conclusion

By opting for debit card and credit card EMI options, you can make large purchases affordable. The choice however depends on your needs and preferences. Credit card EMI benefits you if you choose rewards option with cashback offers at attractive rates of interest.

Debit card EMI, however, is suitable for individuals who do not have credit cards. It offers deductions directly from your linked savings account if you meet the eligibility criteria. Familiarising yourself with the difference between credit card and debit card EMI allows you to manage money, avoid additional debt and continue shopping stress-free.

By

By