Consent Letter For GST Registration: Format and Requirements

- 19 Dec 24

- 7 mins

Consent Letter For GST Registration: Format and Requirements

- GST Consent Letter or NOC

- Importance of Submitting the Consent Letter

- Who Need to Sign the Consent Letter?

- Other Documents Required With Consent Letter

- How to Upload the Consent Letter?

- What Is the Format of a Consent Letter?

- What Is the Consequence of Not Providing a Consent Letter at the Time of Registration?

- Conclusion

Key Takeaways

- A consent letter is a mandatory NOC for GST registration when using owned or non-leased premises.

- Failing to upload a consent letter can delay GST registration and prompt alerts from authorities.

- There’s no fixed format for a consent letter; a simple written document is usually acceptable.

- Supporting documents like address proof and owner’s identity proof must accompany the consent letter.

- Timely submission of the consent letter ensures smooth GST registration and compliance.

In the current trends of the digitised economy, many businesses are run remotely. Most of these business operators need not rent office space or warehouses. However, they must still declare a place of supply to register themselves under the GST Act. Such peculiar situations have given rise to the use of consent letters.

Like any other registered businessperson, e-commerce entrepreneurs too need to comply with the regulations so that they can impose taxes while selling their products or services. Additionally, this compliance allows them to claim Input Tax Credit (ITC) on taxes already paid for business expenses. So, only such businesses need to obtain a consent letter for GST registration.

This guide discusses the importance of a consent letter, its format and the procedure for downloading it for the GST registration process.

GST Consent Letter or NOC

Too many businesses nowadays run across India that do not require registering a commercial space. If these businesses use premises owned by the businessperson for commercial activities, they are to be registered under GST. In such cases, specific documents establishing the taxpayer's legal authority need to be uploaded.

When a rented area is utilised, the business owner must upload the rent/lease agreement to complete GST registration. Finally, when the mentioned place for business in the GST application form is neither rented nor leased, taxpayers must present a consent letter.

A consent letter for GST registration serves as a No Objection Certificate (NOC) issued by the premises’ owner stating that they do not have any particular objection related to the business proceedings. To date, there is no specific format mentioned for this official document. Hand-written formal documents are accepted as a valid format in this case.

Importance of Submitting the Consent Letter

Your business’ formal approval can get hindered if you do not provide a consent letter for GST registration, whenever valid. In cases of legal complications, the applicant receives an alert on their mobile phone from the relevant GST department. It explicitly mentions the business owner to attach the compulsory missing document. So, try to follow the recommended guidelines to complete GST registration smoothly.

Who Need to Sign the Consent Letter?

The person who owns the place of business legally needs to sign the corresponding consent letter. At times, GST officers may request consent letters on stamp papers. If that is the case, the same has to be notarised too.

Disregarding the possibilities, you can simply upload a consent letter without using stamp paper. Additional efforts like using stamp paper, are only necessary when specific instructions are passed on by the GST Council.

Other Documents Required With Consent Letter

You may be required to upload other supporting documents along with the consent letter to complete your business' GST registration. The list of such documents comprises:

- Proof of business existence (PAN card issued to the business)

- Proof of the principal address (Municipal Tax Receipt or current electricity bill)

- Address Proof of the property owner and his identity

In addition to these documents, you would also need to provide a lease deed or rent agreement if you are operating from a rented property. Finally, a bank account statement or a copy of a cancelled cheque can be requested to establish the legal status of a business.

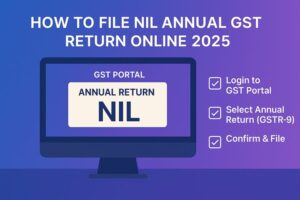

How to Upload the Consent Letter?

Follow the steps outlined below to upload a signed NOC via the online GST portal:

Step 1: As a fresh GST applicant, you must first visit the official GST website, ‘www.gst.gov.in’.

Step 2: Next, select the option ‘Services’ and click on ‘Registration’ followed by the option ‘New Registration’ on the dropdown menu.

Step 3: Then, fill out the GST registration form and select Consent according to the nature of premises.

Step 4: Submit the consent letter for the address under question in a PDF or JPEG format. The maximum file size should not exceed 1 MB.

What Is the Format of a Consent Letter?

Here’s a sample format for a business address or a valid consent letter for GST registration:

NO OBJECTION CERTIFICATE (NOC)

WHOM IT MAY CONCERN

This is to certify that ___________ (Owner Name), as the owner of the property located at the address ___________(Address), has granted Mr./Mrs./Miss ___________(Business Owner Name) permission to use the premises for the purpose of conducting business.

Additionally, I declare that I have no issue with Mr./Mrs./Miss ___________using the premise or location for commercial purposes and as a mailing address. This certification has been granted to facilitate GST registration.

Sd/-(Name)

The proprietor of the property

Date:

Place:

What Is the Consequence of Not Providing a Consent Letter at the Time of Registration?

As a taxpayer, if you forget to upload your business' proof of address or the duly signed consent letter, the designated GST officer may put your GST registration request on hold, causing registration delays. Therefore, it is crucial to provide this document along with Form GST REG-01.

When you accidentally or intentionally omit this step, you can receive a warning message through phone notifications or a notification via email address. Upon receiving such an alert message, make sure to promptly reattach the consent letter/NOC to your application.

Conclusion

A consent letter for GST registration is a must for some businesses to ensure seamless operations from a specific address. Although there is no specific format, you should upload this vital document on time as a normal paper to avoid direct legal issues. It will enhance your business's trustworthiness and credibility due to added compliance with GST regulations.

💡If you want to streamline your payment and make GST payments, consider using the PICE App. Explore the PICE App today and take your business to new heights.

By

By