Composition Scheme for Payment of Service Tax Rules

- 14 Aug 24

- 11 mins

Composition Scheme for Payment of Service Tax Rules

Key Takeaways

- Works Contract Defined: A works contract is a composite contract involving both the supply of goods and the provision of services, particularly in construction, fabrication, and installation projects.

- Service Tax Applicability: Before the GST era, service tax was applicable to the service component of works contracts, with specific rules for calculating the taxable value.

- Mega Exemption Notification No. 25/2012: Listed services are exempt from service tax, including specific types of work contracts.

- CENVAT Credit: Service providers could claim CENVAT credit for the service tax paid on inputs and input services used in executing the works contract, subject to conditions laid out in the CENVAT Credit Rules.

- Short-Paid Service Tax: In cases where the service tax was undercalculated, businesses were required to adjust the shortfall, potentially incurring penalties and interest.

The Works Contract Composition Scheme under Service Tax, which was applicable in India before the introduction of the Goods and Services Tax (GST), was a system designed to simplify the tax implications for contracts involving the transfer of goods and services.

Here's a comprehensive overview of its components, including the definition, taxability, valuation, and exemptions related to Works Contract under Composition Scheme for Payment of Service Tax Rules:

Definition of a Works Contract

A Works Contract is typically defined as a contract for undertaking a project that involves both the supply of goods and the provision of services in the execution of the contract. This can include construction, fabrication, installation, repair, maintenance, or commissioning of any movable or immovable property. Under Service Tax, Works Contracts were recognized as a special category due to their composite service nature.

The complexity of Works Contracts lies in the dual nature of the transaction, where both goods and services are intricately combined, making it challenging to separate the value of goods from the value of services for taxation purposes.

Under the Service Tax regime, specific provisions and valuation rules were established to address these challenges. With the introduction of the Goods and Services Tax (GST), the framework for taxing such contracts has been streamlined, incorporating a comprehensive approach to deal with the complexities inherent in Works Contracts.

- Eligibility

For clarity, I'll address the eligibility criteria for the Composition Scheme under both the Service Tax regime (as it existed prior to July 2017) and the current Goods and Services Tax (GST) regime, focusing on their application to Works Contracts and other relevant services.

Under the Service Tax Regime

The Composition Scheme under the Service Tax rules, specifically designed for Works Contracts and certain other services, allowed service providers to opt for a simpler tax calculation method. The eligibility criteria were as follows:

- Type of Service: Only specific types of services, including Works Contracts involving the construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration, or commissioning of any movable or immovable property, were eligible.

- Turnover Limit: There might have been turnover limits or thresholds that defined which entities could opt into the scheme, focusing on small to medium-sized enterprises to simplify their tax obligations.

- Voluntary Participation: Eligible service providers had to opt into the scheme voluntarily and comply with its specific conditions and limitations.

Under the GST Regime

With the introduction of GST, the eligibility criteria for the Composition Scheme have been broadened and modified to include a wider range of businesses, including service providers. The key eligibility criteria under GST are:

- Annual Turnover: The scheme is available to businesses with an annual turnover below a specific threshold, which is INR 1.5 crore for most states and INR 75 lakhs for special category states (subject to change based on regulatory updates).

- Type of Business: Manufacturers, traders, restaurants (not serving alcohol), and certain service providers can opt for the scheme. Specific rules apply to workers, contractors, and other service-oriented businesses.

- Intra-state Supply: Businesses opting for the Composition Scheme must predominantly engage in the supply of goods or services within a single state. Inter-state supplies are generally not permitted under this scheme.

- Other Conditions: Businesses cannot be e-commerce operators, nor can they supply non-taxable goods or operations. They also cannot claim input tax credits.

Key Differences and Considerations

- Service Tax vs. GST: The Composition Scheme under the Service Tax was more restrictive, with clear specifications for works contractors and certain service categories. GST's Composition Scheme is broader but still includes conditions relevant to works contractors.

- Eligibility Criteria: The criteria under GST are more inclusive, allowing a broader range of small and medium-sized businesses to benefit from simpler tax compliance and lower tax rates.

- Compliance Requirements: Entities under both schemes are subject to simplified tax compliance requirements, but they cannot charge tax to their customers and are not eligible to claim input tax credits.

Taxability of Works Contract in Service Tax

Under Service Tax, Works Contracts were considered taxable or sales tax to be added since they involved a transfer of property in goods as part of the service provided. The Service Tax was applicable on the service component of the contract, and the challenge was to segregate the service value from the goods value, for which specific rules were laid out.

Under Service Tax, Works Contracts were considered taxable or sales tax to be added since they involved a transfer of property in goods as part of the service provided. The Service Tax was applicable on the service component of the contract, and the challenge was to segregate the service value from the goods value, for which specific rules were laid out.

- Short-Paid Service Tax

Instances of short-paid Service Tax in the context of Works Contracts could arise when the service provider fails to accurately segregate the service element from the goods supplied as part of the contract, leading to an underestimation of the taxable amount. Such discrepancies necessitate adjustments and can attract penalties and interest.

- Valuation of Works Contract Service

To address the issue of segregating the value of services from the goods in a Works Contract, the Service Tax law provided two options under Rule 2A of the Service Tax (Determination of Value) Rules, 2006:

- Rule 2A: Option: I (Original Method): This method involved the deduction of the value of property in goods transferred in the execution of the Works Contract from the total contract value. The specific deductions allowed were prescribed, and the balance was considered the value of the taxable service.

- Rule 2A Option: II (Composition Scheme): For simplification, the Composition Scheme allowed taxpayers or persons liable to opt for a fixed percentage of the total contract value as the taxable value. This scheme was designed to ease compliance by eliminating the need for detailed calculation of service and goods values. The rate under this scheme varied for different types of contracts, such as construction of complexes, installation, and other specified categories.

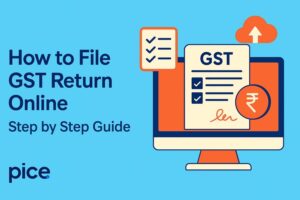

- Implementation and Transition

The Composition Scheme under the Service Tax Rules 2007 was implemented through notifications and circulars issued by the Central Board of Excise and Customs (CBEC), now known as the Central Board of Indirect Taxes and Customs (CBIC). With the introduction of GST, the Service Tax regime, including the Composition Scheme, was subsumed into GST. The GST regime also introduced its own version of the Composition Scheme, extending the benefits of simplified tax compliance to a broader range of businesses.

CENVAT Credit

Under the Service Tax framework, the CENVAT Credit system allowed businesses to offset their service tax liability with the tax paid on inputs and finishing services. For Works Contracts, this meant that service providers could claim CENVAT credit on Central Excise paid for services and goods used in executing the contract, subject to certain conditions and restrictions outlined in the CENVAT Credit Rules.

The assesee under the composition scheme is required to pay 4% of the total value of the work contract as service tax.

- Relation to Construction & Tax In Relation

Works Contracts, particularly those related to construction activities, were intricately linked with Service Tax payable. The taxability of such contracts often hinged on whether the activity was deemed a service or a sale of goods, with different notifications and rules applying to various scenarios.

- Revenue Authorities

The role of revenue authorities in the context of Works Contracts and Service Tax involved oversight, enforcement, and clarification of tax laws. They were responsible for ensuring compliance, issuing clarifications, and adjudicating disputes related to Service Tax liability, exemptions, and the entitlement of CENVAT credit.

- Exemption Notification & Mega Exemption Notification No. 25/2012

The Service Tax regime provided various exemptions for specific operations and circumstances. Notably, Mega Exemption Notification No. 25/2012 listed numerous services that were exempt from service tax, including certain types of work contracts that were deemed critical or essential, such as those related to infrastructure, roads, airports, railways, irrigation, or contracts executed for governmental authorities under specific circumstances.

These exemptions were aimed at reducing the tax burden on essential operational and infrastructure projects.

- Notification No. 24/2007-Service Tax & Notification No. 27/2007 & 28/2007

Notification No. 24/2007 introduced the Works Contract (Composition Scheme for Payment of Service Tax) Rules, which allowed service providers to opt for a simplified tax payment scheme. This composition scheme was a crucial element for businesses engaging in Works Contracts, offering a method to calculate Service Tax liability based on a fixed percentage of the total contract value, thereby simplifying compliance.

Similarly, Notification No. 27/2007 and 28/2007 provided clarifications and amendments to the existing rules, ensuring that the composition scheme and other provisions related to works contracts were clearly understood and effectively implemented.

Conclusion

The Works Contract Composition Scheme under Service Tax was a critical aspect of the taxation system for contracts involving both goods and services. It aimed to simplify the tax calculation and compliance process for service providers engaged in works contracts. With the introduction of GST, the taxation of works contracts has been further streamlined, incorporating these contracts under a unified tax regime.

Explore how Pice business payment applications can help you manage all your business payments, GST, vendor payments, rent, etc. from one place. Request a demo now.

By

By