Business Loan vs Credit Card: A Complete Guide

- 21 Oct 25

- 17 mins

Business Loan vs Credit Card: A Complete Guide

- Key Differences of Business Loan vs Credit Card

- How Does a Business Credit Card Work?

- Application Process and Eligibility Requirements of a Business Credit Card

- Pros of Using Business Credit Cards

- Cons of Using Business Credit Cards

- Can I Get a Business Credit Card Without Business Income?

- Is It Possible to Get a Loan from a Credit Card Company?

- How Do Business Loans Work?

- Is It Possible to Get a Business Loan With a 500 Credit Score?

- Pros of Taking Out a Business Loan

- Cons of Taking Out a Business Loan

- Is It Better to Have Loan Debt or Credit Card Debt?

- Factors to Consider to Choose the Best Financing Option

- Conclusion

Key Takeaways

- The key distinction between a business loan vs credit card lies in purpose. While loans provide large, one-time funding for expansion, equipment, or infrastructure, credit cards help manage daily operational expenses and short-term cash flow.

- Business loans can range from ₹50,000 to several crores and are repaid in structured EMIs over 1–7 years. In contrast, business credit cards typically offer limits up to ₹10 lakh, with flexible repayment and rolling balances.

- Business loans have lower annual interest rates compared to business credit cards. Loans are ideal for cheaper long-term borrowing, while cards are better for immediate liquidity.

- Getting a business loan usually requires extensive documentation and 2–10 working days for disbursal, while business credit cards are quicker to approve with fewer eligibility conditions.

- Timely repayment of a business loan builds long-term creditworthiness for large borrowing in the future, whereas responsible card use improves both business and personal credit scores and helps maintain healthy cash flow.

Dependent access to capital is essential for every Indian firm in the current competitive environment to carry out seamless operations and allow for long-term growth. Company credit cards are used to maintain ongoing vendor payments, travel, sponsor, and subscriptions, whereas business loans provide large lumps for such disbursements as office space, office equipment, and merchandise in bulk.

With 10+ crore credit card users in India till FY 2024, companies seek that balance of security and flexibility. This guide delineates the various aspects and benefits of choosing between a business loan vs. credit card for your needs.

Key Differences of Business Loan vs Credit Card

| Parameters | Business Loan | Business Credit Card |

| Loan Amount/ Credit Limit | Depending on the business profile, collateral, credit history, and turnover, banks and NBFCs in India provide loans ranging from ₹50,000 up to, in some cases, several crores. This serves extremely well for bulk funding. | Credit limits generally range from ₹50,000 to ₹10 lakh, depending on the bank's relationship with the company, the company’s creditworthiness, and the type of card. Limits can be increased gradually with a good repayment history. |

| Interest Rates/ Charges | Interest rates of unsecured loans generally stay between 9% and 16% p.a., while those secured loans have a range of 7% to 12% p.a., apart from other charges like processing fees, prepayment charges, etc. | Business credit cards typically have higher interest rates, ranging from 18% to 36% per annum (or 1.5% to 3% per month). Interest is only levied on unpaid balances after the interest-free grace period has expired. Late-payment fees and annual charges also apply. |

| Repayment Structure/ Tenure | Repaid in fixed EMIs over a period of 1–7 years. Such predictability in cash outflow would better help in budget planning for long-term projects. | Offers flexible repayment. Businesses can pay either the full outstanding or just the minimum due each cycle (30–45 days interest-free period). However, rolling over balances attracts high interest. |

| Approval & Disbursal Time | In general, the period lasts between 2 and 10 working days for application review, documentation, and the disbursement of funds. There may be a lengthening of this process in case of collateral documentation requirements. | Approval is faster and often instant for pre-approved customers and within 24–72 hours for new applicants. Virtual cards may be issued immediately for online use. |

| Usage Suitability | This is best for planned or large-scale or one-time expenses. This can be seen in business expansion along with infrastructure development then purchasing machinery, or bulk inventory. | This is appropriate for recurring and smaller expenses like daily working capital and vendor payments. It also includes travel bookings along with marketing spend together with software subscriptions and emergency liquidity. |

| Benefits & Rewards | It provides a lump sum with a structured repayment plan and lower interest rates. This improves cash-flow stability and long-term financial planning. | It offers added perks including reward points and cash back. Moreover, fuel discounts, travel privileges, expense tracking, and enhanced expense segregation for accounting and tax filing. |

| Eligibility Factors | Depending on business vintage, turnover, and profitability, CIBIL/credit scores, and collateral if secured. Heavy documentation requests for financial statements are often required. | It depends on the credit score of the business, the standing relationship with the bank, and the personal credit history of the promoter. Less amount of documentation is required as compared to loans. |

| Impact on Credit Profile | Timely repayment builds business credit history and strengthens eligibility for higher-value loans in the future. | If used and repaid rightly, then it shall increase the score for the business; on the other hand, a high utilisation or delay in payments can hurt both the creditworthiness of the business in no time. |

How Does a Business Credit Card Work?

Credit cards are fast developing a necessity in the financial world for all business types. Entrepreneurs can use business credit cards to get a short-term loan, to manage working capital, and to avail themselves of important benefits instead of paying bills through their personal accounts. This section also helps you understand how a business loan vs credit card comparison can guide your choice.

- Designed for Businesses

These cards have a distinct credit capacity available to business transactions and payments that are suitable for start-ups, small medium enterprises, and established businesses.

- Revolving Credit Facility

Business cards inject liquidity into daily operations by allowing the borrowing of money up to an approved credit limit followed by paying back over time and borrowing some more with the same principles that personal cards operate under.

- Value-Added Benefits

Many cards reward the businesses for saving money by providing cash backs, reward points, gas discounts, travel privileges, and expense management tools.

- Flexible Fee Structures

There is a wide array of options banks deploy so that smaller businesses can afford the cards. There are cards with no annual fees and those that have lifetime free cards for example.

- Eligibility and Approval

Borrowers who can demonstrate a credit rating of 670+ and show evidence of repayment capacity have a better chance of acceptance.

- Billing and Interest

Monthly statements show the outstanding amounts and minimum dues. Delay in payment attracts interest charges, while payment in full saves you from exorbitant APRs.

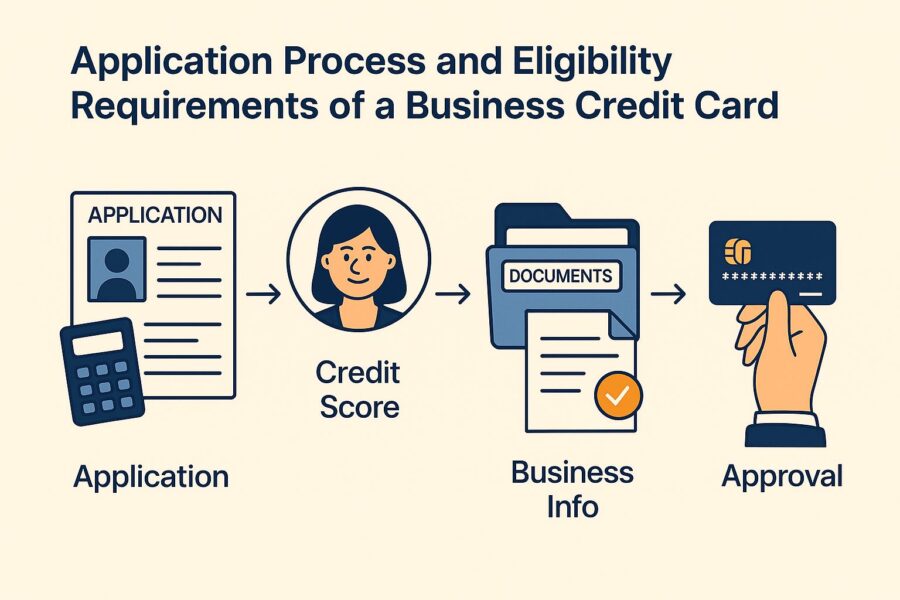

Application Process and Eligibility Requirements of a Business Credit Card

The following are the prime variables affecting your eligibility for this card. There may be other restrictions the lender imposes during the application process and qualification for business credit cards.

- Credit Score

To see if you qualify for a business credit card, lenders look into your business credit ratings. High scores are often considered by lenders, implying a financially sound business applicant.

- Revenue and Profitability

Lenders look at a company's revenue and profitability to assess its creditworthiness. They want to make sure your firm is making money and that you have a steady stream of income.

- Time in Business

The likelihood that the lender will approve your business credit card increases with the length of time your company has been in existence. This is due to the fact that lenders want to see that your company is stable and has a track record of success.

If you can follow the eligibility criteria of your lender, then you need to provide some essential information, which includes:

- Name of your business with contact details

- Your business structure

- The business category and its type

- Business Federal Tax ID

- Revenue and expenses of your business

💡Pay your GST-registered business credit card bills in an easy and secured way with the PICE App.

Pros of Using Business Credit Cards

- Easy Access to Funds

You can access business credit cards at any time without the hassle of reapplication. Ensure that you pay the full balance amount every month. Moreover, avoid paying interest charges to facilitate easy management of short-term cash flow.

- Building a Credit

Responsible use of a business credit card enables you to build business credit. This is necessary for securing your finances in future, which includes loans and bonds.

- Rewards

If you own a business credit card with available credit, you can make purchases as needed and then settle the balance at the end of each month. Following this, you can avail 5% rewards on a credit card.

- Expense Management

Business credit cards make it easy to track and manage expenses by keeping personal and business finances separate. This separation can then simplify accounting for tax purposes. Many cards also provide for easy tracking of employee expenses.

- High Credit Limit

Compared to personal cards, these types of credit cards are offered with high denominations and hit the purchasing power examples when the need arises.

Hence, as for setting cash flows or working on establishing the financial history of the company, business credit cards carry many positive points for consideration.

Cons of Using Business Credit Cards

- High Rates of Interest

Business credit cards generally have higher interest rates than personal credit cards or traditional loans. If you fail to pay off your balance every month, interest might add up quickly.

- Effect on Personal Credit

The most significant risk associated with business credit cards is the impact they have on your personal credit score. The majority of card issuers report their activities to one or more of the major consumer credit bureaus. Missing monthly payments may affect your personal credit, not just your business credit.

- Risk of Debt Accumulation

If you continue to carry a balance from one month to the next, interest accumulates. Thus, make sure to opt for credit cards to pay off the purchase amount quickly.

Can I Get a Business Credit Card Without Business Income?

Many budding entrepreneurs wonder if one could qualify for a business credit card without reporting business income. In effect, yes-if will be more that your personal finances and creditworthiness determines approval-therefore it is not based on your company's earnings.

- Personal Credit History Matters

Your credit history may be leveraged by lenders to weigh the risk they associate with lending to you. For example, one having a CIBIL score of over 700 can easily get the starter business credit card, even with zero turnover in India.

- Personal Guarantee Requirement

Most business credit cards, however, require a personal guarantee from the cardholder, which basically carries the notion that any unpaid balance becomes your personal responsibility, not that of the company. Cards with no personal guarantees usually require that the company be registered and make an annual revenue of at least ₹50 lakh.

- Using Personal Income in Applications

If you are a sole trader or have a start-up with no business income, you may list your own personal income. You can also register using your own name for a business and your own PAN as a tax ID.

- Research Issuer Requirements

Each bank follows different policies. Contrast the terms, fees and limits before applying to make sure you will be accepted and get a better chance of approval.

Is It Possible to Get a Loan from a Credit Card Company?

Yes, you can opt for taking a pre-approved, instant personal loan from a credit card issuer. The phrases "loan against credit card" and "personal loan on credit card" are alternative names for this kind of deal. This is an option to borrow a loan directly from your own bank account with no security, no documents, and flexible repayment terms.

But credit requirements vary depending on the banking method of the bank and your credit score. Applying directly is also an option through the bank's official website, mobile banking, or by contacting customer care.

How Do Business Loans Work?

For the Indian businesses, loans still remain one of the most successful ways to raise developmental capital. Entrepreneurs may tap structured capital disturbing their cash flow to expand their operations or invest in assets, instead of simply relying on their self-capital. Understanding a business loan vs credit card makes product selection much easier.

- Designed for Business Needs

Especially when it comes to infrastructure, working capital, hiring employees, purchasing equipment, or inventory management. These loans can be divided between unsecured ones based on the credit strength and secured ones backed by collateral.

- Structured Lump-Sum Funding

Unlike revolving credit, lenders disburse a fixed amount up front. Payment is made in installments within a fixed span of time, typically between one to seven years, which facilitates forecastable cash flow planning.

- Interest Rates & Charges

Private sector banks or NBFCs can lend unsecured loans up to 22–28% p.a., but public sector banks can begin around 8.25% p.a. For example, based on the borrower's profile, HDFC Bank currently provides business loans at annual interest rates between 10.75% and 22.50%.

- Eligibility & Approval

Lenders consider repayment history, turnover, business age, and credit score usually 700+ increases probability. Disbursement generally happens within two to ten working days.

To build a second factory or add new equipment, a small business would take ₹25 lakh as a loan, which it would repay in five years in fixed EMIs. This example shows how business loans vs. credit cards can influence planning for the future.

Is It Possible to Get a Business Loan With a 500 Credit Score?

Business loans are limited for a credit score of 500. Government banks may disallow you as most banks want 650 and above for acceptance before time, but some NBFCs and government schemes such as Mudra Yojana offer microloans of up to ₹10 lakh at a cheap rate of interest, on cash positions and incomes.

Better chances are there if you submit your GST records, procure a guarantor, or provide collateral. Then, if you continue to work on your credit score, in time, you will be able to access larger amounts of money at more affordable rates of interest.

Pros of Taking Out a Business Loan

- Flexible Repayment

For a business loan, you can select your preferred repayment tenure, ranging from short to long term. Repaying every month makes the budgeting process easier. You can thus determine the amount you owe each month and plan accordingly.

- Access to a Huge Capital Amount

Gain access to a large amount of capital in comparison with business credit cards. Thus, business loans are crucial for large investments, such as expanding operations, purchasing equipment, and covering overhead costs.

- Favourable Rates of Interest

Small business loans often have lower interest rates compared to credit cards. Considering your financial status and creditworthiness, you can opt for a competitive interest rate. This will help you to save consistently in the long run.

- Retain Ownership

By opting for small business loans, you are not required to give up on equity. You are eligible to retain full ownership and gain control of your business. Still, you can acquire the necessary funds needed for growth.

Cons of Taking Out a Business Loan

- Difficulty in Qualifying

The more nascent a business, the harder it would seem for it to qualify for a business loan. Some lenders will need to see 6-months-in-business, whereas others might not. Owners need enough credit history and good financial health to secure the best rate.

- Risk of Collateral

You are to give the asset as collateral in the case of a loan for business purposes. However, should any downturns befall your business, the utility that those assets afford to you will be at risk.

- Limited Flexibility

Loan companies will most often provide a lump sum payment at one time. So, in case there arises a need for further money as time goes on, you will need to keep the papers ready for submission.

- Personal Guarantees

Whether secured or unsecured, personal guarantees can be required by creditors. If you require a personal loan, trying to get one later could be a challenge for you.

Is It Better to Have Loan Debt or Credit Card Debt?

When one has a commission about whether to choose loan debt or credit card debt, an understanding should be gained about how the two work and how they affect one's finances.

- Nature of Debt

A loan usually runs an instalment debt, and a credit card runs a revolving debt. So, when it comes to choosing between loan debt and credit card debt, loan debt is the preferred choice.

- Cost and Manageability

In the long run, loan debt is always cheaper and easier to manage. One can repay loans in fixed EMIs over a defined period, thus making the whole budgeting and planning process more smooth and convenient.

- Example of Loan Debt

Suppose you have taken a 4-lakh loan at an interest rate of 12% for 5 years. Your probable EMI would be something close to ₹10,000.

- Example of Credit Card Debt

Credit card debt multiplies rapidly when you pay only the minimum due amount. An amount of ₹1 lakh at 30% interest would fetch ₹30,000 as extra charges in just one year.

- When Credit Cards Help

Credit cards are of legitimate use in emergency situations or to make ends meet for short-term expenditures due to the benefits of rewards and flexibility. However, carrying forward a high balance amount for an extended period is very risky. Monthly penalties and late fees will make the debt unmanageable.

Factors to Consider to Choose the Best Financing Option

- Needs for Funding

Whether to choose a business loan or a credit card depends on your funding needs. Usually, you can avail a lower borrowing limit with business credit cards than with business loans. Therefore, if you require a substantial amount of funding, opting for a business loan will be beneficial.

- Interest Rate

Considering your creditworthiness, the interest rates on business credit cards and business loans vary. Carefully consider the interest rates before selecting the right financial option for you.

- Credit Score

Before choosing any type of financing, review your business credit score and determine the eligibility criteria. There are fewer eligibility requirements for business credit cards than for business loans. If your credit score is low, choosing a business credit card will then be beneficial.

- Terms of Repayment

For borrowing money on a short-term basis, consider using a business credit card option. However, if you need to borrow for a longer duration, choose a business loan. This is because small business loans usually have longer repayment terms than business credit cards.

Conclusion

Overall, choosing between business loan vs. credit card depends on purpose and timing. Loans are beneficial for planned spending with structured EMIs. But credit cards work well for urgent expenditures.

Suppose you are just starting your business. You will certainly need to get some equipment on loan while using credit cards for the rewards and cashback offers. A good mixture of both helps businesses to grow steadily and remain competitive in the world market.

By

By