Business Credit Card vs Corporate Credit Card: Key Differences Explained

- 17 Oct 25

- 9 mins

Business Credit Card vs Corporate Credit Card: Key Differences Explained

- What are Business Credit Cards?

- What are Corporate Credit Cards?

- Business Credit Card vs Corporate Credit Card: Tabular Comparison

- How Does a Business Credit Card Work?

- What are the Top 5 Business Credit Cards in India?

- Who is Liable for a Corporate Credit Card?

- 5 Best Corporate Credit Cards in India

- Should You Go for a Business Credit Card or a Corporate Credit Card?

- Conclusion

Key Takeaways

- Business credit cards cater to SMEs, startups, and freelancers, while corporate credit cards are designed for large enterprises with audited financials and structured departments.

- With a business credit card, personal liability applies to the owner. In contrast, corporate cards hold the company liable, protecting individuals from debt exposure.

- Business cards offer moderate credit limits (₹50,000–₹25 lakh) and basic management tools, whereas corporate cards can go up to several crores with granular spending controls.

- Corporate credit cards provide advanced ERP integrations and department-wise tracking, while business cards sync with basic accounting tools like Tally, QuickBooks, and Zoho Books.

- Business credit cards suit smaller firms seeking flexibility and rewards, whereas corporate credit cards fit larger organisations managing multiple employees and complex expense systems.

With both business and corporate credit cards, companies and their employees can get funds without any trouble. Moreover, the beneficiaries get several rewards and cost management tools.

Alone in July 2025, credit card expenditures in India increased by 5.5%, totalling ₹1.93 lakh crore. It clearly indicates a consistent growth in digital and point-of-sale transactions. To utilise discounts and offers, small businesses often rely on business credit cards that typically have less stringent requirements compared to corporate cards.

For more information regarding business credit card vs corporate credit card, keep reading.

What are Business Credit Cards?

Business credit cards are designed particularly for small and mid-scale companies operating in different parts of India. These cards provide an organisation with dedicated credit lines. As a result, they facilitate end-to-end expense tracking and help build professional credibility.

Typically, an annual turnover between ₹10 lakh and ₹25 lakh is set as a benchmark by most Indian banks offering these credit cards to established SMEs and emerging businesses.

What are Corporate Credit Cards?

Corporate credit cards are primarily designed for widespread use by larger corporations and more established businesses. Examples include Public Limited Companies, Private Limited Companies, Limited Liability Partnerships (LLPs) and partnership firms.

Business Credit Card vs Corporate Credit Card: Tabular Comparison

| Basis of Comparison | Business Credit Card | Corporate Credit Card |

| Eligibility | Must have basic business registration, GST number and an annual turnover of ₹10-25 lakh | Should be a prominent business entity with well-audited financials, comprehensive documentation and an annual turnover of ₹1 crore or more |

| Liability | Personal assets are registered as liabilities, as an individual guarantee is required | Owners face limited personal exposure as the company assumes responsibility for expenses |

| Applicable Interest Rates | Typically ranges between 18-42% annually. SMEs get promotional offers occasionally with discounted rates | Ranges between 14-36% annually. Although rates are negotiable depending on the relationship with the card issuer |

| Rewards | Includes many benefits like dining offers, discounts on office supplies, cashback on fuel and basic rewards | Covers premium travel perks, exclusive discounts and concierge services |

| Transaction Limit | SMEs get a moderate spending limit (₹50,000 to ₹25 lakh) | Large expenses often qualify for substantial credits (₹5 lakh to several crores) |

| Cardholder permissions | Simple control mechanisms are applied with 2-5 add-on cards | Company can issue hundreds of employee cards, extend granular permissions and control department-wise limits |

| Integration Specifics | Basic synchronisation and APIs with Zoho Books, QuickBooks, Tally and more | Supports advanced ERP integration, enterprise solutions, real-time data flows and custom APIs |

| Security | Standard protection elements are provided, including SMS transaction alerts, fraud monitoring and chip-and-PIN | Secured with multi-factor authentication, advanced fraud detection and biometric verification |

💡Pay your credit card bills in an easy and secured way and experience smooth transactions with the PICE App.

How Does a Business Credit Card Work?

The working principle of a business credit card is much like that of a personal credit card. However, the former generally allows a higher spending limit and offers superior reward programs.

Additionally, business credit cards come with a suite of business-centric tools that help track expenses across different categories and employees. Companies can download this spending information and import it into their in-house software.

Having a Permanent Account Number (PAN) is compulsory when opting for a business credit card. Depending on the creditworthiness, lenders will offer different types of business credit cards.

Each business credit card type has distinct reward structures. For instance, some may offer accelerated reward points on spending under the travel category, while others are more suitable for marketing and advertising-related expenses.

Therefore, small and mid-scale businesses should first assess their spending needs before they search for the best business credit cards online.

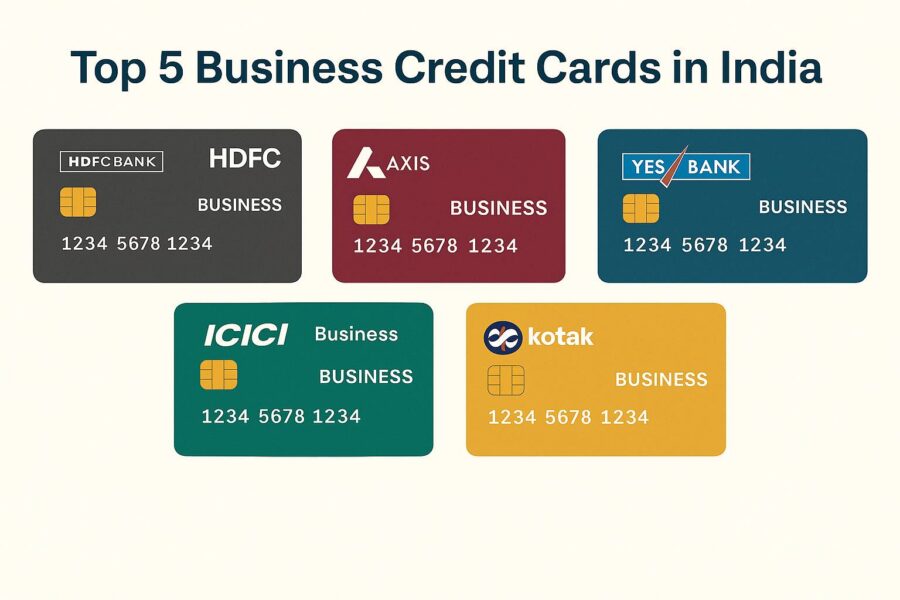

What are the Top 5 Business Credit Cards in India?

| Business Credit Card Name | Eligibility | Key Features | Annual Fee |

| HDFC Biz Black Metal Edition Credit Card | Applicants must be between 21-65 years of age. Yearly ITR should be ₹30 lakh or more | 5X reward points on select business expenses on spending at least ₹50,000 per statement cycle | ₹10,000 + taxes |

| Axis Bank Business Supreme Master Credit Card | Must be a sole proprietor, small business owner or freelancer | 4 reward points for every ₹200 domestic spends, 6 reward points for marketing and advertising bills, 8 reward points per ₹200 spent on international expenses | ₹1,500 |

| ICICI Bank Business Advantage Black Card | Applicants must be above 21 years of age. Can be either salaried or self-employed | 1% cashback for all eligible spends listed in a statement bill, 5% dining discount at partners under ICICI Bank Culinary Treats Programme | ₹1,000 + taxes |

| YES First Business Credit Card | Applicants must be between 21-70 years of age. Yearly ITR should be ₹10 lakh or more | 16 YES Rewardz points on every ₹200 spent across various categories other than 'Select categories', 4 reward points for every ₹200 spent on Select category and a milestone benefit of 20,000 reward points on spending a minimum of ₹12 lakh in every anniversary year | ₹999 + taxes |

| Kotak Biz Business Credit Card | Applicants must be between 21-65 years of age. Yearly ITR should be ₹4.8 lakh or more | 4 reward points gifted for every ₹100 spent on airline travel, advertising services, accommodation and supermarket bills | ₹499 |

Who is Liable for a Corporate Credit Card?

A company is entirely responsible for repaying debts incurred on its corporate liability card. It provides more financial relief for employees, as they do not need to pay upfront. Conversely, the employer must meet all the pending invoices.

Still, businesses holding corporate credit cards must provide their employees with a straightforward policy. This document lists which transactions are approved and declares that unauthorised usage will lead to a direct deduction from the employee's salary. Businesses also use expense reporting to assist with the reconciliation process at the end of every billing period.

In the case of corporate credit cards, issuers ideally do not run credit checks on individuals authorised to use the company credit card. However, similar to personal credit cards, employees' personal credit can be negatively impacted if invalid expenses remain unpaid for a significant duration.

5 Best Corporate Credit Cards in India

| Corporate Credit Card Name | Annual Fee | Max Limit | Key Features |

| YES Bank RazorpayX Corporate Card | NIL | Up to ₹2 crore | Up to 90% discount on Freshworks products, 6 months free Notion access and up to $5000 complimentary Google Cloud credits |

| HDFC Corporate Premium Credit Card | Varies for each card member based on usage | NA | 5X rewards for every ₹150 spent, 5 complimentary airport lounge visits per quarter and 6 international lounge accesses in a year, insurance up to ₹1 crore |

| ICICI Bank BizPay Card | ₹249 + taxes | Up to ₹50 lakh | 20% off on courier services via DHL, cashback worth ₹5,000 on services from Porter, 8% off on bookings made through Hotels.com and more |

| IDFC FIRST Corporate Credit Card | NIL | NA | Up to 150 bonus points on spends, 2 complimentary lounge accesses per quarter, competitive foreign markup rate of 3.5% |

| American Express Corporate Platinum Card | ₹40,000 | NA | Gift voucher worth ₹10,000 on spending more than ₹30 lakh via Flipkart, MMT, ITC and Yatra, exclusive benefits on business stays, Hertz Gold Plus Rewards and Taj Epicure Plus |

Should You Go for a Business Credit Card or a Corporate Credit Card?

Choosing between a business credit card and a corporate credit card depends on the size, structure and financial complexity of a company.

Business credit cards are ideal for SMEs, startups, freelancers and small business owners. They ensure:

- Easier Eligibility: These cards typically require basic business registration, GST compliance and relatively lower annual turnover (₹10-25 lakh).

- Steady Credit Score Building: Business credit cards help build company credit and increase business cash flow. Most importantly, these instruments give access to interest-free credit periods of up to 55 days.

- Limited Liability: These cards separate personal and business expenses, simplifying bookkeeping and tax reporting.

- Swift Access to Rewards: Employees can enjoy discount offers, rewards and cashback on business spends like travel, dining, fuel and office supplies.

Despite the advantages discussed above, business credit cards provide moderate credit limits (generally up to ₹25 lakh) and a simple user management policy (a maximum of two to five employee add-on cards). However, unlike corporate credit cards, personal liability applies to outstanding balances, so the owner’s credit can be impacted if there is misuse of credit.

Alternatively, corporate credit cards are designed for larger businesses and corporations with more complex financial processes and higher annual turnover (₹1 crore+).

As a business owner, you can prefer these cards for:

- Advanced Expense Management: Corporate credit cards enable granular permission settings, department-wise limits, category restrictions and comprehensive expenditure reporting.

- Removing Personal Liability: With a corporate credit card, the company is responsible for payments, protecting individual assets.

- Upgrading Facilities: Employee satisfaction is bolstered by removing out-of-pocket spend and enhancing travel management with perks like lounge access and travel insurance.

Hence, business credit cards best suit small and medium-sized enterprises and professionals who require straightforward expenses and credit benefits. Corporate credit cards are ideal for established organisations with significant employee expenses, complex expense tracking needs and a robust financial infrastructure.

Conclusion

Once you gain clarity on business credit card vs corporate credit card, you can make a well-informed decision regarding which credit line to choose for your expenses. Nevertheless, certain company credit cards might necessitate business collateral. So, review the specific terms and conditions carefully before you apply for a card.

By

By