Bengaluru Airport Lounge Access Credit Cards for Terminal 1

- 15 Oct 25

- 8 mins

Bengaluru Airport Lounge Access Credit Cards for Terminal 1

Key Takeaways

- Bengaluru airport lounge access credit cards allow travellers to enjoy premium amenities like Wi-Fi, snacks, and comfortable seating before flights.

- Top banks offering lounge access at Terminal 1 include HDFC, Axis, ICICI, Kotak Mahindra, SBI, IndusInd, and American Express.

- Most cards require a nominal swipe fee (₹2 for Visa/RuPay and ₹25 for Mastercard) for lounge entry.

- Eligibility for these credit cards generally includes a high income bracket and a good credit score (700+).

- Using premium variants like HDFC Diners Club Black or ICICI Emeralde can provide unlimited lounge access without spend criteria.

Did you know Bengaluru Airport Terminal 1 handles millions of domestic travellers every year? For the comfort of these travellers before or in between flights, lounges offer a convenient space to relax, work or refresh. One can get entry to these lounges through various ways, including Bengaluru airport lounge access credit cards.

This read will provide you with an overview of the 7 credit cards accepted at Terminal 1. So, keep reading to learn more about their features and eligibility requirements.

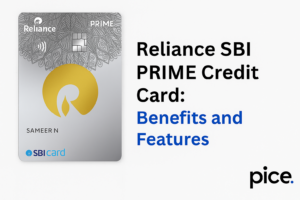

List of Bengaluru Airport Lounge Access Credit Cards for Terminal 1

- American Express Platinum Travel

The American Express Platinum Travel Credit Card provides its basic/primary cardholders with exclusive access to the 080 Domestic Lounge at Terminal 1. Travellers can unwind in a premium setting, enjoy refreshments and relax before their flight. Lounge entry is available for primary cardmembers with a same-day ticket, subject to availability and standard lounge rules.

Unique Features:

- Access to the lounge is for the passengers/cardholders with the same-day tickets.

- Lounge benefits are subject to space availability on a first-come, first-served basis.

- Charges for additional guests apply at walk-in rates.

- Complimentary access requires authorisation of ₹2 on Amex terminals.

- Child policy varies by lounge; generally, children over 2 are charged.

Eligibility and Charges:

- First-year fee is ₹5,000 plus applicable taxes.

- Annual fee from the second year onwards is ₹5,000 plus applicable taxes.

- The welcome gift for this card is 10,000 Membership Rewards points.

- HDFC Diners Club Black

The HDFC Diners Club Black Credit Card is a premium choice for frequent travellers. Diners Club Credit Cards are different from the others as they provide access to exclusive Diners Club lounges to enhance your every trip. Both primary and add-on members of this card can enjoy lounge benefits.

Unique Features:

- Complimentary annual memberships of Club Marriott, Times Prime, Amazon Prime and Swiggy One.

- Up to 10x Reward Points via SmartBuy and 2x on weekend dining.

- Complimentary 6 golf games per quarter at select courses worldwide.

- Up to 50 days of interest-free credit period.

Eligibility and Charges:

- The age eligibility for salaried applicants is between 21 and 60 years and their monthly income should be above ₹2.5 lakh.

- The age eligibility for self-employed applicants is between 21 and 60 years and their ITR should be above ₹30 lakh per annum.

- The joining or renewal fee is ₹10,000 plus GST.

- The renewal fee is waived on annual spending of ₹5 lakh in 12 months.

- Axis Bank Cards

Axis Bank offers various Bengaluru airport lounge access credit cards, making it convenient for travellers across different segments. Cardholders must meet the minimum spend requirement of ₹50,000 in the previous three months to gain access to the lounge. Premium cards stand out by offering unlimited access without spend criteria, while others provide quarterly or annual complimentary visits.

Unique Features:

- Newly issued cards enjoy waived spend criteria for the first 3 months after issuance.

- Premium cards, including RESERVE Credit Card, Olympus Credit Card, Burgundy Private Credit Card, Primus Credit Card, ATLAS Credit Card and Horizon Credit Card, are exempt from the spend requirement.

- Entry requires a nominal swipe fee of ₹2 for Visa or RuPay and ₹25 for Mastercard.

Eligibility and Charges:

- Preferred credit score above 750 to reflect creditworthiness.

- Age between 18 and 60 years for legal adulthood and financial stability.

- Must be a resident Indian or NRI (with conditions) for legal/logistical compliance.

- Initial funding required for the Burgundy Private Credit Card is ₹25 lakh.

- Kotak Mahindra Cards

Kotak Mahindra Bank offers select Bengaluru airport lounge access credit cards, catering to both frequent and occasional travellers. The Mojo Platinum and Royale Signature cards come in this category.

Unique Features:

- Enjoy comfortable travel with gourmet meals and free WiFi.

- Waiver on fuel and railway surcharge.

- Get an annual and joining fee waiver with Mojo Platinum.

- Insurance for theft or loss up to ₹2.5 lakh with Royale Signature.

Eligibility and Charges:

- Mojo Platinum requires an annual income of ₹4 lakh, while Royale Signature requires ₹24 lakh in a year.

- Age of the applicants must be between 21 and 65 years, and they should be Indian citizens.

- Annual fee waivers are available on both cards upon meeting spend thresholds.

- ICICI Bank Cards

ICICI Bank offers unlimited lounge access at Bengaluru Domestic Airport Terminal 1 to its Diamant and Emeralde customers. Its premium cards stand apart, as they do not have any spend criteria attached.

Unique Features:

- Lounge access is given to the travellers for 3 hours per visit.

- Identification and booking confirmation are needed for access to the lounge.

- Entry in the lounge requires a nominal swipe fee of ₹2 for Visa, Mastercard, and RuPay, and ₹1 for Amex.

Eligibility and Charges:

- Joining fee of ₹12,499 with taxes for Emeralde Private Metal Credit Card.

- ATM withdrawal for Emeralde has 3.75% per month interest.

- Minimum age requirement is 21, and 60 years is the upper limit.

- SBI Prime Visa

The SBI Prime Visa Credit Card is another card among Bengaluru airport lounge access credit cards. It provides frequent travellers with both comfort and lifestyle privileges while travelling. The card offers multiple advantages to its users, among which are strong security for transactions and fraud liability cover.

Unique Features:

- E-gift voucher as a welcome gift worth ₹3,000.

- ₹100 spent on groceries, dining, movies and departmental stores provides 10 reward points.

- 20 reward points per ₹100 spent on birthdays.

- Rewards points for different kinds of milestone achievements.

Eligibility and Charges:

- The annual fee of ₹2,999 plus taxes is required for the membership.

- For its renewal, a fee of ₹2,999 plus taxes is required from the very next year.

- ₹3,000 worth of a welcome gift for members.

- IndusInd Bank Cards

IndusInd Bank Credit Cards give their cardholders access to the Bengaluru airport lounges at Terminal 1. The bank ensures that travellers not only enjoy a relaxed waiting experience but also have options for both complimentary free and paid entries, depending on the card type and usage.

Unique Features:

- Eligible cardholders get complimentary lounge access with a nominal swipe of ₹2 for Visa or ₹25 for Mastercard.

- Charges for children accompanying the paying adult(s) are also the same as the full guest fee unless specified otherwise.

- Customers get free entry if the card is approved by IndusInd Bank.

Eligibility and Charges:

- ₹20,000 as a minimum monthly income.

- Minimum age requirement is 18 years, and the maximum can vary from 60 to 75 years.

- 700 or above credit score.

5 Tips to Have Smooth Lounge Access at Bengaluru Airport

- Call the lounge beforehand to verify acceptance and policy details.

- Just in case, carry a backup card to increase entry chances.

- Arrive early, ideally three hours before your flight, as lounges operate on a first-come, first-served basis.

- Be aware of nominal swipe fees and extra charges for services, such as showers or drinks.

- Finally, visit during off-peak hours for a quieter experience.

Conclusion

Bengaluru airport lounge access credit cards make it easier to plan your travel with added convenience. By identifying which credit cards provide access, travellers can make informed choices and enjoy amenities like refreshments, Wi-Fi and premium seating. Whether you hold a premium or regular card with limited visits, knowing the options ensures a smoother airport experience.

By

By